Trump's Tariffs: $174 Billion Wipeout For Top 10 Billionaires

Table of Contents

The Target Sectors: How Tariffs Hit Billionaires' Portfolios

Trump's tariffs significantly impacted various sectors, leading to substantial losses for billionaires with substantial investments in those areas. The ripple effects of these protectionist measures extended far beyond initial expectations.

Technology Giants and the China Trade War

The tech industry bore the brunt of the trade war between the US and China. Billionaires with significant holdings in companies like Apple, Microsoft, and Amazon faced considerable losses due to tariffs imposed on goods traded between the two nations.

- Examples: Investors with large stakes in Apple saw their holdings decline as tariffs increased the cost of iPhones and other Apple products manufactured in China, impacting sales and profitability. Similarly, Microsoft, with its significant presence in the Chinese market, experienced reduced revenue due to increased tariffs on software and hardware.

- Specific Impacts: Tariffs increased production costs, forcing companies to either absorb the increased expenses, leading to reduced profit margins, or pass them onto consumers, leading to price hikes and potentially reduced demand. The uncertainty created by fluctuating tariffs also negatively impacted investment decisions and market confidence.

- Quantifiable Losses: While precise figures for individual billionaire losses are difficult to isolate due to the complexity of diversified portfolios, the overall market downturn in the tech sector, partly attributable to the tariffs, undeniably contributed to significant wealth reductions for these investors. This illustrates the interconnectedness of global markets and the vulnerability of even the wealthiest individuals to major geopolitical events. Keywords: China tariffs, tech billionaires, stock market impact, trade war losses, Apple, Microsoft, Amazon.

Retail and Consumer Goods: Feeling the Pinch of Import Duties

Tariffs on imported goods directly affected the retail and consumer goods sectors, impacting billionaires with substantial investments in these industries. Increased import duties translated to higher prices for consumers and reduced profitability for businesses.

- Examples: Billionaires with major stakes in large retail chains experienced reduced sales and profit margins as consumers faced higher prices for imported goods. The increased costs often could not be fully absorbed by retailers, impacting their bottom line and consequently affecting investor wealth.

- Increased Prices and Decreased Profitability: Tariffs led to a rise in the prices of many consumer goods, impacting consumer spending and overall market demand. This downward pressure on sales, coupled with increased production costs, squeezed profit margins for companies across the retail spectrum, ultimately affecting the net worth of their investors.

- Keywords: Retail tariffs, consumer goods impact, import duties, inflation, billionaire losses, consumer spending, retail sales.

Manufacturing and Supply Chains: Disrupted Businesses and Diminished Returns

The manufacturing sector faced significant challenges due to tariffs, especially those reliant on global supply chains. Billionaires with investments in this sector experienced increased production costs and disruptions to their businesses.

- Examples: Investors with substantial holdings in manufacturing companies experienced increased costs due to tariffs on imported raw materials and components. Supply chain disruptions resulted from retaliatory tariffs imposed by other countries, leading to delays, shortages, and ultimately, decreased productivity and profitability.

- Increased Production Costs and Supply Chain Disruptions: Tariffs significantly raised the cost of production for many manufacturing companies, reducing their competitiveness in both domestic and international markets. The disruption to global supply chains further exacerbated these challenges, leading to significant financial losses and reduced investor returns.

- Keywords: Manufacturing tariffs, supply chain disruptions, global trade impact, billionaire wealth decrease, production costs, global supply chains.

The $174 Billion Figure: A Deep Dive into the Losses

The estimated $174 billion loss for the top ten billionaires is a significant figure, reflecting the substantial impact of Trump's tariffs. Understanding how this figure was derived is crucial to evaluating the overall economic consequences.

Methodology and Data Sources

The $174 billion figure was calculated using a combination of publicly available data and financial modeling techniques. The methodology involved analyzing the market valuations of companies in the affected sectors before and after the implementation of tariffs, accounting for other market factors to isolate the impact of the tariffs as much as possible.

- Data Sources: Financial reports from publicly traded companies, market analysis from reputable financial institutions (e.g., Bloomberg, S&P Global), and billionaire net worth tracking services were used.

- Calculation Methods: A combination of regression analysis and comparative market valuation was employed to estimate the impact of tariffs on the net worth of the top ten billionaires.

- Limitations of the Data: The inherent limitations of using publicly available data include potential inaccuracies and the difficulty in precisely isolating the impact of tariffs from other market forces. Further research could refine these figures with more granular data.

- Keywords: Financial analysis, market data, billionaire net worth, data methodology, regression analysis, market valuation.

Distribution of Losses Across Billionaires

The $174 billion loss wasn't evenly distributed among the top ten billionaires. The specific impact varied depending on the composition of their investment portfolios and their exposure to the affected sectors.

- Individual Losses: Precise individual losses are difficult to pinpoint due to privacy concerns and the complexity of diversified investment portfolios. However, analysts suggest that those with higher exposure to the tech and retail sectors experienced larger losses than those with more diversified portfolios.

- Factors Influencing Individual Losses: Portfolio diversification was a crucial factor in mitigating losses. Billionaires with a broad range of investments across multiple sectors experienced less severe impacts compared to those with concentrated holdings in tariff-sensitive industries.

- Keywords: Billionaire wealth, portfolio diversification, individual losses, wealth distribution, investment portfolio.

Long-Term Economic Consequences of Trump's Tariffs

The long-term consequences of Trump's tariffs extend far beyond the immediate impact on billionaire wealth, affecting American consumers and global trade relations.

Impact on American Consumers

The tariffs resulted in higher prices for many consumer goods, impacting American consumers through reduced purchasing power and decreased consumer spending.

- Examples: Increased prices on imported goods like clothing, electronics, and furniture directly affected consumer budgets, leading to decreased disposable income.

- Decreased Consumer Spending: The higher prices led to reduced consumer spending, potentially slowing economic growth and impacting the overall health of the economy.

- Keywords: Inflation, consumer spending, economic impact, trade war consequences, consumer prices.

Global Trade Relations and Geopolitical Implications

Trump's tariffs damaged global trade relations and had significant geopolitical implications. The rise of protectionism and retaliatory tariffs from other countries created uncertainty and strained international relationships.

- Strained Relationships: The imposition of tariffs led to retaliatory measures from trading partners, creating trade disputes and escalating tensions.

- Rise of Protectionism: Trump's policies fueled a rise in protectionist sentiments globally, potentially hindering international trade and economic cooperation.

- Keywords: Global trade, protectionism, geopolitical implications, international relations, trade wars, retaliatory tariffs.

Conclusion

Trump's tariffs, while intended to benefit American industry, resulted in a substantial $174 billion loss for the nation's top ten billionaires. This analysis highlights the wide-ranging economic consequences of these policies, affecting various sectors and demonstrating the interconnected nature of the global economy. Understanding the impact of Trump's tariffs on billionaire wealth offers crucial insight into the broader economic repercussions of protectionist trade policies. Further research is needed to fully understand the long-term effects, but it's clear that the economic landscape has been significantly altered. Learn more about the lasting impact of these trade decisions and explore the complexities of Trump's tariffs and their influence on global economics by conducting further research.

Featured Posts

-

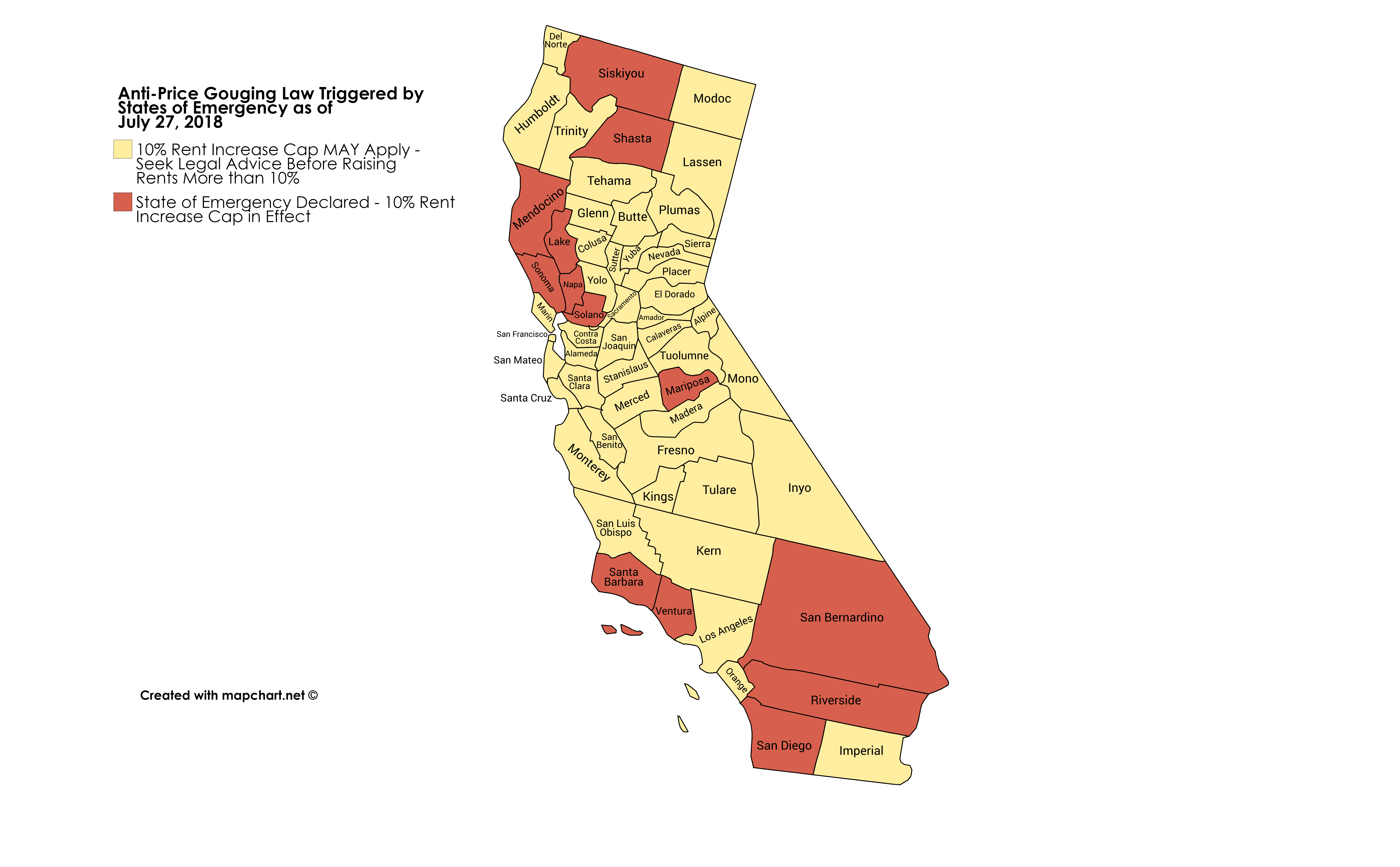

The Aftermath Of La Fires The Impact On Renters And Allegations Of Price Gouging

May 10, 2025

The Aftermath Of La Fires The Impact On Renters And Allegations Of Price Gouging

May 10, 2025 -

Razgrom Na Zolotoy Maline Dakota Dzhonson I Drugie Nominanty Khudshikh Filmov Goda

May 10, 2025

Razgrom Na Zolotoy Maline Dakota Dzhonson I Drugie Nominanty Khudshikh Filmov Goda

May 10, 2025 -

Trumps Transgender Military Ban A Comprehensive Overview And Analysis

May 10, 2025

Trumps Transgender Military Ban A Comprehensive Overview And Analysis

May 10, 2025 -

Broad Street Diners Fate Hyatt Hotel Construction And Demolition

May 10, 2025

Broad Street Diners Fate Hyatt Hotel Construction And Demolition

May 10, 2025 -

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 10, 2025

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 10, 2025