Canadian Dollar Overvalued: Economists Urge Swift Action

Table of Contents

Factors Contributing to Canadian Dollar Overvaluation

Several interconnected factors contribute to the current overvaluation of the Canadian dollar. Understanding these factors is crucial to developing effective solutions.

Strong Commodity Prices

High commodity prices, particularly for oil and natural gas, are a primary driver of the CAD's strength. Canada is a major exporter of these resources, and increased global demand pushes up their prices, leading to a surge in demand for the Canadian dollar.

- Oil Prices: Recent increases in global oil prices, fueled by geopolitical instability and increased demand, have significantly boosted the CAD. For instance, the price of West Texas Intermediate (WTI) crude oil reaching X dollars per barrel directly impacts Canadian export revenues and consequently, the CAD's value.

- Natural Gas: Similar to oil, fluctuations in natural gas prices directly impact the Canadian economy and the value of the CAD. A rise in global natural gas prices strengthens the Canadian dollar.

- Other Commodities: The price of other Canadian commodities, such as lumber, potash, and metals, also plays a role, although perhaps to a lesser extent than oil and gas. Price fluctuations in these markets have a cumulative effect on the CAD. Keywords: Commodity prices, oil prices, natural gas, CAD strength, commodity market

Higher Interest Rates Compared to Global Markets

The Bank of Canada's aggressive interest rate hikes have attracted significant foreign investment, further strengthening the CAD. Higher interest rates make Canadian assets more attractive to international investors seeking higher returns on their investments.

- Comparison to other economies: Canadian interest rates are currently higher than those in many major economies, including the US, the Eurozone, and the UK. This difference in yields attracts capital inflows, increasing demand for the CAD.

- Mechanism of capital inflow: International investors seek to capitalize on the higher interest rates offered in Canada. This increased demand for Canadian dollar-denominated assets drives up its value. Keywords: Bank of Canada, interest rate hikes, monetary policy, foreign investment, capital flows

Safe Haven Status

Geopolitical uncertainty often leads investors to seek refuge in stable currencies like the Canadian dollar, driving up its value. Canada's reputation for political stability and a well-managed economy makes the CAD an attractive safe haven asset during times of global turmoil.

- Recent Geopolitical Events: The ongoing war in Ukraine, for example, has contributed to increased global uncertainty, leading investors to seek the relative safety of the Canadian dollar. Other geopolitical events also influence investor sentiment and increase the demand for safe haven assets.

- Investor Sentiment and Risk Aversion: During periods of heightened uncertainty, investors tend to become more risk-averse and move their investments into safer, more stable assets like the Canadian dollar. This increases demand and pushes up the value of the CAD. Keywords: Geopolitical risk, safe haven currency, investor sentiment, global uncertainty

Consequences of an Overvalued Canadian Dollar

The overvalued Canadian dollar carries several significant risks for the Canadian economy.

Impact on Canadian Exports

A strong CAD makes Canadian goods and services more expensive for international buyers, reducing their competitiveness in global markets. This leads to decreased export volumes and a potential widening of the trade deficit.

- Specific Industries: Industries heavily reliant on exports, such as manufacturing and agriculture, are particularly vulnerable. The overvalued CAD reduces their ability to compete effectively against foreign producers.

- Export Volume and Trade Deficits: Data on export volume and trade balances clearly shows a negative correlation between a strong CAD and the performance of Canadian export-oriented industries. Keywords: Export competitiveness, trade deficit, Canadian exports, global markets, manufacturing, agriculture

Impact on Economic Growth

Reduced export demand due to an overvalued CAD can significantly hamper overall economic growth and lead to a slowdown in economic activity. This, in turn, can lead to job losses in export-oriented sectors and negatively impact the entire Canadian economy.

- GDP Growth and Currency Value: A strong correlation exists between the value of the CAD and the country's GDP growth rate. An overvalued CAD generally dampens economic growth.

- Job Losses: Reduced export demand and the resulting decline in production can lead to substantial job losses in sectors heavily reliant on international markets. Keywords: Economic growth, GDP, employment, job losses, economic slowdown

Inflationary Pressures (Indirect)

While a strong currency can generally curb inflation by reducing import costs, an overvalued CAD can create indirect inflationary pressures. Although import prices decrease, this effect might be offset by other factors.

- Reduced Export Revenues: A stronger CAD leads to lower export revenues for Canadian companies, which can increase prices domestically.

- Supply Chain Disruptions: The strong currency might affect international supply chains and lead to higher input costs for Canadian businesses. Keywords: Inflation, import prices, purchasing power, cost-push inflation

Potential Solutions and Policy Recommendations

Addressing the overvalued Canadian dollar requires a multi-pronged approach involving monetary policy adjustments, fiscal policy considerations, and long-term strategic planning.

Intervention by the Bank of Canada

The Bank of Canada could potentially intervene in the foreign exchange market to weaken the CAD. However, this approach has both benefits and drawbacks.

- Pros and Cons of Intervention: Direct intervention can quickly impact the currency's value but might have unintended consequences and signal a lack of confidence in the market. It is generally seen as a short-term measure.

- Other Policy Tools: The Bank of Canada could also adjust its monetary policy, such as lowering interest rates (though this is complex in the current inflationary environment), to indirectly influence the CAD's value. Keywords: Foreign exchange intervention, monetary policy tools, Bank of Canada policy

Fiscal Policy Measures

Government spending and tax policies can indirectly influence the value of the Canadian dollar. Careful management of fiscal policy can help reduce the negative impacts of an overvalued CAD.

- Impact on Currency Value: Fiscal policies impacting government spending and taxes can affect investor sentiment and investment flows, which in turn influence the value of the CAD. Keywords: Fiscal policy, government spending, tax policy, budget deficit

Long-Term Strategies for Economic Diversification

Reducing Canada's reliance on commodity exports requires a long-term strategy focused on diversification and innovation. Investing in other sectors will make the economy less vulnerable to fluctuations in commodity prices.

- Promoting Innovation: Investing in research and development, education, and technology will help foster innovation in diverse sectors.

- Supporting Non-Commodity Sectors: Government policies supporting industries like technology, advanced manufacturing, and renewable energy will enhance economic diversification. Keywords: Economic diversification, innovation, technological advancement, sustainable growth

Conclusion

The overvaluation of the Canadian dollar poses a significant challenge to Canada's economic stability and demands immediate attention. The factors contributing to this overvaluation – high commodity prices, higher interest rates, and safe-haven demand – have severe consequences for Canadian exports, economic growth, and employment. Urgent action is needed. Potential intervention by the Bank of Canada, strategic adjustments in fiscal policy, and the implementation of long-term economic diversification policies are crucial to mitigate the negative effects of a persistently Canadian dollar overvalued market. Ignoring this issue risks causing further economic damage. Understanding the dynamics of a CAD overvalued currency and taking proactive measures are essential for maintaining a healthy and robust Canadian economy. We need swift and decisive action to address this Canadian dollar overvalued situation before further damage is done.

Featured Posts

-

Bitcoin Surge Positive Trade Talks Boost Crypto Market

May 08, 2025

Bitcoin Surge Positive Trade Talks Boost Crypto Market

May 08, 2025 -

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Implications

May 08, 2025

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Implications

May 08, 2025 -

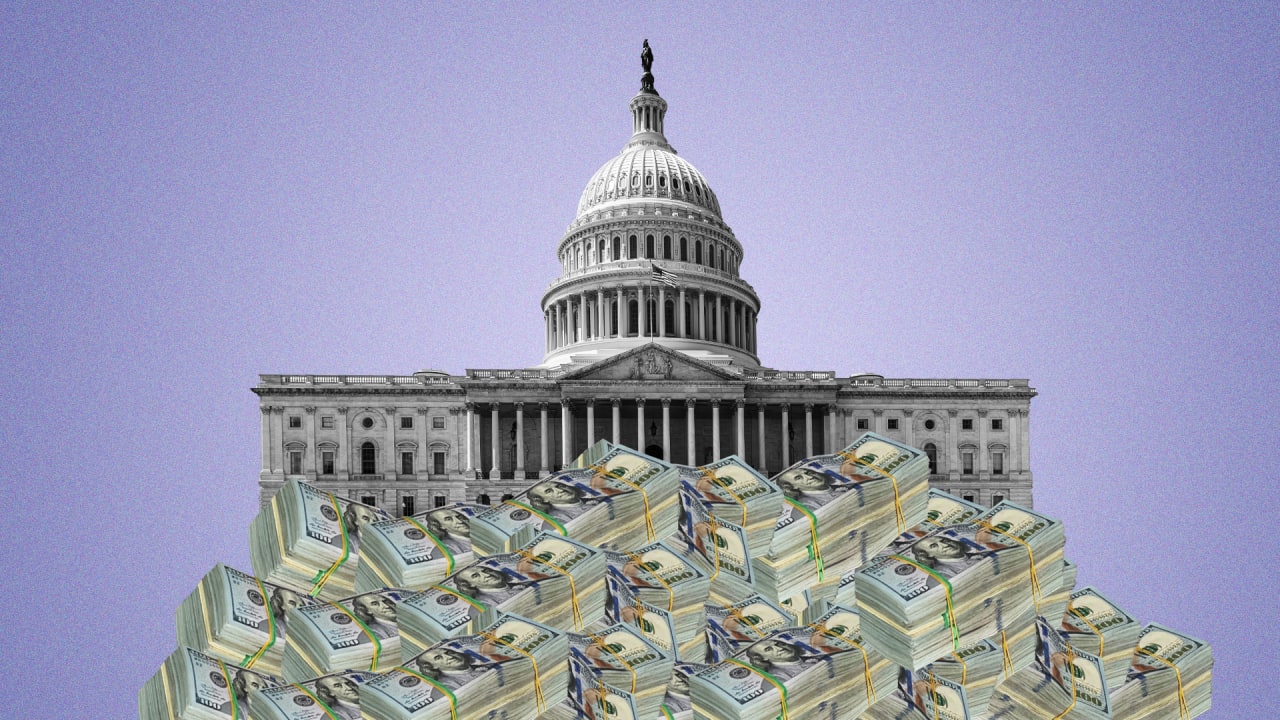

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025 -

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

May 08, 2025

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

May 08, 2025 -

Rain Shortened Game Paris Homer Delivers Angels Victory Over White Sox

May 08, 2025

Rain Shortened Game Paris Homer Delivers Angels Victory Over White Sox

May 08, 2025

Latest Posts

-

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

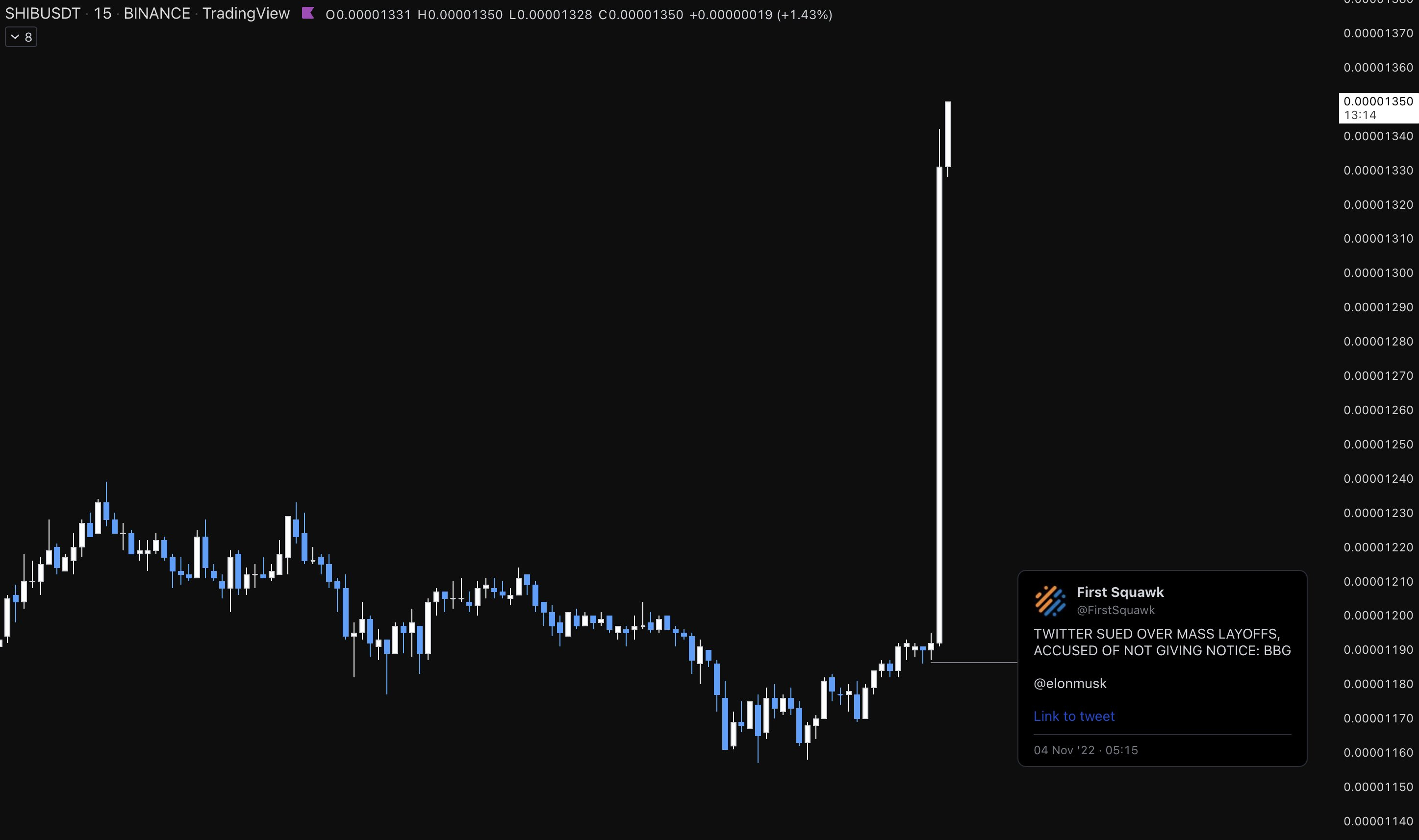

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025