Climate Change And Your Home Loan: How Environmental Risks Impact Credit Scores

Table of Contents

The cost of homeowners insurance has skyrocketed by an average of 10% annually in some high-risk areas due to increasing climate change impacts. This alarming statistic highlights a growing concern: climate change is significantly impacting your home loan and credit score. This article explores the escalating relationship between climate change and your home loan, focusing on how environmental risks like floods, wildfires, and extreme weather are altering lender risk assessments and impacting mortgage affordability. We'll delve into how these factors affect property values, insurance premiums, and ultimately, your creditworthiness.

H2: Rising Insurance Premiums & Their Impact on Loan Approval

Increased insurance costs due to climate-related risks are making homes less attractive to lenders. Areas prone to floods, wildfires, or hurricanes are experiencing dramatically higher premiums for flood insurance, wildfire risk coverage, and homeowners insurance. This directly impacts your ability to secure a home loan.

- Higher premiums increase the overall cost of borrowing. Lenders consider insurance costs when calculating your total debt burden, impacting your loan-to-value ratio (LTV). A higher premium means a potentially higher monthly payment, reducing your affordability.

- Lenders may require higher down payments or refuse loans altogether in high-risk areas. To mitigate their own risk, lenders may demand larger down payments from borrowers in areas susceptible to climate-related damage. In some cases, they may reject applications entirely, deeming the risk too high.

- Impact on mortgage affordability and loan-to-value ratios (LTV). Rising insurance premiums directly decrease affordability by increasing your monthly mortgage payments. This can also negatively impact your LTV, which is the ratio of your loan amount to the property's value. A lower LTV is generally preferred by lenders.

- Examples of areas significantly affected by rising insurance costs. Coastal communities facing sea-level rise, regions prone to wildfires in the western US, and areas with a history of severe flooding are prime examples where insurance premiums are significantly higher.

H2: Property Value Depreciation Due to Climate Change

Climate change events directly contribute to property value depreciation. The increased frequency and severity of extreme weather events leave their mark, impacting both the physical structure of homes and the desirability of the surrounding area.

- Damage from floods, wildfires, and extreme weather events. Direct damage from these events can significantly reduce a property's value, requiring costly repairs or even rendering it uninhabitable.

- Decreased desirability of properties in high-risk zones. Buyers are increasingly hesitant to purchase homes in areas identified as high-risk for climate-related damage, leading to a decline in demand and property values.

- The impact of increased frequency and severity of climate events on long-term value. The ongoing threat of future damage further erodes property value, making it a less stable investment.

- Examples of property value declines in climate-vulnerable regions. Studies show significant declines in property values in areas repeatedly affected by hurricanes, wildfires, or prolonged droughts.

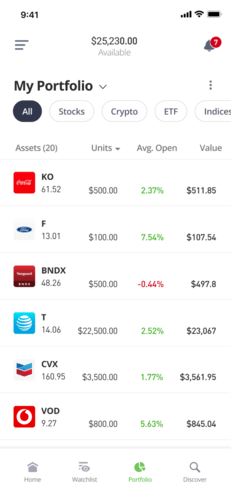

H2: Lender Risk Assessments and Climate Data

Lenders are increasingly incorporating climate risk data into their underwriting processes. This means they're more actively assessing the potential impact of climate change on the properties they're financing.

- Increased scrutiny of properties in high-risk areas. Lenders are now more likely to scrutinize loan applications for properties located in areas identified as vulnerable to climate-related risks.

- Use of climate models and risk scores to assess loan applications. Advanced climate models and risk scores are being integrated into the underwriting process, providing lenders with a more accurate assessment of risk.

- The role of government regulations and disclosure requirements. Government regulations are likely to increase in the future, requiring lenders to disclose climate-related risks to borrowers.

- Examples of how lenders are adapting their risk assessments. Some lenders are already adjusting their loan terms or increasing interest rates for properties in high-risk areas.

H3: Protecting Your Credit Score in a Changing Climate

Proactive steps can help mitigate climate-related risks to your home and credit score.

- Investing in climate-resilient home improvements. Upgrades such as flood-resistant foundations, fire-resistant roofing materials, and improved drainage can reduce your risk and potentially lower insurance premiums.

- Understanding your property's climate risk profile. Research your property's vulnerability to specific climate hazards and take appropriate preventative measures.

- Shopping around for insurance and finding competitive rates. Comparing quotes from different insurance providers can help you secure the most affordable and comprehensive coverage.

- Considering relocation if risks are too high. If the risks associated with your property are too significant, relocating to a lower-risk area might be a prudent decision to protect your financial future.

Conclusion:

Climate change is undeniably impacting home loans and credit scores. Rising insurance premiums, property value depreciation, and stricter lender risk assessments are all consequences of a changing climate. Understanding these impacts is crucial for responsible homeownership. Assess your climate risk, protect your home loan, and mitigate environmental risks to your credit by taking proactive steps to improve your property's resilience and secure appropriate insurance. Learn more about climate change and your home loan by consulting with financial professionals and researching climate risk assessments in your area. By acting responsibly now, you can safeguard your financial future in the face of climate change.

Featured Posts

-

To Adiamfisvitito Tampoy Analyontas Toys Fonoys

May 20, 2025

To Adiamfisvitito Tampoy Analyontas Toys Fonoys

May 20, 2025 -

Bbcs Bold New Agatha Christie Project Bringing Her Back To Life

May 20, 2025

Bbcs Bold New Agatha Christie Project Bringing Her Back To Life

May 20, 2025 -

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takiminda

May 20, 2025

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takiminda

May 20, 2025 -

Numerotation Des Batiments A Abidjan Guide Du Projet D Adressage

May 20, 2025

Numerotation Des Batiments A Abidjan Guide Du Projet D Adressage

May 20, 2025 -

Manga Disaster Prediction Tourist Cancellations Surge

May 20, 2025

Manga Disaster Prediction Tourist Cancellations Surge

May 20, 2025

Latest Posts

-

Qbts Earnings Announcement Implications For Stock Price

May 20, 2025

Qbts Earnings Announcement Implications For Stock Price

May 20, 2025 -

Analyzing Qbts Stocks Performance After Upcoming Earnings

May 20, 2025

Analyzing Qbts Stocks Performance After Upcoming Earnings

May 20, 2025 -

Qbts Stocks Upcoming Earnings What To Expect

May 20, 2025

Qbts Stocks Upcoming Earnings What To Expect

May 20, 2025 -

Qbts Stock Predicting The Earnings Reaction

May 20, 2025

Qbts Stock Predicting The Earnings Reaction

May 20, 2025 -

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025