QBTS Stock: Predicting The Earnings Reaction

Table of Contents

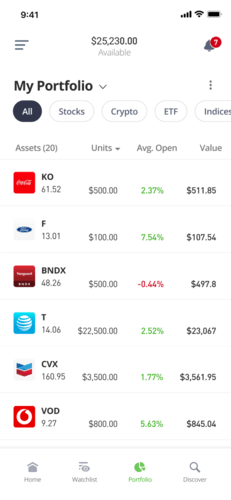

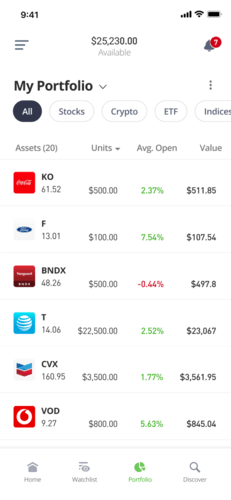

Analyzing QBTS's Historical Earnings Performance

Understanding QBTS's past performance is crucial for predicting future reactions to its earnings. By examining historical data, we can identify trends and patterns that may repeat themselves.

Identifying Trends and Patterns

Analyzing the last four quarters of QBTS's earnings reports reveals valuable insights. Let's consider key metrics:

- Revenue Growth Rate: Has QBTS shown consistent revenue growth, or have there been periods of stagnation or decline? A consistent upward trend suggests strong performance, while inconsistent growth might indicate underlying challenges.

- EPS Growth Rate: Examining the growth (or decline) in earnings per share provides a clearer picture of profitability on a per-share basis. This metric is particularly important for investors evaluating the return on their investment.

- Operating Margin: This metric shows QBTS's profitability after operating expenses. A consistently high operating margin reflects efficient operations and strong cost management.

[Insert chart/graph here visually representing historical revenue, EPS, and operating margin data for QBTS.]

Significant deviations from expected results in previous quarters should be investigated further. Were these deviations due to one-off events or underlying issues? Understanding the reasons behind these fluctuations is key to informed predictions.

Understanding the Market's Reaction to Past Earnings

Equally important is analyzing the stock market's response to past QBTS earnings announcements.

- Stock Price Volatility: How volatile has QBTS stock been immediately following earnings releases? High volatility might indicate a significant market sensitivity to the company's performance.

- Earnings Surprise: Did QBTS consistently beat or miss analyst expectations? The magnitude of positive or negative surprises and their corresponding impact on the stock price are valuable data points.

- Market Sentiment: Consider the overall market sentiment at the time of past earnings announcements. A bullish market might lead to a more positive reaction to positive earnings, while a bearish market could dampen even strong results. Understanding the interplay between company-specific news and broader market trends is vital.

Key Factors Influencing the Next QBTS Earnings Reaction

Predicting the market's reaction to the next QBTS earnings report requires considering several key factors beyond just historical performance.

Pre-Earnings Expectations and Analyst Forecasts

Analyst consensus estimates for QBTS's upcoming earnings (revenue, EPS, etc.) provide a benchmark against which actual results will be compared.

- Analyst Consensus: A wide range of analyst predictions indicates uncertainty, while a narrow range suggests a greater degree of confidence in the forecast.

- Earnings Estimates: Discrepancies between the high and low ends of analyst estimates can signal potential for a significant positive or negative earnings surprise.

- Price Target: Changes in analyst ratings or price targets in the lead-up to the earnings announcement offer valuable insights into the market's shifting expectations.

Company-Specific News and Developments

Recent company-specific developments can significantly influence the market's reaction to QBTS's earnings.

- Product Launches: Successful new product launches can boost revenue and earnings, leading to a positive market reaction.

- Strategic Partnerships: New partnerships can broaden QBTS's market reach and enhance its competitive position.

- Acquisitions: Acquisitions can expand the company's product offerings or market presence, but their impact on earnings can be complex and vary greatly.

- Regulatory Changes: Regulatory changes impacting QBTS's industry can have significant effects on its performance and the market's assessment.

Macroeconomic Factors and Market Sentiment

Broader macroeconomic conditions and overall market sentiment are also important considerations.

- Market Sentiment: A bullish market tends to be more forgiving of minor earnings disappointments, while a bearish market may amplify negative reactions.

- Economic Outlook: A strong economy generally benefits most companies, while a recessionary environment can negatively impact even well-performing businesses.

- Geopolitical Risks: Geopolitical events can create uncertainty and influence investor behavior, impacting the market's reaction to QBTS earnings.

Strategies for Predicting the QBTS Earnings Reaction

Predicting the QBTS earnings reaction isn't an exact science, but employing a combination of analytical techniques can improve the odds.

Technical Analysis

Analyzing chart patterns and technical indicators (e.g., moving averages, RSI) can offer insights into potential price movements following the earnings release. However, technical analysis should be used in conjunction with fundamental analysis for a more comprehensive approach.

Fundamental Analysis

Understanding QBTS's financial statements, competitive landscape, and management team is crucial for evaluating its long-term prospects and determining a fair valuation.

Sentiment Analysis

Monitoring social media and news sentiment can provide insights into the overall market feeling towards QBTS and its upcoming earnings. However, this should be used cautiously, as social media sentiment can be volatile and unreliable.

Risk Management

It's crucial to remember that no prediction is guaranteed. Diversifying your investment portfolio and setting stop-loss orders are essential risk management strategies.

Conclusion: Making Informed Decisions on QBTS Stock

Predicting the market's reaction to QBTS earnings requires a thorough analysis of historical performance, pre-earnings expectations, company-specific developments, and macroeconomic factors. By considering these elements and employing various analytical techniques, investors can develop a more informed strategy. Remember, however, that thorough research and a diversified investment strategy are vital for managing risk. Conduct your own in-depth QBTS stock analysis, focusing on predicting QBTS stock performance and understanding QBTS earnings, to develop a well-informed investment strategy suited to your risk tolerance. Don't rely solely on predictions; thorough research and understanding of QBTS earnings are paramount.

Featured Posts

-

Des Cours D Ecriture Ia Agatha Christie Reinventee Innovation Ou Simple Copie

May 20, 2025

Des Cours D Ecriture Ia Agatha Christie Reinventee Innovation Ou Simple Copie

May 20, 2025 -

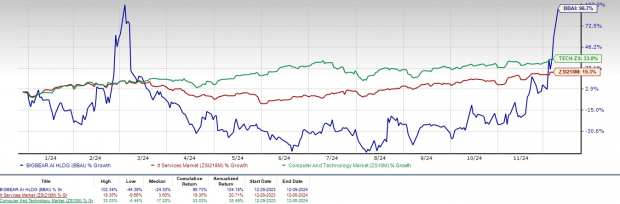

Big Bear Ai Should Investors Buy Sell Or Hold

May 20, 2025

Big Bear Ai Should Investors Buy Sell Or Hold

May 20, 2025 -

Live Bundesliga Streaming Best Options And Where To Watch

May 20, 2025

Live Bundesliga Streaming Best Options And Where To Watch

May 20, 2025 -

Navigating The Chinese Market Case Studies Of Bmw Porsche And Beyond

May 20, 2025

Navigating The Chinese Market Case Studies Of Bmw Porsche And Beyond

May 20, 2025 -

Jutarnji List Tko Je Sve Sjajio Na Premijeri

May 20, 2025

Jutarnji List Tko Je Sve Sjajio Na Premijeri

May 20, 2025

Latest Posts

-

Wwe Raw May 19th 2025 A Mixed Bag Of Matches And Moments

May 20, 2025

Wwe Raw May 19th 2025 A Mixed Bag Of Matches And Moments

May 20, 2025 -

Wwe Raw 5 19 2025 Recap Highlights And Lowlights

May 20, 2025

Wwe Raw 5 19 2025 Recap Highlights And Lowlights

May 20, 2025 -

Wwe Smack Down Rey Fenixs Debut And New Ring Name Confirmed

May 20, 2025

Wwe Smack Down Rey Fenixs Debut And New Ring Name Confirmed

May 20, 2025 -

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025 -

Wwe Tyler Bates Highly Anticipated Television Comeback

May 20, 2025

Wwe Tyler Bates Highly Anticipated Television Comeback

May 20, 2025