Warren Buffett's Apple Bet: What Investors Can Learn

Table of Contents

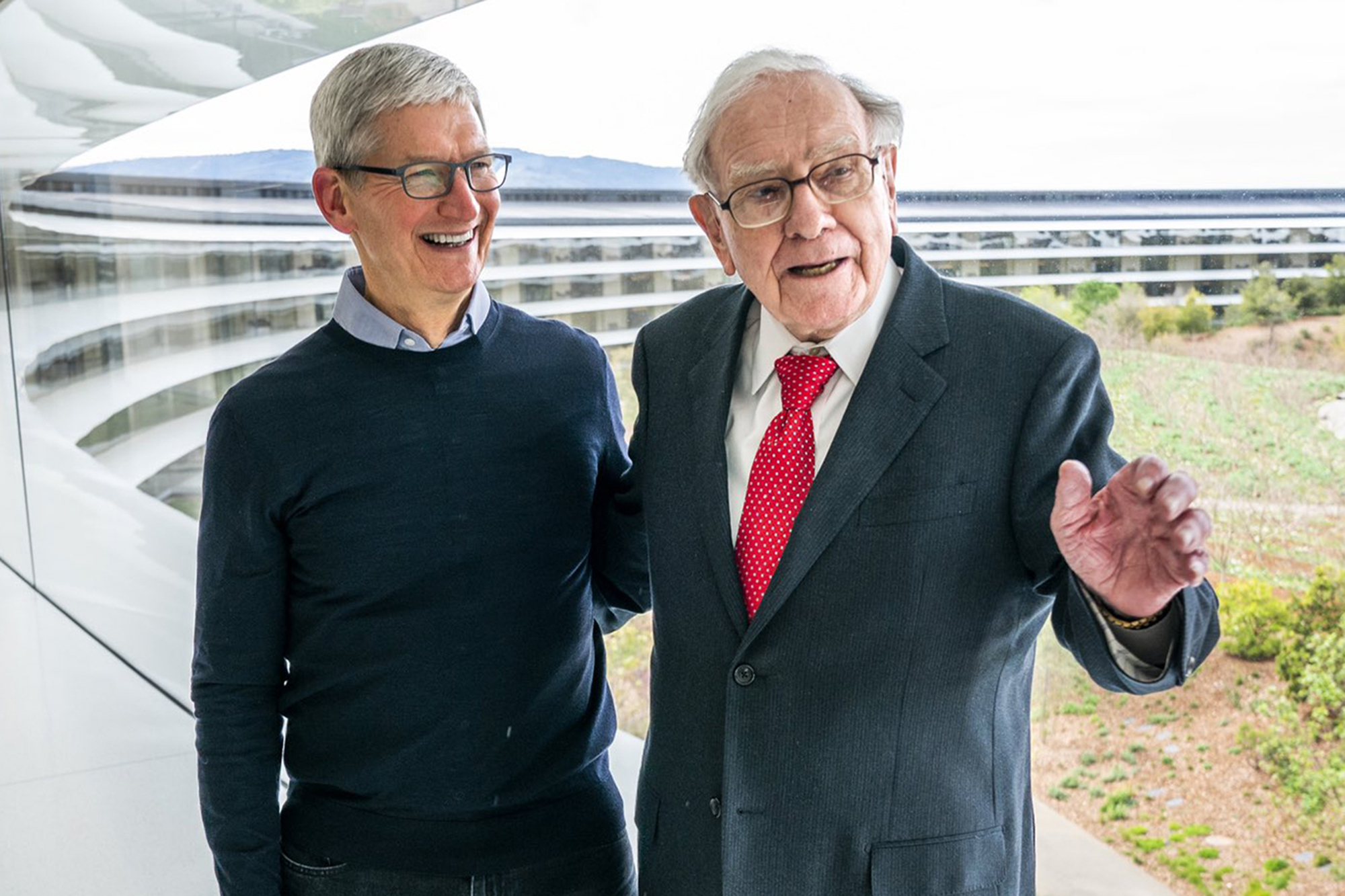

The Genius Behind Buffett's Apple Investment

Buffett's Apple investment wasn't a gamble; it was a calculated move based on a deep understanding of both Apple's business model and his own long-term value investing philosophy.

Understanding Apple's Business Model

Apple's success isn't accidental. It's built on a powerful foundation of several key elements:

- Unmatched Brand Loyalty: Apple cultivates a fiercely loyal customer base, creating a powerful moat around its products and services. This loyalty translates into repeat purchases and a high degree of customer retention.

- Recurring Revenue Streams: The growth of Apple's services segment—including the App Store, iCloud, Apple Music, and Apple TV+—provides a consistent stream of recurring revenue, cushioning the company against fluctuations in hardware sales. This predictable revenue flow is a cornerstone of its strong financial performance.

- Innovative Product Ecosystem: Apple’s products are designed to work seamlessly together, creating a sticky ecosystem that encourages users to remain within the Apple sphere. This ecosystem effect makes switching to competitors significantly more difficult.

- iPhone Dominance: While other products contribute, the iPhone remains the engine driving Apple's success, generating billions in revenue annually and anchoring the rest of the ecosystem.

These factors, combined with Apple's reputation for innovation and design, contribute to the company's enduring strength and make it a compelling long-term investment. Keywords like "Apple ecosystem," "recurring revenue," "brand loyalty," and "iPhone sales" clearly highlight the robust nature of Apple's business.

Buffett's Long-Term Value Investing Philosophy

Buffett's approach centers on identifying companies possessing:

- Strong Fundamentals: He meticulously analyzes a company's financial statements, looking for consistent profitability, strong cash flow, and a healthy balance sheet.

- Durable Competitive Advantages (Moats): Buffett seeks companies with inherent advantages that protect them from competition, such as strong brands, unique technologies, or efficient operations. Apple's brand loyalty and ecosystem perfectly exemplify this concept.

- Consistent Growth Potential: He invests in businesses with a demonstrable track record of growth and the potential for continued expansion in the future.

Buffett's focus on intrinsic value—a company's true worth based on its fundamentals—is paramount. He's a firm believer in understanding the business inside and out before investing, a cornerstone of his long-term investment strategy. Keywords like "value investing," "intrinsic value," "durable competitive advantage," and "long-term investment" accurately represent his core philosophy.

Risk Management in Buffett's Apple Strategy

Berkshire Hathaway's large Apple position appears to contradict Buffett's usual emphasis on portfolio diversification. However, this concentration is justified by the perceived low risk associated with Apple's exceptional business model.

Diversification vs. Concentration

While diversification is generally considered a sound risk management technique, Buffett's concentrated bet on Apple highlights the importance of understanding individual companies deeply. This concentrated position reflects:

- Exceptional Business Quality: The strength and stability of Apple's business provided a compelling rationale for a concentrated bet. The company’s strong financial performance, recurring revenue, and brand loyalty justified the risk.

- Low Risk Profile: Given Apple's financial strength and consistent profitability, the risk associated with this substantial position was deemed manageable within Berkshire Hathaway's overall portfolio.

This decision demonstrates that exceptional quality can justify a deviation from traditional diversification strategies within a well-managed investment portfolio.

Understanding Market Volatility

Buffett's long-term perspective allowed him to weather market fluctuations affecting Apple's stock price. This illustrates:

- Patience and Faith: His long-term outlook allowed him to ride out short-term volatility, focusing on the underlying strength of the business rather than reacting to daily market noise.

- Mitigating Short-Term Swings: A buy-and-hold strategy, rooted in confidence in the company's fundamentals, minimizes the impact of short-term market swings.

This approach exemplifies the benefits of a long-term investment horizon in mitigating the effects of market volatility and maximizing returns.

Practical Lessons for Investors from Buffett's Apple Play

Buffett's success with Apple offers practical lessons for all investors:

The Power of Long-Term Thinking

Long-term investing is critical for consistent returns:

- Patience and Discipline: Avoid the temptation of short-term trading, which often leads to impulsive decisions based on emotion rather than rational analysis.

- Buy-and-Hold Strategy: A buy-and-hold approach, coupled with regular rebalancing, can significantly enhance long-term returns and minimize emotional decision-making.

- Compounding Returns: Time is a crucial element in investing. Over the long term, compounding returns can generate substantial wealth.

Thorough Due Diligence is Key

Before investing in any company, conducting thorough due diligence is crucial:

- Fundamental Analysis: Analyze a company's financial statements, including income statements, balance sheets, and cash flow statements, to assess its financial health.

- Competitive Landscape Assessment: Understand the competitive environment, identifying potential threats and opportunities.

- Management Quality: Evaluate the quality of the management team and its ability to execute its business strategy.

Conclusion: Applying the Lessons of Buffett's Apple Bet

Warren Buffett's Apple investment underscores the importance of a long-term perspective, thorough due diligence, a deep understanding of the business model, and effective risk management. By studying his approach, investors can learn to develop a robust and successful investment strategy. Remember the power of Warren Buffett's investment strategy, built on long-term investing and careful research. Learn from Apple's success and incorporate these lessons into your own investment journey. Don’t just follow the herd; conduct your own thorough research before investing in any company.

Share your thoughts on Warren Buffett’s Apple bet and your investment strategies in the comments below. Let's learn from each other!

Featured Posts

-

Election Aftermath Potential For Australian Asset Growth

May 06, 2025

Election Aftermath Potential For Australian Asset Growth

May 06, 2025 -

How A Weaker Dollar Impacts Asian Currency Markets

May 06, 2025

How A Weaker Dollar Impacts Asian Currency Markets

May 06, 2025 -

Surprisingly Good Cheap Stuff A Buyers Guide

May 06, 2025

Surprisingly Good Cheap Stuff A Buyers Guide

May 06, 2025 -

From Triumph To Setback Understanding Warren Buffetts Investment Journey

May 06, 2025

From Triumph To Setback Understanding Warren Buffetts Investment Journey

May 06, 2025 -

Jeff Goldblum Checks His Own Oscars Photos A Viral Moment

May 06, 2025

Jeff Goldblum Checks His Own Oscars Photos A Viral Moment

May 06, 2025

Latest Posts

-

Internet Buzz Jeff Goldblums Self Admiration Of His Oscars Photos

May 06, 2025

Internet Buzz Jeff Goldblums Self Admiration Of His Oscars Photos

May 06, 2025 -

Jeff Goldblum Checks His Own Oscars Photos A Viral Moment

May 06, 2025

Jeff Goldblum Checks His Own Oscars Photos A Viral Moment

May 06, 2025 -

Jeff Goldblums Oscar Photos Go Viral The Internet Reacts

May 06, 2025

Jeff Goldblums Oscar Photos Go Viral The Internet Reacts

May 06, 2025 -

Jeff Goldblum Releases A New Jazz Album

May 06, 2025

Jeff Goldblum Releases A New Jazz Album

May 06, 2025 -

Jeff Goldblums Version Of The Flys Conclusion

May 06, 2025

Jeff Goldblums Version Of The Flys Conclusion

May 06, 2025