Ethereum Price Outlook: Analyzing The Latest Weekly Chart Buy Signal

Table of Contents

Deciphering the Weekly Chart: Key Technical Indicators

Analyzing the weekly Ethereum chart provides a broader perspective on the price trend compared to shorter-term charts. This allows us to identify significant patterns and potential turning points in the ETH price.

Identifying the Buy Signal

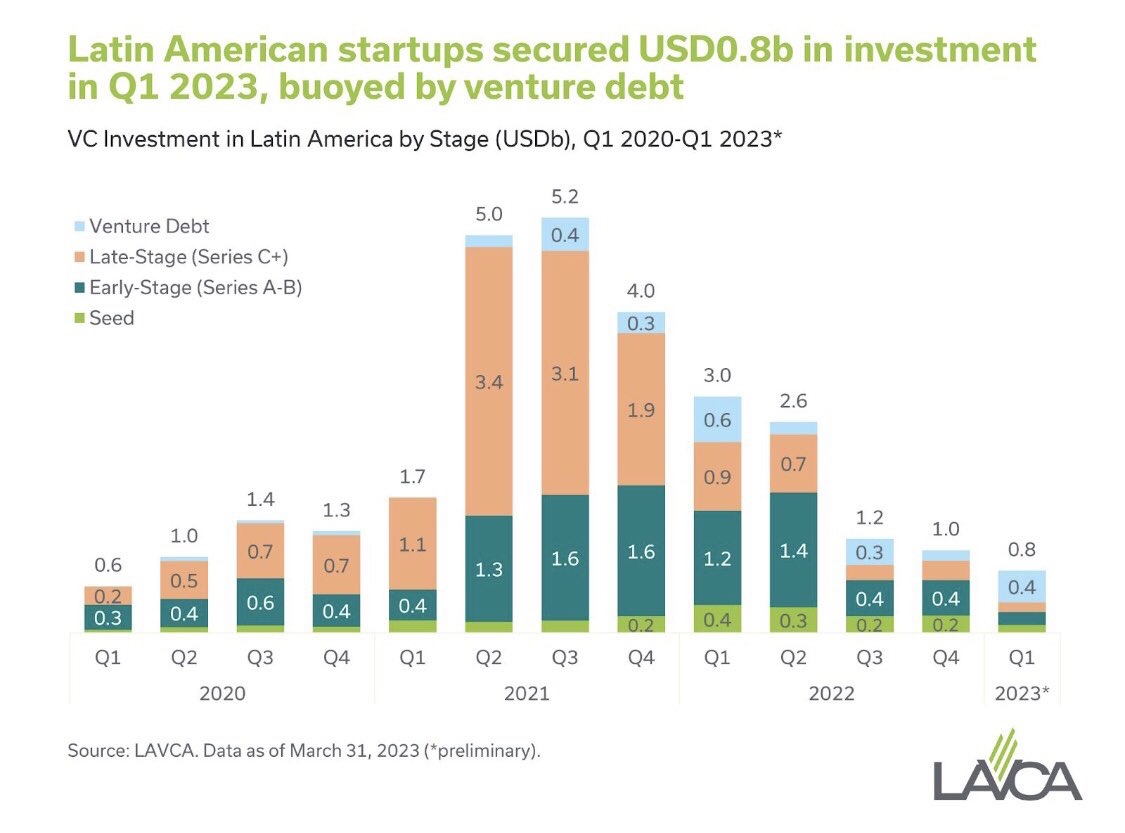

This week's Ethereum weekly chart displays a confluence of bullish indicators strengthening the potential buy signal. Specifically, we observe:

-

Bullish Engulfing Candle: A large green candle completely engulfs the previous red candle, suggesting a shift in momentum from bearish to bullish. This pattern often signals a potential reversal in the ETH price trend.

-

Breakout from Key Resistance: The price has decisively broken above a significant resistance level, indicating a potential continuation of the upward trend. This resistance level had previously capped the ETH price for several weeks.

-

Positive RSI Divergence: While the price formed lower lows, the Relative Strength Index (RSI) formed higher lows, a classic sign of bullish divergence and a potential precursor to a price increase. This suggests that buying pressure is increasing despite short-term price weakness.

[Insert image/chart here illustrating the bullish engulfing candle, breakout, and RSI divergence on the Ethereum weekly chart]

The confluence of these indicators significantly strengthens the bullish signal. The combination suggests a higher probability of an upward price movement for ETH.

Volume Confirmation

High trading volume accompanying the bullish candle confirms the strength and validity of the buy signal. Strong volume during the breakout above the resistance level indicates significant buying pressure pushing the ETH price higher.

-

High Volume = Confirmation: Increased volume reinforces the price movement, indicating that the price increase is not merely a result of thin trading.

-

Low Volume = Warning Sign: Conversely, low volume during the breakout could indicate weak buying pressure and potentially invalidate the buy signal. The price movement may not be sustainable without substantial volume.

[Insert image/chart here highlighting volume changes alongside the price action on the Ethereum weekly chart]

Fundamental Factors Influencing Ethereum Price

Technical analysis alone is insufficient for a complete Ethereum price prediction. Fundamental factors significantly impact the price of ETH.

Ethereum Network Developments

Several positive developments within the Ethereum ecosystem are contributing to a more bullish Ethereum price outlook:

-

Layer-2 Scaling Solutions: The increasing adoption of Layer-2 scaling solutions like Optimism and Arbitrum is improving transaction speed and reducing fees, making Ethereum more user-friendly and scalable.

-

DeFi Growth: The thriving Decentralized Finance (DeFi) ecosystem built on Ethereum continues to attract users and developers, driving demand for ETH.

-

NFT Market Activity: Although fluctuating, the Non-Fungible Token (NFT) market remains active on Ethereum, further boosting demand for ETH.

Conversely, any potential delays in Ethereum's network upgrades or regulatory uncertainty could negatively impact the ETH price. However, at present, the positive developments outweigh the negatives.

Macroeconomic Factors

Broader economic conditions influence cryptocurrency prices, including Ethereum.

-

Inflation and Interest Rates: High inflation and rising interest rates generally negatively impact riskier assets like cryptocurrencies. This could potentially reduce demand for ETH.

-

Regulatory Changes: Government regulations and policies concerning cryptocurrencies can significantly impact the price, either positively or negatively. Positive regulatory developments generally foster growth.

It's crucial to monitor these macroeconomic factors as they can affect the validity and strength of the technical buy signal.

Risk Assessment and Potential Targets

While the weekly Ethereum chart shows a promising buy signal, a thorough risk assessment is crucial before making any investment decisions.

Identifying Support and Resistance Levels

Based on the weekly chart, we can identify potential support and resistance levels to estimate price targets.

-

Support Levels: These levels represent potential price floors where buying pressure is expected to increase.

-

Resistance Levels: These levels represent potential price ceilings where selling pressure might increase.

[Insert image/chart here showing support and resistance levels on the Ethereum weekly chart. Estimate potential price ranges based on these levels.]

Risk Management Strategies

Effective risk management is paramount:

-

Stop-Loss Orders: Always use stop-loss orders to limit potential losses if the price moves against your position.

-

Position Sizing: Never invest more than you can afford to lose. Diversify your portfolio to mitigate risk.

Conclusion

This analysis suggests a potentially bullish Ethereum price outlook based on a compelling buy signal identified on the weekly Ethereum chart. This signal is supported by both technical indicators (bullish engulfing candle, breakout, positive RSI divergence, and high volume) and fundamental factors (positive Ethereum network developments). However, macroeconomic factors must also be considered.

Remember to conduct your own thorough research and consider your personal risk tolerance before making any investment decisions. Stay informed about the latest developments in the Ethereum price and continue monitoring the weekly chart for confirmation of this potential Ethereum price outlook. Regularly review and adapt your Ethereum trading strategy based on market conditions. Understanding the Ethereum price prediction requires diligent monitoring and analysis.

Featured Posts

-

Taca Guanabara Mira El Impresionante Gol De Giorgian De Arrascaeta

May 08, 2025

Taca Guanabara Mira El Impresionante Gol De Giorgian De Arrascaeta

May 08, 2025 -

The Overvalued Canadian Dollar Time For Decisive Action

May 08, 2025

The Overvalued Canadian Dollar Time For Decisive Action

May 08, 2025 -

Cryptocurrency Investment Weathering The Trade War Storm

May 08, 2025

Cryptocurrency Investment Weathering The Trade War Storm

May 08, 2025 -

Brazil Approves First Spot Xrp Etf Ripple Xrp News And Trumps Reaction

May 08, 2025

Brazil Approves First Spot Xrp Etf Ripple Xrp News And Trumps Reaction

May 08, 2025 -

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025

Latest Posts

-

Hernandez Dirigira Al Flamengo El Nuevo Proyecto Del Club Carioca

May 08, 2025

Hernandez Dirigira Al Flamengo El Nuevo Proyecto Del Club Carioca

May 08, 2025 -

Uber Auto Service A Cash Only Transition

May 08, 2025

Uber Auto Service A Cash Only Transition

May 08, 2025 -

Uber One Kenya Discounts And Free Deliveries Now Available

May 08, 2025

Uber One Kenya Discounts And Free Deliveries Now Available

May 08, 2025 -

Flamengo Anuncia A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025

Flamengo Anuncia A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025 -

Cash Only Ubers New Auto Service Payment Policy

May 08, 2025

Cash Only Ubers New Auto Service Payment Policy

May 08, 2025