Sensex Soars 500 Points, Nifty Above 18400: Market Movers Today

Table of Contents

Sensex's 500-Point Jump: Analyzing the Surge

The Sensex's 500-point gain represents a substantial increase, particularly considering the recent market volatility. This impressive jump signifies a significant shift in market sentiment. The Sensex closed at [Insert Closing Value Here], while the Nifty ended the day at [Insert Closing Value Here]. This robust performance can be attributed to several contributing factors:

-

Positive Global Cues: Easing inflation concerns in the US and positive performance in global markets provided a significant boost to investor confidence, leading to increased buying in the Indian stock market. The positive sentiment spilled over from international markets, creating a ripple effect in India.

-

Strong Corporate Earnings Reports: Several leading companies announced strong quarterly earnings reports, exceeding market expectations. This positive news fueled investor optimism and encouraged further investment. Robust earnings often translate to higher stock valuations, contributing directly to index growth.

-

Positive Government Policy Announcements: Recent positive government policy announcements, focusing on [mention specific policies if available, e.g., infrastructure development, tax benefits], injected renewed confidence into the market. Government initiatives often have a substantial impact on investor sentiment and market direction.

-

Sector-Specific Performance Drivers: Specific sectors outperformed others, significantly contributing to the overall market rally. The strong performance of these sectors played a pivotal role in driving the Sensex's upward trajectory.

Nifty Above 18400: A Milestone Achieved

The Nifty index crossing the 18400 mark is a significant milestone, signaling strong investor confidence and positive market sentiment. This breakthrough suggests a potential shift towards further upward momentum, although caution is always warranted. This achievement has several implications:

-

Increased Investor Confidence: Reaching this milestone reinforces investor confidence, potentially attracting more investment into the Indian stock market.

-

Positive Market Sentiment: The Nifty's strong performance reflects a generally positive market outlook. This sentiment can influence further investment decisions and market direction.

-

Resistance Levels Broken: The Nifty's crossing of 18400 suggests that previous resistance levels have been overcome, indicating a potential for continued growth. This technical indicator often signifies a change in market momentum.

-

Broader Market Trends: The Nifty's performance reflects a broader positive trend in the Indian economy, suggesting a healthy growth outlook. The index serves as a significant barometer of the overall market health.

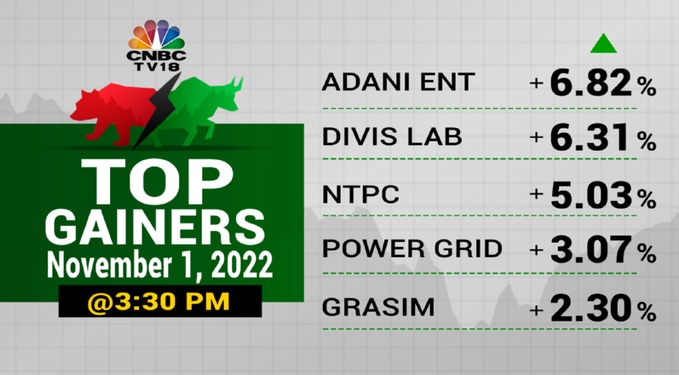

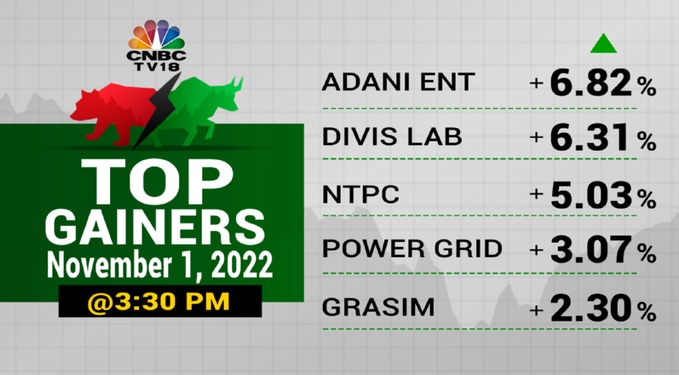

Top Market Movers Today: Sector-Wise Analysis

Several sectors experienced significant gains, driving the overall market rally. Here's a sector-wise breakdown of the top market movers:

-

Sector Name: IT

- Key Stocks: Infosys, TCS, HCL Tech

- Reasons for Performance: Strong quarterly earnings, increased global demand for IT services.

-

Sector Name: Banking

- Key Stocks: HDFC Bank, SBI, ICICI Bank

- Reasons for Performance: Positive interest rate environment, increased credit growth.

-

Sector Name: FMCG

- Key Stocks: Hindustan Unilever, Nestle India, ITC

- Reasons for Performance: Strong consumer demand, robust sales figures.

While many sectors performed well, some underperformed. [Mention any underperforming sectors and provide brief reasons]. Understanding both winners and losers provides a comprehensive picture of the day's market activity.

Expert Opinions and Market Outlook

Market analysts remain cautiously optimistic about the near-term outlook. [Insert quotes from market analysts here, if available]. While the current market rally is encouraging, potential risks remain, including [mention potential risks, e.g., global economic uncertainties, geopolitical factors]. Upcoming economic data releases, such as [mention specific data releases], will play a crucial role in shaping future market trends.

Sensex and Nifty's Strong Performance – What's Next?

Today's market rally, with the Sensex surging over 500 points and the Nifty crossing 18400, signifies a significant positive development for the Indian stock market. Key drivers include positive global cues, strong corporate earnings, government policies, and sector-specific performance. While the outlook remains positive, investors should remain aware of potential risks and uncertainties. The Nifty's crossing of 18400 marks a substantial milestone, but sustained growth depends on various factors, including global economic conditions and domestic policy developments.

Stay updated on the latest Sensex and Nifty movements and market analysis for informed investment decisions. Check back tomorrow for the next market update!

Featured Posts

-

Chinas Canola Strategy Beyond The Canada Trade Dispute

May 10, 2025

Chinas Canola Strategy Beyond The Canada Trade Dispute

May 10, 2025 -

Sharing Transgender Experiences Impact Of Trumps Executive Actions

May 10, 2025

Sharing Transgender Experiences Impact Of Trumps Executive Actions

May 10, 2025 -

600 Sensex Nifty

May 10, 2025

600 Sensex Nifty

May 10, 2025 -

Putins Victory Day Ceasefire A Strategic Calculation

May 10, 2025

Putins Victory Day Ceasefire A Strategic Calculation

May 10, 2025 -

10 Film Noir Movies Guaranteed To Grip You

May 10, 2025

10 Film Noir Movies Guaranteed To Grip You

May 10, 2025