Canadian Guitar Maker Battles Import Tariff Confusion

Table of Contents

The Impact of Rising Import Tariffs on Canadian Guitar Makers

The increased costs associated with importing raw materials and finished components are significantly impacting Canadian guitar makers. Building a guitar requires a delicate balance of high-quality materials sourced from around the globe. The import of these materials, including exotic woods from overseas, specialized electronics from Asia, and high-quality hardware from Europe, is fundamental to the industry. Rising import tariffs directly translate to increased production costs, creating a ripple effect throughout the supply chain.

-

Increased production costs leading to higher retail prices: Higher import costs force Canadian guitar makers to raise their prices, making their instruments less competitive in both the domestic and international markets. This price increase can impact sales volume and reduce profitability.

-

Reduced competitiveness against foreign manufacturers with lower import costs: Guitar makers in countries with more favourable trade agreements or lower tariffs have a distinct cost advantage, making it challenging for Canadian manufacturers to compete on price. This forces Canadian makers to focus on higher-end niche markets to offset the higher costs.

-

Potential job losses within the Canadian guitar-making industry: If the situation worsens, rising costs and reduced competitiveness may lead to layoffs and business closures within the Canadian guitar-making industry, impacting skilled artisans and supporting roles.

-

Difficulty in sourcing specific, high-quality materials only available internationally: Many high-quality woods and components crucial for building high-end guitars are simply unavailable domestically. The added cost and complexity of importing these essential materials significantly hampers production and innovation. This affects not only the maker's ability to produce but also their creativity, resulting in potentially limited product design and offering.

Navigating the Complexities of Canadian Customs Regulations

Canadian guitar makers face significant bureaucratic hurdles when dealing with Canadian customs regulations and guitar import tariffs. The classification of guitar parts and components under different tariff codes is often ambiguous and inconsistent. This leads to delays, disputes, and unexpected costs.

-

Confusing classification of guitar parts and components under different tariff codes: The lack of clear and consistent classification for various guitar parts often results in incorrect tariff assessments, leading to increased costs and administrative burdens for importers. A simple change in wording or a minor variation in a component can result in a substantially different tariff being applied.

-

Time-consuming and costly processes for appealing incorrect tariff assessments: Challenging incorrect tariff assessments is a lengthy and expensive process, requiring specialized expertise and significant time investment, diverting resources away from core business activities.

-

Lack of clear and concise information from government agencies regarding import regulations: The lack of accessible and easy-to-understand information from government agencies regarding import regulations makes navigating the system even more difficult for small- to medium-sized businesses.

-

Uncertainty surrounding future tariff changes impacting long-term business planning: The constant threat of tariff changes and amendments makes long-term business planning challenging and adds an element of unpredictability, impacting investment decisions and hindering future growth.

The Case Study: A Specific Canadian Guitar Maker's Experience

Let's consider the example of "North Star Guitars," a small but reputable Canadian guitar maker based in Ontario. They recently faced significant challenges importing a specialized type of rosewood for their high-end acoustic guitars. Initially classified under a lower tariff code, a subsequent customs review reclassified the wood, resulting in a substantial increase in import duties. This unexpected cost increase forced North Star Guitars to absorb the loss, reducing their profit margin significantly. To mitigate the impact of future tariff increases, they are exploring alternative sourcing strategies, including using domestically sourced woods whenever possible, although this limits their design options and quality. The owner, John Smith, stated, "The uncertainty and inconsistency surrounding import tariffs create an enormous burden on our business. We need clearer guidelines and more support from the government to navigate this challenging landscape."

Advocating for Change: The Need for Clearer Import Tariff Policies

The Canadian government must address the import tariff confusion impacting the musical instrument industry. The current system is overly complex and creates significant challenges for businesses.

-

Calls for simplified tariff codes and clearer guidelines for guitar parts classification: Clearer and more consistent tariff codes are needed, along with simplified guidelines that clearly define the classification criteria for various guitar parts.

-

Suggestions for improved communication and support from Canadian customs authorities: Improved communication channels and proactive support from Canadian customs authorities can significantly ease the burden on importers. This could include dedicated resources and training sessions for businesses struggling with tariff complexities.

-

Advocacy groups and organizations working to support Canadian musical instrument makers: Industry associations and advocacy groups are crucial for lobbying the government and bringing these issues to the forefront.

-

Potential policy solutions (e.g., tariff reductions, streamlined import processes): Policy solutions like tariff reductions on specific components or streamlining the import process could significantly benefit Canadian guitar makers, improving their competitiveness and ensuring the continued growth of the industry.

Conclusion

This article has highlighted the significant challenges faced by Canadian guitar makers due to import tariff confusion. The complexities of customs regulations, coupled with rising costs and inconsistent tariff applications, threaten the viability and competitiveness of this important segment of the Canadian economy. The experiences of companies like North Star Guitars illustrate the real-world impact of these issues.

The Canadian government needs to address this pressing issue of import tariff confusion. Clearer policies, simplified procedures, and increased support for Canadian guitar makers are essential to ensure the continued growth and success of this vital sector. Let's work together to find solutions to alleviate the burden of import tariff confusion on our Canadian musical instrument manufacturers. The future of Canadian guitar making depends on it.

Featured Posts

-

Wigan And Leigh College Student Skills On Display At Flower Show

Apr 25, 2025

Wigan And Leigh College Student Skills On Display At Flower Show

Apr 25, 2025 -

The Slow Rollout Of Elon Musks Autonomous Vehicle Plans

Apr 25, 2025

The Slow Rollout Of Elon Musks Autonomous Vehicle Plans

Apr 25, 2025 -

2025 Te Canakkale Zaferi Nin Yildoenuemue Kacinci Yil Ne Zaman Kazanildi

Apr 25, 2025

2025 Te Canakkale Zaferi Nin Yildoenuemue Kacinci Yil Ne Zaman Kazanildi

Apr 25, 2025 -

Roche Q1 Sales Report Examining Growth And Future Pipeline Potential

Apr 25, 2025

Roche Q1 Sales Report Examining Growth And Future Pipeline Potential

Apr 25, 2025 -

Places In The North East To Visit This Easter Your Holiday Guide

Apr 25, 2025

Places In The North East To Visit This Easter Your Holiday Guide

Apr 25, 2025

Latest Posts

-

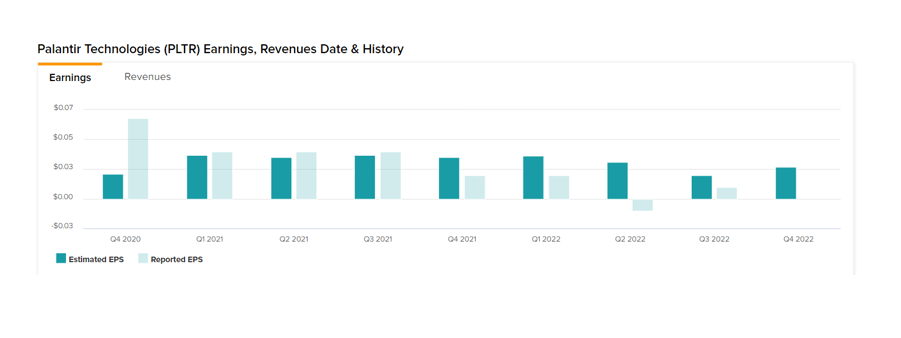

To Buy Or Not To Buy Palantir Stock Before May 5th The Analysts View

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th The Analysts View

May 10, 2025 -

Should You Invest In Palantir Before May 5th Expert Opinions And Analysis

May 10, 2025

Should You Invest In Palantir Before May 5th Expert Opinions And Analysis

May 10, 2025 -

Palantir Technologies Stock Forecast Should You Invest Before May 5th

May 10, 2025

Palantir Technologies Stock Forecast Should You Invest Before May 5th

May 10, 2025 -

Palantir Stock Before May 5th A Prudent Investment

May 10, 2025

Palantir Stock Before May 5th A Prudent Investment

May 10, 2025 -

Investing In Palantir Should You Buy Before The May 5th Deadline

May 10, 2025

Investing In Palantir Should You Buy Before The May 5th Deadline

May 10, 2025