Investing In Palantir Technologies: Is It The Right Time To Buy?

Table of Contents

Palantir's Business Model and Growth Prospects

Palantir Technologies provides cutting-edge data analytics platforms, primarily Gotham and Foundry. Gotham caters to government agencies, assisting them in tackling complex intelligence and national security challenges. Foundry, on the other hand, serves the commercial sector, empowering businesses to leverage their data for improved operational efficiency and strategic decision-making. This dual approach allows Palantir to tap into two distinct, yet potentially synergistic, markets.

Palantir's revenue growth has been substantial, but profitability remains a key focus. Future projections hinge on several factors, including the continued success of its government contracts and its ability to penetrate the increasingly competitive commercial market.

-

Government Contracts: These represent a significant portion of Palantir's revenue, offering a degree of stability. However, dependence on government contracts also introduces geopolitical risks. Future growth in this sector depends on securing new contracts and maintaining existing relationships.

-

Commercial Sector Expansion: Palantir is actively expanding its commercial client base. While this presents significant growth potential, success hinges on demonstrating a strong return on investment for commercial clients and effectively competing with established players in the data analytics space.

-

Key Competitors: Palantir faces competition from established tech giants like Microsoft and Amazon Web Services (AWS), as well as specialized data analytics firms. These competitors possess extensive resources and market reach, posing a challenge to Palantir's continued growth.

-

Long-Term Growth Potential: The long-term growth potential of Palantir depends on its ability to innovate, maintain its competitive edge, and successfully expand its commercial footprint while managing its dependence on government contracts. The ever-increasing demand for sophisticated data analytics solutions suggests a promising market outlook, albeit a competitive one.

Analyzing Palantir's Financial Performance

A thorough assessment of Palantir's financial health is crucial before considering a Palantir investment. We need to examine key financial metrics:

-

Historical Financial Performance Trends: Analyzing historical revenue, earnings per share (EPS), and other financial data reveals trends in profitability and growth.

-

Profitability Margins and Potential for Improvement: Examining profit margins indicates the efficiency of Palantir's operations and the potential for future profit increases.

-

Debt Levels and their Impact: High debt levels can negatively impact a company's financial stability. Assessing Palantir's debt-to-equity ratio provides insight into this aspect.

-

Comparison to Industry Benchmarks: Comparing Palantir's financial performance to that of its competitors provides valuable context and helps to gauge its relative strength. Metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio are useful for valuation comparisons. These ratios can fluctuate based on market sentiment and overall economic conditions.

Risks and Potential Downsides of Investing in Palantir

While Palantir offers exciting growth prospects, several risks must be considered:

-

Geopolitical Risks: The nature of Palantir's government contracts exposes it to geopolitical uncertainties. Changes in government priorities or international relations could impact revenue streams.

-

Technological Disruptions: The rapid pace of technological advancement presents a constant threat. Competitors may introduce innovative solutions that outpace Palantir's offerings.

-

Stock Price Volatility: Palantir's stock price has historically exhibited significant volatility, reflecting the inherent risks associated with investing in a growth-oriented technology company.

-

High Valuation Concerns: Palantir's valuation, particularly in relation to its current profitability, raises concerns for some investors. This high valuation means there's a greater potential for loss if the company fails to meet expectations.

Considering the Current Market Conditions

The overall market environment significantly impacts Palantir's stock price.

-

Market Trends: A bull market generally favors growth stocks like Palantir, while a bear market can lead to significant price declines.

-

Inflationary Pressures: High inflation can impact Palantir's operational costs and potentially reduce investor confidence.

-

Analyst Ratings and Price Targets: Following analyst ratings and price targets can provide valuable insight, but it's crucial to remember these are opinions, not guarantees.

-

Comparison to Other Tech Stocks: Comparing Palantir's performance and valuation to those of other technology companies provides further context.

Conclusion: Should You Invest in Palantir Technologies Now?

Investing in Palantir Technologies presents a complex decision. While its innovative data analytics platforms and potential for growth are compelling, the risks associated with its high valuation, dependence on government contracts, and a competitive market must be carefully weighed. Palantir's financial performance and future prospects need continuous monitoring.

Ultimately, the decision of whether or not to buy Palantir stock (PLTR stock) rests on your individual investment strategy and risk tolerance. Remember to conduct your own thorough due diligence, including consulting with a financial advisor, before investing in Palantir Technologies. Consider your personal investment timeline and whether the potential rewards outweigh the inherent risks associated with a Palantir investment. Don't solely rely on this article; independent research is paramount before buying Palantir.

Featured Posts

-

Hl Altdkhyn Athr Ela Msyrt Ashhr Laeby Krt Alqdm

May 10, 2025

Hl Altdkhyn Athr Ela Msyrt Ashhr Laeby Krt Alqdm

May 10, 2025 -

Changes To Uk Visa Regulations Addressing Work And Student Visa Abuse

May 10, 2025

Changes To Uk Visa Regulations Addressing Work And Student Visa Abuse

May 10, 2025 -

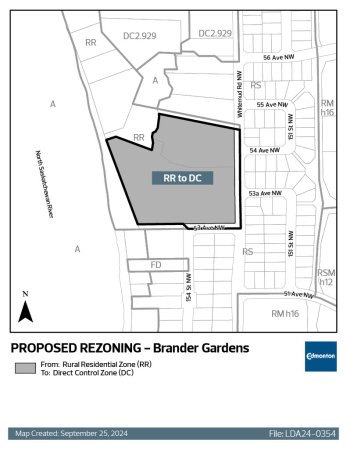

Council Approves Rezoning Edmonton Nordic Spa Closer To Construction

May 10, 2025

Council Approves Rezoning Edmonton Nordic Spa Closer To Construction

May 10, 2025 -

The Monkey Movie And Stephen Kings 2025 A Prediction

May 10, 2025

The Monkey Movie And Stephen Kings 2025 A Prediction

May 10, 2025 -

Legendarniy Stiven Fray Poluchil Rytsarstvo Ot Korolya Charlza Iii

May 10, 2025

Legendarniy Stiven Fray Poluchil Rytsarstvo Ot Korolya Charlza Iii

May 10, 2025