Strengthening Financial Cooperation: Joint Venture Between Pakistan, Sri Lanka And Bangladesh Capital Markets

Table of Contents

Potential Economic Benefits of a Joint Venture

A joint venture between the capital markets of Pakistan, Sri Lanka, and Bangladesh offers compelling economic advantages. By integrating their markets, these nations can access new opportunities for growth and stability.

Increased Investment Flows

A unified capital market significantly enhances the region's attractiveness to foreign investors. This joint venture can:

- Diversify investment opportunities: Investors gain access to a wider range of assets and sectors across three distinct economies, reducing reliance on a single market.

- Expand access to larger capital pools: The combined market size creates a more attractive proposition for both domestic and international investors, leading to increased FDI and portfolio investment.

- Reduce reliance on individual economies: The diversification of investment sources strengthens the resilience of each participating economy to external shocks.

This integration boosts regional investment, fostering capital markets integration and attracting crucial FDI and portfolio investment.

Enhanced Market Liquidity and Depth

A larger, integrated market naturally leads to greater liquidity and depth. This translates to:

- Increased trading volume: A broader investor base and greater trading activity result in higher overall trading volumes.

- Reduced price volatility: More liquid markets are generally less volatile, benefiting investors and promoting greater stability.

- Improved price discovery mechanisms: More efficient price discovery mechanisms ensure that asset prices more accurately reflect their underlying value.

These improvements in market liquidity and depth are crucial for sustainable capital markets integration, supporting trading volume and enhancing price discovery.

Improved Risk Sharing and Diversification

Risk mitigation is a key advantage of this joint venture. By pooling resources and diversifying investment portfolios, the three economies can:

- Reduce exposure to idiosyncratic risks: Risks specific to a single economy are mitigated through diversification across the region.

- Enhance resilience to economic shocks: The integrated market becomes more resilient to macroeconomic shocks affecting any one of the participating nations.

This improved risk management enhances financial stability across the region and fosters economic resilience, leading to improved risk diversification and overall financial stability.

Challenges in Establishing a Joint Venture

While the potential benefits are significant, several challenges need addressing for successful implementation.

Regulatory Harmonization

Aligning regulatory frameworks across Pakistan, Sri Lanka, and Bangladesh is a major hurdle. This includes:

- Differences in accounting standards: Harmonizing accounting standards is vital for transparency and comparability of financial information.

- Securities regulations: Differences in securities regulations can impede cross-border transactions and investor confidence.

- Corporate governance practices: Ensuring consistent corporate governance practices promotes investor protection and market integrity.

Achieving regulatory convergence and harmonization across different regulatory bodies requires significant effort, addressing cross-border regulations and facilitating securities regulation.

Infrastructure Development

Robust technological infrastructure is essential for seamless cross-border transactions:

- Efficient clearing and settlement systems: Reliable and efficient clearing and settlement systems are crucial for timely and secure transactions.

- Advanced trading platforms: Modern and integrated trading platforms are needed to support high trading volumes and efficient order execution.

- Reliable communication networks: Reliable communication networks ensure smooth information flow between market participants.

Investing in robust market infrastructure, incorporating trading technology and efficient clearing and settlement systems, is crucial for successful integration.

Political and Economic Risks

Political instability and economic uncertainties pose significant risks:

- Currency fluctuations: Fluctuations in exchange rates can impact investment flows and profitability.

- Geopolitical risks: Geopolitical events can create uncertainty and affect investor confidence.

- Macroeconomic instability: Macroeconomic instability in any one of the three economies can negatively impact the overall market.

Careful risk assessment and mitigation strategies are vital, considering political risk, economic risk, and macroeconomic stability.

Strategies for Successful Implementation

A phased approach and strategic partnerships are crucial for successful implementation.

Phased Approach

A gradual implementation strategy minimizes risks and allows for adjustments based on experience. This could involve:

- Pilot programs: Initiating pilot programs focusing on specific market segments to test the feasibility and effectiveness of the integration process.

- Gradual expansion of cooperation: Expanding the scope of cooperation gradually, starting with simpler initiatives and progressively incorporating more complex aspects.

- Focus on specific market segments: Focusing on specific market segments, such as debt or equity markets, to facilitate easier integration.

Adopting a phased implementation, focusing on gradual integration and initiating pilot projects, will ensure smooth market segment integration.

Capacity Building

Investing in human capital is essential:

- Training programs for regulators: Providing training programs for regulators to enhance their understanding of cross-border market integration.

- Training for market professionals: Equipping market professionals with the necessary skills and knowledge for operating in an integrated market.

- Investor education programs: Educating investors on the opportunities and risks associated with investing in the integrated market.

Capacity building, including training programs for regulators and market professionals, is vital for human capital development.

Regional Cooperation and Collaboration

Close collaboration among governments and regulatory bodies is paramount:

- Joint working groups: Establishing joint working groups to address common challenges and coordinate policy initiatives.

- Information sharing: Facilitating efficient information sharing between regulatory bodies to promote transparency and coordination.

- Regular dialogue: Maintaining regular dialogue between governments and regulatory bodies to ensure effective policy coordination.

Regional cooperation, facilitated by government collaboration and regulatory dialogue, ensures policy coordination and information sharing.

Conclusion

Strengthening financial cooperation through a joint venture between the Pakistan, Sri Lanka, and Bangladesh capital markets presents a unique opportunity for regional economic growth. While challenges related to regulatory harmonization, infrastructure development, and political and economic risks exist, a phased approach, capacity building, and robust regional cooperation can pave the way for success. The potential benefits – increased investment flows, enhanced market liquidity and depth, and improved risk sharing – are too significant to ignore. Let's work together to overcome the challenges and unlock the significant potential of this strategic initiative, fostering deeper South Asian capital markets integration and promoting lasting economic prosperity.

Featured Posts

-

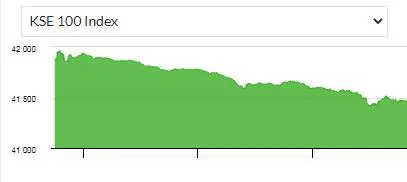

Pakistan Stock Exchange Outage Amidst Market Volatility

May 10, 2025

Pakistan Stock Exchange Outage Amidst Market Volatility

May 10, 2025 -

Renaissance Et Modem Vers Une Fusion Sous L Impulsion D Elisabeth Borne

May 10, 2025

Renaissance Et Modem Vers Une Fusion Sous L Impulsion D Elisabeth Borne

May 10, 2025 -

Sensex Live Market Gains Momentum Nifty Surges Past 17 950

May 10, 2025

Sensex Live Market Gains Momentum Nifty Surges Past 17 950

May 10, 2025 -

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025 -

Securing Your Future Identifying A Real Safe Bet

May 10, 2025

Securing Your Future Identifying A Real Safe Bet

May 10, 2025