China's CATL Plans Indonesian Expansion With $1 Billion Loan

Table of Contents

CATL's Strategic Move into the Indonesian EV Battery Market

CATL's decision to invest heavily in Indonesia is a strategic masterstroke driven by several key factors. Indonesia possesses abundant nickel reserves, a crucial component in the production of EV batteries, particularly those using nickel-rich chemistries like Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA). This ready access to raw materials significantly reduces CATL's reliance on global supply chains and minimizes transportation costs.

Furthermore, the Indonesian government is actively promoting the growth of its electric vehicle industry through various incentives and supportive policies. These initiatives, coupled with Indonesia's geographically advantageous location within a rapidly growing Asian market, make it an extremely attractive location for CATL's expansion.

- Abundant Nickel Reserves: Indonesia boasts some of the world's largest nickel reserves, providing CATL with a secure and reliable source of this vital battery material.

- Government Support for EVs: Indonesia's proactive policies aimed at fostering the EV industry offer substantial benefits to investors like CATL, including tax breaks and streamlined regulatory processes.

- Global Expansion Strategy: This Indonesian investment is part of CATL's broader global strategy to secure its position as a leading EV battery supplier, competing with other major players in the increasingly competitive EV battery market.

By establishing a significant presence in Indonesia, CATL secures its supply chain, reduces transportation costs, and gains access to a burgeoning Asian market for electric vehicles. This strategic move solidifies CATL's position at the forefront of the global EV battery industry.

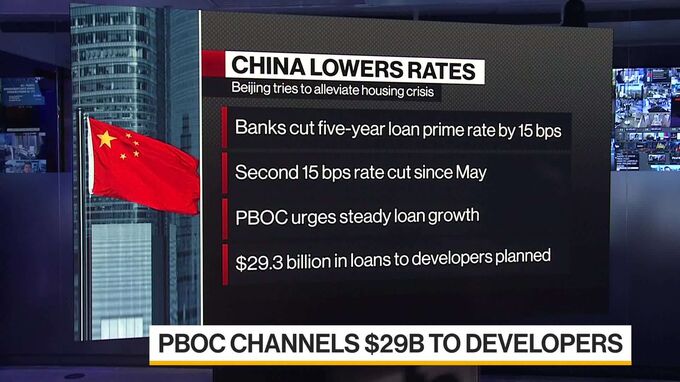

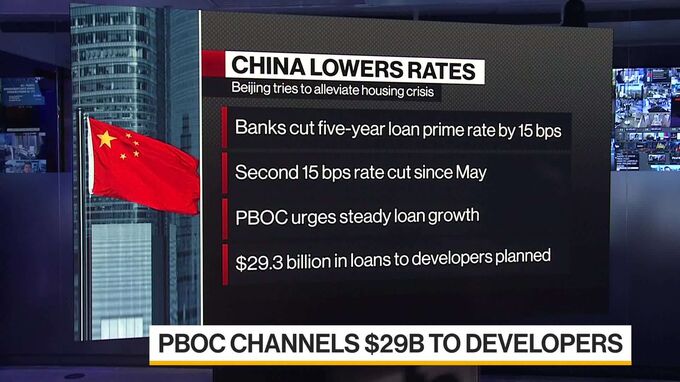

Details of the $1 Billion Loan and its Implications

The specifics of the $1 billion loan secured by CATL remain partially undisclosed, but it is likely a combination of financing from Chinese banks, international lenders, and possibly some Indonesian government backing. The exact terms—interest rates, repayment schedules, and any conditions attached—are not yet publicly available, but they will undoubtedly play a crucial role in shaping CATL's Indonesian operations.

- Impact on CATL's Financial Position: The loan significantly boosts CATL’s capacity for expansion and further strengthens its global competitiveness.

- Potential Risks: As with any large-scale investment, potential risks exist, including fluctuations in nickel prices, geopolitical instability in the region, and the inherent challenges of operating in a new market.

- Government Facilitation: The Indonesian and Chinese governments' roles in facilitating this loan are likely significant, showcasing the importance of this partnership for both nations.

The economic implications for Indonesia are considerable. This investment will generate substantial job opportunities in the mining and manufacturing sectors, stimulate infrastructure development, and attract further foreign direct investment. It marks a significant step toward Indonesia becoming a global hub for EV battery production.

Impact on Indonesia's Economy and the Global EV Industry

CATL's $1 billion investment in Indonesia will have a profound impact on both the Indonesian economy and the global EV industry. For Indonesia, this represents a significant boost in economic growth, offering numerous benefits.

- Job Creation: Thousands of jobs are expected to be created across the mining, manufacturing, and supporting industries.

- Technological Advancement: Transfer of technology and expertise from CATL will lead to technological advancement within Indonesia.

- Economic Diversification: The investment diversifies Indonesia's economy, reducing its reliance on traditional industries.

The implications for the global EV industry are equally significant. Increased competition from CATL could lead to price reductions in EV batteries, making electric vehicles more affordable and accessible worldwide. This will also significantly affect the global supply chain of EV battery materials.

- Increased Employment: Jobs will be created not only in Indonesia but also in related industries globally.

- Technological Spillover: Indonesia's technological capabilities will improve, potentially benefiting other sectors of the economy.

- Shifting Global Landscape: The expansion will shift the global balance of EV battery production, potentially impacting other countries' manufacturing sectors.

However, challenges remain. Environmental concerns regarding nickel mining need careful management to ensure sustainable practices. Competition from other battery manufacturers will remain fierce, and geopolitical factors could influence the investment's long-term success.

Conclusion: Investing in Indonesia's EV Future with CATL's $1 Billion Bet

CATL's $1 billion investment in Indonesia represents a bold strategic move that will reshape the global EV battery landscape. The access to abundant nickel resources, supportive government policies, and the strategic location make Indonesia an ideal location for CATL's expansion. This significant investment will not only benefit CATL by securing its supply chain but also boost Indonesia's economy, fostering job creation and technological advancement. The implications for the global EV industry are far-reaching, potentially impacting battery prices and the overall global supply chain. The long-term success of this venture will depend on addressing environmental concerns and managing competitive pressures. Stay informed about the latest developments in the electric vehicle battery market and CATL's continued expansion in Indonesia. Learn more about the future of EV battery technology and the global race for dominance.

Featured Posts

-

The Impact Of Celebrities On Who Wants To Be A Millionaire A Look At The Special Edition

May 07, 2025

The Impact Of Celebrities On Who Wants To Be A Millionaire A Look At The Special Edition

May 07, 2025 -

Talking Heads Donovan Mitchell And A Question For His Fans

May 07, 2025

Talking Heads Donovan Mitchell And A Question For His Fans

May 07, 2025 -

Trumps Trade War The Impact Of A 100 Tariff On Foreign Films

May 07, 2025

Trumps Trade War The Impact Of A 100 Tariff On Foreign Films

May 07, 2025 -

Randles Physical Presence Advantage Timberwolves A Lakers Analysis

May 07, 2025

Randles Physical Presence Advantage Timberwolves A Lakers Analysis

May 07, 2025 -

Pocivaj V Miru Spomin Na Ljubljeno Osebo

May 07, 2025

Pocivaj V Miru Spomin Na Ljubljeno Osebo

May 07, 2025

Latest Posts

-

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025

67 Million In Ethereum Liquidations Whats Next For Eth Prices

May 08, 2025 -

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025 -

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025 -

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025