Taiwan Dollar Surge: Implications For Economic Restructuring

Table of Contents

Factors Contributing to the Taiwan Dollar Surge

Several interconnected factors have contributed to the recent remarkable Taiwan dollar surge. These include increased foreign investment, strong export performance, and relatively high interest rates compared to other major economies.

Increased Foreign Investment

Taiwan's thriving technology sector, particularly its dominance in semiconductor manufacturing, has attracted massive foreign investment. This influx of capital significantly boosts demand for the TWD.

- Increased inflows from global tech giants: Companies like Qualcomm, Apple, and Nvidia continue to invest heavily in Taiwanese semiconductor foundries, fueling demand for the local currency.

- Strong performance of Taiwanese tech companies: The robust performance of Taiwanese tech companies listed on international stock exchanges, such as TSMC, further enhances investor confidence and drives capital inflows.

- Growing global demand for Taiwanese-made electronics and components: The world's increasing reliance on Taiwanese-made electronics and components, particularly in the 5G and AI sectors, strengthens the nation's economic position and boosts the TWD.

Strong Export Performance

Despite global economic headwinds, Taiwan's export sector remains remarkably resilient, adding further support to the TWD's appreciation.

- High demand for Taiwanese semiconductors and other high-tech products: The ongoing global chip shortage and robust demand for high-tech products ensure a continuous flow of export revenue, strengthening the currency.

- Strategic location in global supply chains: Taiwan's pivotal role in global supply chains provides a significant competitive advantage and contributes to its strong export performance.

- Government support for export-oriented industries: The Taiwanese government's continued support for export-oriented industries further enhances their competitiveness and contributes to the overall strength of the TWD.

High Interest Rates

Relatively higher interest rates in Taiwan compared to other major economies, such as the US, Japan, and the Eurozone, have attracted significant capital inflows, placing upward pressure on the TWD.

- Comparison of Taiwanese interest rates with those of major economies: Taiwan's interest rate policies, often slightly higher than those of competing economies, make it an attractive destination for investors seeking higher returns.

- Impact of monetary policy decisions by the Central Bank of Taiwan: The Central Bank of Taiwan's monetary policy decisions play a crucial role in managing interest rates and influencing the value of the TWD.

- Attractiveness of Taiwan as a safe haven investment: In times of global economic uncertainty, Taiwan's political stability and strong economic fundamentals make it a sought-after safe haven investment, driving further demand for the TWD.

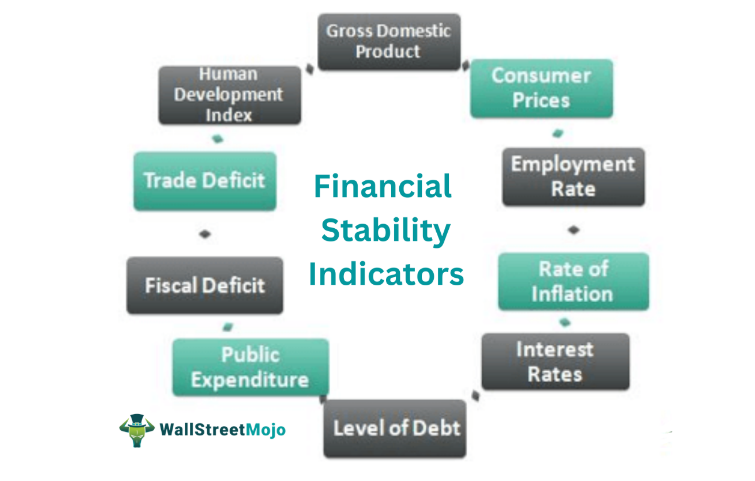

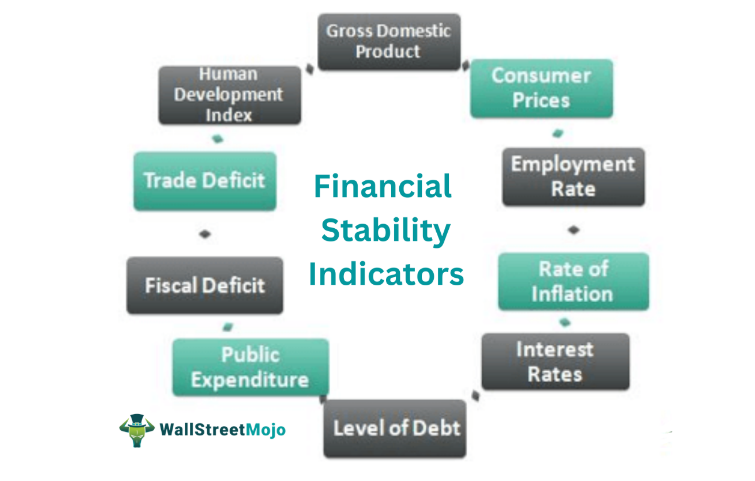

Implications for Economic Restructuring

The Taiwan dollar surge presents a mixed bag of implications for Taiwan's ongoing economic restructuring efforts, presenting both challenges and opportunities.

Challenges for Export-Oriented Industries

The stronger TWD makes Taiwanese exports more expensive in international markets, potentially impacting the competitiveness of export-oriented industries.

- Analysis of price competitiveness of Taiwanese goods in key export markets: A stronger TWD necessitates a careful analysis of price competitiveness in key export markets to identify potential vulnerabilities.

- Potential need for diversification of export markets and products: To mitigate the impact of currency appreciation, diversifying export markets and product offerings is crucial.

- Strategies for maintaining export competitiveness in the face of currency appreciation: Strategies such as enhancing product differentiation, improving efficiency, and focusing on higher value-added products are essential to maintain competitiveness.

Opportunities for Domestic Consumption

A stronger TWD can lead to lower import prices, potentially boosting domestic consumption and reducing inflation.

- Impact on the cost of imported goods and services: A stronger TWD directly translates into lower costs for imported goods and services, benefiting consumers.

- Potential increase in consumer spending power: The increased purchasing power resulting from lower import prices could stimulate domestic consumption.

- Analysis of the relationship between TWD appreciation and consumer price index (CPI): Monitoring the correlation between TWD appreciation and the Consumer Price Index (CPI) is crucial for understanding the impact on inflation.

Impact on Foreign Investment

While initially attracting foreign investment, a sustained strong TWD might reduce the attractiveness of Taiwan as an investment destination for some foreign companies due to reduced returns.

- Potential impact on return on investment (ROI) for foreign investors: A stronger TWD can reduce the ROI for foreign investors, potentially deterring future investments.

- Need for strategies to attract foreign investment despite currency appreciation: Taiwan needs to develop strategies to attract foreign investment even with a strong TWD, such as focusing on high-value-added industries and offering other incentives.

- Government policies to mitigate the negative impacts of a strong TWD on foreign investment: Government policies aimed at mitigating the negative impacts of a strong TWD on foreign investment are crucial for maintaining economic growth.

Conclusion

The recent Taiwan dollar surge presents a complex and multifaceted challenge and opportunity for Taiwan's economic restructuring. While it signifies the strength of the Taiwanese economy, particularly its technological prowess, it also demands proactive adaptation by businesses and policymakers. Successfully navigating this necessitates a strategic approach encompassing export diversification, investment in domestic consumption, and targeted policies to maintain Taiwan's attractiveness as a foreign investment hub. Continued monitoring of the Taiwan dollar surge and its implications is vital for future economic planning and ensuring sustainable, long-term growth. Further research and analysis are crucial to effectively leverage the opportunities and mitigate the challenges presented by this dynamic economic shift. Understanding the intricacies of this TWD appreciation is key to securing Taiwan's continued economic success.

Featured Posts

-

Analysis Canadas Trade Deficit Reduction To 506 Million

May 08, 2025

Analysis Canadas Trade Deficit Reduction To 506 Million

May 08, 2025 -

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Implications

May 08, 2025

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Implications

May 08, 2025 -

1 6 Scale Galen Erso Figure A Hot Toys Japan Exclusive

May 08, 2025

1 6 Scale Galen Erso Figure A Hot Toys Japan Exclusive

May 08, 2025 -

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025 -

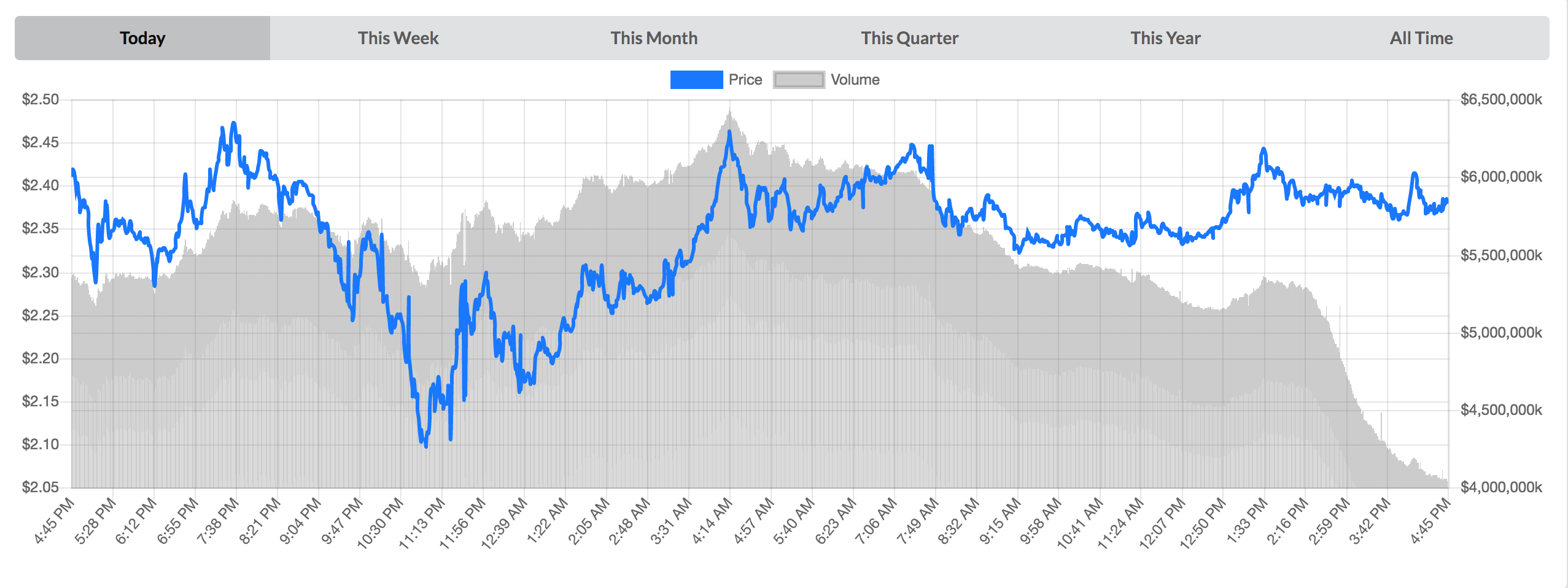

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

Latest Posts

-

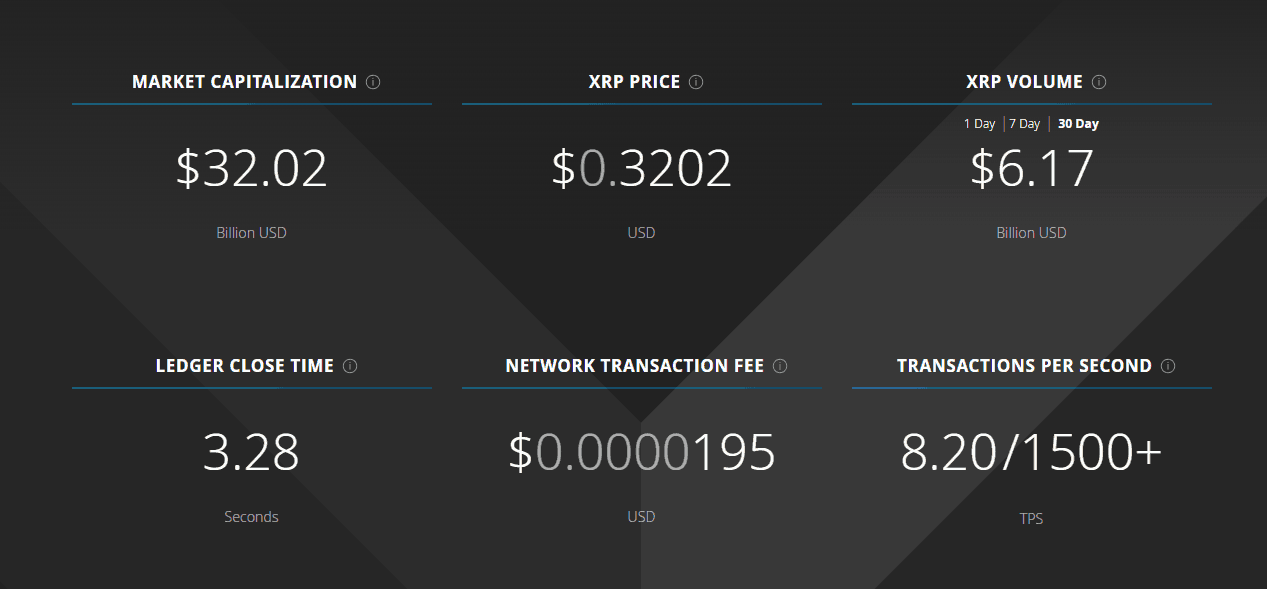

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025 -

Understanding Xrp Ripple Before You Invest

May 08, 2025

Understanding Xrp Ripple Before You Invest

May 08, 2025 -

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025 -

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025 -

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025