QBTS Earnings Announcement: Implications For Stock Price

Table of Contents

Key Metrics to Watch in the QBTS Earnings Report

The QBTS earnings report will offer a wealth of data points, but some are more critical than others for predicting the impact on the QBTS stock price. Let's focus on the most influential metrics:

Revenue Growth

Revenue growth is a fundamental indicator of a company's health and future prospects. We'll be scrutinizing both year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth. Meeting or exceeding market expectations will be crucial for a positive market reaction. Factors such as increased competition in the market or the successful launch of new products will significantly influence this metric.

- Compare QBTS revenue growth to industry benchmarks: Is QBTS outperforming or underperforming its competitors? This comparison provides context and reveals the company's relative strength.

- Analyze the breakdown of revenue across different product segments or geographical regions: Identifying high-growth areas and underperforming segments helps investors understand the drivers of revenue growth and potential future performance.

- Consider the impact of any recent acquisitions or divestitures on revenue figures: Mergers and acquisitions can significantly affect revenue, and their influence needs to be carefully evaluated.

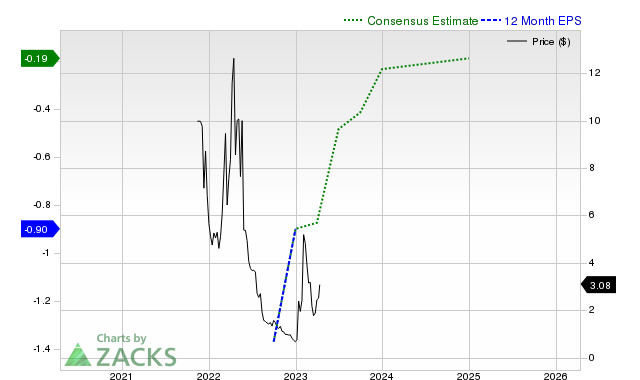

Earnings Per Share (EPS)

Earnings Per Share (EPS) reflects the portion of a company's profit allocated to each outstanding share. A higher EPS generally signals a healthier financial position and often leads to a positive impact on the stock price. We will compare the reported EPS to analyst estimates and the performance of previous quarters.

- Highlight the difference between actual EPS and projected EPS: A significant deviation from projections will likely move the QBTS stock price.

- Analyze the impact of any changes in accounting policies on EPS: Changes in accounting standards can affect reported earnings, requiring careful examination.

- Discuss the sustainability of the current EPS trend: Is this a one-off gain, or is it indicative of a long-term positive trend for QBTS earnings?

Profit Margins

Profit margins, including gross, operating, and net profit margins, reveal QBTS's profitability and efficiency. Trends in profit margins indicate the company's ability to manage costs and generate profits.

- Compare QBTS's profit margins to its competitors: Benchmarking against competitors provides a measure of QBTS's competitive advantage and efficiency.

- Analyze the impact of pricing strategies on profit margins: Price increases or decreases can drastically influence profit margins.

- Discuss the efficiency of QBTS's operations and its impact on profitability: Operational efficiency directly affects a company's profitability.

Market Sentiment and Investor Expectations

Understanding market sentiment and investor expectations is as critical as analyzing the financial figures themselves when predicting the QBTS stock price reaction to the earnings announcement.

Analyst Ratings and Price Targets

Analyst ratings and price targets reflect the collective opinion of financial analysts regarding QBTS's stock. Any shifts in these forecasts following previous announcements or news will greatly influence the market's reception of the upcoming report.

- Summarize the range of analyst price targets: This provides a snapshot of the potential range for the QBTS stock price.

- Identify any significant changes in analyst sentiment: Upgrades or downgrades will directly influence investor confidence.

- Consider the potential impact of any downgrades or upgrades on the stock price: Negative sentiment can lead to sell-offs, while positive sentiment could drive the price upward.

Overall Market Conditions

The broader market environment significantly impacts individual stock performance. Macroeconomic factors, interest rates, and investor risk appetite all play a role.

- Discuss the impact of current economic trends on QBTS's sector: Economic downturns or upturns can influence demand for QBTS's products or services.

- Analyze the correlation between QBTS's stock price and broader market indices: Understanding the stock's sensitivity to overall market movements is essential.

- Consider the impact of geopolitical events or regulatory changes on the stock price: External factors can cause significant volatility in the market.

Conclusion

The QBTS earnings announcement will be a pivotal moment for investors, as the results will significantly influence the QBTS stock price. By carefully analyzing key metrics such as revenue growth, EPS, and profit margins, alongside market sentiment and overall economic conditions, investors can better assess the potential impact on their QBTS investment. Staying informed about QBTS's financial performance and paying attention to market reactions is vital for making sound investment decisions. Continue to monitor the QBTS stock price and future earnings announcements for a complete understanding of its performance. Understanding the implications of the QBTS earnings announcement is critical for effective QBTS stock investment strategies. Prepare for the QBTS earnings announcement by reviewing your investment strategy and understanding the potential ramifications for your QBTS holdings.

Featured Posts

-

Stade Toulousain Et Jaminet Reglement Du Litige Des 450 000 E

May 20, 2025

Stade Toulousain Et Jaminet Reglement Du Litige Des 450 000 E

May 20, 2025 -

When College Boom Turns Bust The Economic Realities Of Enrollment Decline

May 20, 2025

When College Boom Turns Bust The Economic Realities Of Enrollment Decline

May 20, 2025 -

Big Bear Ai Bbai Penny Stock Potential And Investment Risks

May 20, 2025

Big Bear Ai Bbai Penny Stock Potential And Investment Risks

May 20, 2025 -

Sharapova 2 0 Novaya Nadezhda Rossiyskogo Tennisa

May 20, 2025

Sharapova 2 0 Novaya Nadezhda Rossiyskogo Tennisa

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Monday A Detailed Look

May 20, 2025

D Wave Quantum Qbts Stock Performance Monday A Detailed Look

May 20, 2025

Latest Posts

-

Why Did David Walliams Leave Britains Got Talent

May 21, 2025

Why Did David Walliams Leave Britains Got Talent

May 21, 2025 -

Klopps Agent Addresses Real Madrid Links What He Said

May 21, 2025

Klopps Agent Addresses Real Madrid Links What He Said

May 21, 2025 -

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025 -

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 21, 2025

Jurgen Klopp To Real Madrid Agent Comments Fuel Speculation

May 21, 2025 -

The Truth About David Walliams Bgt Exit

May 21, 2025

The Truth About David Walliams Bgt Exit

May 21, 2025