Decoding Buffett's Success: Key Learnings From The Apple Investment

Table of Contents

Understanding Buffett's Shift Towards Tech: A Paradigm Shift in Value Investing?

Warren Buffett's traditional approach has always been rooted in value investing, focusing on undervalued companies with strong fundamentals and predictable earnings. However, his substantial investment in Apple, a tech giant, seemed to mark a departure (or perhaps an evolution) from this established philosophy. This raises the question: Did Buffett's Apple investment signify a paradigm shift in his investment strategy, or does it simply represent an adaptation to the changing dynamics of the modern market?

The characteristics of Apple that likely appealed to Buffett, even within the tech sector, include:

- Strong Brand Recognition and Customer Loyalty: Apple boasts unparalleled brand recognition and fiercely loyal customers, ensuring consistent demand for its products.

- Recurring Revenue Streams from Services: Apple's services segment, including subscriptions like Apple Music and iCloud, provides predictable recurring revenue, a feature highly valued by value investors.

- Consistent Profitability and High Margins: Apple consistently demonstrates high profit margins and strong profitability, indicating a robust and efficient business model.

- Dominant Market Position and Competitive Advantages: Apple enjoys a dominant position in several key markets, offering considerable competitive advantages and pricing power.

This investment doesn't necessarily contradict Buffett's core value investing principles. Instead, it might reflect an expansion of his philosophy to encompass companies demonstrating strong recurring revenue, significant brand loyalty, and enduring competitive advantages, even within the tech sector. The key is to identify businesses with durable competitive moats, regardless of the industry. This showcases an evolution of value investing, adapting to the modern landscape and recognizing value in different forms.

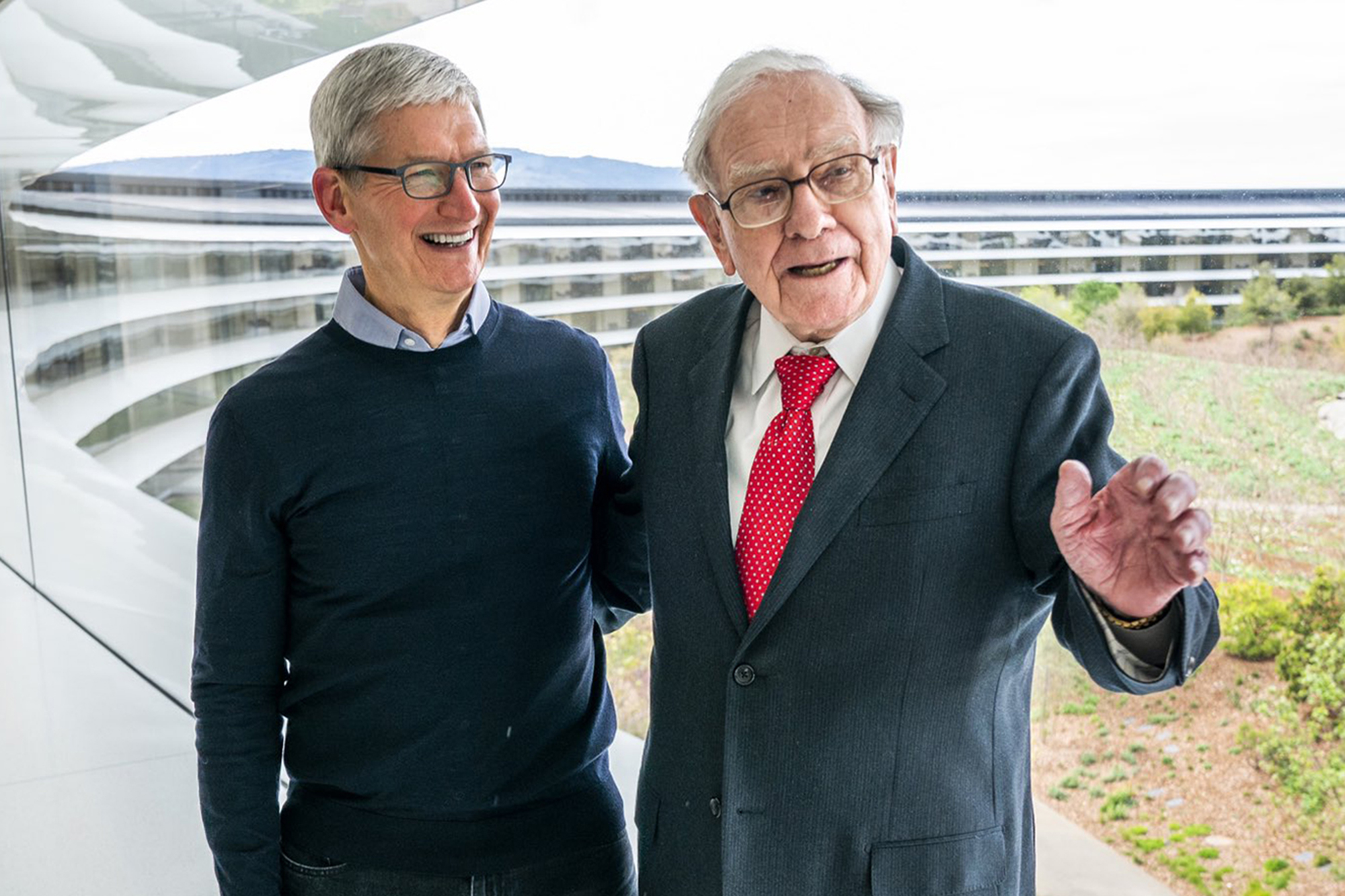

Identifying the Role of Strong Management: The Importance of Leadership in Long-Term Growth

Beyond financial metrics, Buffett's investment decisions often heavily factor in the quality of a company's leadership. In the case of Apple, Tim Cook's leadership played a pivotal role. Buffett's assessment of Apple's management team was undoubtedly a significant influence on his investment decision.

- Tim Cook's Steady Hand: Cook's steady leadership and execution have been instrumental in Apple's continued success, building on the foundation laid by Steve Jobs. His focus on operational efficiency and strategic expansion into new markets solidified Apple's position.

- Corporate Governance: Apple's effective corporate governance structure, transparency, and long-term vision provide additional confidence for long-term investors.

A strong and competent management team is paramount for long-term value creation. Such a team ensures operational efficiency, strategic decision-making, and a sustainable competitive advantage. The quality of leadership directly impacts a company's ability to navigate challenges, seize opportunities, and deliver consistent growth over the long haul.

The Power of Patience: Embracing a Long-Term Investment Horizon

Buffett's investment philosophy is famously centered around a long-term perspective. This is vividly illustrated by his Apple investment. He didn't react to short-term market fluctuations. This patience is a critical element of his success.

- Buy-and-Hold Strategy: The Apple investment exemplifies Buffett's buy-and-hold strategy. He's not focused on short-term gains but rather on long-term value appreciation.

- Ignoring Market Volatility: Short-term market volatility didn't deter Buffett's long-term strategy. He understood that the intrinsic value of Apple would likely appreciate over time, regardless of temporary market dips.

Patience and a long-term investment horizon are crucial for reaping the rewards of successful investments. A long-term perspective allows investors to weather market storms, capitalize on long-term growth, and avoid emotional decision-making driven by short-term market noise.

Beyond the Numbers: Qualitative Factors in Buffett's Investment Decision

While quantitative analysis is undoubtedly important, Buffett also considers qualitative factors heavily. His Apple investment decision wasn't solely based on financial metrics.

- Brand Reputation and Customer Loyalty: Apple's strong brand reputation and highly loyal customer base were significant qualitative factors.

- Ecosystem and Network Effects: The Apple ecosystem and network effects created significant barriers to entry for competitors and enhanced the value of Apple products and services.

- Technological Innovation and Future Potential: Buffett recognized Apple's capacity for technological innovation and its potential for future growth in various markets.

These qualitative factors, often overlooked in purely quantitative analysis, contribute significantly to the overall valuation of a company. They provide insights into a company's long-term competitive advantage and its potential for sustained growth.

Mastering Buffett's Approach: Applying the Apple Investment Lessons

Buffett's Apple investment provides several key learnings for investors of all levels: prioritize value investing, identify strong management teams, embrace a long-term perspective, and always consider qualitative factors alongside quantitative data. Mastering long-term investing, as exemplified by Buffett's Apple investment, requires patience and a deep understanding of a company's fundamentals and competitive landscape. By applying these principles to your own investment strategies, you can begin to decode your own Buffett-style Apple Investment, focusing on businesses with strong long-term potential. Apply these lessons to your portfolio and begin building wealth through a long-term, value-oriented approach.

Featured Posts

-

High Quality Goods At Low Prices Smart Shopping

May 06, 2025

High Quality Goods At Low Prices Smart Shopping

May 06, 2025 -

Finding Quality On A Budget Affordable Options

May 06, 2025

Finding Quality On A Budget Affordable Options

May 06, 2025 -

Warren Buffetts Apple Bet What Investors Can Learn

May 06, 2025

Warren Buffetts Apple Bet What Investors Can Learn

May 06, 2025 -

Trump Meeting Strategies A Guide To Winning And Losing Scenarios

May 06, 2025

Trump Meeting Strategies A Guide To Winning And Losing Scenarios

May 06, 2025 -

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Lawsuit

May 06, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Lawsuit

May 06, 2025

Latest Posts

-

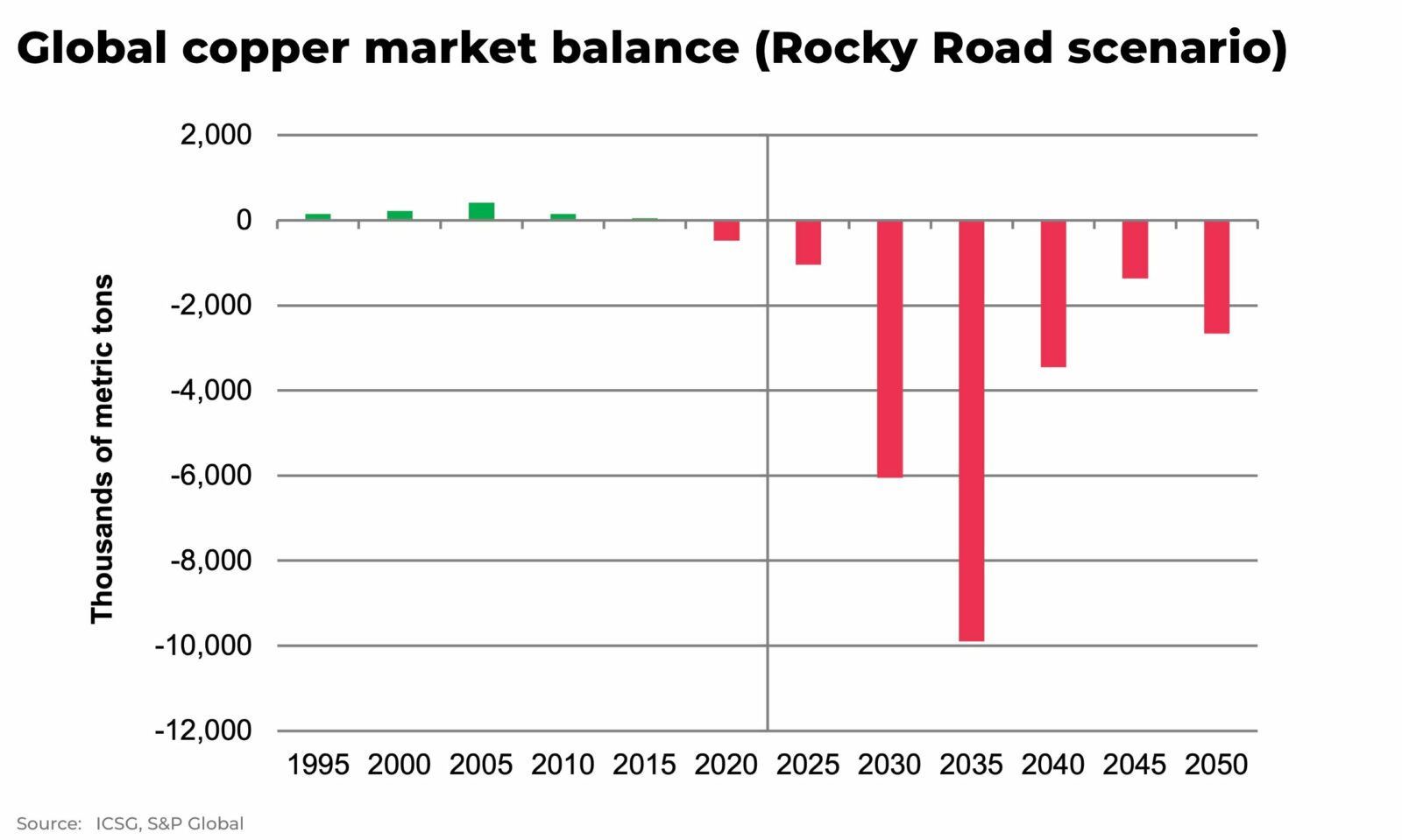

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025 -

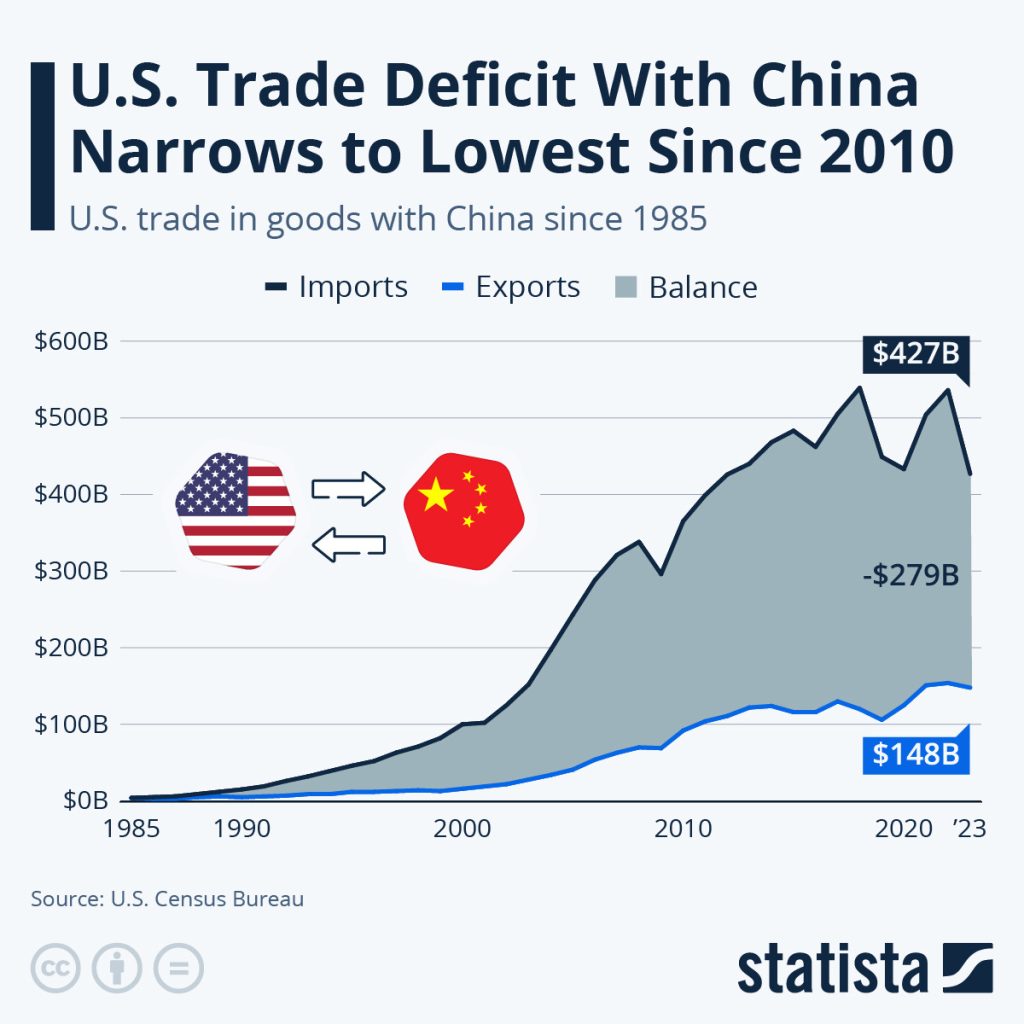

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025 -

The Copper Market And The Us China Trade Dynamic

May 06, 2025

The Copper Market And The Us China Trade Dynamic

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nudity Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nudity Chris Pratts Response

May 06, 2025 -

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025