FIU: ₹5.45 Crore Penalty On Paytm Payments Bank For Money Laundering

Table of Contents

The Alleged Money Laundering Violations

The FIU's investigation revealed significant lapses in Paytm Payments Bank's adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) norms. These violations, leading to the substantial ₹5.45 crore penalty, represent a serious breach of regulatory trust and highlight the risks associated with insufficient due diligence in the Indian financial sector.

-

Inadequate KYC Procedures: The investigation allegedly uncovered instances where the bank failed to properly verify the identities of its customers, a crucial aspect of KYC compliance. This includes failing to collect and verify essential identification documents and failing to update customer information regularly. Such lax procedures create vulnerabilities that can be exploited for money laundering activities.

-

Failure to Report Suspicious Transactions: A key element of AML compliance involves the timely reporting of suspicious transactions to the relevant authorities. The FIU's investigation likely found that Paytm Payments Bank failed to adequately monitor transactions and flag potentially illicit activities, potentially facilitating the flow of illegal funds. This negligence represents a significant failure in their AML compliance framework.

-

Insufficient Due Diligence: The bank allegedly failed to conduct proper due diligence on its customers and their transactions. This includes neglecting to assess the risk profiles of customers and failing to implement appropriate risk-mitigation measures. The lack of due diligence allowed potentially illicit activities to go undetected.

The ₹5.45 Crore Penalty and its Implications

The ₹5.45 crore penalty imposed by the FIU is a substantial amount, signifying the seriousness of the alleged money laundering violations and the government's commitment to cracking down on financial crime. This regulatory action carries several important implications:

-

Strong Deterrent: The penalty sends a clear message to other financial institutions, particularly in the rapidly growing Indian fintech sector, regarding the importance of stringent AML compliance. Non-compliance will result in severe consequences.

-

Increased Scrutiny on Fintechs: This case highlights the increasing regulatory scrutiny faced by fintech companies in India. As fintech adoption grows, regulators are stepping up enforcement efforts to ensure the sector operates within the confines of the law.

-

Reputational Damage: The penalty is likely to impact Paytm Payments Bank's reputation and could affect its ability to attract new customers and secure funding. Trust is paramount in the financial sector, and such regulatory actions can severely damage that trust.

-

Further Regulatory Action: The RBI (Reserve Bank of India) may take further actions against Paytm Payments Bank, including additional fines, restrictions on operations, or even license revocation, depending on the outcome of ongoing investigations.

Strengthening AML Compliance in the Indian Fintech Sector

The Paytm Payments Bank case underscores the urgent need for strengthening AML compliance measures across the Indian fintech sector. This requires a multifaceted approach:

-

Robust KYC Procedures: Financial institutions must implement robust and up-to-date KYC procedures, including thorough customer identification, verification, and ongoing monitoring. This includes leveraging technology to automate KYC processes and enhance accuracy.

-

Advanced Technology for Fraud Detection: Implementing advanced technologies such as AI-powered transaction monitoring systems and machine learning algorithms is crucial for identifying suspicious patterns and preventing money laundering activities.

-

Employee Training and Awareness: Regular training programs for employees on AML regulations and best practices are essential to ensure that staff are equipped to identify and report suspicious activities effectively. A culture of compliance must be fostered within the organization.

-

Regular Audits and Compliance Reviews: Regular internal and external audits are necessary to assess the effectiveness of AML compliance programs and identify areas for improvement. Staying abreast of evolving regulatory changes is also critical.

Conclusion:

The FIU's ₹5.45 crore penalty on Paytm Payments Bank serves as a stark reminder of the critical importance of robust AML and KYC compliance within the Indian fintech sector. The alleged money laundering violations highlight the significant risks involved in inadequate due diligence and the potential consequences for non-compliance. This case underscores the need for all financial institutions, especially fintech companies, to prioritize and strengthen their anti-money laundering measures. Understanding and implementing effective KYC and AML procedures is not just a regulatory requirement but a crucial step in maintaining financial integrity and preventing future penalties related to money laundering. Stay informed on the latest regulations and best practices to ensure your institution is fully compliant with AML and KYC regulations to avoid similar penalties related to money laundering.

Featured Posts

-

Onderzoek Naar Angstcultuur Bij De Npo Na Beschuldigingen Tegen Baas

May 15, 2025

Onderzoek Naar Angstcultuur Bij De Npo Na Beschuldigingen Tegen Baas

May 15, 2025 -

Top 10 Gainers On Bse Sensex Rally Highlights

May 15, 2025

Top 10 Gainers On Bse Sensex Rally Highlights

May 15, 2025 -

The Role Of Aircraft In Trumps Political Network

May 15, 2025

The Role Of Aircraft In Trumps Political Network

May 15, 2025 -

Bse Stocks Surge Sensex Rise Fuels Double Digit Gains

May 15, 2025

Bse Stocks Surge Sensex Rise Fuels Double Digit Gains

May 15, 2025 -

Trump And Oil Prices Goldman Sachs Analysis Of Public Statements

May 15, 2025

Trump And Oil Prices Goldman Sachs Analysis Of Public Statements

May 15, 2025

Latest Posts

-

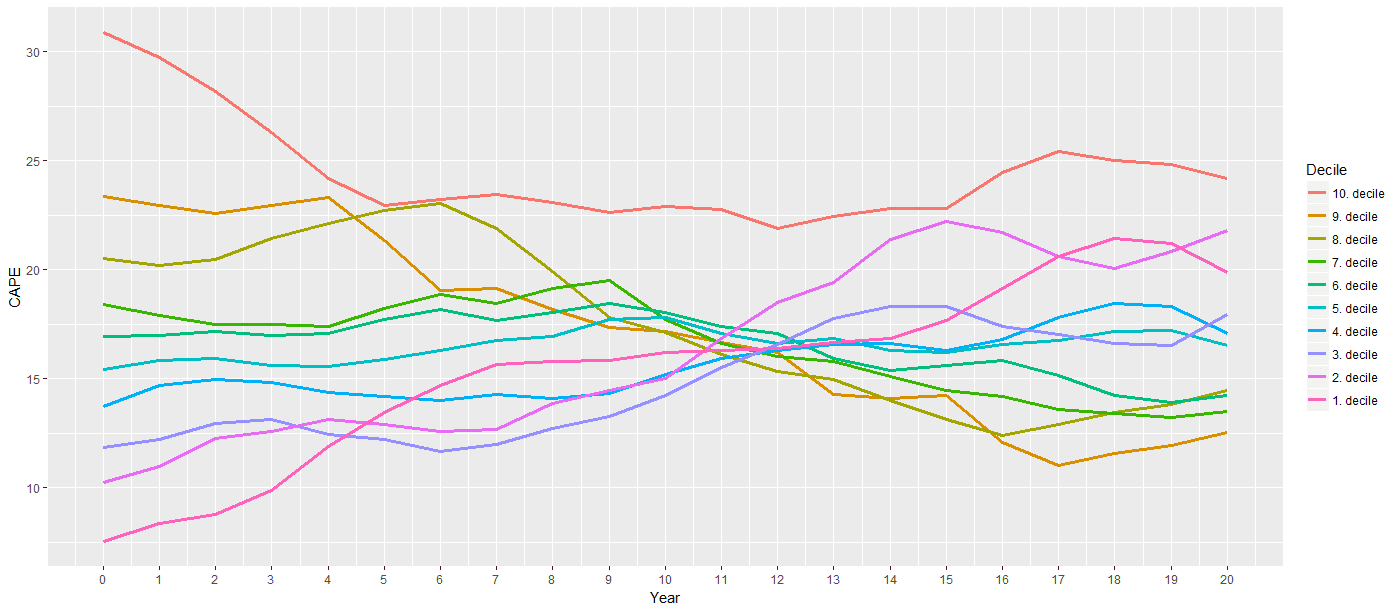

Stock Market Valuations Bof As Arguments Against Investor Concern

May 15, 2025

Stock Market Valuations Bof As Arguments Against Investor Concern

May 15, 2025 -

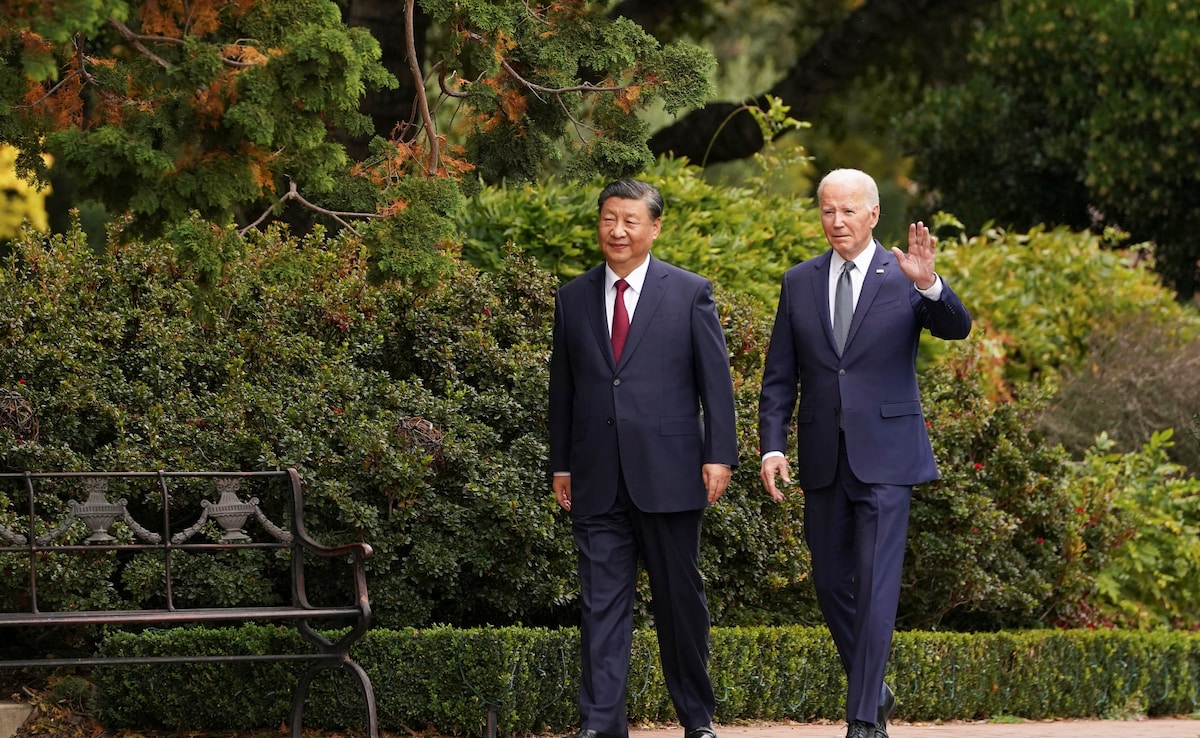

Analysis Chinas Expert Driven Approach To A Critical Us Agreement

May 15, 2025

Analysis Chinas Expert Driven Approach To A Critical Us Agreement

May 15, 2025 -

Negotiating Success How Xi Jinpings Experts Secured A Us Deal For China

May 15, 2025

Negotiating Success How Xi Jinpings Experts Secured A Us Deal For China

May 15, 2025 -

Key Us Deal For China Xis Reliance On Seasoned Advisors

May 15, 2025

Key Us Deal For China Xis Reliance On Seasoned Advisors

May 15, 2025 -

China Secures Us Deal Xis Team Of Experts Plays Key Role

May 15, 2025

China Secures Us Deal Xis Team Of Experts Plays Key Role

May 15, 2025