The Overvalued Canadian Dollar: Time For Decisive Action

Table of Contents

Factors Contributing to an Overvalued Canadian Dollar

Several interconnected factors contribute to the current perception of an overvalued Canadian dollar.

High Commodity Prices

Canada's economy is heavily reliant on commodity exports, particularly oil and natural gas. Strong global demand and rising prices for these commodities directly boost the Canadian dollar's value. This positive correlation between commodity prices and the CAD (Canadian dollar) is well-established.

- Strong oil prices: Increased global demand for crude oil leads to higher export revenue, increasing demand for the Canadian dollar.

- Natural gas surge: Similarly, a rise in natural gas prices boosts Canadian export earnings, strengthening the CAD.

- Other commodities: Metals, lumber, and agricultural products also play a significant role in influencing the CAD's value. A rise in global prices for these commodities further strengthens the Canadian currency.

The relationship is cyclical: a stronger CAD can eventually dampen commodity export demand, leading to price adjustments. However, the current strength of commodity markets continues to be a major driver of the CAD's overvaluation.

Interest Rate Differentials

The Bank of Canada's monetary policy significantly influences the CAD's value relative to other currencies. Higher interest rates in Canada compared to other major economies attract foreign investment, increasing demand for the Canadian dollar.

- Comparison with the US: The interest rate differential between Canada and the United States is a key factor. Higher Canadian rates draw investment away from the US, boosting the CAD.

- Eurozone comparison: Similar comparisons with the Eurozone and other major economies highlight the impact of interest rate disparities on capital flows.

- Bank of Canada's role: The Bank of Canada's decisions regarding interest rate adjustments are crucial in managing the exchange rate and mitigating the effects of overvaluation. However, raising rates too much can stifle domestic economic growth.

Safe-Haven Status

Canada's reputation as a politically stable and economically sound country attracts significant foreign investment, further contributing to the demand for the Canadian dollar. This "safe-haven" status is particularly pronounced during times of global uncertainty.

- Geopolitical factors: Global instability often leads to increased demand for Canadian assets, driving up the value of the CAD.

- Strong institutions: Canada's robust legal and regulatory frameworks enhance its appeal as a safe investment destination.

- Economic stability: Relative economic stability compared to other countries contributes to its safe-haven status and strengthens the CAD.

Negative Consequences of an Overvalued Canadian Dollar

An overvalued Canadian dollar carries several detrimental consequences for the Canadian economy.

Impact on Exports

A strong CAD makes Canadian goods and services more expensive for international buyers, reducing their competitiveness in global markets. This leads to decreased export volumes and potential job losses.

- Manufacturing sector: The manufacturing industry is particularly vulnerable, as many products compete directly with lower-cost producers in other countries.

- Agricultural products: Canadian agricultural exports also face challenges due to higher prices in foreign markets.

- Job losses: Reduced export competitiveness can translate to job losses in export-oriented sectors.

Stifled Economic Growth

The reduced export revenue resulting from an overvalued Canadian dollar directly impacts overall economic growth and GDP. This can lead to slower economic expansion and fewer job creation opportunities.

- GDP impact: Reduced export earnings translate to a lower overall GDP, impacting economic growth projections.

- Investment slowdown: The negative impact on exports can also discourage investment in export-oriented sectors.

- Reduced competitiveness: A persistently overvalued dollar hinders the competitiveness of Canadian businesses on the global stage.

Increased Import Costs

While an overvalued currency makes imports cheaper for Canadian consumers, it can lead to increased inflation if the cost savings are not passed on.

- Consumer price impact: The benefits of lower import costs may not be fully realized by consumers if businesses increase their profit margins instead of lowering prices.

- Cost of living: Increased prices for goods and services, despite cheaper imports, can contribute to a higher cost of living.

- Inflationary pressures: The potential for increased inflation poses a significant challenge for the Bank of Canada's monetary policy.

Potential Solutions to Address the Overvalued Canadian Dollar

Addressing the overvalued Canadian dollar requires a multi-pronged approach.

Diversification of the Economy

Reducing Canada's reliance on commodity exports is crucial for long-term economic stability and resilience. Diversifying into other sectors is essential to reduce the volatility associated with fluctuating commodity prices.

- Investment in technology: Fostering innovation and technological advancements in various sectors can create new export opportunities.

- Developing other sectors: Investing in sectors like advanced manufacturing, clean technology, and the creative industries can help balance the economy.

- Supporting SMEs: Providing support and resources for small and medium-sized enterprises (SMEs) is vital for driving economic diversification.

Monetary Policy Adjustments

The Bank of Canada plays a crucial role in managing the exchange rate, but its influence is limited. Monetary policy tools are primarily focused on inflation control and cannot directly target the exchange rate.

- Interest rate adjustments: While interest rate adjustments can influence the exchange rate, they need to be carefully considered in light of their potential impact on domestic economic growth.

- Communication strategy: Clear and consistent communication from the Bank of Canada about its monetary policy decisions can help manage market expectations.

- Limitations of monetary policy: It's important to acknowledge the limitations of using monetary policy solely to manage the exchange rate.

Fiscal Policy Interventions

Government policies can also play a role, though direct intervention in currency markets is generally avoided. Fiscal policies can indirectly influence the exchange rate by influencing economic growth and investment.

- Investment incentives: Targeted government investments in specific sectors can boost economic growth and indirectly influence the exchange rate.

- Trade agreements: Negotiating favorable trade agreements can improve export competitiveness and lessen the negative impacts of an overvalued currency.

- Cautious approach: Direct government intervention in currency markets is generally avoided due to its potential negative consequences.

Conclusion

The overvalued Canadian dollar is a complex issue with far-reaching consequences for the Canadian economy. The factors contributing to this overvaluation, including high commodity prices, interest rate differentials, and Canada's safe-haven status, have created a challenging environment for Canadian businesses. The negative consequences, such as reduced export competitiveness, stifled economic growth, and potential inflationary pressures, require a carefully considered response. Addressing this challenge necessitates a multi-pronged approach involving economic diversification, strategic monetary policy adjustments, and supportive fiscal policies. Understanding the complexities of the overvalued Canadian dollar is crucial for navigating the current economic landscape. Stay informed and participate in the conversation to ensure a healthy and prosperous future for the Canadian economy.

Featured Posts

-

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025 -

Six Goals Fly In Barcelona Inter Milan Champions League Semi Final Clash

May 08, 2025

Six Goals Fly In Barcelona Inter Milan Champions League Semi Final Clash

May 08, 2025 -

Pavle Grbovic Psg Kompromisno Resenje Za Prelaznu Vladu

May 08, 2025

Pavle Grbovic Psg Kompromisno Resenje Za Prelaznu Vladu

May 08, 2025 -

Desetta Pobeda Za Vesprem Triumf Nad Ps Zh Vo L Sh

May 08, 2025

Desetta Pobeda Za Vesprem Triumf Nad Ps Zh Vo L Sh

May 08, 2025 -

X Men Beyond Rogues Skimpiest Outfit A New Era Of Costume Design

May 08, 2025

X Men Beyond Rogues Skimpiest Outfit A New Era Of Costume Design

May 08, 2025

Latest Posts

-

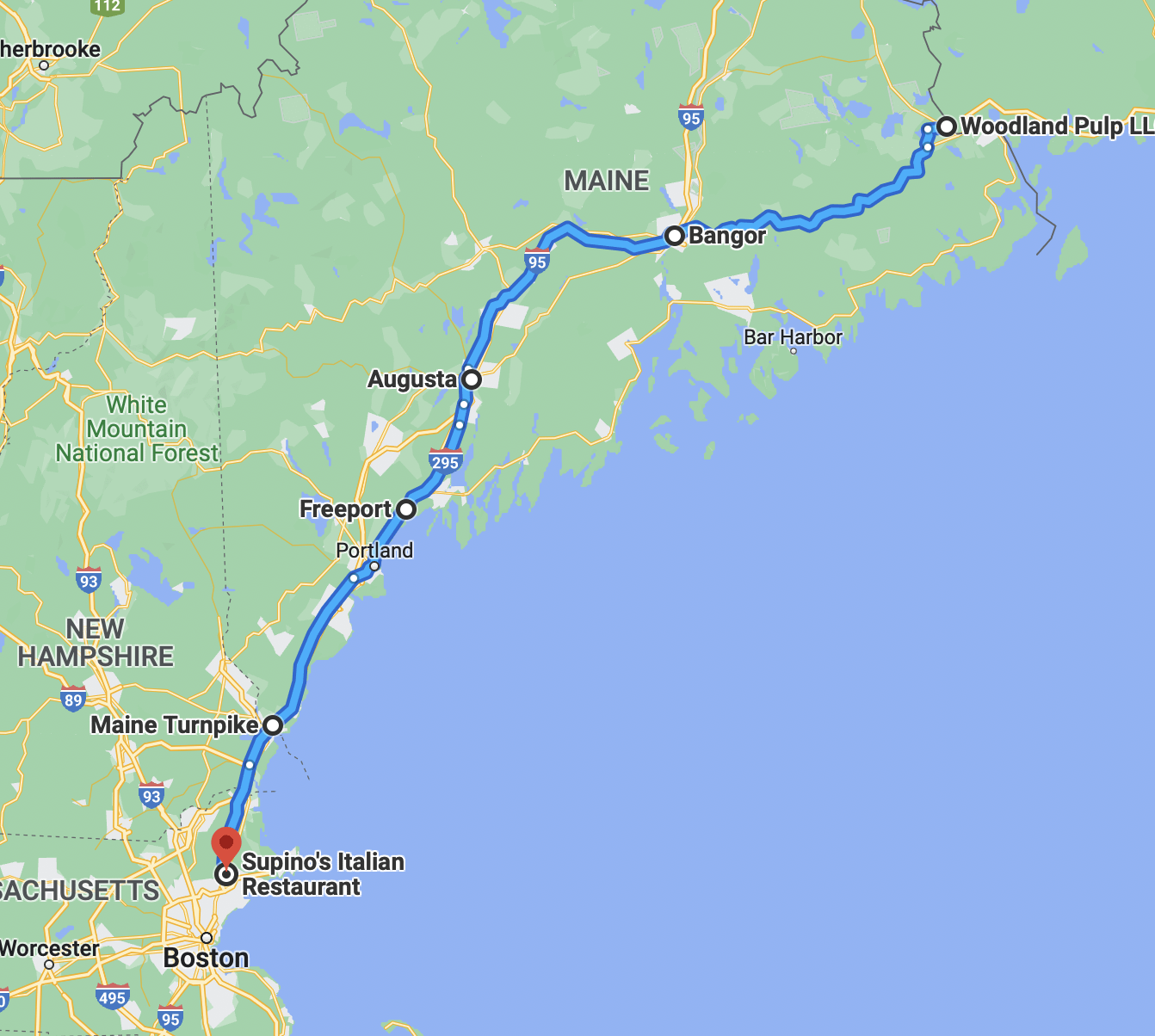

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025 -

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025

The Long Walk Trailer Stephen King Calls It Too Dark

May 08, 2025 -

New Dystopian Horror Movie Based On Stephen King First Trailer Unveiled

May 08, 2025

New Dystopian Horror Movie Based On Stephen King First Trailer Unveiled

May 08, 2025 -

Stephen Kings Underrated Novel Gets Dystopian Horror Treatment First Trailer Released

May 08, 2025

Stephen Kings Underrated Novel Gets Dystopian Horror Treatment First Trailer Released

May 08, 2025 -

First Trailer Dystopian Horror From Hunger Games Director Based On Stephen King

May 08, 2025

First Trailer Dystopian Horror From Hunger Games Director Based On Stephen King

May 08, 2025