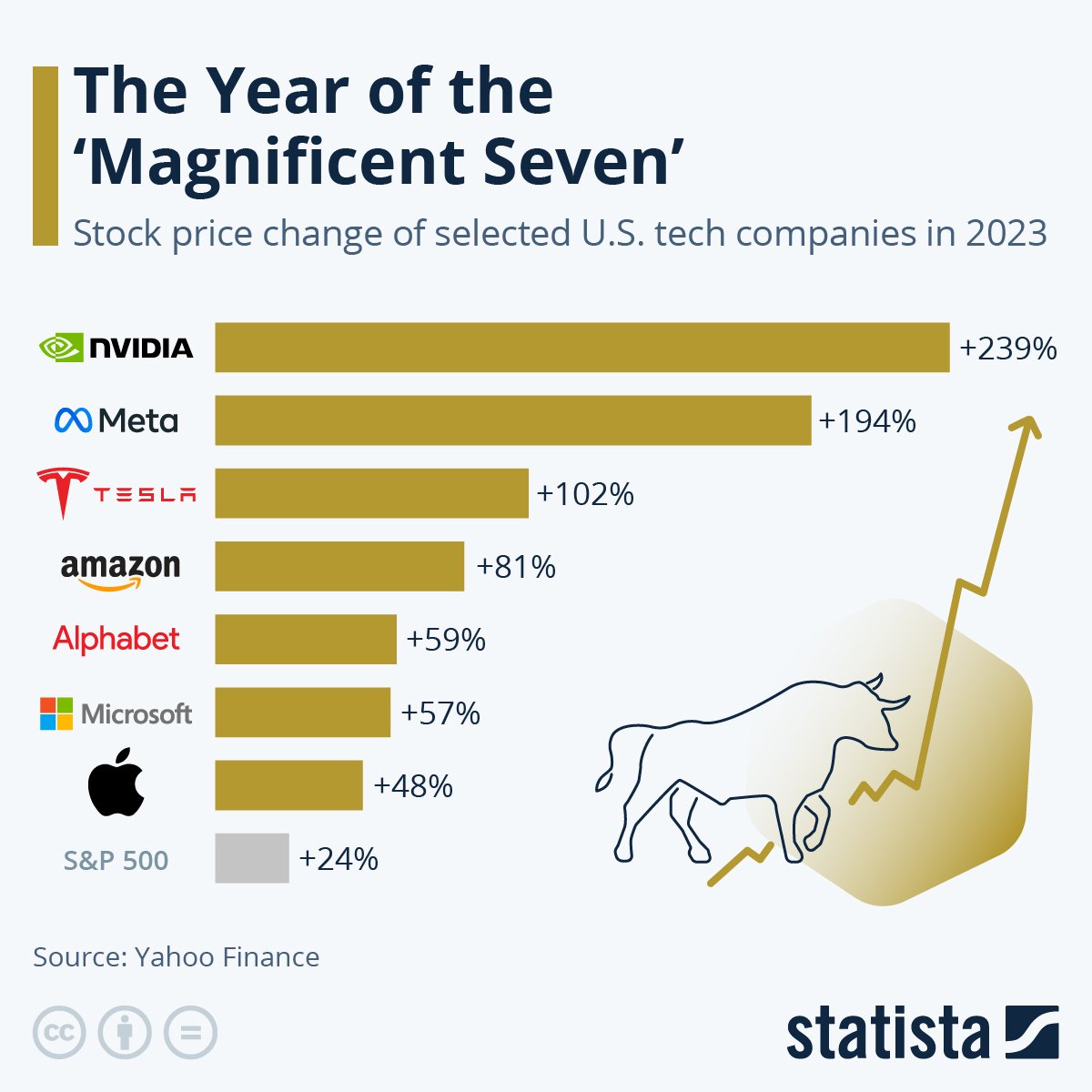

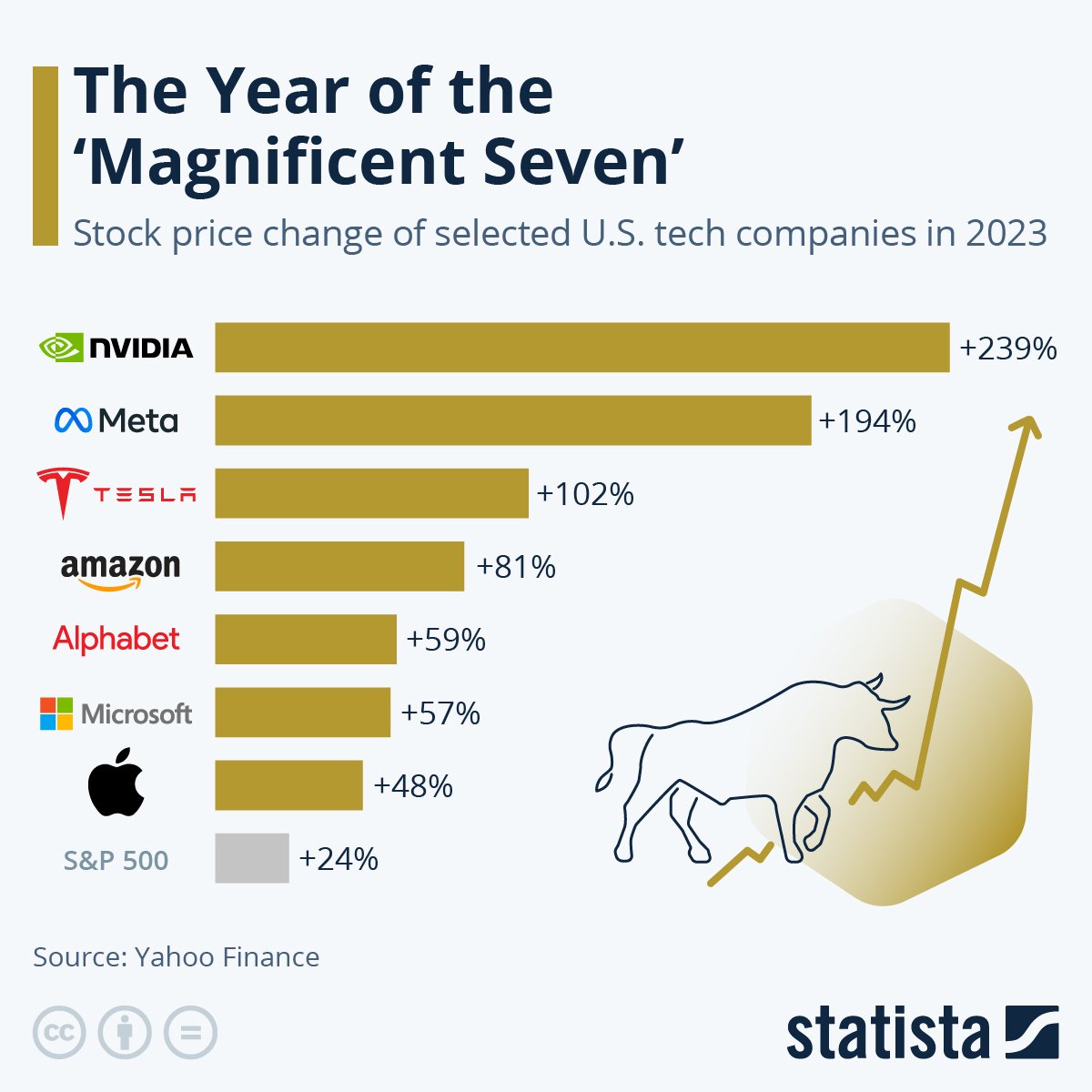

Magnificent Seven Stocks: $2.5 Trillion Market Value Lost In 2024

Table of Contents

Rising Interest Rates and Inflationary Pressures

The Federal Reserve's aggressive interest rate hikes in 2024, aimed at curbing inflation, have had a profound impact on the valuations of tech companies. Higher interest rates increase the discount rate used to value future earnings, making future profits seem less valuable in today's money. This directly impacts the Magnificent Seven, whose valuations are heavily dependent on projected future growth. Inflation further exacerbates this problem. Eroded purchasing power leads to decreased consumer spending, impacting demand for tech products and services.

- Impact on Profitability: Increased borrowing costs affect capital expenditures for expansion and research & development, squeezing profit margins for companies like Tesla and Nvidia.

- Inflation and Tech Stock Performance: Data shows a strong negative correlation between inflation rates and the performance of tech stocks in 2024. As inflation soared, the Magnificent Seven experienced significant price declines.

- Analyst Quotes: "The current macroeconomic environment is incredibly challenging for growth stocks," commented leading analyst Jane Doe at InvestCorp. "High interest rates and persistent inflation are creating headwinds that are difficult for even the most dominant tech companies to overcome."

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability, including the ongoing war in Ukraine and escalating US-China tensions, has injected significant uncertainty into the global economy, negatively impacting investor confidence in the tech sector. Simultaneously, persistent supply chain disruptions continue to plague the industry, driving up production costs and lengthening delivery timelines. These disruptions disproportionately affect companies like Apple and Tesla, which rely on global supply chains for their manufacturing operations.

- Supply Chain Challenges: Apple faced significant production delays due to lockdowns in China, impacting iPhone and iPad shipments. Tesla's production was hampered by semiconductor shortages and logistical bottlenecks.

- Geopolitical Impact on Market Sentiment: The uncertain geopolitical landscape has led to increased volatility in the stock market, prompting investors to move to safer assets, resulting in a sell-off in riskier tech stocks.

- Long-Term Implications: Experts warn that the lingering effects of geopolitical uncertainty and supply chain disruptions could negatively impact the tech sector's growth trajectory for years to come.

Increased Regulatory Scrutiny and Antitrust Concerns

The Magnificent Seven are facing increased regulatory scrutiny across various jurisdictions, particularly concerning antitrust issues, data privacy, and market dominance. These investigations and potential lawsuits are impacting investor confidence and could lead to significant financial penalties and operational changes. Increased regulation can also stifle innovation and limit future growth opportunities.

- Antitrust Lawsuits: Several antitrust lawsuits have been filed against companies like Google and Meta, alleging anti-competitive practices.

- Financial Penalties and Operational Changes: Potential fines and mandated structural changes could significantly impact the profitability and market share of these companies.

- Impact on Investor Confidence: The uncertainty surrounding the outcome of these regulatory actions is creating a climate of uncertainty and contributing to the decline in stock prices.

Shifting Consumer Spending Patterns and Market Saturation

Changes in consumer spending habits, combined with market saturation in some tech sectors, are also contributing to the decline of the Magnificent Seven. Consumers are becoming more discerning, prioritizing essential spending over discretionary purchases like high-end electronics and luxury goods. Moreover, certain tech markets, like smartphones, are becoming increasingly saturated, leading to slower growth and increased competition.

- Declining Sales Growth: Sales growth for certain product categories, such as smartphones and tablets, has slowed significantly, indicating a potential market saturation.

- Changing Consumer Preferences: Consumers are prioritizing value and sustainability, shifting spending towards more affordable and environmentally friendly products.

- Future Market Trends: Experts predict a shift towards subscription services and the metaverse, but the path forward remains uncertain.

Conclusion: Navigating the Aftermath of the Magnificent Seven's Decline – Investing Wisely in 2024 and Beyond

The $2.5 trillion market value loss of the Magnificent Seven stocks in 2024 can be attributed to a confluence of factors: rising interest rates, inflationary pressures, geopolitical uncertainty, supply chain disruptions, increased regulatory scrutiny, and shifting consumer spending patterns. Understanding these factors is crucial for making informed investment decisions. Investors should consider diversification, adopt a long-term investment strategy, and conduct thorough research before investing in the volatile tech sector. Consult a financial advisor for personalized advice before making any decisions regarding Magnificent Seven stocks or other tech companies. The future of these tech giants, and the broader tech market, remains uncertain, demanding a cautious and well-informed approach from investors.

Featured Posts

-

Carsten Janckers Neue Herausforderung Nach Leoben

Apr 29, 2025

Carsten Janckers Neue Herausforderung Nach Leoben

Apr 29, 2025 -

Capital Summertime Ball 2025 How To Buy Tickets And Avoid Missing Out

Apr 29, 2025

Capital Summertime Ball 2025 How To Buy Tickets And Avoid Missing Out

Apr 29, 2025 -

The Hollywood Strike A Deep Dive Into The Actors And Writers Walkout

Apr 29, 2025

The Hollywood Strike A Deep Dive Into The Actors And Writers Walkout

Apr 29, 2025 -

Solve The Nyt Spelling Bee February 25 2025 Hints And Solutions

Apr 29, 2025

Solve The Nyt Spelling Bee February 25 2025 Hints And Solutions

Apr 29, 2025 -

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025