How Norway's Top Investor, Nicolai Tangen, Navigated Trump's Tariffs

Table of Contents

Understanding the Impact of Trump's Tariffs on Global Markets

Donald Trump's imposition of tariffs, notably targeting China and other key trading partners, created significant upheaval in global markets. The "Trump trade war" significantly impacted global trade and investment.

-

Nature and Scope: Tariffs targeted specific sectors, including steel, aluminum, and consumer goods, leading to price increases and reduced competitiveness for affected industries. These tariffs extended beyond direct targets, creating a ripple effect across numerous supply chains.

-

Market Volatility and Uncertainty: The unpredictability of Trump's trade policies generated considerable market volatility. Investors faced increased uncertainty, making it challenging to forecast future returns and manage investment risks effectively. This volatility impacted various asset classes.

-

Ripple Effect on Supply Chains and Global Trade: Disruptions to global supply chains became commonplace. Businesses faced increased costs, delays, and difficulties in sourcing materials, leading to reduced production and higher prices for consumers. The overall impact on global trade was significant, slowing growth in many sectors.

-

Impact on Asset Classes: Equities in sectors directly affected by tariffs experienced significant price fluctuations. Bond yields were influenced by concerns about slowing global growth. Commodity prices, especially those of goods subject to tariffs, experienced considerable volatility.

Nicolai Tangen's Investment Strategy During the Trump Era

Nicolai Tangen's leadership at NBIM during this turbulent period exemplifies proactive and long-term investment strategy.

-

NBIM's Investment Philosophy: NBIM adopts a long-term, value-based investment approach, focusing on sustainable returns over the long haul. This patient approach minimized the impact of short-term market fluctuations caused by the tariffs.

-

Tangen's Specific Strategies: Tangen likely employed a combination of strategies, including increased diversification across asset classes and geographies, to mitigate the risks associated with the tariffs. Active management allowed for timely adjustments based on changing market conditions.

-

Active vs. Passive Management: While NBIM maintains a largely passive investment strategy, it employs active management selectively in areas where they believe they have a competitive advantage. This allowed Tangen to be responsive to the shifting dynamics of the trade war.

-

Portfolio Allocation Shifts: It's plausible that NBIM adjusted its portfolio allocation, potentially reducing exposure to sectors most heavily impacted by tariffs while increasing investments in more resilient sectors or geographies. Such adjustments would have been crucial in protecting the fund's overall value.

-

ESG Factors: NBIM's commitment to ESG principles likely informed its investment decisions. Companies with robust ESG profiles might have been viewed as less vulnerable to trade disruptions.

Risk Management and Portfolio Diversification

NBIM's robust risk management framework was critical in weathering the storm of Trump's tariffs.

-

NBIM's Risk Management Framework: A sophisticated risk management framework, incorporating both quantitative and qualitative assessments, enabled NBIM to identify and mitigate potential risks associated with the trade war.

-

Geographical Diversification: Diversification across geographies played a vital role in mitigating the impact of tariffs. Exposure to various markets reduced the fund's dependence on any single region or sector.

-

Currency Hedging: Currency hedging strategies likely minimized the impact of currency fluctuations resulting from the trade war's effects on exchange rates.

-

Sectoral Exposure: Understanding the fund's exposure to different sectors and their vulnerability to tariffs allowed NBIM to proactively adjust its portfolio allocation, minimizing potential losses.

The Role of Oil Price Volatility and Norway's Economy

Norway's significant reliance on oil revenue presents unique challenges when global economic uncertainty takes hold.

-

Interplay of Oil Prices, Tariffs, and the Norwegian Economy: Global trade tensions and the resulting slowdown in economic activity directly impacted oil prices. This had significant implications for Norway's economy, which is highly dependent on oil and gas exports.

-

Impact of Tariffs on Energy-Related Investments: Tariffs imposed on goods related to the energy sector could have impacted Norway's energy investments and revenue streams.

-

Norway's Oil Dependence: The Norwegian economy's dependence on oil revenue necessitates robust risk management strategies to mitigate the effects of price volatility.

-

Fluctuating Oil Prices: Oil price fluctuations, exacerbated by the global uncertainty surrounding Trump's tariffs, added another layer of complexity to Tangen's investment decisions.

Lessons Learned from Navigating Geopolitical Uncertainty

Tangen's experience offers valuable lessons for investors navigating geopolitical uncertainty.

-

Key Lessons: The paramount importance of a long-term investment horizon, coupled with robust risk management and proactive portfolio adjustments, were crucial to weather the Trump-era trade tensions.

-

Adaptability and Long-Term Vision: Maintaining a long-term vision, while remaining adaptable to swiftly changing geopolitical circumstances, proved pivotal.

-

Implications for Other Investors: Tangen's approach serves as a valuable case study for investors globally. His actions demonstrate the crucial role of proactive risk management, diversification, and a flexible approach when facing global economic headwinds.

Conclusion

This article has explored how Nicolai Tangen, at the helm of NBIM, skillfully steered Norway's sovereign wealth fund through the choppy waters of Donald Trump's tariffs. By employing a sophisticated investment strategy, robust risk management techniques, and a long-term perspective, he successfully navigated the uncertainties and protected the fund's value. His approach serves as a valuable case study for investors worldwide seeking to manage geopolitical risk.

Call to Action: Learn more about effective investment strategies in the face of geopolitical uncertainty. Understand how to navigate future economic challenges with insights from the expert navigation of Nicolai Tangen and the Norwegian sovereign wealth fund. Discover how to build a resilient portfolio that can withstand trade wars and other global shocks – learn from the best in navigating economic turmoil!

Featured Posts

-

Discover The Countrys Top New Business Locations

May 05, 2025

Discover The Countrys Top New Business Locations

May 05, 2025 -

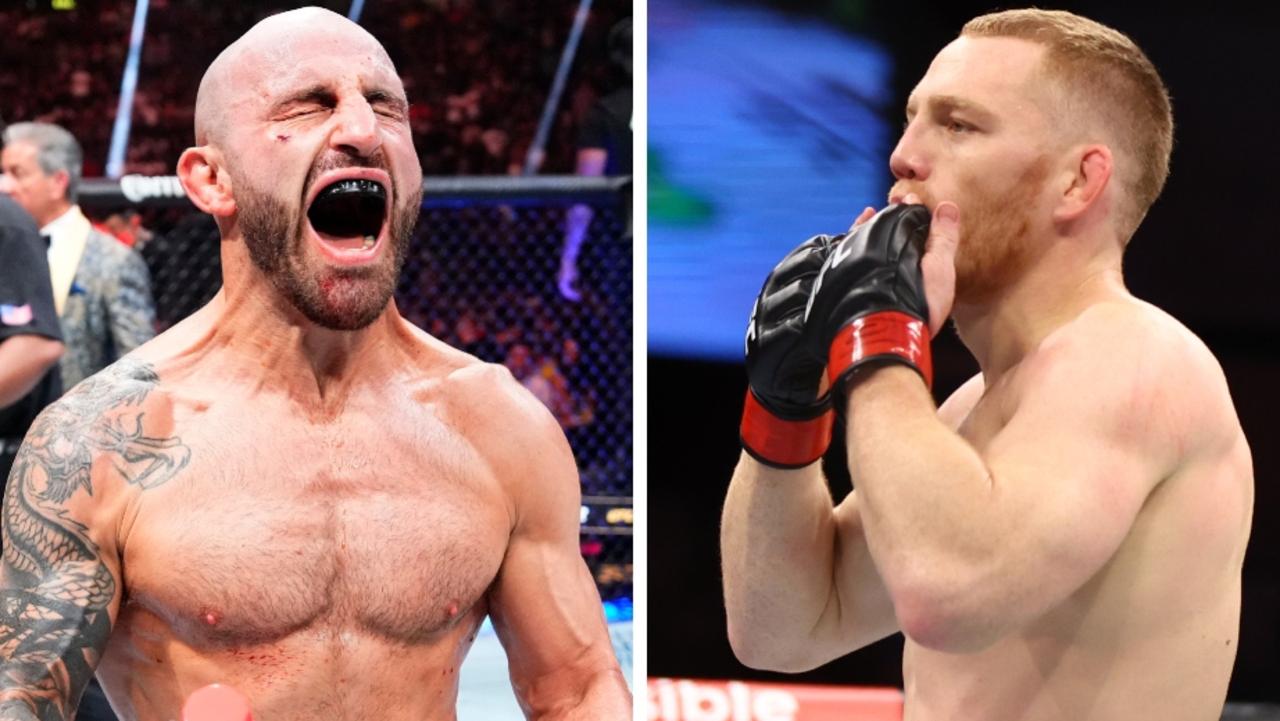

Star Studded Ufc 314 Lineup Weakened By Cancellation

May 05, 2025

Star Studded Ufc 314 Lineup Weakened By Cancellation

May 05, 2025 -

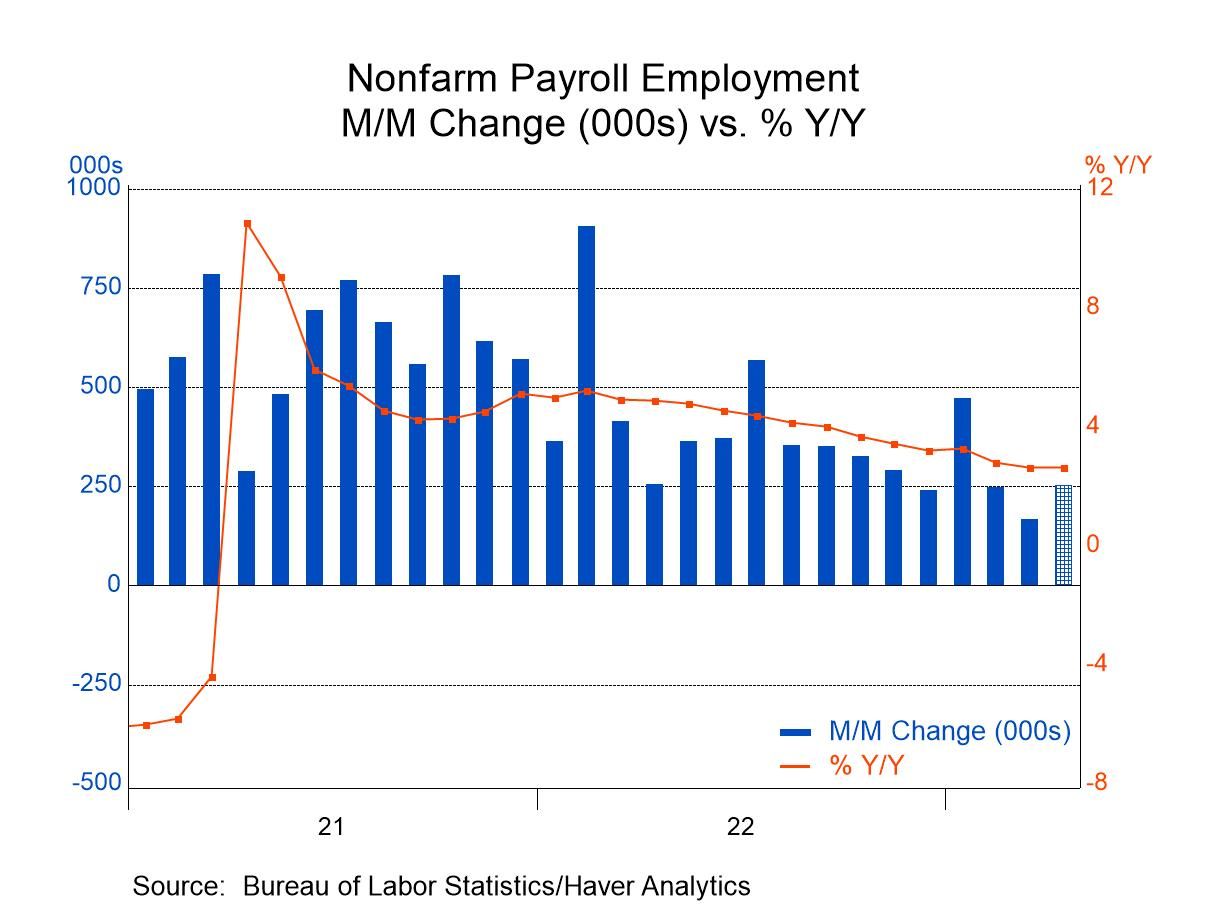

U S Economy Adds 177 000 Jobs In April Unemployment Rate Remains At 4 2

May 05, 2025

U S Economy Adds 177 000 Jobs In April Unemployment Rate Remains At 4 2

May 05, 2025 -

Trainer Responds To Criticism Of Lizzos Fitness

May 05, 2025

Trainer Responds To Criticism Of Lizzos Fitness

May 05, 2025 -

Anna Kendricks Real Age Fans React To Milestone Birthday

May 05, 2025

Anna Kendricks Real Age Fans React To Milestone Birthday

May 05, 2025

Latest Posts

-

Ufc 314 Fight Card Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Fight Card Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025 -

Poiriers Retirement Paddy Pimbletts Perspective And Analysis

May 05, 2025

Poiriers Retirement Paddy Pimbletts Perspective And Analysis

May 05, 2025 -

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025 -

Paddy Pimblett On Dustin Poiriers Retirement A Critical Analysis

May 05, 2025

Paddy Pimblett On Dustin Poiriers Retirement A Critical Analysis

May 05, 2025 -

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 05, 2025