Germany's DAX Soars: Will Wall Street's Performance Cast A Shadow?

Table of Contents

Factors Contributing to the DAX's Rise

Several factors have contributed to the recent rise of the DAX index. Understanding these drivers is crucial to assessing the long-term outlook for this key European benchmark.

Strong Corporate Earnings

Positive earnings reports from major German companies are a significant contributor to the DAX's upward trajectory. Several sectors, notably the automotive and technology industries, have demonstrated robust performance, boosting investor confidence. Strong corporate profits are translating into higher stock valuations, fueling the index's growth.

- Examples of strong performers: Volkswagen's improved sales figures, alongside strong performances from technology companies like SAP and Siemens, have significantly contributed to the DAX's rise. These earnings reports signal a healthy underlying economic environment in Germany.

Government Stimulus and Infrastructure Spending

Government initiatives aimed at stimulating economic growth have also played a significant role. Increased government spending on infrastructure projects has created jobs, boosted demand, and injected capital into the economy. This fiscal policy is designed to support businesses and create a positive feedback loop.

- Examples of government programs: Increased investment in renewable energy infrastructure and digitalization initiatives are directly stimulating economic activity and contributing to positive corporate earnings, reflecting positively on the DAX.

Easing Geopolitical Tensions (if applicable)

If applicable, a reduction in geopolitical risks can significantly influence investor sentiment. A decrease in global uncertainty can lead to increased investment and a more stable market environment, positively affecting the DAX.

- Example (if applicable): A de-escalation of a specific geopolitical conflict might result in decreased market volatility and a subsequent rise in the DAX. This would demonstrate the strong correlation between geopolitical stability and market performance.

The Potential Shadow of Wall Street's Performance

While the DAX's rise is promising, the potential influence of Wall Street's performance and broader global economic factors cannot be overlooked.

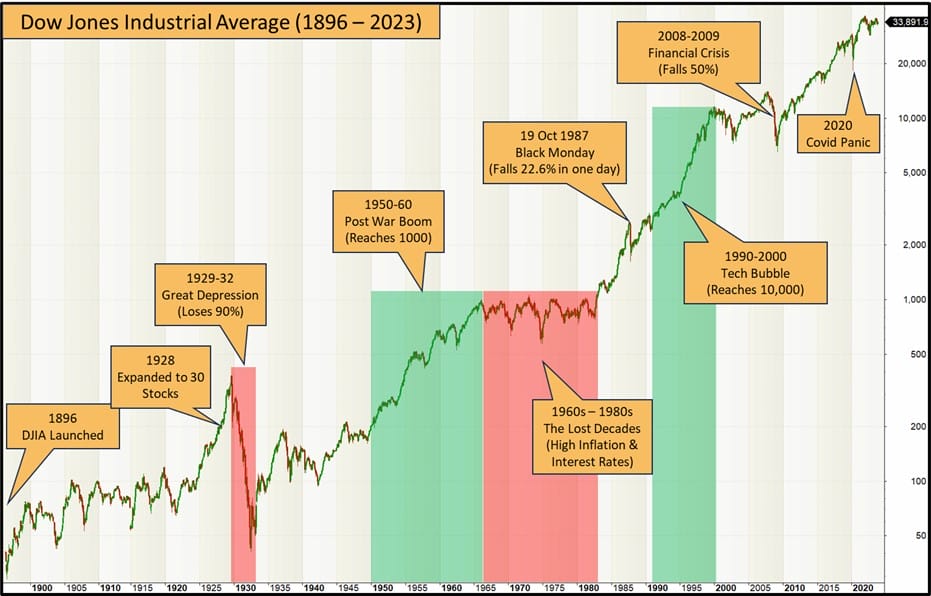

Correlation Between DAX and US Markets

The DAX and US stock markets, specifically the Dow Jones, S&P 500, and Nasdaq, exhibit a significant degree of correlation. A downturn on Wall Street can trigger contagion effects, impacting investor sentiment and potentially leading to a decline in the DAX.

- Historical correlation data: Analyzing past performance data highlights the strong historical correlation between the DAX and US indices. This demonstrates the interconnectedness of global markets and the potential for knock-on effects.

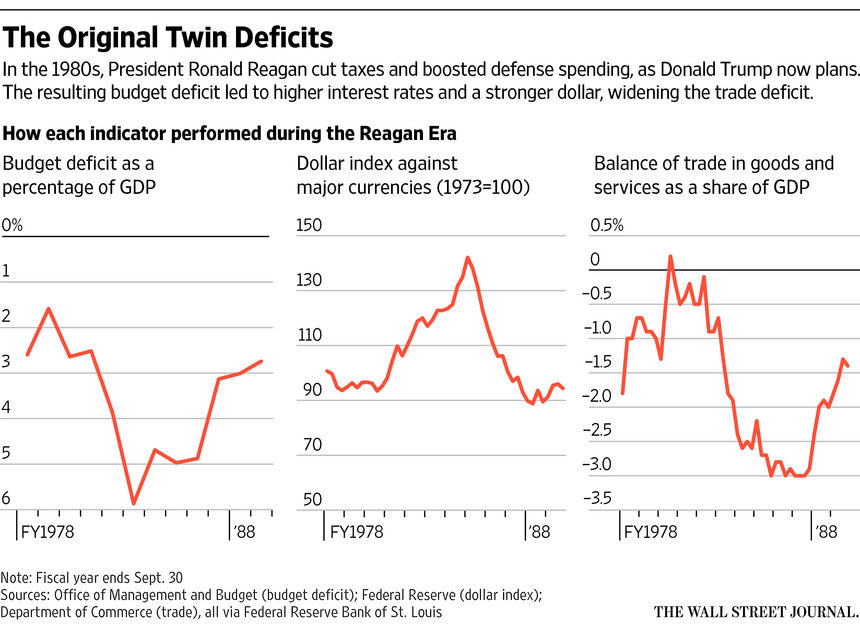

Impact of US Interest Rate Hikes

Rising interest rates in the US can negatively impact the DAX. Higher interest rates can reduce investment flows into European markets, as investors seek higher returns in the US. Furthermore, increased borrowing costs for German companies can stifle investment and hinder economic growth.

- Impact on different sectors: Sectors heavily reliant on debt financing, such as real estate or construction, could be particularly vulnerable to higher interest rates. This could result in a dampening effect on the overall DAX performance.

Global Economic Uncertainty

Several global economic factors pose potential risks to the DAX's performance. High inflation, volatile energy prices, and supply chain disruptions can all negatively impact business confidence and economic growth.

- Potential global economic risks: The ongoing war in Ukraine, persistent inflationary pressures, and the potential for a global recession represent significant headwinds for the DAX. These factors can severely impact market sentiment.

Conclusion: Navigating the DAX's Future – A Cautiously Optimistic Outlook?

The recent surge in the DAX is driven by strong corporate earnings, government stimulus, and (potentially) easing geopolitical tensions. However, the close correlation between the DAX and US markets, the impact of US interest rate hikes, and broader global economic uncertainties pose significant challenges. While the current outlook appears cautiously optimistic, investors must remain vigilant. Monitoring DAX performance and closely observing global market trends is crucial for making informed investment decisions regarding the DAX outlook. Staying informed about the DAX index and global market trends is essential for navigating the complexities of investing in the DAX and other European markets. The future trajectory of the DAX will depend on the interplay of these domestic and global factors, making ongoing monitoring essential for informed investment decisions.

Featured Posts

-

H Nonline Sk Krach Na Trhu Prace V Nemecku Analyza Prepustania

May 24, 2025

H Nonline Sk Krach Na Trhu Prace V Nemecku Analyza Prepustania

May 24, 2025 -

Mia Farrow Visits Sadie Sink On Broadway A Photo 5162787 Moment

May 24, 2025

Mia Farrow Visits Sadie Sink On Broadway A Photo 5162787 Moment

May 24, 2025 -

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025 -

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 24, 2025 -

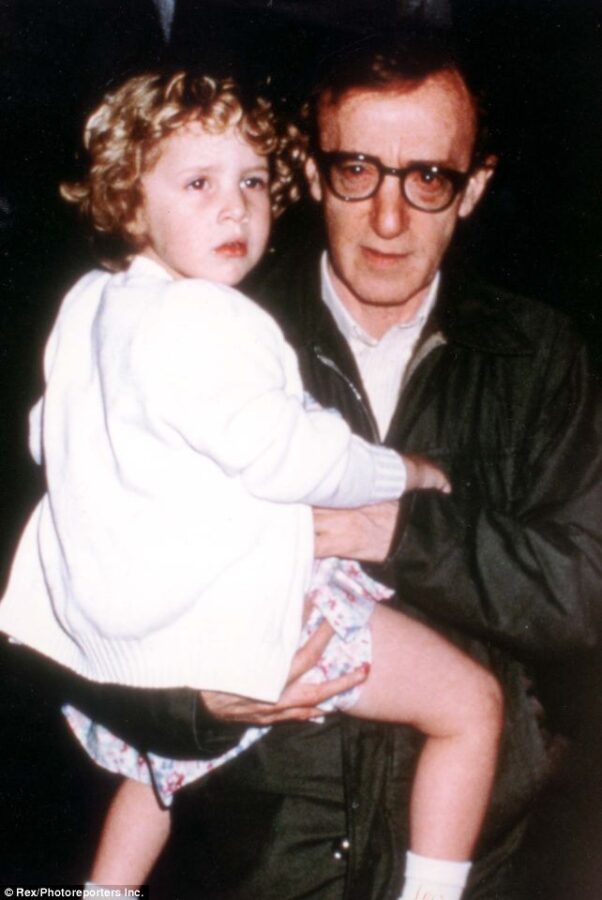

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025 -

Did Woody Allen Abuse Dylan Farrow Sean Penn Weighs In

May 24, 2025

Did Woody Allen Abuse Dylan Farrow Sean Penn Weighs In

May 24, 2025 -

How 17 Celebrities Lost Everything Instantly

May 24, 2025

How 17 Celebrities Lost Everything Instantly

May 24, 2025 -

The 17 Biggest Celebrity Reputation Ruins

May 24, 2025

The 17 Biggest Celebrity Reputation Ruins

May 24, 2025