Elliott Eyes Exclusive Bet On Russian Gas Pipeline

Table of Contents

The Allure of Russian Gas Infrastructure Despite Sanctions

The decision by Elliott Management to invest in a Russian gas pipeline, despite existing sanctions and geopolitical turmoil, highlights the potentially lucrative returns in a volatile market. While the risks are undeniably substantial, the potential rewards could be equally immense.

High Potential Returns in a Volatile Market

Several factors contribute to the allure of this investment, even amidst sanctions:

- High gas prices: Global energy markets remain tight, driving up prices for natural gas.

- Increasing global energy demand: The world's growing energy needs create consistent demand for Russian gas, despite efforts to diversify sources.

- Potential for future pipeline expansion: Future expansion could significantly increase the pipeline's capacity and profitability.

- Reduced competition due to sanctions: Sanctions against Russia have reduced competition, potentially benefiting existing infrastructure.

Elliott's investment strategy likely involves sophisticated financial modeling, taking into account the inherent risks. They may be leveraging discounted valuations due to sanctions, betting on a future easing of restrictions, or focusing on specific contractual arrangements that mitigate exposure to sanctions.

Navigating the Sanctions Landscape

Investing in a sanctioned entity requires careful navigation of a complex legal and regulatory environment. Elliott faces several key challenges:

- Compliance risks: Strict adherence to international sanctions is crucial to avoid legal penalties.

- Potential for legal challenges: The investment could face legal challenges from various stakeholders.

- Reputation damage: Association with a sanctioned entity could harm Elliott's reputation.

- Strategies for mitigating sanctions impact: Creative structuring of the investment, potentially through intermediaries, is likely necessary.

Elliott likely employs a multi-layered approach to minimize sanctions exposure. This could involve complex legal structures, partnerships with entities outside of direct sanction reach, and a deep understanding of the evolving sanctions landscape.

Geopolitical Implications and Risks

The investment carries significant geopolitical implications, adding another layer of complexity to an already precarious situation.

The Geopolitical Chessboard

The Russian gas pipeline investment is deeply intertwined with the current geopolitical climate:

- Ukraine conflict: The ongoing conflict significantly impacts gas flows and the broader energy landscape.

- EU energy dependence: Europe's reliance on Russian gas creates leverage for Russia, impacting geopolitical dynamics.

- Russia's leverage over gas supplies: Control over gas supplies gives Russia significant influence over European countries.

- Potential for further sanctions: Further sanctions could significantly impact the viability of the investment.

This investment could potentially exacerbate tensions between Russia and the West, leading to unpredictable consequences for Elliott and the global energy market.

Assessing the Risk Tolerance

Elliott Management, with its history of high-risk, high-reward investments, possesses a significant risk tolerance:

- Diversification of Elliott's portfolio: This single investment is likely a small part of a much larger, diversified portfolio.

- History of high-risk investments: Elliott has a track record of navigating complex and risky investment scenarios.

- Capacity to absorb potential losses: The firm has the financial resources to absorb significant losses if the investment fails.

This investment is consistent with Elliott's established strategy, demonstrating a calculated risk appetite and the potential for substantial returns despite the inherent uncertainties.

Market Analysis and Future Projections

The success of Elliott's investment hinges on several factors, including the future demand for Russian gas and the potential for pipeline expansion.

Demand for Russian Gas

Despite geopolitical tensions and sanctions, the demand for Russian gas remains a crucial consideration:

- European energy dependence: While efforts to diversify energy sources are underway, Europe remains reliant on Russian gas in the short term.

- Alternative energy sources: The transition to renewable energy sources is gradual, and gas will likely remain a significant energy source for years to come.

- Long-term energy transition: The speed and trajectory of the energy transition will significantly impact the future demand for Russian gas.

- Emerging markets: Growing energy needs in emerging markets could offset reduced European demand.

Various scenarios exist, ranging from a sustained high demand for gas to a more rapid adoption of renewables, which could significantly impact the value of this investment.

Potential for Long-Term Growth

Despite current sanctions, several factors could drive long-term growth:

- Expansion into Asia: Increased exports to Asian markets could compensate for reduced European demand.

- New gas fields: The development of new gas fields could increase pipeline capacity and profitability.

- Increased efficiency: Technological improvements could enhance the pipeline's efficiency and longevity.

- Technological advancements: Innovations in gas transportation and processing could increase profitability.

Long-term growth scenarios depend on numerous factors, including geopolitical stability, technological advancements, and shifts in global energy demand.

Conclusion

Elliott Management's investment in a Russian gas pipeline represents a high-risk, high-reward gamble with significant geopolitical implications. While the potential for substantial returns exists, the inherent risks, including sanctions, geopolitical instability, and potential for significant losses, are equally substantial. This situation highlights the complexities of investing in the global energy sector and the intricate interplay between finance and geopolitics. To learn more about Elliott's investment strategy and the intricacies of navigating the Russian gas pipeline market, further research into high-yield investments in the energy sector is crucial. Analyze the risks and rewards of investing in Russian energy to fully understand this unique and complex situation.

Featured Posts

-

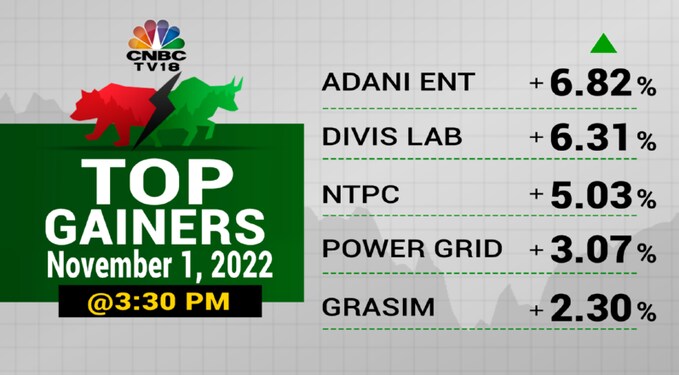

Sensex Soars 500 Points Nifty Above 18400 Market Movers Today

May 10, 2025

Sensex Soars 500 Points Nifty Above 18400 Market Movers Today

May 10, 2025 -

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025 -

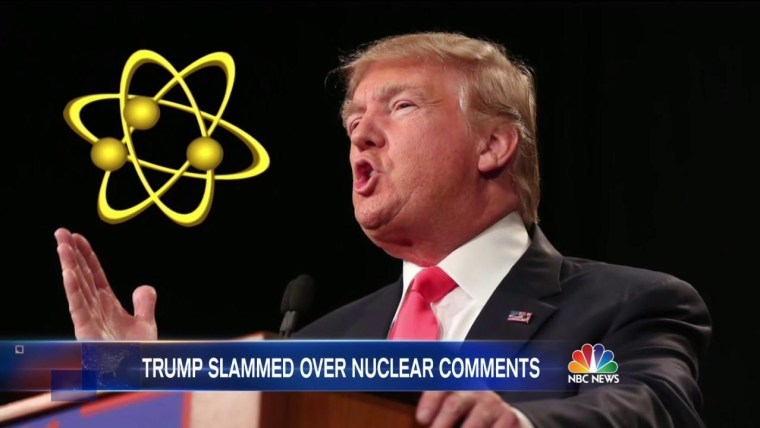

Trumps Plan To Fast Track Nuclear Power Plant Projects

May 10, 2025

Trumps Plan To Fast Track Nuclear Power Plant Projects

May 10, 2025 -

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok Gostey

May 10, 2025

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok Gostey

May 10, 2025 -

Young Thug And Mariah The Scientist Snippet Reveals A Promise Of Fidelity

May 10, 2025

Young Thug And Mariah The Scientist Snippet Reveals A Promise Of Fidelity

May 10, 2025

Latest Posts

-

Decoding Adam Sandlers Oscars 2025 Appearance The Outfit Timothee Chalamet And The Laughter

May 11, 2025

Decoding Adam Sandlers Oscars 2025 Appearance The Outfit Timothee Chalamet And The Laughter

May 11, 2025 -

Review Anthony Mackie Stars As A Sneaker In Childrens Movie

May 11, 2025

Review Anthony Mackie Stars As A Sneaker In Childrens Movie

May 11, 2025 -

The Story Behind Adam Sandlers Oscars 2025 Cameo Outfit Chalamet Hug And More

May 11, 2025

The Story Behind Adam Sandlers Oscars 2025 Cameo Outfit Chalamet Hug And More

May 11, 2025 -

Sneak Peek Anthony Mackie In A New Family Film

May 11, 2025

Sneak Peek Anthony Mackie In A New Family Film

May 11, 2025 -

Oscars 2025 Adam Sandlers Cameo Hilarious Outfit And Timothee Chalamet Moment Explained

May 11, 2025

Oscars 2025 Adam Sandlers Cameo Hilarious Outfit And Timothee Chalamet Moment Explained

May 11, 2025