Understanding The Bitcoin Rebound: Risks And Opportunities

Table of Contents

Factors Contributing to a Bitcoin Rebound

Several factors can contribute to a Bitcoin rebound, creating a complex interplay of market forces and investor sentiment. Understanding these factors is key to predicting and potentially profiting from these market movements.

Regulatory Changes and Institutional Adoption

Positive regulatory developments and increased institutional adoption are significant catalysts for a Bitcoin rebound.

- Positive Regulatory Developments: Clearer regulatory frameworks in major economies can increase investor confidence, leading to greater institutional involvement and retail participation. For example, the establishment of specific cryptocurrency regulations in countries like Switzerland or Singapore can signal a more stable and legitimate investment environment.

- Institutional Investment: The entry of large financial institutions, such as hedge funds, asset managers, and publicly traded companies, injects significant capital into the Bitcoin market. This added liquidity can stabilize prices and fuel upward momentum. Examples include MicroStrategy's substantial Bitcoin holdings or Tesla's initial investment.

- Example 1: Grayscale Investments' Bitcoin Trust (GBTC) provides a vehicle for institutional investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

- Example 2: BlackRock's application for a spot Bitcoin ETF signifies significant institutional interest and a potential influx of capital.

Market Sentiment and Investor Psychology

Market sentiment plays a crucial role in Bitcoin's price movements. A shift from bearish (negative) to bullish (positive) sentiment can trigger a rapid rebound.

- Fear of Missing Out (FOMO): As the price starts to rise, FOMO can accelerate the rebound, pushing prices even higher as more investors rush to buy.

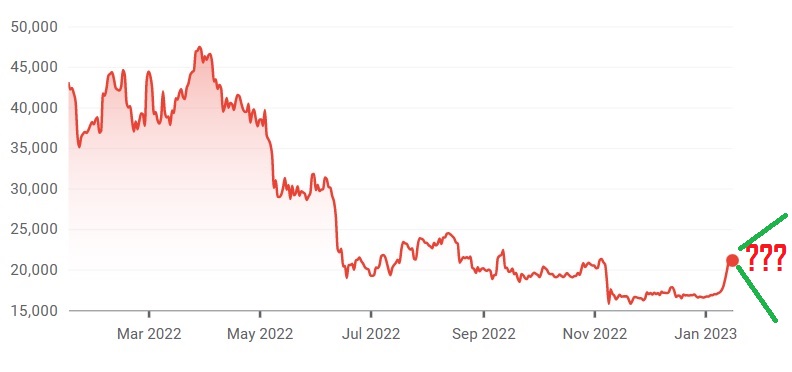

- Technical Indicators: While not foolproof, technical indicators like moving averages (MA) and Relative Strength Index (RSI) can provide insights into potential price reversals. However, it's crucial to analyze them in conjunction with fundamental factors.

- News and Media Influence: Positive news coverage and social media sentiment can significantly sway investor psychology, influencing buying and selling decisions and contributing to the Bitcoin rebound.

Technological Advancements and Network Upgrades

Technological advancements and successful network upgrades can bolster confidence in Bitcoin's long-term viability and trigger a rebound.

- Scaling Solutions: Improvements to Bitcoin's scalability, such as the Lightning Network, can address transaction speed and cost limitations, making it more attractive to a wider range of users.

- Security Upgrades: Enhancements in Bitcoin's security protocols can increase investor confidence and reduce the risk of attacks, potentially boosting the price.

- Example: The successful implementation of Taproot, a significant upgrade improving Bitcoin's transaction efficiency and privacy, contributed positively to market sentiment.

Risks Associated with a Bitcoin Rebound

While a Bitcoin rebound presents opportunities, it also carries substantial risks. Understanding these risks is paramount for responsible investment.

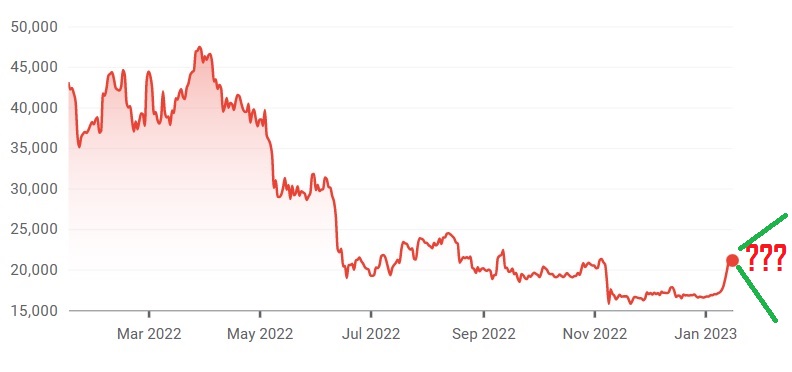

Market Volatility and Price Corrections

Bitcoin rebounds are often followed by periods of sharp price corrections or consolidations.

- Bubble Formation: Rapid price increases can create speculative bubbles, making the market susceptible to sudden and significant price drops.

- Market Corrections: Corrections are normal in any market, but their intensity in the volatile cryptocurrency market can be significant, leading to substantial losses for investors.

- Chart Analysis: Analyzing historical Bitcoin charts reveals numerous instances of sharp rebounds followed by substantial price corrections.

Security Risks and Hacks

Increased trading volume during a rebound can increase the risk of hacks and security breaches.

- Exchange Vulnerabilities: Centralized exchanges can be vulnerable to hacking, leading to the loss of user funds and potentially impacting market confidence.

- Wallet Security: It is crucial to use secure hardware wallets and practice robust security measures to protect personal Bitcoin holdings.

- Example: Past hacks of major cryptocurrency exchanges have resulted in significant price drops, underscoring the importance of security.

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty and potential government interventions remain significant risks.

- Regulatory Crackdowns: Governments could implement stricter regulations that negatively impact Bitcoin's price, even during a rebound.

- Taxation Policies: Changes in taxation policies related to cryptocurrencies can also influence investor behavior and market sentiment.

- Geopolitical Events: Global events and political instability can create uncertainty in the market, impacting Bitcoin's price.

Opportunities Presented by a Bitcoin Rebound

Despite the inherent risks, a Bitcoin rebound presents significant opportunities for savvy investors.

Profit Potential and Investment Strategies

Bitcoin rebounds can offer substantial profit potential.

- Early Identification: Identifying the early stages of a rebound can lead to significant returns.

- Investment Strategies: Strategies such as dollar-cost averaging (DCA) and swing trading can be employed to mitigate risk and maximize potential profits.

- Risk Management: Implementing proper risk management techniques, such as setting stop-loss orders, is crucial to protect against potential losses.

Diversification and Portfolio Management

Incorporating Bitcoin into a diversified portfolio can help reduce overall risk.

- Asset Allocation: Determining the appropriate allocation of Bitcoin within a broader investment portfolio is vital.

- Portfolio Diversification: Diversification across different asset classes can reduce the impact of Bitcoin price volatility on the overall portfolio.

- Long-Term Perspective: A long-term investment horizon can help mitigate the impact of short-term price fluctuations.

Conclusion

Understanding a Bitcoin rebound requires a careful assessment of the contributing factors, inherent risks, and potential opportunities. While the prospect of significant profits is alluring, investors must approach this volatile market with caution and a thorough understanding of the risks involved. By analyzing market trends, regulatory changes, and technological advancements, investors can better position themselves to navigate the complexities of a Bitcoin rebound and potentially capitalize on the opportunities it presents. Remember to always conduct thorough research and consider your risk tolerance before investing in Bitcoin or any other cryptocurrency. Learn more about navigating the volatility of the Bitcoin rebound and discover effective strategies today!

Featured Posts

-

Ps Plus Premium And Extra March 2024 Games Lineup Revealed

May 08, 2025

Ps Plus Premium And Extra March 2024 Games Lineup Revealed

May 08, 2025 -

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025 -

Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

May 08, 2025

Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

May 08, 2025 -

Possible Ps 5 And Ps 4 Game Announcements At The March 2025 Nintendo Direct

May 08, 2025

Possible Ps 5 And Ps 4 Game Announcements At The March 2025 Nintendo Direct

May 08, 2025 -

Counting Crows 2025 Tour Potential Setlist And Song Choices

May 08, 2025

Counting Crows 2025 Tour Potential Setlist And Song Choices

May 08, 2025

Latest Posts

-

Kripto Para Satislari Duesuesuen Ardindaki Nedenler

May 08, 2025

Kripto Para Satislari Duesuesuen Ardindaki Nedenler

May 08, 2025 -

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025 -

Yatirimcilar Korkuyor Kripto Para Duesuesue Ve Satis Baskisi

May 08, 2025

Yatirimcilar Korkuyor Kripto Para Duesuesue Ve Satis Baskisi

May 08, 2025 -

Spk Nin Kripto Varlik Platformlarina Yoenelik Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Nin Kripto Varlik Platformlarina Yoenelik Sermaye Ve Guevenlik Sartlari

May 08, 2025 -

Kripto Piyasasi Coekuesue Ve Yatirimci Tepkisi Satislar Artti

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Tepkisi Satislar Artti

May 08, 2025