To Buy Or Not To Buy Palantir Stock Before May 5th: The Analyst's View

Table of Contents

Palantir's Recent Performance and Future Outlook

To determine whether to buy Palantir stock, a thorough examination of the company's recent performance and future outlook is crucial. This involves analyzing its financial health, product innovation, and the broader market conditions impacting its business.

Financial Performance Analysis

Palantir's recent quarterly earnings reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus for investors. Examining Q4 2023 results against previous quarters is essential. Key metrics to consider include:

- Revenue Growth: Compare year-over-year and quarter-over-quarter revenue growth rates. A consistent upward trend suggests a healthy and expanding business. [Insert relevant data and chart showing revenue growth].

- Government vs. Commercial Revenue: Analyze the breakdown of revenue between government contracts and commercial clients. Strong growth in both sectors signals a diversified and resilient business model. [Insert relevant data and chart showing revenue breakdown].

- Operating Expenses and Margins: Scrutinize operating expenses and their impact on profit margins. Improving margins indicate increased efficiency and profitability. [Insert relevant data and chart showing operating expenses and margins].

- Cash Flow: Analyze the company's cash flow from operations to assess its financial strength and ability to fund future growth initiatives. [Insert relevant data and chart showing cash flow].

Product Innovation and Market Position

Palantir's success hinges on its ability to innovate and maintain a competitive edge. Key products like Foundry and Gotham are central to its growth strategy. Analyzing their market adoption and potential for future growth is critical.

- Foundry Adoption: Assess the rate of Foundry adoption across different industries. Higher adoption rates signal strong market acceptance and potential for future revenue growth.

- Gotham's Role in Government: Analyze Gotham's role in securing and retaining government contracts. This segment is a significant driver of Palantir's revenue.

- Competitive Landscape: Evaluate Palantir's competitive advantages against companies offering similar data analytics and AI-powered solutions. Identifying and assessing competitive threats is vital.

Geopolitical Factors and Industry Trends

Geopolitical events and industry trends significantly influence Palantir's business.

- Government Spending on National Security: Increased government spending on national security and intelligence can positively impact Palantir's government contracts.

- Global Economic Conditions: Recessions or economic downturns can affect spending by both government and commercial clients, impacting Palantir's revenue.

- Data Privacy Regulations: Changes in data privacy regulations across various jurisdictions can affect Palantir's operations and ability to secure and process data.

Analyst Ratings and Price Targets

Understanding the consensus view among analysts and any divergence in opinions is crucial before considering buying Palantir stock.

Consensus View Among Analysts

A summary of buy, sell, and hold ratings from reputable financial institutions provides valuable insight.

- Average Price Target: The average price target from various analysts provides a benchmark for potential future price appreciation.

- Rationale for Ratings: Understanding the reasoning behind each analyst's rating helps in assessing their outlook on Palantir's future performance. [Insert summary of analyst ratings and price targets].

Divergence in Analyst Opinions

Disagreements among analysts highlight the inherent uncertainties associated with Palantir's stock.

- Bullish vs. Bearish Views: Identify the key factors driving bullish and bearish views on Palantir stock. This will help to identify potential risks and opportunities.

- Uncertainties and Risks: Understand the uncertainties and risks cited by analysts that could negatively affect Palantir's performance and share price.

Risk Assessment and Investment Considerations

Investing in Palantir stock involves inherent risks. A thorough risk assessment is necessary before making any investment decisions.

Potential Risks

- Tech Sector Volatility: The technology sector is known for its volatility. Palantir's share price is susceptible to market fluctuations.

- Competition: Increased competition in the data analytics and AI space poses a risk to Palantir's market share.

- Financial Performance: Failure to meet financial expectations could negatively impact Palantir's share price.

Investment Strategies

Investment strategies should align with individual risk tolerance and investment goals.

- Long-Term Buy-and-Hold: A long-term approach may be suitable for investors with a higher risk tolerance and a longer time horizon.

- Short-Term Trading: Short-term trading carries higher risks and requires a greater understanding of market dynamics.

- Diversification: Diversifying investments across different asset classes reduces overall portfolio risk.

Conclusion

Deciding whether to buy Palantir stock before May 5th requires careful consideration of its recent performance, future outlook, and inherent risks. While Palantir demonstrates potential for growth in key areas, including government contracts and product innovation, the tech sector's volatility and intense competition present significant challenges. Based on the current market conditions and analyst predictions, a cautious approach to investing in Palantir stock before May 5th is recommended. Before making any investment decisions concerning Palantir stock, remember to conduct your own thorough research and seek advice from a qualified financial advisor.

Featured Posts

-

Transparency In Us Funding A Focus On Transgender Mouse Research

May 10, 2025

Transparency In Us Funding A Focus On Transgender Mouse Research

May 10, 2025 -

Months Of Warnings Ignored Dangerous Incidents Preceding Newark Atc System Failure

May 10, 2025

Months Of Warnings Ignored Dangerous Incidents Preceding Newark Atc System Failure

May 10, 2025 -

Bundesliga 2 Matchday 27 Overview Cologne Dethrones Hamburg

May 10, 2025

Bundesliga 2 Matchday 27 Overview Cologne Dethrones Hamburg

May 10, 2025 -

Elon Musk Wealth Increase Billions Added After Tesla Rally Dogecoin Step Back

May 10, 2025

Elon Musk Wealth Increase Billions Added After Tesla Rally Dogecoin Step Back

May 10, 2025 -

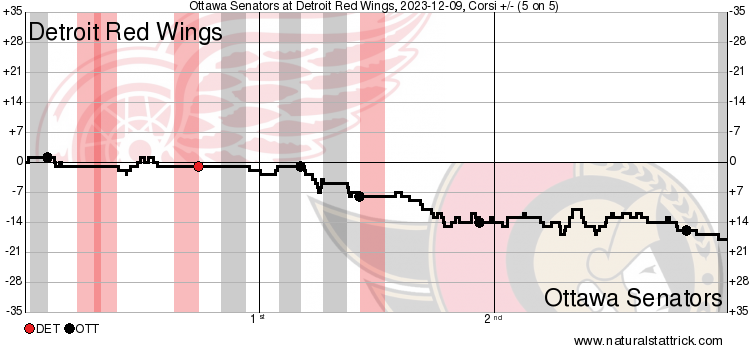

Red Wings Suffer 6 3 Defeat Playoff Chances Diminish

May 10, 2025

Red Wings Suffer 6 3 Defeat Playoff Chances Diminish

May 10, 2025

Latest Posts

-

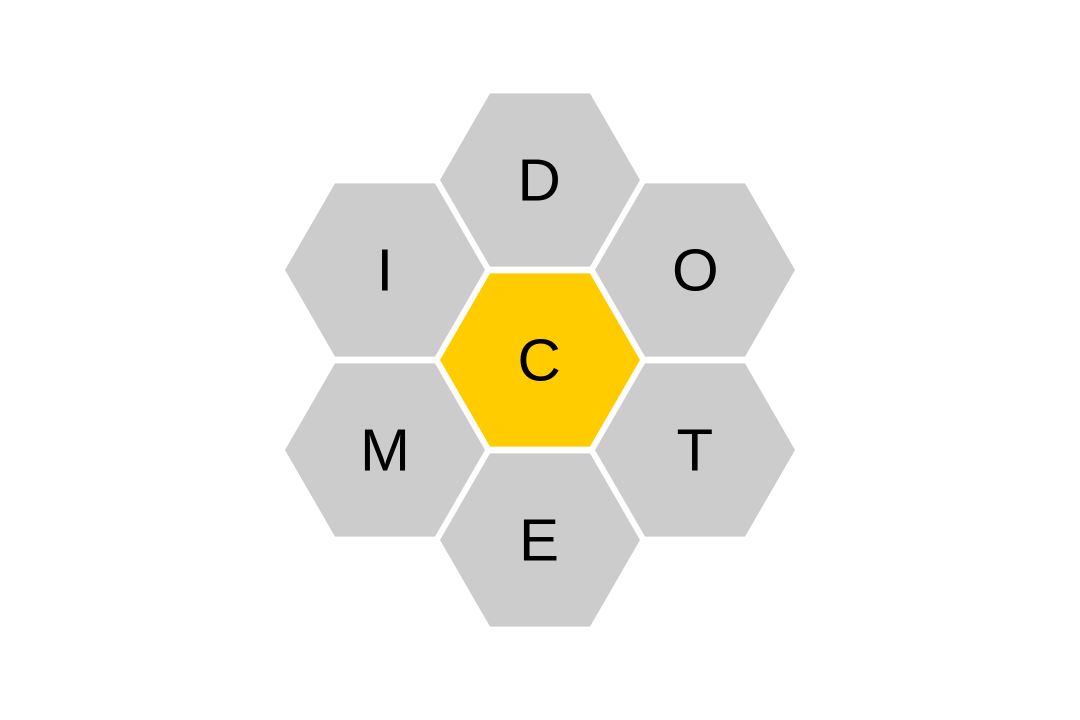

Nyt Spelling Bee April 1 2025 Complete Solution Guide

May 10, 2025

Nyt Spelling Bee April 1 2025 Complete Solution Guide

May 10, 2025 -

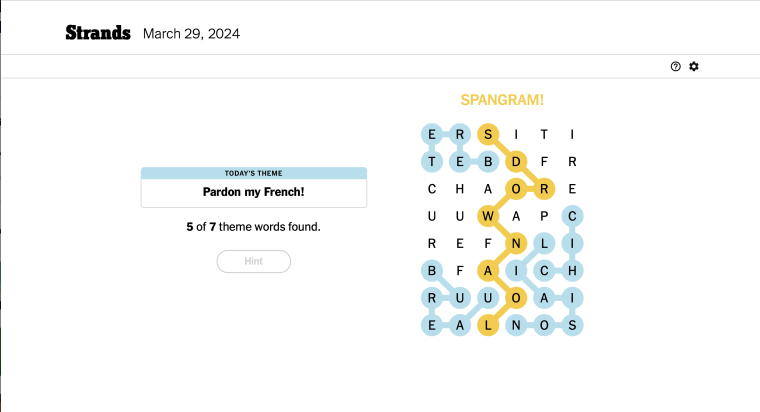

Tuesday March 4th Nyt Strands Answers Game 366

May 10, 2025

Tuesday March 4th Nyt Strands Answers Game 366

May 10, 2025 -

Nyt Strands Puzzle Solutions Tuesday March 4th Game 366

May 10, 2025

Nyt Strands Puzzle Solutions Tuesday March 4th Game 366

May 10, 2025 -

Strands Nyt Crossword Hints And Answers Tuesday March 4th Game 366

May 10, 2025

Strands Nyt Crossword Hints And Answers Tuesday March 4th Game 366

May 10, 2025 -

Nyt Crossword Solutions April 6 2025 Hints For The Sunday Puzzle

May 10, 2025

Nyt Crossword Solutions April 6 2025 Hints For The Sunday Puzzle

May 10, 2025