Bitcoin's 10x Multiplier: Could It Shake Wall Street?

Table of Contents

Bitcoin's Historical Growth and Future Potential

Past Performance as an Indicator

Bitcoin's history is marked by periods of explosive growth, punctuated by significant corrections. Analyzing past Bitcoin price history provides valuable insights into its potential for future price appreciation. Examining its market capitalization and adoption rate throughout its existence reveals patterns and drivers of its volatility.

- 2010-2013: Bitcoin's early years saw exponential growth, driven by increasing awareness and early adoption among tech enthusiasts.

- 2017: The cryptocurrency market experienced a bull run, with Bitcoin reaching an all-time high, fueled by mainstream media attention and increasing institutional interest.

- Technological Advancements: Upgrades like the SegWit implementation and the Lightning Network have improved Bitcoin's scalability and transaction speed, attracting wider adoption.

- Regulatory Developments: While regulatory clarity remains a significant factor, both positive and negative regulatory actions have impacted Bitcoin's price.

Understanding these historical trends, combined with current market conditions and technological advancements, is crucial when assessing Bitcoin's future potential. The analysis of past halving events—programmed reductions in Bitcoin's mining rewards—has also contributed to price prediction models.

Factors Contributing to a Potential 10x Multiplier

Several factors could potentially propel Bitcoin's price to a 10x multiplier:

- Increasing Institutional Investment: The entry of large institutional investors, such as hedge funds and asset management firms, signifies growing confidence in Bitcoin as an asset class. A Bitcoin ETF approval could further accelerate this trend.

- Growing Global Adoption: As more countries and businesses embrace cryptocurrency, demand for Bitcoin is expected to increase, potentially driving up its price.

- Scarcity of Bitcoin: Bitcoin's limited supply of 21 million coins contributes to its inherent scarcity, making it an attractive asset in an inflationary environment.

- Inflation Hedging: Many view Bitcoin as a hedge against inflation, leading to increased demand during times of economic uncertainty. This role as "digital gold" further supports price appreciation.

- Regulatory Clarity (or Lack Thereof): Clearer regulatory frameworks could boost institutional investment, while uncertainty could, paradoxically, also increase demand from those seeking refuge from regulatory scrutiny in traditional markets.

The Impact of a 10x Bitcoin Multiplier on Wall Street

Disruption of Traditional Financial Markets

A 10x Bitcoin price increase would have profound implications for Wall Street:

- Shift in Investor Portfolios: Investors might shift a significant portion of their portfolios towards Bitcoin, potentially reducing demand for traditional assets.

- Increased Competition for Assets: Traditional financial institutions would face increased competition from the cryptocurrency market, potentially impacting their profitability and market share.

- Decreased Demand for Traditional Investments: As investors flock to Bitcoin, demand for traditional assets like bonds and stocks could decline.

- Challenges to Existing Financial Models: The dominance of Bitcoin could necessitate a fundamental reassessment of existing financial models and investment strategies.

Increased Regulatory Scrutiny and Response

Such a massive shift in market dynamics would undoubtedly attract intense regulatory scrutiny:

- Increased Regulation: Governments worldwide would likely intensify their efforts to regulate the cryptocurrency market, aiming to mitigate risks and prevent market manipulation.

- Potential for New Legislation: New laws and regulations specific to cryptocurrencies, including Bitcoin, could be enacted to address the challenges posed by its rapid growth.

- Impact on Cryptocurrency Exchanges: Cryptocurrency exchanges would face increased regulatory pressure, potentially impacting their operations and profitability.

- Challenges to Existing Financial Regulations: The success of Bitcoin could challenge the very foundation of existing financial regulations, forcing a re-evaluation of their effectiveness and relevance.

Arguments Against a 10x Bitcoin Multiplier

Market Volatility and Risk

The cryptocurrency market is notoriously volatile, and a 10x increase carries significant risks:

- Market Corrections: Sharp price corrections are common in the cryptocurrency market, and a significant price increase could be followed by a dramatic downturn.

- Potential for "Bubble" Bursts: Some argue that Bitcoin's price is inflated and could experience a significant "bubble" burst, leading to substantial losses for investors.

- Risks of Investing in Volatile Assets: Investing in highly volatile assets like Bitcoin carries significant risk, and investors should be aware of the potential for substantial losses.

Technological and Adoption Challenges

Several factors could hinder widespread Bitcoin adoption:

- Scalability Issues: Bitcoin's transaction processing speed and scalability remain areas of ongoing development.

- Energy Consumption Concerns: Bitcoin mining's high energy consumption continues to be a source of debate and concern.

- User Experience Limitations: The user experience for interacting with Bitcoin can be complex and challenging for many users.

Conclusion

The possibility of Bitcoin's 10x multiplier presents a compelling narrative of potential disruption to Wall Street and the global financial system. While the factors contributing to a potential surge in price are substantial, including increasing institutional investment, growing global adoption, and its scarcity, it's crucial to acknowledge the inherent volatility and risks associated with such a dramatic price movement. The arguments against a 10x multiplier highlight significant technological challenges and the ever-present risk of market corrections. While Bitcoin's impact on finance is undeniable, whether it will reach a 10x multiplier remains a topic of ongoing debate and extensive analysis. Further research into Bitcoin's price predictions and market analysis will allow you to form your own informed conclusion about Bitcoin's future.

Featured Posts

-

Play Station Podcast Episode 512 True Blue Review And Analysis

May 08, 2025

Play Station Podcast Episode 512 True Blue Review And Analysis

May 08, 2025 -

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025 -

Rogues Leadership A Necessary Evolution

May 08, 2025

Rogues Leadership A Necessary Evolution

May 08, 2025 -

Trump Vs China The Fight For Greenlands Future

May 08, 2025

Trump Vs China The Fight For Greenlands Future

May 08, 2025 -

Rogue Avenger Or X Men Marvels Surprising Answer

May 08, 2025

Rogue Avenger Or X Men Marvels Surprising Answer

May 08, 2025

Latest Posts

-

7 Surprisingly Good Movies To Watch On Paramount

May 08, 2025

7 Surprisingly Good Movies To Watch On Paramount

May 08, 2025 -

Discover 7 Great Movies Streaming Now On Paramount

May 08, 2025

Discover 7 Great Movies Streaming Now On Paramount

May 08, 2025 -

7 Hidden Gems On Paramount Must See Movies You Ve Missed

May 08, 2025

7 Hidden Gems On Paramount Must See Movies You Ve Missed

May 08, 2025 -

7 Best Undiscovered Paramount Movies You Should Stream Now

May 08, 2025

7 Best Undiscovered Paramount Movies You Should Stream Now

May 08, 2025 -

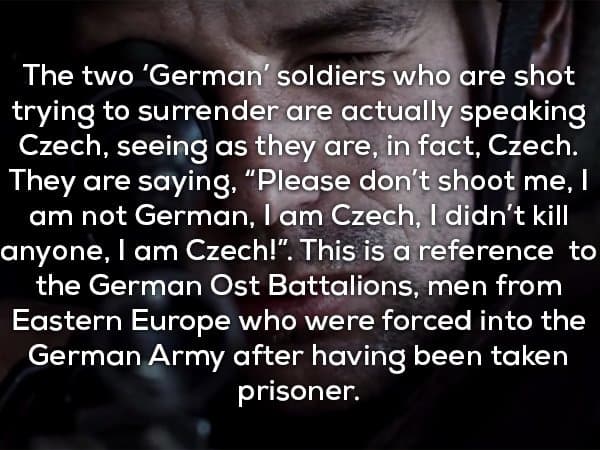

20 Surprising Facts About The Making Of Saving Private Ryan

May 08, 2025

20 Surprising Facts About The Making Of Saving Private Ryan

May 08, 2025