Should You Invest In Palantir Before May 5th? Expert Opinions & Analysis

Table of Contents

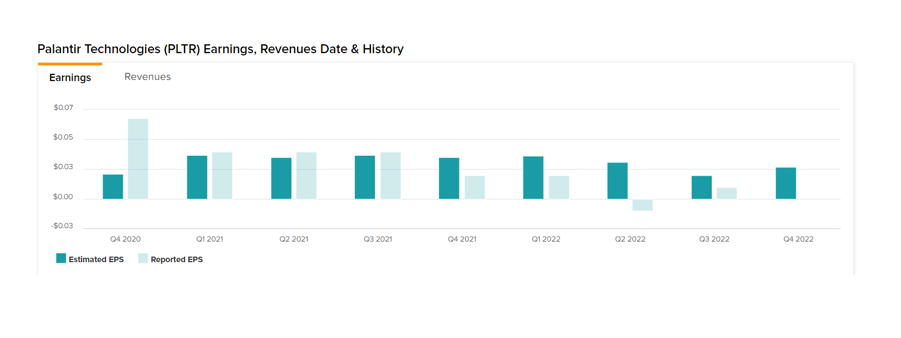

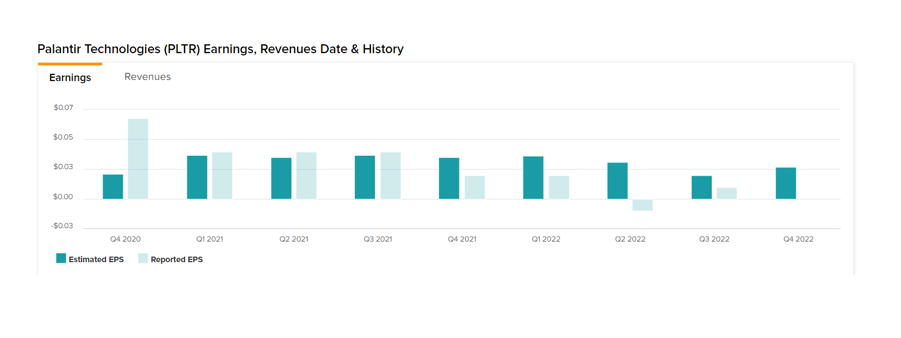

Palantir's Recent Performance and Financial Health

Palantir, a leading data analytics company, has shown a mixed bag in its recent financial reports. Analyzing its performance requires a thorough examination of key metrics. Understanding revenue growth, profitability, and customer acquisition is vital for assessing its long-term potential.

- Revenue Growth: While Palantir has demonstrated consistent year-over-year (YoY) revenue growth, the quarter-over-quarter (QoQ) growth has shown some fluctuations. Analyzing the trend in these figures is crucial for understanding the company's momentum. Investors should look for sustained, positive growth across both YoY and QoQ reports.

- Profitability Margins: Palantir's profitability margins have been a focus of investor attention. Examining the gross profit margin and operating income margin provides insight into its operational efficiency and cost management strategies. Improving margins signal increased profitability and a stronger financial position.

- Key Customer Wins: Palantir's success depends on securing and retaining large government and commercial clients. Significant new contracts, particularly those with long-term implications, are positive indicators of future revenue streams and growth potential. Analyzing the size and type of contracts provides insights into the company's overall market penetration and growth trajectory.

- Debt Levels and Cash Flow: A strong balance sheet with manageable debt and positive cash flow is essential for long-term sustainability. Examining these metrics helps assess Palantir's financial stability and its ability to weather potential economic downturns.

Expert Opinions and Analyst Ratings

Understanding the sentiment of financial analysts toward Palantir is crucial for any investment decision. A range of opinions exists, reflecting diverse perspectives and risk tolerances.

- Analyst Ratings: Major investment banks, such as Goldman Sachs and Morgan Stanley, have issued various ratings (Buy, Hold, or Sell) for Palantir stock. Reviewing these ratings provides a snapshot of the overall market sentiment. However, it's important to remember that analyst ratings are just one piece of the puzzle.

- Average Price Target: The average price target set by analysts offers a potential indication of future stock price expectations. This should be interpreted with caution, as price targets can vary significantly and are not guarantees.

- Bullish vs. Bearish Arguments: Understanding the rationale behind bullish and bearish opinions is crucial. Bullish analysts might emphasize Palantir's technological advantages and strong government contracts, while bearish analysts might highlight valuation concerns or competition within the data analytics space. A well-rounded assessment should consider both viewpoints.

Market Factors Affecting Palantir's Stock Price

External factors significantly influence Palantir's stock price. Understanding these factors is critical for making an informed investment decision.

- Broader Market Trends: The overall health of the stock market (bull or bear market) heavily impacts individual stock performance, especially for growth stocks like Palantir.

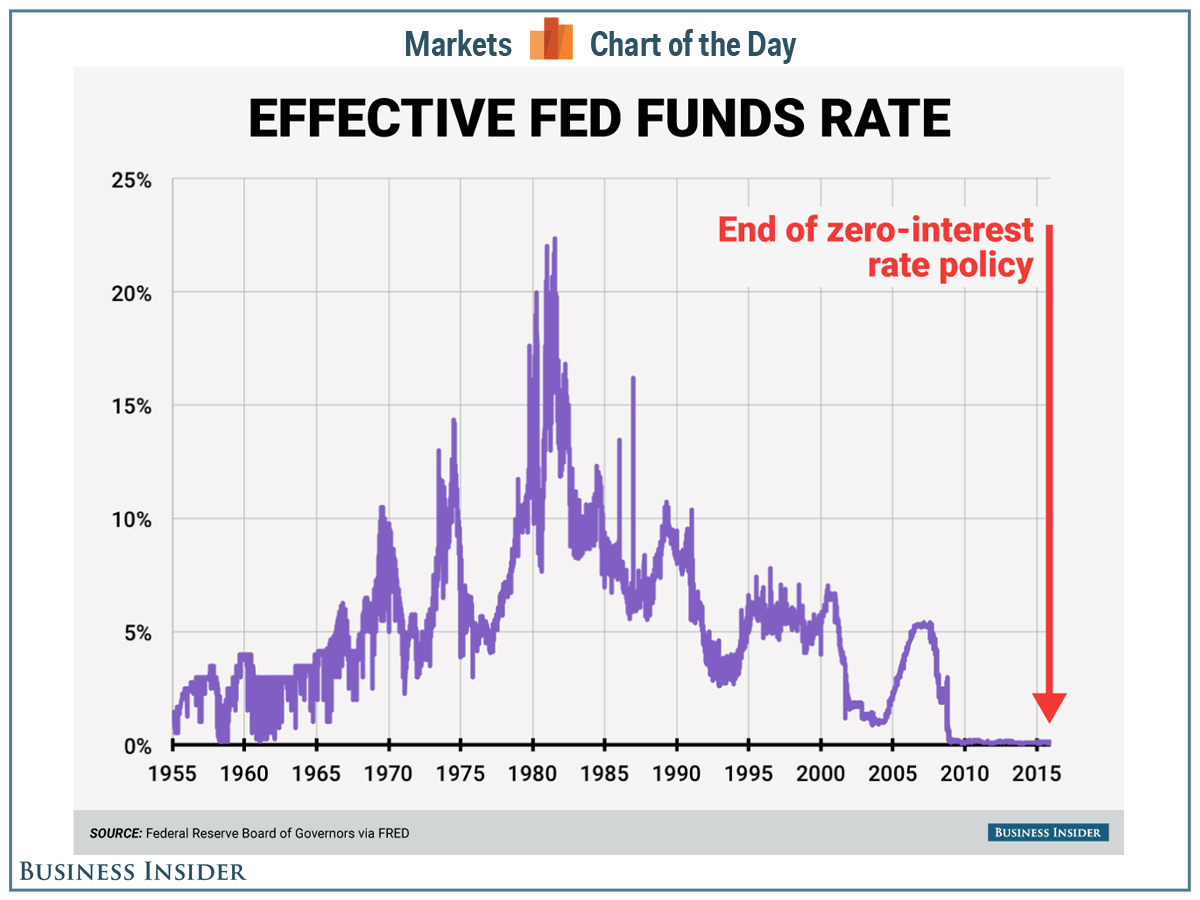

- Interest Rates: Rising interest rates generally exert downward pressure on tech stocks, including Palantir, due to increased borrowing costs and decreased investor appetite for riskier assets.

- Geopolitical Risks: Global events and geopolitical instability can influence investor sentiment and significantly impact Palantir's stock price, particularly due to its reliance on government contracts.

- Competition: The data analytics market is competitive. The presence of established players and emerging competitors can affect Palantir's market share and growth prospects.

Risks and Potential Downsides of Investing in Palantir

Investing in Palantir, like any stock, carries inherent risks:

- High Valuation: Palantir's valuation compared to its competitors is a factor to consider.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, exposing it to potential changes in government spending.

- Competition: The competitive landscape of the data analytics market presents ongoing challenges.

- Tech Market Volatility: The technology sector is known for its volatility, making Palantir's stock price susceptible to fluctuations.

Analyzing the May 5th Catalyst

The May 5th event, likely the release of Palantir's earnings report, is a potential catalyst for significant stock price movement.

- Expected Announcements: Investors should anticipate announcements concerning revenue, earnings, guidance for future quarters, and any significant contract wins or partnerships.

- Market Reactions: Positive news, such as exceeding expectations, could lead to a price increase, while negative news might trigger a price decline.

- Historical Precedent: Analyzing Palantir's past reactions to earnings releases can offer insights into potential market responses.

- Risk Management: Investors should carefully consider their risk tolerance and have a defined exit strategy before the May 5th event.

Conclusion: Should You Invest in Palantir Before May 5th? A Final Verdict

Deciding whether to invest in Palantir before May 5th requires a careful assessment of its financial health, expert opinions, market conditions, and the potential impact of the upcoming earnings report. While Palantir shows promise in the data analytics field, the inherent risks associated with its high valuation, dependence on government contracts, and the volatile tech market should not be overlooked. The May 5th announcement could significantly impact its stock price, making thorough due diligence essential.

Therefore, before investing in Palantir before May 5th, conduct your own thorough research, considering the information presented here. Remember to consult with a financial advisor to determine the suitability of Palantir for your individual investment portfolio and risk tolerance. Weigh the potential rewards against the identified risks before making any investment decisions regarding Palantir.

Featured Posts

-

10 Film Noir Movies Guaranteed To Thrill You

May 10, 2025

10 Film Noir Movies Guaranteed To Thrill You

May 10, 2025 -

U S Federal Reserve Holds Steady Rate Decision Amidst Economic Pressures

May 10, 2025

U S Federal Reserve Holds Steady Rate Decision Amidst Economic Pressures

May 10, 2025 -

Fox News Hosts Offer Contrasting Views On Trumps Tariff Policies

May 10, 2025

Fox News Hosts Offer Contrasting Views On Trumps Tariff Policies

May 10, 2025 -

Federal Reserves Stance A Deep Dive Into Why Rate Cuts Are Delayed

May 10, 2025

Federal Reserves Stance A Deep Dive Into Why Rate Cuts Are Delayed

May 10, 2025 -

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 10, 2025

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 10, 2025

Latest Posts

-

Analysis Proposed Uk Visa Changes For Pakistan Nigeria And Sri Lanka Applicants

May 10, 2025

Analysis Proposed Uk Visa Changes For Pakistan Nigeria And Sri Lanka Applicants

May 10, 2025 -

New Uk Visa Regulations Nigeria And Pakistan Face Stricter Scrutiny

May 10, 2025

New Uk Visa Regulations Nigeria And Pakistan Face Stricter Scrutiny

May 10, 2025 -

Report Uk To Restrict Visa Applications From Pakistan Nigeria And Sri Lanka

May 10, 2025

Report Uk To Restrict Visa Applications From Pakistan Nigeria And Sri Lanka

May 10, 2025 -

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 10, 2025

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 10, 2025 -

Tougher Asylum Rules In Uk Impact On Migrants From Three Targeted Nations

May 10, 2025

Tougher Asylum Rules In Uk Impact On Migrants From Three Targeted Nations

May 10, 2025