Andrew Cuomo's Undisclosed Nuclear Startup Stock Options: A $3 Million Question

Table of Contents

The Nature of the Investment

The undisclosed investment centers around [Insert Name of Nuclear Startup Company Here], a promising but relatively unknown player in the nuclear energy sector. Cuomo reportedly received [Specify type of stock options, e.g., call options, warrants] in the company. While the exact number of options remains partially obscured, reports suggest they could be worth a potential $3 million depending on the company's future performance. The potential for substantial financial gain presents a clear ethical dilemma, especially given Cuomo's position at the time.

- Date of Investment: [Insert Date, if known. If unknown, state "The exact date of the investment remains unclear."]

- Number of Options Received: [Insert Number, if known. If unknown, state "The precise number of options remains undisclosed."]

- Potential Profit Scenarios: A successful IPO or acquisition could yield the full $3 million, whereas a less favorable outcome might result in a considerably smaller return or even a complete loss. The fluctuating nature of the stock market further complicates the assessment of the actual value.

The Conflict of Interest Allegations

As Governor of New York, Andrew Cuomo held considerable influence over state policies impacting the energy sector, including nuclear energy initiatives. This presents a clear potential conflict of interest. Critics argue his undisclosed financial stake in [Insert Name of Nuclear Startup Company Here] could have swayed his decisions on matters related to nuclear energy regulation, licensing, and funding. This raises concerns about whether his actions were influenced by personal financial gain rather than the public interest.

- Specific Examples of Potential Conflicts: [Cite specific policy decisions or regulatory actions that could be viewed as influenced by the investment. Include specific dates and details for better SEO.]

- Statements by Cuomo or Representatives: [Summarize any statements made by Cuomo or his representatives addressing the allegations. Quote directly, if possible, to add credibility.]

- Reactions from Opponents and Watchdogs: Political opponents and ethics watchdogs have vehemently criticized the lack of transparency, calling for a full investigation into potential ethical breaches and abuse of power.

The Public Disclosure Issue

Public officials are legally obligated to disclose financial interests to prevent conflicts of interest and maintain public trust. The failure to disclose these significant stock options in a timely manner constitutes a serious breach of this obligation. This non-disclosure potentially violates [Cite specific state laws and ethics regulations]. The lack of transparency undermines public confidence in the integrity of government and raises concerns about accountability.

- Relevant Legal Precedents: [Cite any similar cases and their outcomes, strengthening the argument.]

- Timeline of Events: [Create a concise timeline of events: when the investment was made, when it was discovered, when investigations were launched, etc.]

- Potential Fines or Penalties: Depending on the findings of any investigations, Cuomo could face significant financial penalties and reputational damage.

The Role of the Media and Public Scrutiny

The media played a crucial role in uncovering Andrew Cuomo's undisclosed nuclear startup stock options. [Name specific news outlets] broke the story, leading to intense public scrutiny and widespread condemnation. Public reaction was largely negative, with many expressing outrage at the perceived breach of trust and the potential for corruption.

- Specific News Outlets: [List the news organizations that initially reported the story.]

- Public Opinion: [If available, cite any polls or surveys gauging public opinion on the matter. This will provide data to support claims.]

- Social Media Reaction: Social media platforms became a battleground for debate, with many expressing anger and calling for accountability.

Conclusion

Andrew Cuomo's undisclosed $3 million investment in a nuclear energy startup highlights a significant ethical lapse and raises serious questions about transparency and conflicts of interest in public service. The potential for his financial stake to influence policy decisions has eroded public trust. This case serves as a stark reminder of the importance of complete and timely financial disclosures by public officials.

We urge readers to delve deeper into this case and similar instances of undisclosed financial interests in politics. Understanding the intricacies of political finance and holding elected officials accountable for transparency are crucial to maintaining a healthy democracy. Research resources for financial disclosures of public officials can be found at [Insert Links to Relevant Government Websites or Resources]. The issue of "Andrew Cuomo's undisclosed nuclear startup stock options" demands continued attention and a thorough examination of ethics in public service. We must demand greater transparency from our elected officials to prevent similar situations from arising in the future.

Featured Posts

-

Wildfire Wagers The Ethics And Implications Of Betting On The Los Angeles Fires

May 05, 2025

Wildfire Wagers The Ethics And Implications Of Betting On The Los Angeles Fires

May 05, 2025 -

Transportation Departments Planned Workforce Cuts Impact And Concerns

May 05, 2025

Transportation Departments Planned Workforce Cuts Impact And Concerns

May 05, 2025 -

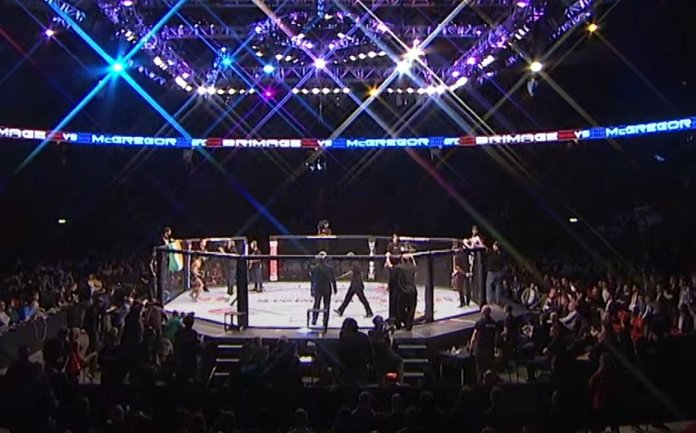

Announced Ufc 314 Main Card And Preliminary Bout Order

May 05, 2025

Announced Ufc 314 Main Card And Preliminary Bout Order

May 05, 2025 -

Cusmas Fate Hangs In The Balance As Carney Meets Trump

May 05, 2025

Cusmas Fate Hangs In The Balance As Carney Meets Trump

May 05, 2025 -

Heatwave Alert In West Bengal Four Districts On High Alert

May 05, 2025

Heatwave Alert In West Bengal Four Districts On High Alert

May 05, 2025

Latest Posts

-

Ufc 314 Ppv Updated Lineup After Prates And Neal Bout Cancelled

May 05, 2025

Ufc 314 Ppv Updated Lineup After Prates And Neal Bout Cancelled

May 05, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025 -

Volkanovski Vs Lopes Ufc 314 A Comprehensive Review Of Winners And Losers

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Comprehensive Review Of Winners And Losers

May 05, 2025 -

Ufc 314 Fight Card Breakdown Volkanovski Vs Lopes Results And Analysis

May 05, 2025

Ufc 314 Fight Card Breakdown Volkanovski Vs Lopes Results And Analysis

May 05, 2025 -

Ufc 314 Winners Losers And Key Moments From Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Winners Losers And Key Moments From Volkanovski Vs Lopes

May 05, 2025