XRP ETF Approval: Potential For $800 Million In Week 1 Inflows

Table of Contents

The Significance of XRP ETF Approval

Securing approval for an XRP ETF represents a monumental achievement, overcoming significant regulatory hurdles that have previously hampered the growth of the cryptocurrency. Historically, ETF approvals have consistently injected significant capital into the approved asset, boosting liquidity and driving price appreciation. The potential approval of an XRP ETF is expected to drastically increase institutional investment in XRP, a segment that has previously shown considerable hesitation due to regulatory uncertainty.

- Increased liquidity and trading volume for XRP: The influx of institutional capital will significantly increase XRP's trading volume, making it more accessible and liquid for all investors.

- Greater accessibility for mainstream investors: ETFs provide a regulated and simplified entry point for mainstream investors who may have been hesitant to directly engage with cryptocurrency exchanges.

- Potential reduction of XRP price volatility: While not guaranteed, increased liquidity often helps to stabilize price fluctuations, making XRP a more attractive investment.

- Enhanced credibility and legitimacy for XRP: ETF approval lends a significant degree of legitimacy to XRP, bolstering its reputation and attracting a wider range of investors.

Estimating the Potential $800 Million Inflow

The $800 million inflow projection is based on a multifaceted analysis, incorporating several key factors. We've examined similar ETF launches in the past, noting the considerable initial inflows they generated. Coupled with current market sentiment indicating strong investor interest in XRP and its underlying technology, Ripple's ongoing legal battles notwithstanding, a significant influx of funds is anticipated. This projection considers the current XRP market capitalization and trading volume, extrapolating from estimated investor demand and allocated investment funds.

- Analysis of similar ETF launches and their initial inflows: Historical data from other successful ETF launches reveals a strong correlation between initial investor excitement and considerable early investment.

- Consideration of current XRP market capitalization and trading volume: The existing market size and trading activity provide a baseline for assessing the potential impact of new investment.

- Projection based on estimated investor demand and allocated funds: Our projection takes into account the anticipated level of demand and the estimated amounts of capital likely to be allocated to an XRP ETF.

- Discussion of potential upside and downside scenarios: While $800 million is a strong projection, market conditions and regulatory uncertainty could affect the actual inflow, resulting in higher or lower numbers.

Impact on XRP Price and Market Dynamics

The approval of an XRP ETF is likely to trigger a significant price surge. The influx of $800 million, or even more, would dramatically increase demand, pushing the price upward. This would also significantly influence XRP's market dominance and trading volume, potentially boosting its position within the cryptocurrency ecosystem. Moreover, this surge could impact other cryptocurrencies, triggering a ripple effect across the broader market.

- Price prediction models and scenarios: While precise price predictions are impossible, various models suggest a substantial price increase following ETF approval.

- Impact on trading volume and liquidity: The increased trading activity will significantly boost liquidity, making XRP a more attractive asset for both short-term and long-term investors.

- Potential ripple effects on the broader crypto market: The positive sentiment surrounding XRP could spill over into other cryptocurrencies, leading to a broader market rally.

- Influence on XRP's position within the cryptocurrency ecosystem: ETF approval could solidify XRP's position as a leading cryptocurrency, attracting further investment and development.

Risks and Considerations

While the potential benefits of an XRP ETF are significant, investors must be aware of the inherent risks. Market volatility remains a key concern, and the price of XRP, like other cryptocurrencies, can fluctuate dramatically. Regulatory uncertainty also persists, with potential future changes impacting the ETF's performance. It’s crucial to conduct thorough due diligence before investing.

- Market volatility and price fluctuations: Cryptocurrency markets are inherently volatile, and XRP is no exception. Price swings can be substantial, leading to both significant gains and losses.

- Regulatory uncertainty and potential legal challenges: The regulatory landscape for cryptocurrencies is still evolving, and future changes could negatively affect XRP ETFs.

- Risks associated with ETF investment strategies: As with any investment, ETF strategies carry inherent risks that investors should understand.

- Importance of thorough due diligence before investing: Investors should conduct comprehensive research and understand the risks before investing in any XRP ETF.

Conclusion

The potential approval of an XRP ETF represents a game-changer for the cryptocurrency, potentially attracting massive institutional investment and causing a major price surge. The projected $800 million inflow in the first week underscores the immense potential impact of this regulatory milestone. However, investors must carefully consider the inherent risks associated with cryptocurrency investments before allocating capital to an XRP ETF. Stay informed about the latest developments regarding XRP ETF approval and learn more about the potential opportunities and risks involved in investing in this emerging asset class. Don't miss out on the potential benefits of the XRP ETF – research your options today!

Featured Posts

-

Randles Play How He Changed Timberwolves Fans Minds

May 07, 2025

Randles Play How He Changed Timberwolves Fans Minds

May 07, 2025 -

Can Xrp Ripple Make You Rich A Prudent Investors Guide

May 07, 2025

Can Xrp Ripple Make You Rich A Prudent Investors Guide

May 07, 2025 -

Rare Sighting Lewis Capaldi Amidst Rumors Of New Music

May 07, 2025

Rare Sighting Lewis Capaldi Amidst Rumors Of New Music

May 07, 2025 -

Gears Of War Remaster Coming To Play Station And Xbox

May 07, 2025

Gears Of War Remaster Coming To Play Station And Xbox

May 07, 2025 -

Get Ready To Play Nhl 25 Arcade Mode Launches This Week

May 07, 2025

Get Ready To Play Nhl 25 Arcade Mode Launches This Week

May 07, 2025

Latest Posts

-

Counting Crows Snl Appearance A Turning Point

May 08, 2025

Counting Crows Snl Appearance A Turning Point

May 08, 2025 -

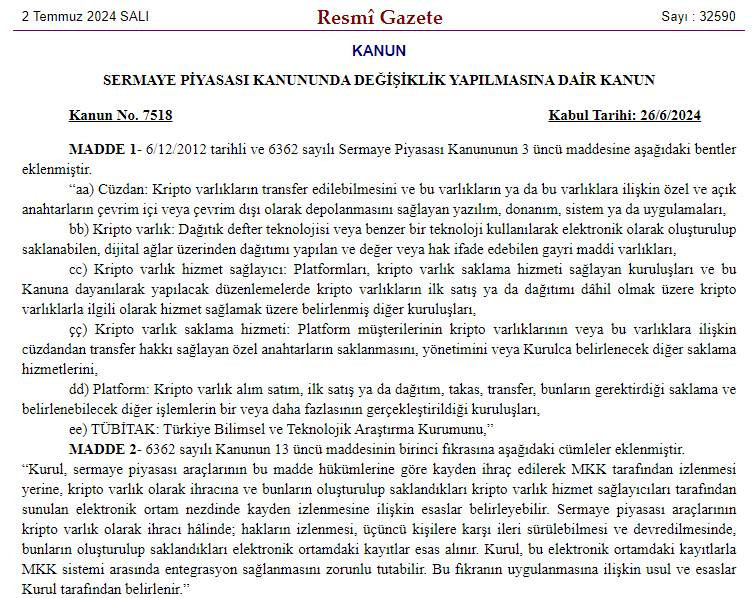

Kripto Para Miras Planlamasi Riskleri Ve Guevenli Yoentemleri

May 08, 2025

Kripto Para Miras Planlamasi Riskleri Ve Guevenli Yoentemleri

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025 -

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025 -

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025