Dow Jones Index: Steady Rise Bolstered By Positive PMI Report

Table of Contents

Positive PMI Report Fuels Investor Confidence

The PMI report serves as a crucial indicator of economic health, reflecting the prevailing conditions in the manufacturing and services sectors. A positive PMI reading, generally above 50, indicates expansion in business activity, signaling optimism among purchasing managers. This positive sentiment directly translates into increased investor confidence. The recent PMI report showcased strong growth across various sectors. For instance, the manufacturing PMI reached 55.5, exceeding expectations, while the services PMI clocked in at 57.2, indicating robust expansion in the service sector. The composite PMI, a weighted average of manufacturing and services, also registered a significant increase.

- Increased business activity reflected in the PMI: The data suggests a notable uptick in new orders and production levels across various industries.

- Positive outlook for future economic growth: The strong PMI figures point towards sustained economic growth in the coming months, encouraging investment.

- Boost in consumer spending expectations: A healthy economy fueled by strong PMI data often translates into higher consumer confidence and increased spending, further driving economic activity.

- Impact on corporate earnings projections: Positive PMI data usually leads to upward revisions of corporate earnings forecasts, attracting investors seeking higher returns.

Sector-Specific Performance within the Dow Jones Index

The positive PMI report didn't impact all sectors equally. Following the release of the data, certain sectors within the Dow Jones Index exhibited exceptional performance. The technology sector experienced a notable surge, driven by strong demand for tech products and services. This growth was further fueled by positive projections for future technological advancements. The financial sector also showed significant gains, fueled by increased investor activity and positive interest rate expectations. However, not all sectors performed equally well. Some sectors, like energy, experienced moderate growth, potentially influenced by global supply chain dynamics and fluctuating oil prices.

- Strong performance in technology stocks: Fueled by robust demand and positive future growth projections in AI, cloud computing and software.

- Increased activity in the financial sector: Driven by positive interest rate expectations and increased investor activity in the market.

- Resilience of industrial stocks: Industrial stocks demonstrated resilience despite lingering supply chain challenges and geopolitical uncertainties.

Implications for Future Market Performance: Dow Jones Index Outlook

The positive PMI report sets a positive stage for the Dow Jones Index's short-term and long-term performance. The continued growth fueled by increased investor confidence and strong economic indicators suggests potential for further upward movement. However, it's crucial to consider potential risks. Inflationary pressures and potential interest rate hikes by central banks could dampen economic growth and negatively impact market sentiment. Geopolitical events and global uncertainties also pose significant risks. Many market analysts believe that while the current outlook is positive, investors should maintain a balanced portfolio and remain vigilant about potential risks.

- Potential for continued growth in the Dow Jones Index: Positive economic data and investor confidence suggest continued upward momentum in the short term.

- Risks associated with inflation and interest rate hikes: Rising inflation could erode corporate profits, impacting market performance.

- Impact of geopolitical events on market stability: Global political instability and economic sanctions can negatively impact market confidence.

- Opportunities for investors in specific sectors: The positive PMI data highlights growth opportunities in various sectors, such as technology and financials.

Conclusion: Understanding the Dow Jones Index's Recent Surge

The recent surge in the Dow Jones Index is strongly correlated with the positive PMI report, indicating a healthy economic outlook and boosting investor confidence. This increase reflects the positive impact of robust business activity, particularly in the technology and financial sectors. While the outlook appears positive, it is important to acknowledge potential risks associated with inflation, interest rate changes, and geopolitical uncertainties. However, the overall picture suggests a continued positive trend, with opportunities for investors who remain informed and adaptable. Stay updated on the latest Dow Jones Index movements and PMI data to make well-informed investment decisions and capitalize on market opportunities. Understanding the Dow Jones Index and its relationship with key economic indicators like the PMI is crucial for navigating the complexities of the stock market.

Featured Posts

-

Kyle Walker And The Mysterious Milan Night Out Following Wifes Departure

May 25, 2025

Kyle Walker And The Mysterious Milan Night Out Following Wifes Departure

May 25, 2025 -

Bangkok Post Ferrari Unveils State Of The Art Facility

May 25, 2025

Bangkok Post Ferrari Unveils State Of The Art Facility

May 25, 2025 -

Ae Xplore Campaign England Airpark And Alexandria International Airport Boost Local And Global Travel

May 25, 2025

Ae Xplore Campaign England Airpark And Alexandria International Airport Boost Local And Global Travel

May 25, 2025 -

Escape To The Country Budgeting For Your Rural Lifestyle

May 25, 2025

Escape To The Country Budgeting For Your Rural Lifestyle

May 25, 2025 -

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yhqq Hdha Alinjaz

May 25, 2025

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yhqq Hdha Alinjaz

May 25, 2025

Latest Posts

-

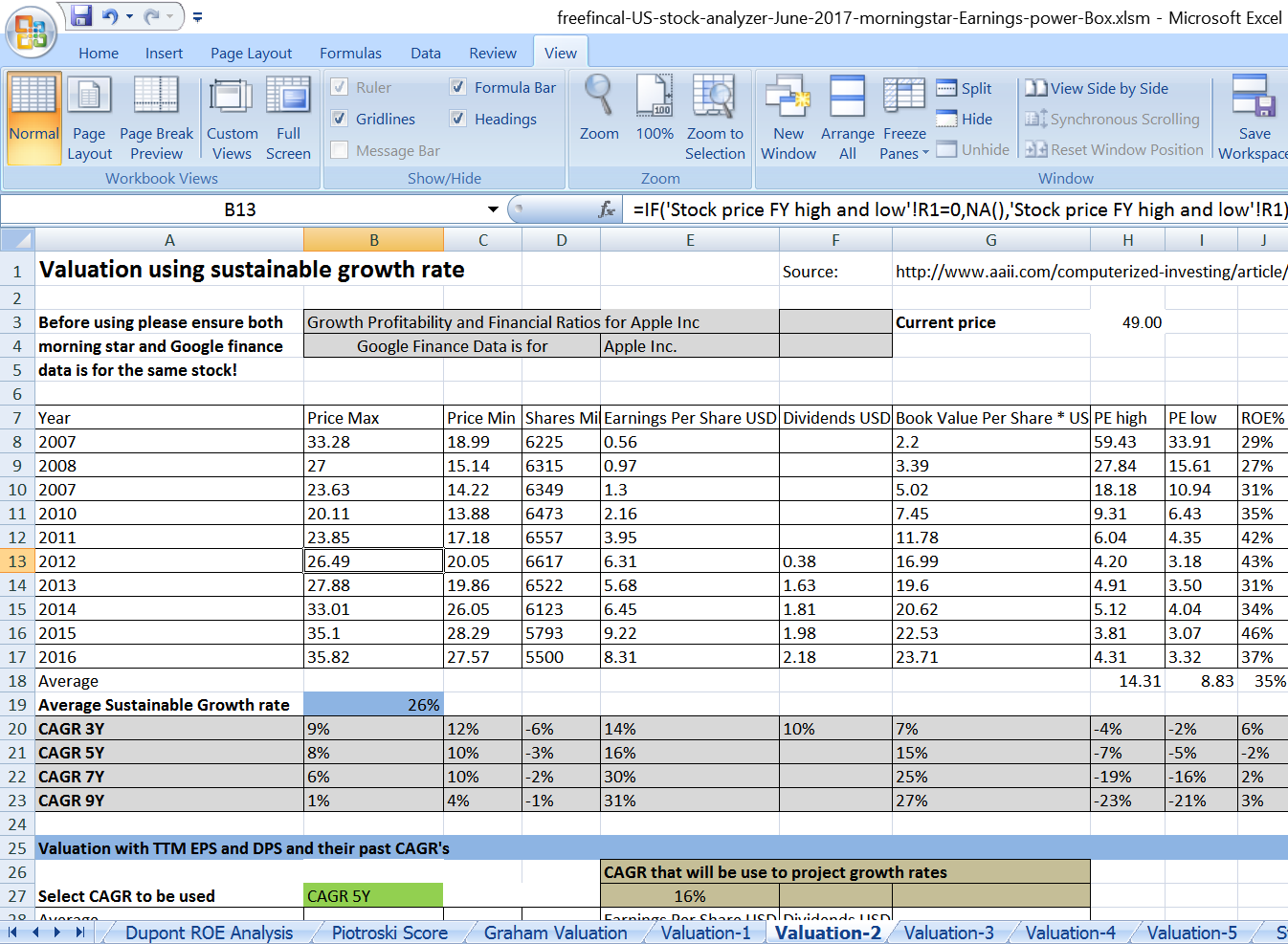

Apple Stock Decline Impact Of Announced Tariffs

May 25, 2025

Apple Stock Decline Impact Of Announced Tariffs

May 25, 2025 -

Apple Stock Outlook Post Q2 Earnings Report

May 25, 2025

Apple Stock Outlook Post Q2 Earnings Report

May 25, 2025 -

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025 -

Apple Stock Investment Analysis Of Q2 Financial Results

May 25, 2025

Apple Stock Investment Analysis Of Q2 Financial Results

May 25, 2025 -

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 25, 2025

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 25, 2025