Stock Market Valuations: BofA's Arguments Against Investor Concern

Table of Contents

BofA's Perspective on Current Price-to-Earnings (P/E) Ratios

Understanding stock market valuations requires analyzing key metrics, with the Price-to-Earnings ratio (P/E ratio) being a cornerstone. The P/E ratio represents the market price of a company's stock relative to its earnings per share. A high P/E ratio generally suggests investors are willing to pay more for each dollar of earnings, potentially indicating overvaluation. Conversely, a low P/E ratio might signal undervaluation.

BofA's assessment of current P/E ratios is nuanced. While acknowledging that some sectors exhibit elevated P/E ratios compared to historical averages, they argue that these are not uniformly high across the board. Their analysis considers several factors:

- Historical P/E Ratio Data Points: BofA likely references historical P/E ratio data, comparing current levels to those observed during previous economic cycles and bull markets. This comparison helps determine whether current valuations are significantly above or below historical norms.

- Factors Influencing P/E Ratios: Interest rates, economic growth prospects, and anticipated future earnings significantly impact P/E ratios. Low interest rates, for example, can inflate valuations as investors seek higher returns in the stock market.

- BofA's Justification: BofA's justification likely involves a multifaceted analysis, incorporating factors like projected earnings growth, interest rate forecasts, and qualitative assessments of individual companies and sectors.

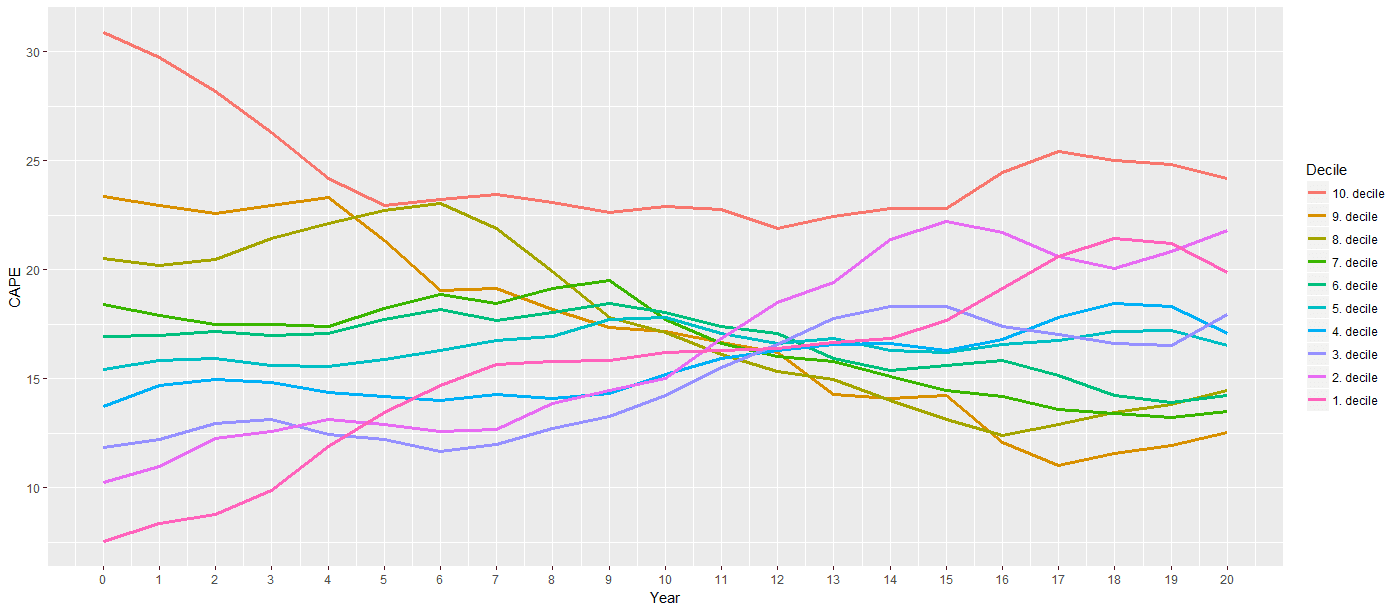

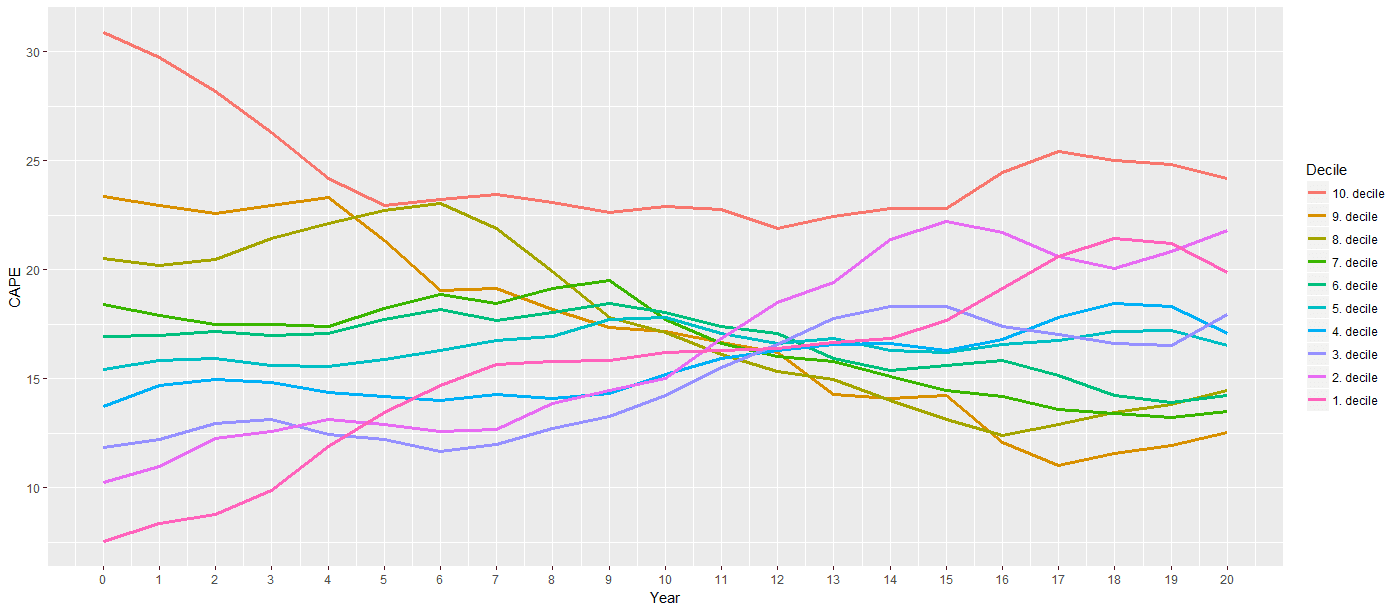

[Insert chart or graph here illustrating P/E ratios over time, clearly labeled and sourced.]

The Role of Interest Rates in Stock Market Valuations

Interest rates play a crucial role in stock market valuations. There's an inverse relationship: as interest rates rise, stock valuations tend to fall, and vice versa. Higher interest rates increase the attractiveness of fixed-income investments, drawing capital away from the stock market.

BofA's analysis likely incorporates projections for future interest rate movements. Their assessment of the impact on stock valuations will depend on their interest rate forecasts:

- BofA's Interest Rate Predictions: BofA's economists likely provide forecasts for short-term and long-term interest rates, influencing their valuation models.

- Impact on Investor Behavior: Rising rates can lead to decreased investor risk appetite, potentially resulting in lower stock prices. Conversely, falling rates can stimulate investment and increase valuations.

- Impact on Corporate Earnings: Interest rate changes affect corporate borrowing costs. Higher rates increase borrowing expenses, potentially squeezing corporate profits and reducing earnings growth.

Understanding the yield curve, which plots the interest rates of government bonds with different maturities, is essential for assessing the economy's health and its implications for stock valuations. BofA likely uses yield curve analysis to inform its projections.

BofA's Assessment of Corporate Earnings Growth Potential

Corporate earnings growth is a key driver of stock valuations. Strong earnings growth justifies higher stock prices, while weak or negative growth can lead to lower valuations. BofA's projections for future corporate earnings growth are vital to their overall assessment:

- Key Sectors Driving Growth: BofA likely identifies specific sectors expected to drive earnings growth (e.g., technology, healthcare) and those potentially facing headwinds.

- Methodology for Forecasting: Their earnings forecasting methodology may involve analyzing historical trends, economic indicators, industry-specific data, and company-specific financial reports.

- Comparison with Other Analysts: Comparing BofA's projections with those of other prominent financial institutions helps gauge the consensus view on future earnings growth.

BofA's analysis should acknowledge potential risks and uncertainties that could impact earnings growth, such as geopolitical instability, supply chain disruptions, or unexpected economic downturns.

Addressing Potential Market Risks and Corrections

While BofA's analysis might present a relatively positive outlook, it's crucial to acknowledge potential market risks and the possibility of corrections.

- Specific Risks Identified: BofA likely identifies specific risks such as inflation, geopolitical tensions, or unexpected economic slowdowns that could negatively impact stock market valuations.

- Risk Mitigation Strategies: They might discuss strategies for mitigating these risks, such as diversification of investment portfolios or hedging strategies.

- Market Resilience Assessment: BofA assesses the market's resilience to these risks, considering factors like overall economic strength and investor sentiment.

By addressing potential risks and market corrections, BofA's analysis aims to provide a more comprehensive and balanced view of current stock market valuations.

Conclusion: Understanding Stock Market Valuations and BofA's Perspective

BofA's analysis of stock market valuations suggests that while some sectors might show elevated P/E ratios, the overall picture isn't one of uniform overvaluation. Their assessment considers factors like projected earnings growth, the impact of interest rates, and potential market risks. However, it's crucial to remember that this is just one perspective. Investors should conduct their own thorough research and consider various viewpoints before making investment decisions. Stay informed about the evolving landscape of stock market valuations to make sound investment choices. [Insert link to relevant BofA resources here, if available.]

Analyzing The Development Of Evan Phillips Sean Paul Linan And Eduardo Quintero In The Dodgers System

Analyzing The Development Of Evan Phillips Sean Paul Linan And Eduardo Quintero In The Dodgers System

Why The Jimmy Butler Warriors Dynamic Could Hurt Miami Heat Recruitment

Why The Jimmy Butler Warriors Dynamic Could Hurt Miami Heat Recruitment

Grab This Free Game On Steam A Review Roundup

Grab This Free Game On Steam A Review Roundup

Untangling The Musk Family Fortune A Look At Elon Musks Familys Financial History

Untangling The Musk Family Fortune A Look At Elon Musks Familys Financial History

Cody Poteets Successful Abs Challenge A Chicago Cubs Spring Training Win

Cody Poteets Successful Abs Challenge A Chicago Cubs Spring Training Win