Exclusive: Elliott's High-Stakes Gamble On Russian Gas Pipeline

Table of Contents

Elliott's Investment Strategy and Rationale

Elliott Management is renowned for its expertise in identifying and capitalizing on undervalued assets, often in high-risk, high-reward markets. Their investment in the Russian gas pipeline sector fits this established pattern.

Targeting undervalued assets:

Elliott's history is replete with examples of successfully navigating distressed assets and turning them into profitable ventures. This strategy is predicated on thorough due diligence, a deep understanding of market dynamics, and a calculated acceptance of substantial risk.

- Examples of previous successful investments: Elliott's track record includes successful investments in the telecommunications, energy, and manufacturing sectors, often involving distressed companies or assets in challenging geopolitical environments. These past successes inform their current approach to the Russian gas pipeline investment.

- Analysis of the perceived undervaluation: Elliott likely identified what it perceives as an undervaluation of Russian gas pipeline assets, possibly due to sanctions, geopolitical uncertainty, or temporary market downturns. This perceived undervaluation represents a key element of their investment thesis.

- Due diligence process and risk assessment: A crucial aspect of Elliott’s strategy is its rigorous due diligence process. This would have included detailed financial analysis, geopolitical risk assessment, and legal review, attempting to quantify and manage the inherent risks associated with such an investment.

Geopolitical Considerations:

Investing in the Russian energy sector presents significant geopolitical risks. The ongoing conflict in Ukraine, Western sanctions, and fluctuating international relations all pose considerable challenges.

- Potential impacts of Western sanctions: The potential for further sanctions against Russia, targeting its energy sector, represents a major risk. Elliott would have carefully considered the impact of potential sanctions on asset value and operational capabilities.

- Russian government's influence on the energy sector: The Russian government's significant influence over its energy sector poses a unique risk, influencing regulatory decisions, pricing, and even access to resources. This level of state control is a crucial factor in the risk assessment.

- Long-term stability of the Russian energy market: The long-term stability of the Russian energy market itself remains uncertain, influenced by geopolitical factors and global energy transitions. Predicting long-term stability is a critical but challenging element of Elliott's investment strategy.

Financial Aspects of the Gamble

The financial aspects of Elliott's Russian gas pipeline investment involve significant potential rewards, but also substantial risks.

Potential Returns and Profits:

If Elliott's gamble pays off, the potential financial gains are considerable. This depends on future gas prices, market demand, and the successful navigation of geopolitical headwinds.

- Projected ROI based on various market scenarios: Elliott's investment model would include detailed projections of return on investment (ROI) based on various market scenarios, from optimistic to pessimistic, accounting for different gas price trajectories and geopolitical events.

- Potential dividends and capital appreciation: The potential for dividends from the pipeline operations, combined with anticipated capital appreciation if the asset value rises, represents the core financial allure of the investment.

- Comparison with returns from other investment strategies: Elliott's investment strategy would have involved a comparative analysis with returns from other investment strategies, considering risk-adjusted returns and portfolio diversification.

Risk Management and Mitigation Strategies:

To mitigate the substantial risks, Elliott would have implemented various risk management strategies.

- Hedging strategies against price volatility: Hedging strategies, such as derivatives contracts, would likely be employed to protect against price volatility in the gas market.

- Diversification strategies to reduce overall portfolio risk: This investment wouldn't represent Elliott's entire portfolio. Diversification across various asset classes reduces the overall portfolio risk.

- Contingency plans in case of geopolitical instability or sanctions: Comprehensive contingency plans are crucial. These would address various scenarios, including further sanctions, operational disruptions, or changes in the regulatory environment.

The Broader Implications of Elliott's Investment

Elliott's investment has far-reaching implications for both the Russian energy sector and the global energy market.

Impact on the Russian Energy Sector:

Elliott's investment could significantly influence the Russian energy sector.

- Potential impact on gas prices and supply chains: The investment could influence gas prices and supply chains, either through increased efficiency or disruptions depending on the success and nature of the investment.

- Influence on the Russian government's energy policies: Elliott's presence as a significant investor could exert some influence on the Russian government's energy policies, though this is likely to be limited given the significant state control.

- Effect on other investors and stakeholders: The investment's success or failure could impact other investors and stakeholders in the Russian energy sector, creating ripple effects throughout the market.

Global Energy Market Implications:

The global impact of this investment is also significant.

- Potential impact on global gas prices: Changes in the Russian gas supply or market dynamics could potentially impact global gas prices, though the extent of this impact is subject to numerous other factors.

- Influence on energy security concerns worldwide: The investment could indirectly influence global energy security concerns, depending on the outcome and the broader geopolitical context.

- Shifting dynamics in global energy power: Over the long term, this investment – and others like it – reflect the shifting dynamics in global energy power and the growing role of private investment in what has traditionally been a highly state-controlled sector.

Conclusion

Elliott Management's high-stakes gamble on the Russian gas pipeline represents a bold strategic move with significant potential rewards and substantial risks. The complexities of the Russian energy sector, coupled with the volatile geopolitical landscape, make this a high-risk, high-reward venture. The potential impact on the Russian energy market and global energy prices is undeniable, highlighting the interconnectivity of finance and global politics. This exclusive analysis of Elliott's high-stakes gamble highlights the complexities and potential of investing in volatile geopolitical landscapes. Stay informed about developments in the Russian energy sector and follow our future articles for more in-depth analysis of high-stakes investment strategies in the global energy market. Learn more about Elliott Management's investment strategies and the risks and rewards of Russian gas pipeline investment by subscribing to our newsletter.

Featured Posts

-

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Other Essential Personnel

May 10, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Other Essential Personnel

May 10, 2025 -

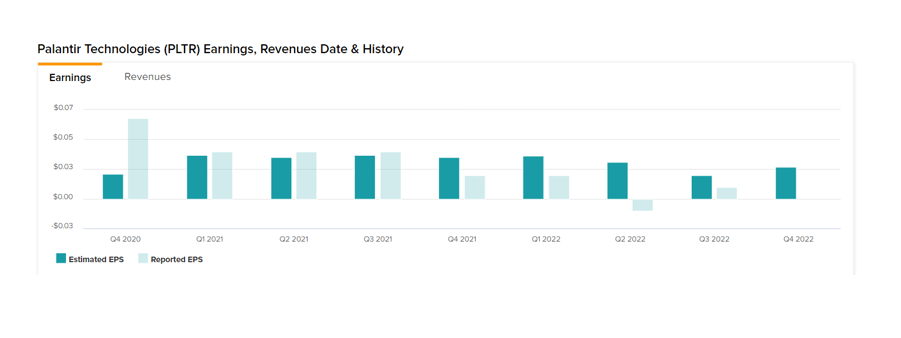

Investing In Palantir Technologies Is It The Right Time To Buy

May 10, 2025

Investing In Palantir Technologies Is It The Right Time To Buy

May 10, 2025 -

Dijon L Ombre De Melanie Sur La Tour Eiffel

May 10, 2025

Dijon L Ombre De Melanie Sur La Tour Eiffel

May 10, 2025 -

L Heritage Meconnu De Melanie Eiffel A Dijon

May 10, 2025

L Heritage Meconnu De Melanie Eiffel A Dijon

May 10, 2025 -

Should You Invest In Palantir Before May 5th Expert Opinions And Analysis

May 10, 2025

Should You Invest In Palantir Before May 5th Expert Opinions And Analysis

May 10, 2025