China's Rate Cuts: Easier Bank Lending Amidst Tariff Impact

Table of Contents

The Rationale Behind China's Rate Cuts

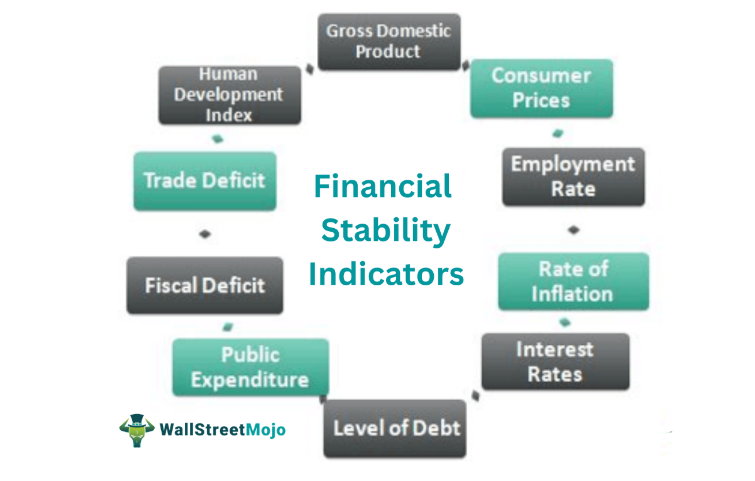

China's economic growth has slowed considerably, a trend influenced by several interconnected factors. The ongoing trade war with the US, characterized by escalating tariffs, has significantly impacted export-oriented industries and dampened investor confidence. Simultaneously, high levels of domestic debt have constrained further economic expansion, creating a challenging environment for businesses and consumers alike. This economic slowdown necessitates a proactive response from the Chinese government.

- Slowing Economic Growth: GDP growth has fallen below target levels, signaling a need for stimulus to prevent a sharper decline.

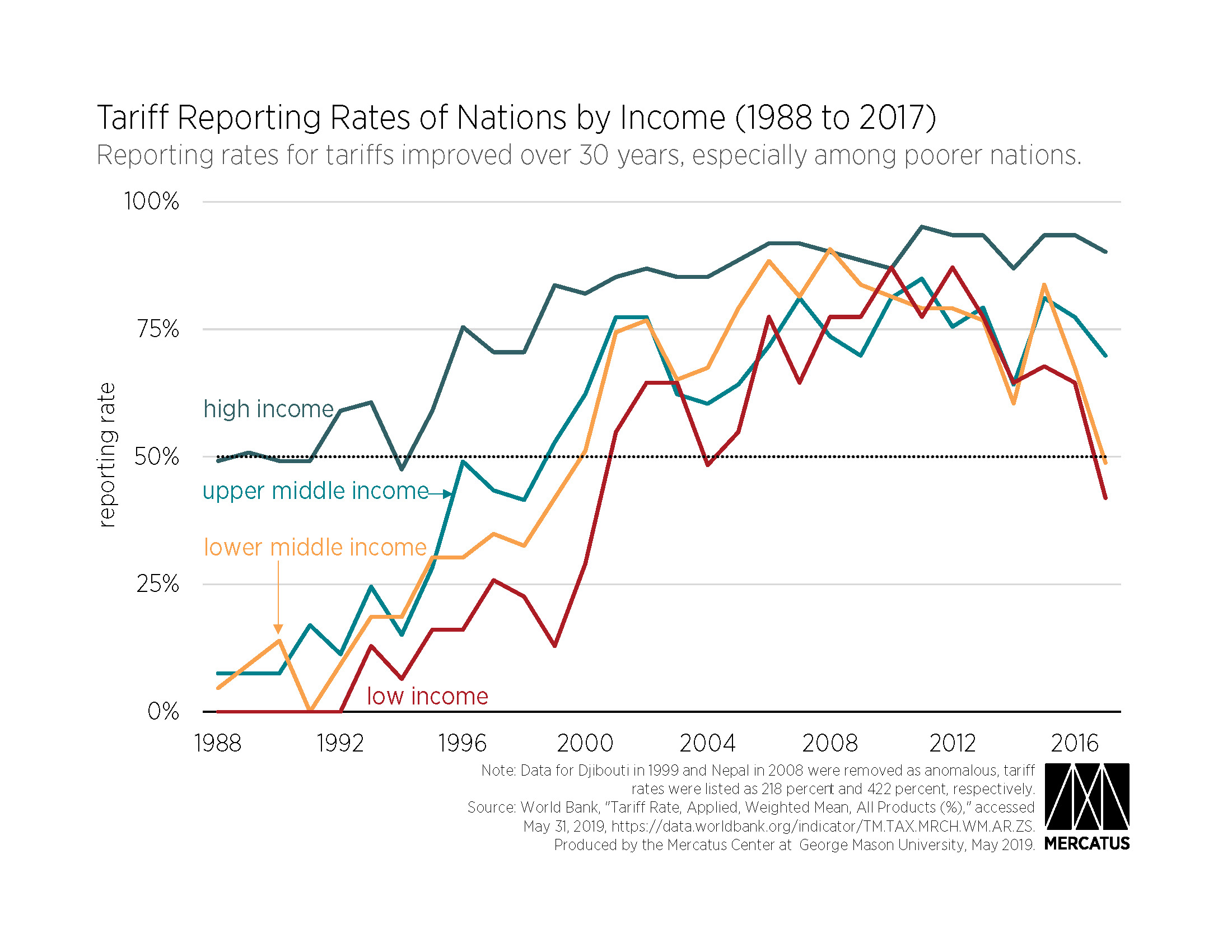

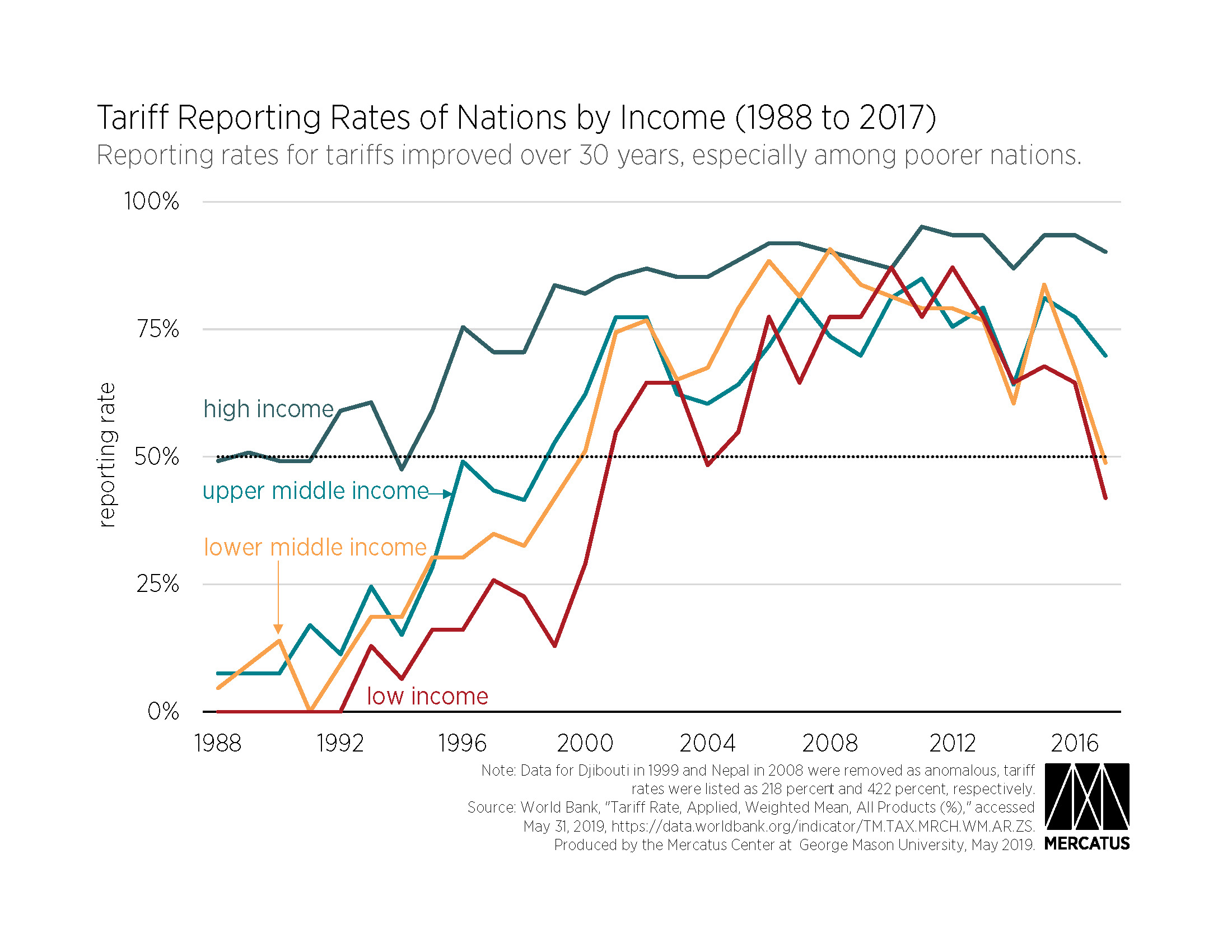

- Trade War Impact: Tariffs have disrupted supply chains, reduced exports, and increased uncertainty for businesses.

- Domestic Debt Concerns: High levels of corporate and local government debt limit the capacity for further investment and economic expansion.

- Inflationary Pressure: While inflation remains relatively subdued, the risk of deflation necessitates measures to boost demand and prevent a price spiral downward. The rate cuts aim to avoid deflationary pressures and stimulate spending.

- Stimulus Measures: The rate cuts, including reductions in the reserve requirement ratio (RRR) for banks and benchmark lending rates, are designed to inject liquidity into the economy and encourage lending.

Impact on Bank Lending and Investment

The rate cuts directly impact the cost of borrowing for banks and businesses. Lower interest rates translate to cheaper credit, making it more attractive for businesses to invest and expand. This increased credit availability is expected to fuel loan growth across various sectors.

- Lower Borrowing Costs: Reduced interest rates incentivize banks to lend more, and businesses to borrow and invest.

- Increased Loan Growth: We can expect to see a rise in lending to sectors like infrastructure, manufacturing, and potentially even consumer spending.

- Sectoral Impact: Specific sectors are expected to benefit more than others, depending on their access to credit and investment opportunities.

- Corporate Debt Risks: The increased availability of credit also carries the risk of rising corporate debt, potentially leading to future financial instability if not managed carefully.

- Government Regulation: To mitigate the risks of excessive borrowing, the Chinese government is implementing stricter regulations on lending practices and monitoring debt levels closely.

Navigating the Tariff Impact

The ongoing US-China trade war and the resulting tariffs present a significant challenge to China's economic growth. Export-oriented industries have been particularly hard hit, facing reduced demand and increased production costs. The rate cuts are intended, at least in part, to offset these negative impacts.

- Export Sector Challenges: Tariffs have directly impacted China's exports, particularly in sectors like manufacturing and technology.

- Offsetting Tariff Effects: The rate cuts aim to stimulate domestic demand and investment to compensate for reduced export revenue.

- Effectiveness of Monetary Policy: Monetary policy alone might not be sufficient to fully counteract the negative effects of trade restrictions. Structural reforms and diversification of markets are also needed.

- Alternative Strategies: China might explore other strategies such as strengthening domestic consumption, investing in technological innovation, and fostering closer ties with other trading partners to reduce reliance on the US market.

Global Implications of China's Rate Cuts

China's rate cuts have significant global implications, impacting capital flows, currency exchange rates, and international trade. The changes in Chinese monetary policy can influence global economic growth and market sentiment.

- Capital Flows: Lower interest rates might attract some foreign capital into China, but this could also lead to capital outflows from other countries.

- Currency Exchange Rates: The Yuan's value could be affected by the rate cuts, influencing international trade and competitiveness.

- Global Economic Growth: China's economic performance significantly impacts global growth, and the rate cuts aim to bolster this performance.

- Ripple Effects: Changes in China's economy will have ripple effects on other economies, particularly those with significant trade relationships with China.

- Investor Implications: Investors in global markets need to carefully consider the implications of China's rate cuts and their potential impact on various asset classes.

Conclusion

China's rate cuts represent a complex response to a multifaceted economic challenge. While they aim to stimulate bank lending and counter the negative impacts of the trade war and slowing economic growth, the effectiveness of this strategy remains to be seen. The potential risks associated with increased credit availability and the limitations of monetary policy in addressing trade tensions need careful consideration. Understanding the interplay between China's monetary policy, trade tensions, and economic growth is crucial for navigating the complexities of the current global financial landscape. Stay informed about the evolving economic situation in China and its impact on global markets by following updates on China's rate cuts and their effects on bank lending.

Featured Posts

-

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025 -

Barcelona 3 3 Inter Milan A Classic Champions League Semi Final Encounter

May 08, 2025

Barcelona 3 3 Inter Milan A Classic Champions League Semi Final Encounter

May 08, 2025 -

Caruso Makes Nba Playoff History In Thunders Game 1 Win

May 08, 2025

Caruso Makes Nba Playoff History In Thunders Game 1 Win

May 08, 2025 -

Resultados Liga Francesa Psg Vence Al Lyon

May 08, 2025

Resultados Liga Francesa Psg Vence Al Lyon

May 08, 2025 -

Taiwan Dollar Surge Implications For Economic Restructuring

May 08, 2025

Taiwan Dollar Surge Implications For Economic Restructuring

May 08, 2025

Latest Posts

-

Cute Krypto Highlights In New Superman Movie Footage

May 08, 2025

Cute Krypto Highlights In New Superman Movie Footage

May 08, 2025 -

A Good Boy Kryptos Appearance In Latest Superman Film Clip

May 08, 2025

A Good Boy Kryptos Appearance In Latest Superman Film Clip

May 08, 2025 -

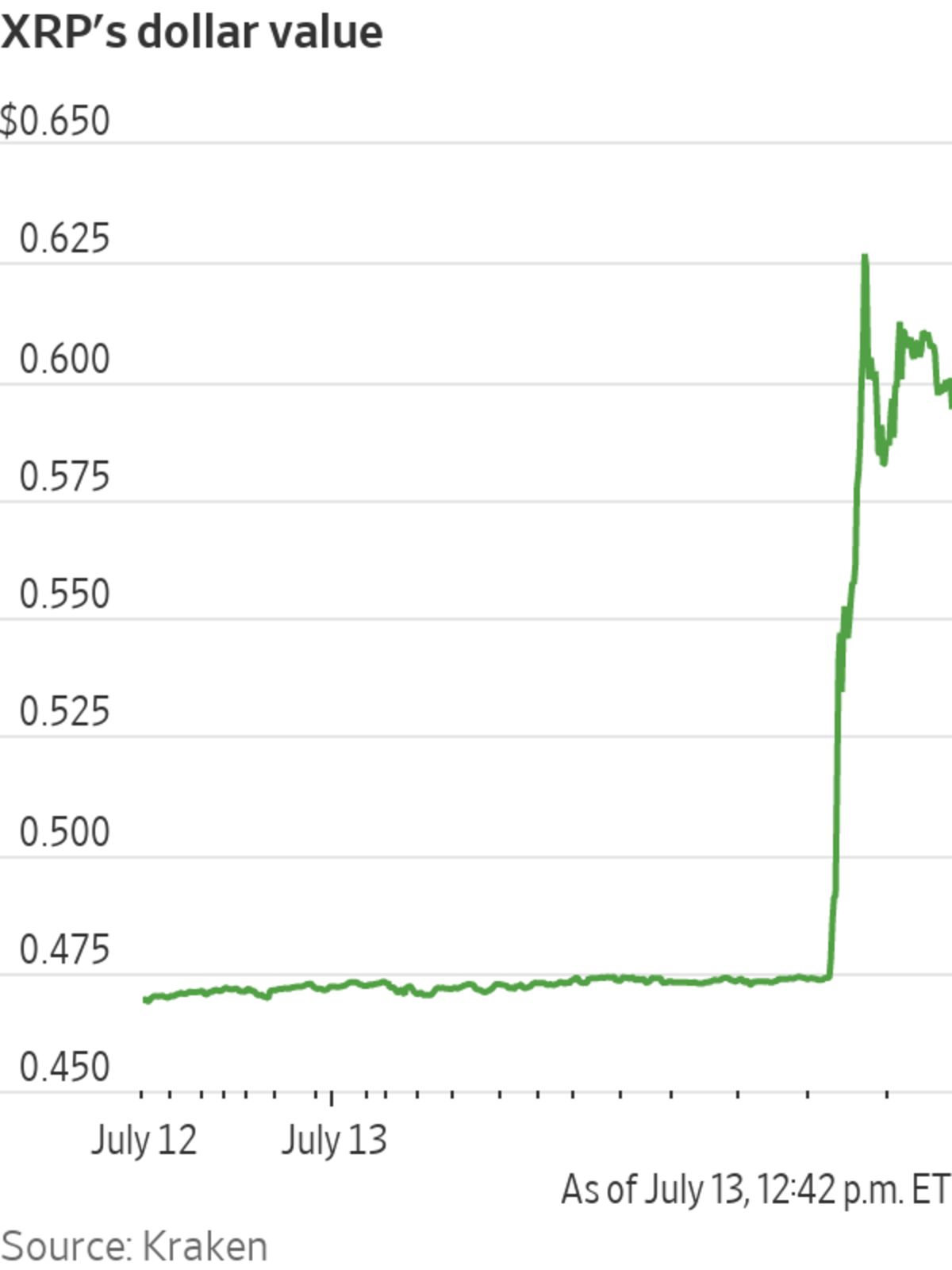

Xrp Attempts Recovery Despite Derivatives Market Stagnation

May 08, 2025

Xrp Attempts Recovery Despite Derivatives Market Stagnation

May 08, 2025 -

Krypto The Super Dog Steals The Show In New Superman Footage

May 08, 2025

Krypto The Super Dog Steals The Show In New Superman Footage

May 08, 2025 -

Xrp Gains Momentum Institutional Investments Driven By Trumps Endorsement

May 08, 2025

Xrp Gains Momentum Institutional Investments Driven By Trumps Endorsement

May 08, 2025