China's Impact On BMW And Porsche Sales: Market Headwinds And Strategies

Table of Contents

Declining Sales and Market Share in China

Economic Slowdown and Shifting Consumer Preferences

China's economic slowdown significantly impacts luxury car purchases. Consumers, facing reduced disposable income and uncertainty, are less likely to invest in high-priced vehicles. Simultaneously, consumer preferences are dramatically changing. There's a marked shift towards domestic brands and electric vehicles (EVs), posing a considerable challenge to established players like BMW and Porsche. Recent sales figures reflect this trend; both BMW and Porsche have reported declining sales in China compared to previous years.

- Reduced consumer confidence leading to decreased discretionary spending on luxury goods.

- Growing popularity of domestic EV brands like BYD and NIO, offering competitive pricing and technologically advanced features.

- Increased preference for SUVs and smaller, more fuel-efficient vehicles, reflecting changing urban lifestyles and environmental concerns. This contrasts with the traditional preference for larger sedans, a segment where BMW and Porsche have historically excelled.

Intensifying Competition from Domestic and International Brands

Rise of Domestic Automakers

The rise of Chinese automakers represents a major competitive threat. Brands like BYD, NIO, and Xpeng are rapidly gaining market share, leveraging their understanding of the local market, competitive pricing, and technological innovation in areas like battery technology and autonomous driving. Their aggressive marketing campaigns, often targeting younger, tech-savvy consumers, further solidify their position.

- Aggressive pricing strategies undercut the pricing of established luxury brands.

- Technological advancements in EVs and autonomous driving systems attract tech-conscious Chinese consumers.

- Strong local brand loyalty and effective marketing campaigns resonate deeply with Chinese consumers.

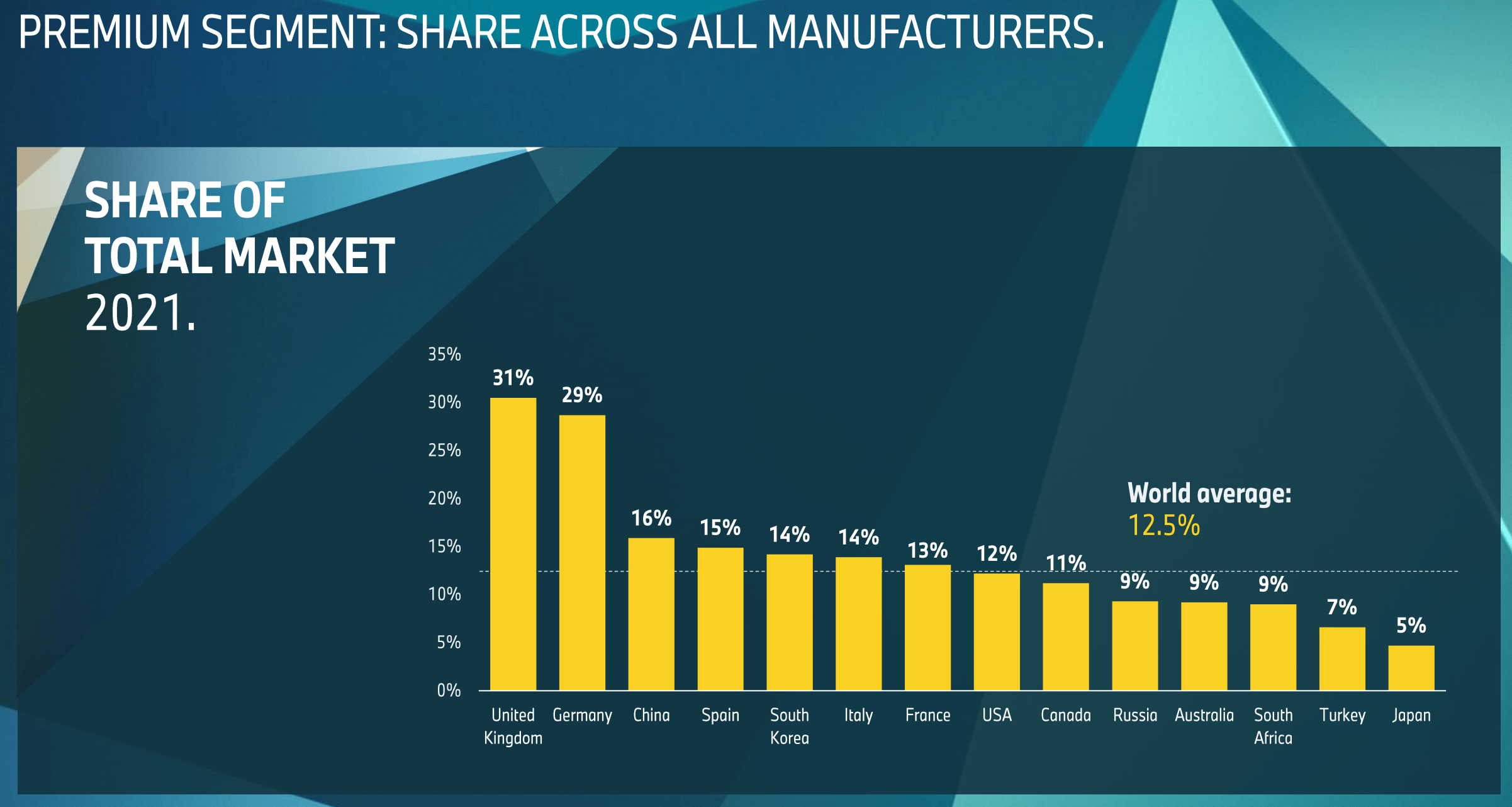

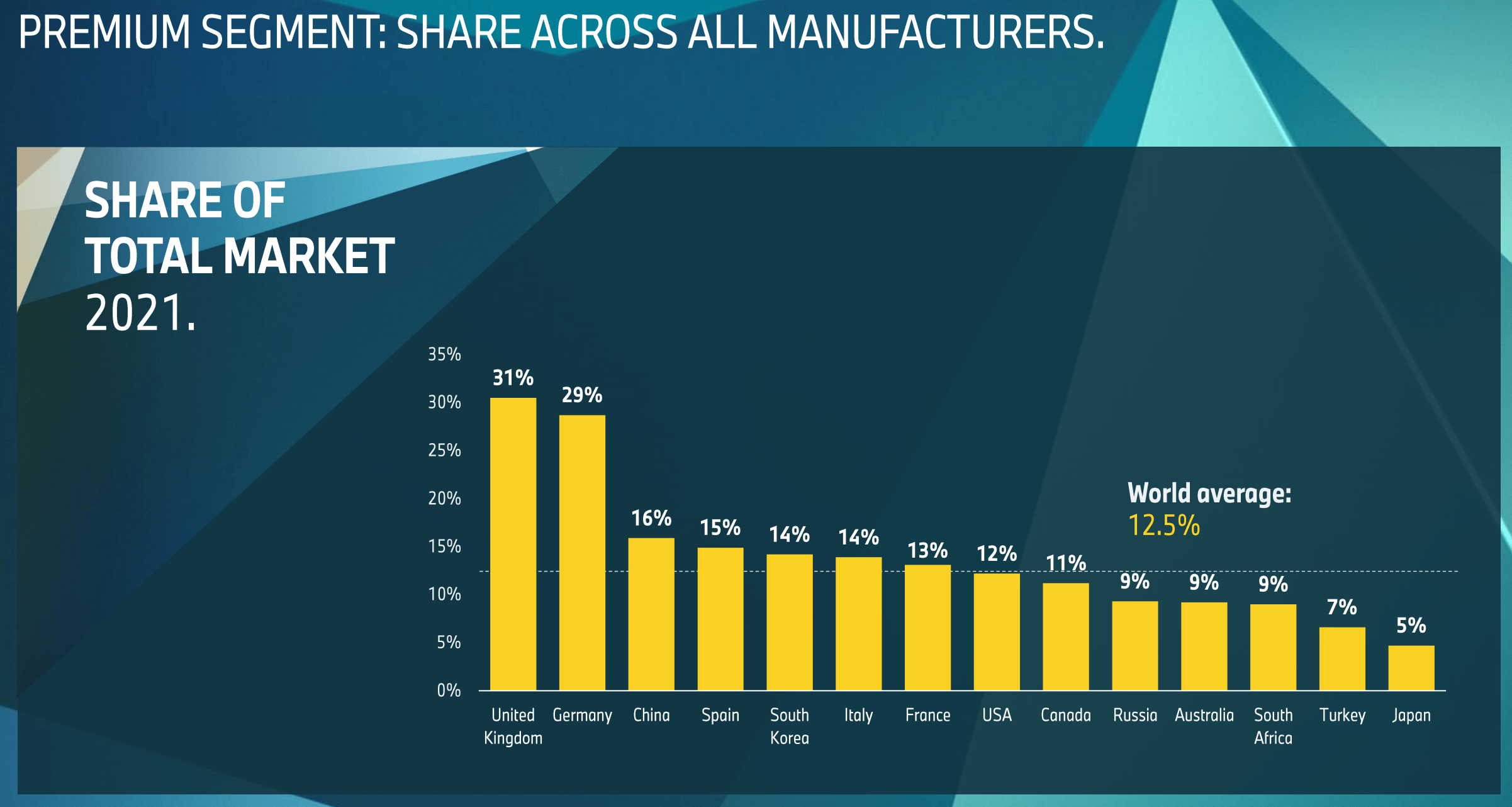

Global Competition in the Luxury Segment

BMW and Porsche also face stiff competition from other international luxury brands such as Audi, Mercedes-Benz, and Tesla. These brands are adapting to the changing market dynamics through significant investments in R&D, targeted marketing campaigns focusing on specific consumer segments (e.g., younger professionals), and expanding their product lines to include more EVs and hybrid vehicles.

- Increased investment in R&D and new technologies, particularly in areas like electrification and connectivity.

- Targeted marketing campaigns focusing on specific consumer segments and lifestyle preferences.

- Expanding product lines to meet diverse consumer demands, including offerings in the increasingly popular EV and hybrid segments.

BMW and Porsche's Strategic Responses

Product Diversification and Localization Strategies

To counter declining sales, BMW and Porsche are diversifying their product offerings and employing localization strategies. This includes developing China-specific vehicle features, adapting models to suit local tastes and preferences, and tailoring marketing messages to resonate with Chinese consumers. They are also prioritizing the introduction of electric and hybrid models to meet growing demand in this segment.

- Introduction of electric and hybrid vehicle models, catering to the growing preference for environmentally friendly vehicles.

- Development of China-specific vehicle features and options, catering to local consumer preferences and regulatory requirements.

- Customization of marketing messages and brand communication, ensuring effective resonance with the target audience.

Investment in Electric Vehicle Technology and Infrastructure

BMW and Porsche are heavily investing in EV technology and charging infrastructure in China. This includes collaborations with Chinese battery manufacturers, expansion of charging networks in major cities, and substantial R&D investment in battery technology and EV development. These investments are crucial for long-term growth and competitiveness in the rapidly evolving Chinese automotive market.

- Joint ventures with Chinese battery manufacturers to secure access to advanced battery technologies and supply chains.

- Expansion of charging networks in major Chinese cities to address range anxiety and improve EV accessibility.

- Investment in research and development of EV technology to maintain a competitive edge in the EV market.

Conclusion

The Chinese automotive market presents both substantial challenges and opportunities for luxury brands like BMW and Porsche. Economic slowdown, evolving consumer preferences, and fierce competition create significant headwinds. However, their strategic responses, including product diversification, localization, and substantial investment in EV technology, showcase their commitment to navigating these challenges and maintaining their presence in this vital market.

Call to Action: Understanding China's impact on BMW and Porsche sales is critical for anyone following the global automotive industry. Stay informed about the latest developments in this dynamic market to understand the strategies employed by leading luxury automakers and anticipate future trends impacting the competitive landscape of China's evolving automotive landscape.

Featured Posts

-

New Evidence Reveals Pilot Error In Near Collision At Reagan Airport

Apr 29, 2025

New Evidence Reveals Pilot Error In Near Collision At Reagan Airport

Apr 29, 2025 -

Mhairi Black And The Debate Misogyny And The Protection Of Women And Girls

Apr 29, 2025

Mhairi Black And The Debate Misogyny And The Protection Of Women And Girls

Apr 29, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025 -

The Impact Of Adhd On Driving Safety A Review Of Current Research

Apr 29, 2025

The Impact Of Adhd On Driving Safety A Review Of Current Research

Apr 29, 2025 -

Fhi Rapport Begrenset Effekt Av Adhd Medisin Pa Skole

Apr 29, 2025

Fhi Rapport Begrenset Effekt Av Adhd Medisin Pa Skole

Apr 29, 2025