G-7 Weighs Lower Tariffs On Chinese Imports: De Minimis Debate Heats Up

Table of Contents

Understanding De Minimis Value and its Implications for Tariffs

The "de minimis value" refers to the threshold below which imported goods are exempt from import tariffs. It's a crucial element in determining whether a package, shipment, or individual item is subject to duties and taxes. Essentially, if the value of your imported goods falls below this threshold, you can avoid paying tariffs. This seemingly simple concept has significant ramifications.

A lower de minimis value means that more packages and shipments will be subject to tariffs, increasing costs for both businesses and consumers. Conversely, a higher de minimis value means fewer packages will be subject to tariffs, potentially boosting cross-border e-commerce and benefiting consumers through lower prices. This has implications for various sectors, particularly the burgeoning online retail market.

- Lower de minimis value = more packages subject to tariffs. This increases the administrative burden on importers and customs agencies, leading to delays and potentially higher overall costs.

- Higher de minimis value = fewer packages subject to tariffs, stimulating e-commerce growth and offering consumers access to a wider variety of cheaper goods. However, it could also negatively impact domestic industries.

- Significant impact on cross-border e-commerce sales. A change in the de minimis value could drastically affect the profitability of businesses engaged in e-commerce, particularly those relying on imports from China.

- Complexities of customs valuation and declaration. Determining the accurate value of goods for customs purposes can be challenging, leading to potential disputes and delays. Accurate and transparent customs declaration processes are vital for the smooth flow of goods.

The G-7's Current Stance on Tariffs and the De Minimis Debate

The G-7's relationship with China is multifaceted and complex, marked by both cooperation and competition. Existing tariffs on Chinese imports vary across different G7 nations and product categories. The debate regarding lowering tariffs stems from differing perspectives on economic growth and national security.

Arguments for lowering tariffs: Proponents argue that lower tariffs would stimulate economic growth by reducing prices for consumers, increasing the availability of goods, and boosting overall consumption. This, in turn, could lead to increased economic activity and competitiveness.

Arguments against lowering tariffs: Opponents express concerns about protecting domestic industries from unfair competition and safeguarding national security interests. Lowering tariffs could lead to job losses in domestic sectors that compete directly with Chinese imports. Furthermore, concerns remain regarding intellectual property protection and fair trade practices.

- Varying G7 nations' positions: While a consensus is yet to be reached, individual member nations have voiced differing opinions based on their unique economic and political landscapes.

- Significant potential economic impacts: A significant change in import tariffs could have wide-ranging economic ripple effects, influencing inflation, consumer spending, and employment across the G7 nations.

- Political considerations heavily influence the decision: The decision will be shaped by political factors, including domestic political pressures, international relations, and the overall global trade landscape.

Impacts of Altering De Minimis Values on Businesses and Consumers

The impact of altering de minimis values will be felt across various sectors. Small businesses importing goods from China could face significant cost increases, potentially impacting their competitiveness. Consumers could see price increases on goods purchased online from Chinese retailers. Domestic industries competing with Chinese imports could experience increased pressure and potential job losses.

- Increased costs for businesses: Higher import tariffs will directly impact businesses' profit margins and could force some businesses to raise prices or reduce production.

- Price increases for consumers: Consumers will likely face higher prices for a range of goods if tariffs are increased or the de minimis value is lowered.

- Potential job losses in competing sectors: Increased competition from cheaper imports could lead to job losses in domestic industries struggling to compete.

- Changes in consumer spending patterns: Higher prices could alter consumer spending patterns, impacting economic activity and overall market dynamics.

Alternative Trade Policy Options and Future Outlook

Adjusting de minimis values is not the only approach to managing trade relations with China. Alternative trade policies include strengthening trade agreements to address specific concerns, providing targeted subsidies to support domestic industries, and investing in domestic production capabilities to enhance competitiveness.

The likelihood of the G7 reaching a consensus on tariff adjustments remains uncertain, given the diverse interests and political considerations involved. The ongoing debate highlights the need for a balanced approach that promotes economic growth while safeguarding national interests.

- Strengthening existing trade agreements: This could include renegotiating existing agreements or creating new ones to address specific issues such as intellectual property protection and fair trade practices.

- Targeted subsidies for domestic industries: Providing financial assistance to struggling domestic industries can help them compete more effectively against foreign imports.

- Investing in domestic production capabilities: Improving domestic production capabilities through technological advancements and workforce development can make domestic industries more competitive.

- Predicting future G7 trade policies towards China: The future direction of G7 trade policy will depend on several factors, including the ongoing geopolitical landscape and economic developments.

Conclusion

The debate surrounding lower tariffs on Chinese imports, particularly the implications of adjusting the de minimis value, is complex and multifaceted. While lowering tariffs could stimulate economic growth and benefit consumers through lower prices, it also carries risks, including potential job losses in domestic industries and threats to national security. Conversely, maintaining or increasing tariffs could negatively impact consumers and businesses. Altering the de minimis value presents a critical policy decision that requires careful consideration of its wide-ranging implications on businesses, consumers, and the global economy. Stay informed about the developments in G-7 trade policies and the ongoing debate surrounding G-7, Chinese import tariffs, and the de minimis value. Engage in discussions and conduct further research to fully understand the complexities of this crucial issue.

Featured Posts

-

Dylan Dreyer And Today Show Co Stars A Mishap And Its Aftermath

May 24, 2025

Dylan Dreyer And Today Show Co Stars A Mishap And Its Aftermath

May 24, 2025 -

Kynning A Fyrstu 100 Rafmagnsutgafu Porsche Macan

May 24, 2025

Kynning A Fyrstu 100 Rafmagnsutgafu Porsche Macan

May 24, 2025 -

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025 -

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Latest Posts

-

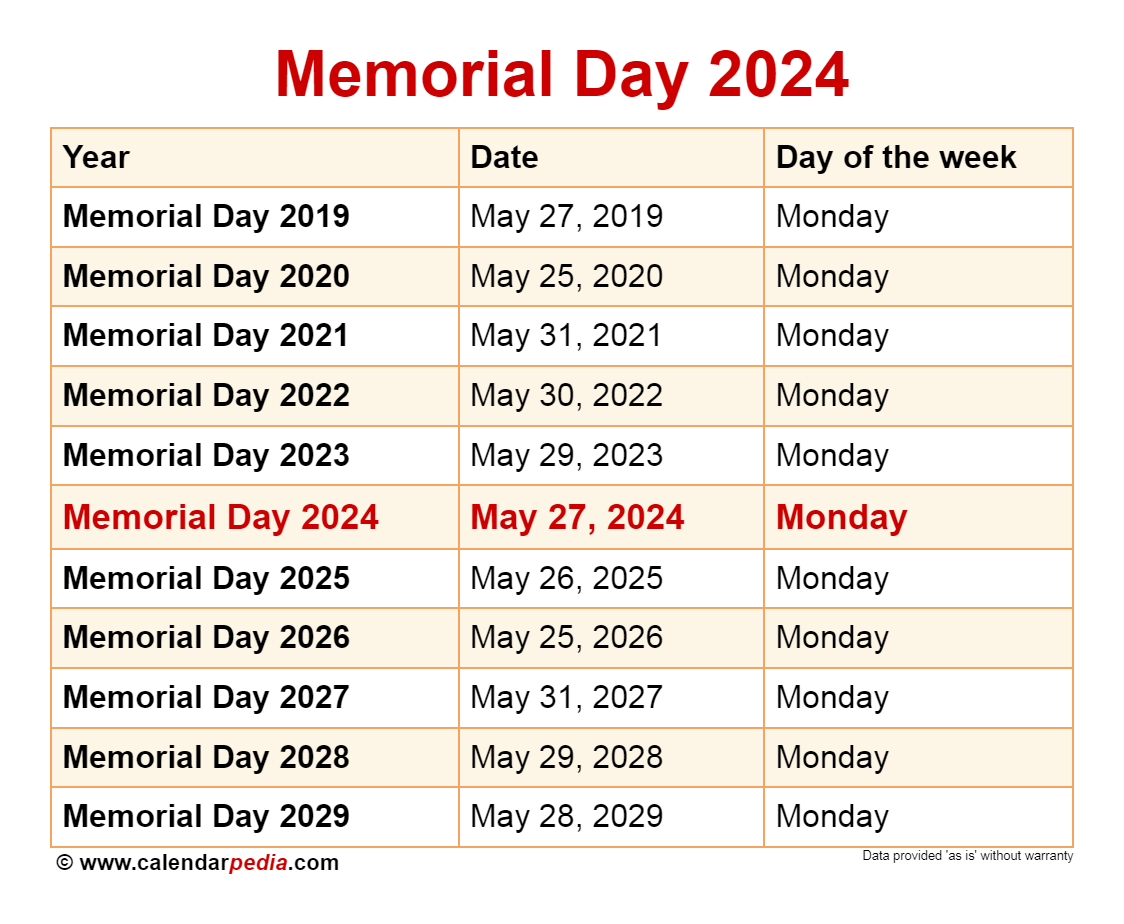

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025 -

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025 -

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025 -

Dc Legends Of Tomorrow Mastering The Gameplay And Achieving Victory

May 24, 2025

Dc Legends Of Tomorrow Mastering The Gameplay And Achieving Victory

May 24, 2025 -

2025 Memorial Day Sales Best Deals Curated By A Shopping Editor

May 24, 2025

2025 Memorial Day Sales Best Deals Curated By A Shopping Editor

May 24, 2025