Cancer Drug Setback: Akeso Stock Plummets On Disappointing Trial Results

Table of Contents

Disappointing Clinical Trial Results: Unveiling the Data

The cancer drug in question, [Insert Drug Name Here], was being tested in a Phase [Insert Phase Number Here] clinical trial targeting [Insert Specific Cancer Type Here], a particularly aggressive form of cancer with limited effective treatment options. The key metrics that failed to meet expectations were progression-free survival (PFS) and overall survival (OS).

While Akeso has not yet publicly released the full dataset, preliminary reports suggest [Insert Specific Number, e.g., a 20%] shortfall in PFS compared to the projected benchmarks. Similarly, the OS data also fell significantly short of expectations. [Cite Source if available, e.g., "According to a press release issued by Akeso on [Date],..."].

- Specific endpoint failures: Disappointing PFS and OS rates.

- Magnitude of the shortfall: Significant underperformance compared to projected benchmarks (quantify with percentages if possible).

- Possible explanations: [Insert any explanations offered by Akeso or speculate on potential reasons based on publicly available information, e.g., "Akeso suggested that [reason 1] might have contributed to the underwhelming results, while analysts speculate that [reason 2] may also have played a role."]

Akeso Stock Plummets: Market Reaction and Analysis

Following the announcement of the disappointing trial results, Akeso stock experienced a dramatic [Insert Percentage, e.g., 30%] drop within [Insert Timeframe, e.g., 24 hours] of the news release. This sharp decline reflects the negative investor sentiment and the market's reaction to the unexpected setback. Akeso's market capitalization also suffered a substantial decrease, [Insert Quantification, e.g., losing billions of dollars].

- Percentage drop in Akeso stock price: [Insert Percentage]

- Trading volume changes: A significant increase in trading volume was observed following the announcement, indicating high volatility.

- Analyst downgrades: Several analysts downgraded their ratings on Akeso stock, and revised price targets were significantly lowered.

- Impact on investor confidence: Investor confidence in Akeso's pipeline and future prospects has been severely shaken.

Implications for the Future of Akeso and Cancer Drug Development

The setback could significantly impact Akeso's research and development efforts. The company may need to restructure its R&D strategy, potentially scaling back on certain projects or seeking new collaborations to secure funding. The long-term financial stability of Akeso is also a significant concern, as investor confidence may remain low until more positive data emerges.

The implications extend beyond Akeso, affecting the broader cancer drug development landscape. Other companies developing similar treatments may need to re-evaluate their approaches, paying closer attention to the challenges and limitations highlighted by Akeso's experience.

- Potential restructuring: Possible changes in Akeso's R&D strategy, including potential layoffs or project cancellations.

- Impact on future funding: Challenges in securing additional funding rounds or securing collaborations with other pharmaceutical companies.

- Lessons learned: The experience could lead to more cautious development strategies and improved risk assessment for similar therapies.

- Alternative approaches: The need for exploration of alternative treatment modalities for the specific cancer type.

Understanding the Risks Associated with Investing in Biotech

Investing in biotech companies like Akeso inherently carries significant risk. The sector is known for its volatility, with high failure rates in clinical trials and a complex regulatory landscape. Diversification is crucial for mitigating these risks. Investors should be aware of the substantial financial losses that can occur when clinical trials fail to meet expectations.

- High failure rates: A substantial percentage of clinical trials for new drugs fail to reach their primary endpoints.

- Regulatory hurdles: The drug approval process is lengthy, rigorous, and involves significant regulatory hurdles.

- Importance of due diligence: Thorough research and understanding of the investment risks are essential.

- Alternative investment strategies: Consider diversification across different sectors and asset classes.

Conclusion

The disappointing clinical trial results for Akeso's cancer drug have severely impacted Akeso stock, causing a significant price drop and raising concerns about the company's future. This setback highlights the inherent risks in the biotech industry and the unpredictable nature of drug development.

Call to Action: Stay informed about the latest developments regarding Akeso stock and other biotech investments. Understanding the complexities of the pharmaceutical industry and conducting thorough due diligence before investing are crucial to mitigating risk in the volatile world of Akeso stock and similar biotech companies. Continue to monitor Akeso stock for future updates and analyses.

Featured Posts

-

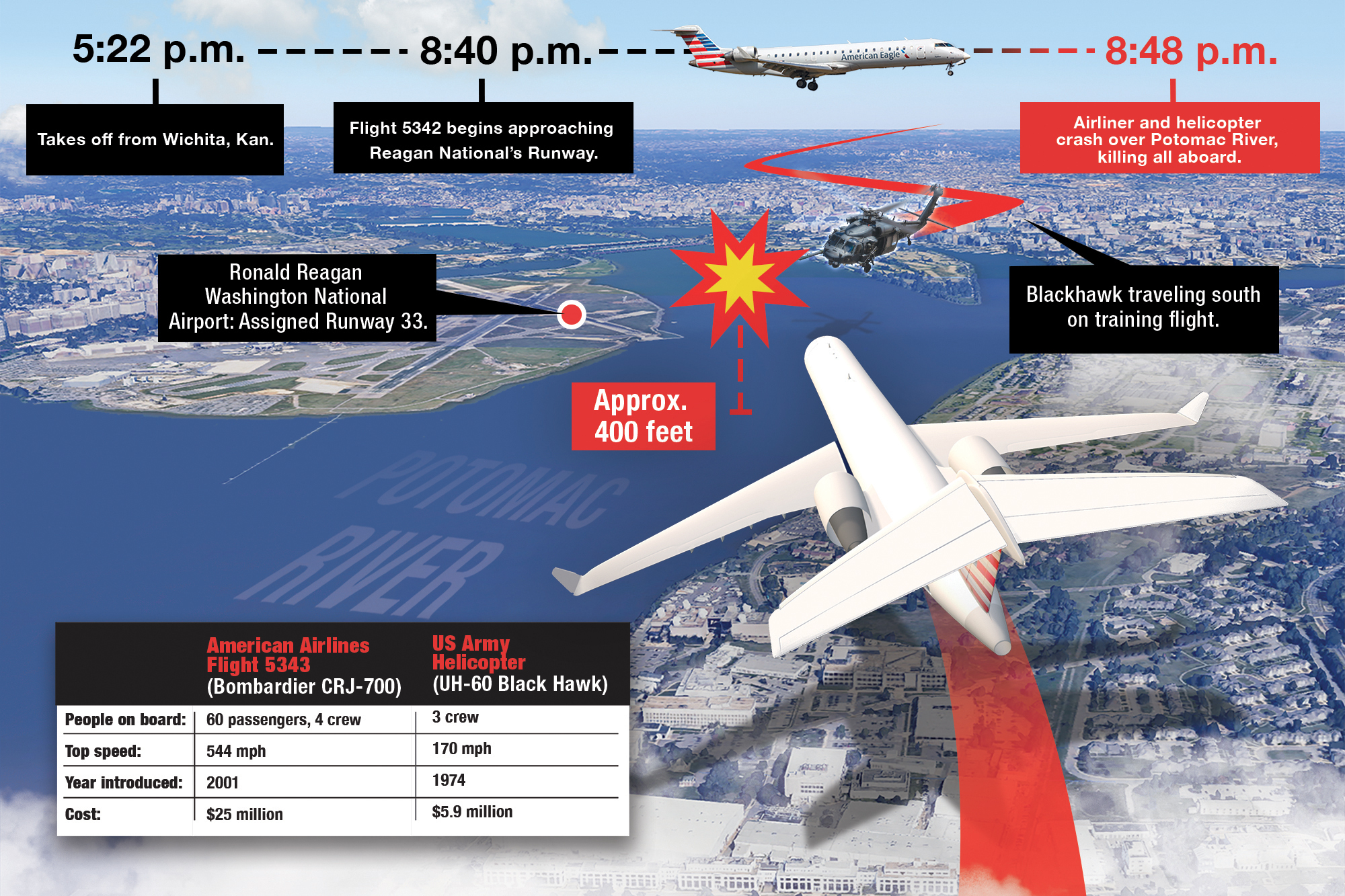

Black Hawk Pilots Actions Before Fatal D C Crash A Detailed Account

Apr 29, 2025

Black Hawk Pilots Actions Before Fatal D C Crash A Detailed Account

Apr 29, 2025 -

Jazda Probna Porsche Cayenne Gts Coupe Opinia Po Kilku Dniach

Apr 29, 2025

Jazda Probna Porsche Cayenne Gts Coupe Opinia Po Kilku Dniach

Apr 29, 2025 -

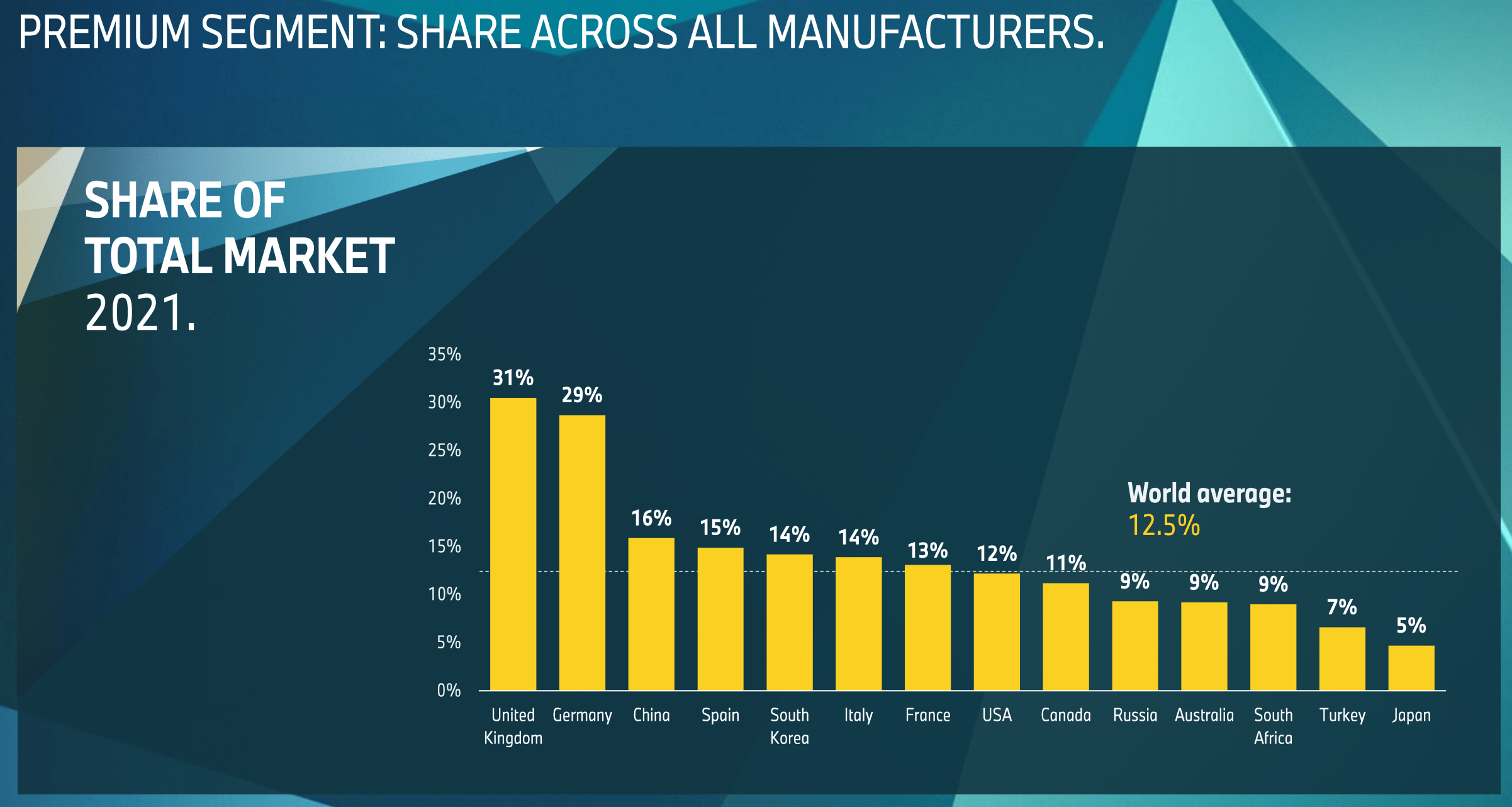

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategies

Apr 29, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategies

Apr 29, 2025 -

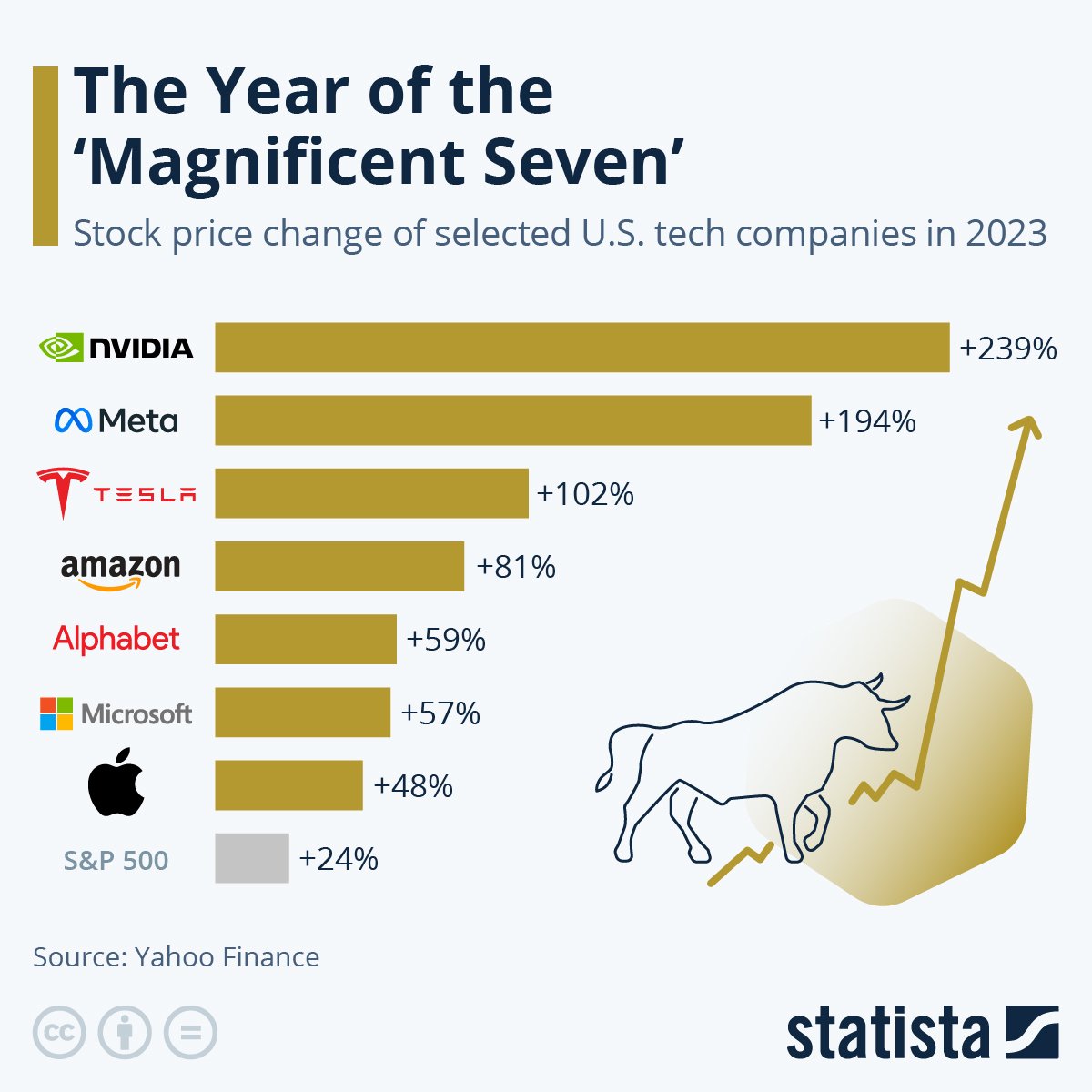

Magnificent Seven Stocks 2 5 Trillion Market Value Lost In 2024

Apr 29, 2025

Magnificent Seven Stocks 2 5 Trillion Market Value Lost In 2024

Apr 29, 2025 -

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni