Chinese Stocks Surge After Trading Halt: US Talks And Economic Data Drive Market Recovery

Table of Contents

The Trading Halt: Understanding the Pause in Chinese Stock Markets

A temporary trading halt gripped Chinese stock markets on [Insert Date], lasting [Insert Duration]. The official reason cited was [Insert Official Reason], likely stemming from concerns about [Insert Underlying Concerns, e.g., market volatility, regulatory uncertainty]. This pause, however, amplified existing anxieties among investors. The preceding days witnessed a significant market downturn, with the [Insert Index Name] index experiencing a [Insert Percentage]% drop before the halt was implemented. This abrupt suspension sent a wave of uncertainty across investor sentiment.

- Reasons for the Halt:

- Market volatility exceeding pre-defined thresholds.

- Concerns regarding regulatory changes impacting specific sectors.

- A need to allow for a period of reassessment and prevent further losses.

- Impact on Various Sectors:

- Technology stocks experienced [Insert Description of Impact].

- Energy stocks saw [Insert Description of Impact].

- Financial stocks were impacted by [Insert Description of Impact].

- Investor Reactions:

- Initial panic selling followed by a period of cautious observation.

- Increased speculation and uncertainty regarding the market's future trajectory.

- Heightened demand for information and analysis regarding the situation.

US-China Talks and Their Influence on the Chinese Stock Market Rebound

The recent US-China talks, primarily focused on [Insert Focus of Talks, e.g., trade negotiations, diplomatic relations], played a crucial role in the subsequent market recovery. While specific details remain confidential, the perceived outcome—[Insert Perceived Outcome, e.g., de-escalation of trade tensions, a commitment to further dialogue]—boosted investor confidence. This positive sentiment translated into a significant influx of capital into the Chinese stock market. Specific sectors, particularly [Insert Sectors, e.g., technology, consumer goods], reacted particularly favorably to the news.

- Key Takeaways from the Talks:

- [Insert Key Point 1 from the Talks]

- [Insert Key Point 2 from the Talks]

- [Insert Key Point 3 from the Talks]

- Investor Reaction:

- Increased buying activity following positive announcements.

- Reduced risk aversion and increased willingness to invest.

- A shift from a bearish to a more bullish market outlook.

- Correlation between Talk Outcomes and Stock Market Movements:

- Direct positive correlation between positive news from the talks and upward stock movements.

- Specific stocks directly related to the negotiations experienced disproportionately large gains.

Positive Economic Data Fuels the Chinese Stock Market Recovery

The release of positive economic data further fueled the market's resurgence. Indicators such as [Insert Specific Indicators, e.g., GDP growth of X%, industrial production increasing by Y%], significantly exceeding analysts' expectations, provided reassurance regarding the strength and resilience of the Chinese economy. This data effectively countered concerns about slowing growth and strengthened investor confidence in the long-term prospects of Chinese companies. However, it's crucial to acknowledge potential limitations; the data might not fully reflect [Insert Potential Limitations, e.g., regional disparities, underlying structural challenges].

- Specific Economic Indicators:

- GDP Growth: [Insert Value and Percentage Change]

- Industrial Production: [Insert Value and Percentage Change]

- Consumer Spending: [Insert Value and Percentage Change]

- Market Response:

- Positive market reaction to each indicator released.

- Increased investment in sectors showing robust growth.

- Comparison to Previous Periods:

- A marked improvement compared to the previous quarter's performance.

- Positive deviation from previously projected growth rates.

Analysis of Specific Chinese Stock Performances

Major Chinese stock indices responded positively, with the Shanghai Composite, Shenzhen Component, and Hang Seng all experiencing significant gains. Among individual stocks, [Insert Company Name] in the [Insert Sector] sector saw remarkable growth of [Insert Percentage]%, driven by [Insert Reason for Growth]. However, not all stocks performed equally well; some companies in the [Insert Sector] sector experienced underperformance due to [Insert Reasons for Underperformance].

- Top Performing Stocks:

- [Insert Stock Name and Percentage Gain]

- [Insert Stock Name and Percentage Gain]

- [Insert Stock Name and Percentage Gain]

- Sectors with Strongest Gains:

- [Insert Sector and Percentage Gain]

- [Insert Sector and Percentage Gain]

- Analysis of Significant Losses:

- [Insert Stock Name and Reason for Loss]

Conclusion: The Future of Chinese Stocks After the Surge

The recent surge in Chinese stocks is a complex phenomenon driven by a combination of factors: the resolution of concerns related to the trading halt, positive developments in US-China relations, and encouraging economic data. While the rebound is impressive, a cautious outlook is warranted. Potential risks remain, including [Insert Potential Risks, e.g., geopolitical uncertainties, regulatory changes]. The sustainability of this surge will depend on the continued positive momentum in these areas.

Keep monitoring Chinese stocks closely; stay updated on Chinese stock market news to make informed investment decisions. Learn more about investing in Chinese stocks and navigate this dynamic market effectively. The future trajectory of Chinese stocks hinges on ongoing developments, making continuous monitoring essential.

Featured Posts

-

Xrp Etf Approval Potential For 800 Million In Week 1 Inflows

May 07, 2025

Xrp Etf Approval Potential For 800 Million In Week 1 Inflows

May 07, 2025 -

Laguneras Triunfan En El Torneo De Gimnasia De Simone Biles

May 07, 2025

Laguneras Triunfan En El Torneo De Gimnasia De Simone Biles

May 07, 2025 -

The Karate Kid A Deeper Look At The Training And Philosophy

May 07, 2025

The Karate Kid A Deeper Look At The Training And Philosophy

May 07, 2025 -

Randles Play How He Changed Timberwolves Fans Minds

May 07, 2025

Randles Play How He Changed Timberwolves Fans Minds

May 07, 2025 -

Jenna Ortega Es A Szineszno Aki Ihlette Ot

May 07, 2025

Jenna Ortega Es A Szineszno Aki Ihlette Ot

May 07, 2025

Latest Posts

-

The Rookies Nathan Fillion An Unforgettable Wwii Performance

May 08, 2025

The Rookies Nathan Fillion An Unforgettable Wwii Performance

May 08, 2025 -

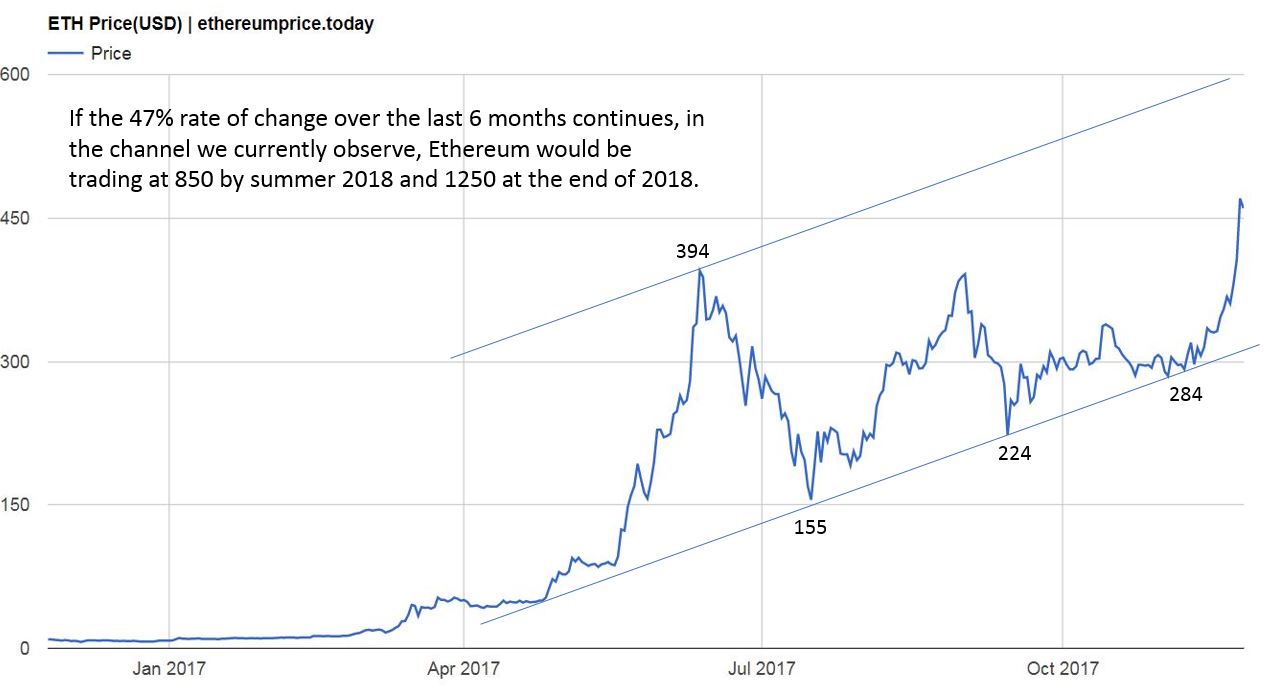

Ethereum Price Surge Bullish Momentum And Future Price Predictions

May 08, 2025

Ethereum Price Surge Bullish Momentum And Future Price Predictions

May 08, 2025 -

The 67 Million Ethereum Liquidation Understanding The Causes And Consequences

May 08, 2025

The 67 Million Ethereum Liquidation Understanding The Causes And Consequences

May 08, 2025 -

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025 -

Is Ethereum Ready To Rebound Weekly Indicator Suggests A Buy Signal

May 08, 2025

Is Ethereum Ready To Rebound Weekly Indicator Suggests A Buy Signal

May 08, 2025