Amsterdam Stock Exchange Plunges 2% After Trump's Tariff Hike

Table of Contents

Immediate Impact of the Tariff Hike on Amsterdam AEX

The announcement of the Trump tariff hike triggered an immediate and sharp reaction in the Amsterdam AEX index. The AEX, a key benchmark for the Dutch stock market, saw a swift 2.1% decline within hours of the news breaking. This significant drop reflects the heightened sensitivity of European markets to trade policy developments emanating from the United States.

- AEX Index Drop: The AEX index plummeted by 2.1%, representing a substantial loss for investors. This drop exceeded initial market predictions, suggesting a higher-than-expected negative impact.

- Trading Volume Surge: Trading volume on the Amsterdam Stock Exchange increased dramatically following the news, indicating heightened market activity and investor anxiety. Many traders reacted swiftly to the news, either selling off assets or attempting to hedge against further losses.

- Analyst Reactions: Market analysts expressed widespread concern, citing the uncertainty surrounding the trade war and its potential for long-term economic damage as key factors contributing to the market volatility. Many predicted further short-term volatility.

- Affected Sectors: Technology and manufacturing sectors, heavily reliant on international trade, were particularly hard hit, experiencing disproportionately large drops in their stock prices. These sectors are especially vulnerable to tariff increases, impacting both exports and imports.

- (Insert Graph/Chart here visualizing the AEX's drop on the day of the tariff announcement)

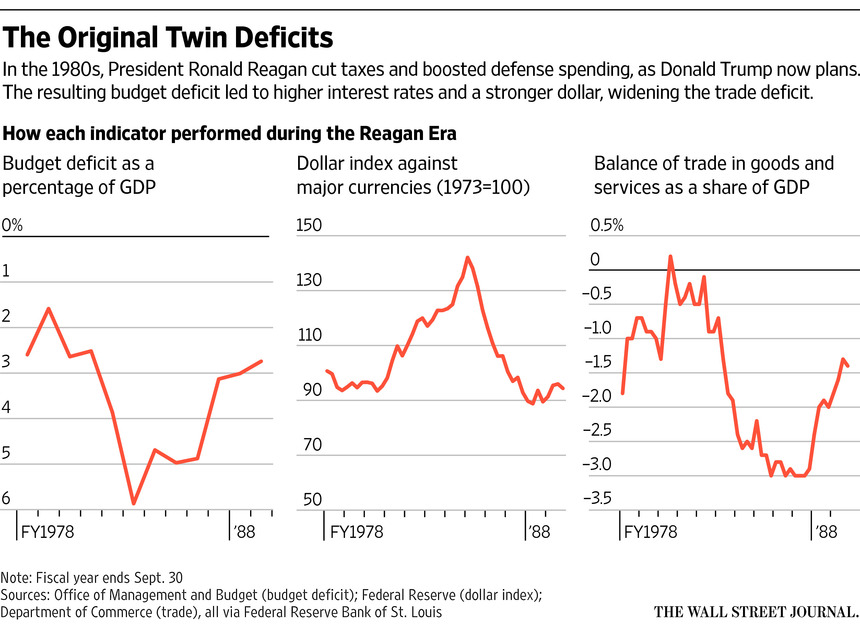

Underlying Causes and Contributing Factors

The 2% plunge in the Amsterdam Stock Exchange wasn't solely a reaction to the immediate tariff hike; it reflects a confluence of underlying factors contributing to global market uncertainty.

- Trump's Tariff Hike and its Relevance: President Trump's specific tariff increases targeted goods crucial to both Dutch and EU economies, triggering anxieties about increased import costs and reduced competitiveness. This directly impacted businesses reliant on global trade relationships.

- Broader Trade War Context: The latest tariff hike is merely the latest escalation in the ongoing trade war, creating a climate of global uncertainty and fear of further escalation. This ongoing uncertainty weighs heavily on investor sentiment.

- Decline in Investor Confidence: The uncertainty surrounding trade policies has significantly eroded investor confidence. The fear of further economic instability prompted many investors to adopt a risk-averse approach, leading to a sell-off in stocks.

- Economic Slowdown Concerns: The trade war raises serious concerns about a potential global economic slowdown. Increased trade barriers and uncertainty can disrupt supply chains, reduce investment, and hinder economic growth.

- Geopolitical Risk: Beyond the immediate trade concerns, broader geopolitical risks further contributed to the market instability. These factors amplify the existing uncertainty and contribute to a negative investor outlook.

The Role of Dutch Export-Oriented Industries

The Netherlands boasts a robust export-oriented economy, making it particularly vulnerable to the effects of the Trump tariff hike.

- Dutch Export Dependence: Industries like agriculture and technology, which are significant contributors to the Dutch GDP, rely heavily on exports. The new tariffs directly threaten their competitiveness in global markets.

- Competitive Disadvantage: Increased tariffs make Dutch products less attractive in international markets, potentially leading to reduced sales and lower profits for Dutch companies. This could trigger job losses and economic hardship.

- Supply Chain Disruptions: The tariffs can disrupt established supply chains, impacting manufacturing processes and potentially delaying or halting production for many Dutch businesses.

- Vulnerability to Trade Disputes: The significant dependence on exports makes the Netherlands particularly vulnerable to future trade disputes and protectionist policies. This highlights the need for economic diversification.

Potential Long-Term Implications for the Amsterdam Stock Exchange

The immediate impact of the Trump tariff hike is concerning, but the potential long-term consequences for the Amsterdam Stock Exchange and the Dutch economy are even more significant.

- Long-Term Economic Consequences: Prolonged trade tensions could lead to a sustained period of slower economic growth in the Netherlands, affecting employment, investment, and overall economic prosperity.

- Economic Recovery Timeline: The speed and strength of any economic recovery will depend on several factors, including the resolution of the trade dispute, government policies, and the overall global economic climate.

- Investor Confidence Restoration: Restoring investor confidence will require a clear path towards de-escalation of trade tensions and a demonstration of government commitment to supporting the affected industries.

- Government Policy Response: Government intervention, in the form of financial support for affected businesses, and trade diversification strategies, will play a crucial role in mitigating the long-term damage.

- Impact on European Financial Markets: The turmoil in the Amsterdam Stock Exchange serves as a warning sign for other European financial markets, highlighting the interconnectedness of global economies and the potential for wider repercussions.

Conclusion

The 2% plunge in the Amsterdam Stock Exchange following President Trump's tariff hike underscores the significant impact of trade disputes on global markets. The immediate reaction highlighted the vulnerability of export-oriented economies like the Netherlands. Underlying factors, including broader trade war anxieties, declining investor confidence, and concerns of an economic slowdown, contributed to the severity of the drop. The potential long-term consequences for the Amsterdam Stock Exchange and the Dutch economy demand close monitoring and proactive policy responses. Stay informed about the evolving situation impacting the Amsterdam Stock Exchange and the global market. Continue monitoring the effects of the Trump tariff hike and its ramifications on the AEX index and the broader European economy. Regularly check for updates on the Amsterdam Stock Exchange's performance and related news to manage your investments effectively.

Featured Posts

-

Alexandria International Airport And England Airparks New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

Alexandria International Airport And England Airparks New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

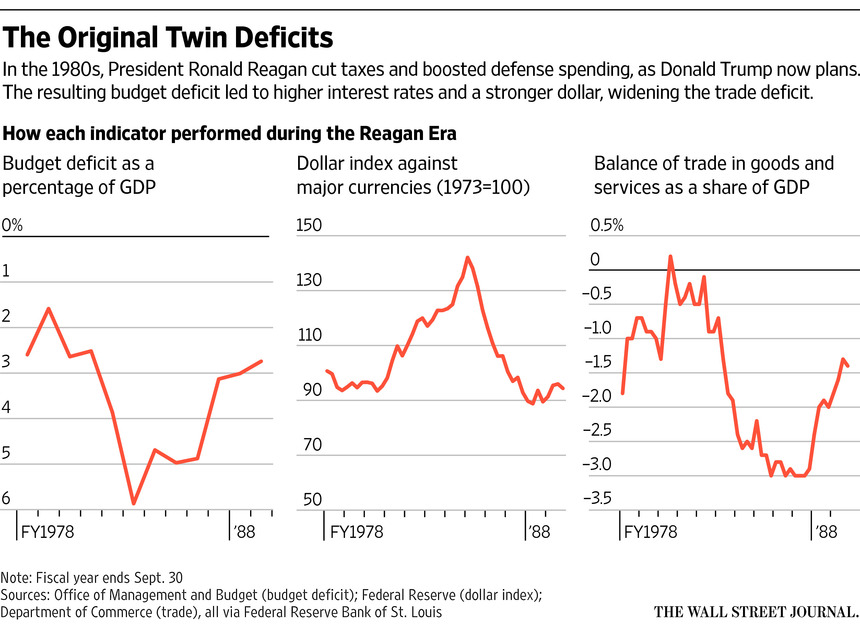

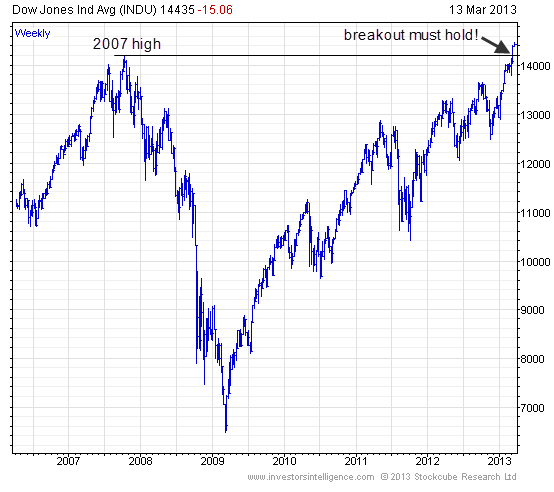

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value Nav

May 24, 2025 -

Is An Escape To The Country Right For You A Comprehensive Guide

May 24, 2025

Is An Escape To The Country Right For You A Comprehensive Guide

May 24, 2025 -

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025