BofA's View: Are High Stock Market Valuations Cause For Investor Concern?

Table of Contents

BofA's Key Arguments on High Valuations

BofA's analysis likely focuses on several key metrics to support their assessment of high stock market valuations. Their arguments likely center on the idea that current prices are not fully justified by underlying fundamentals.

-

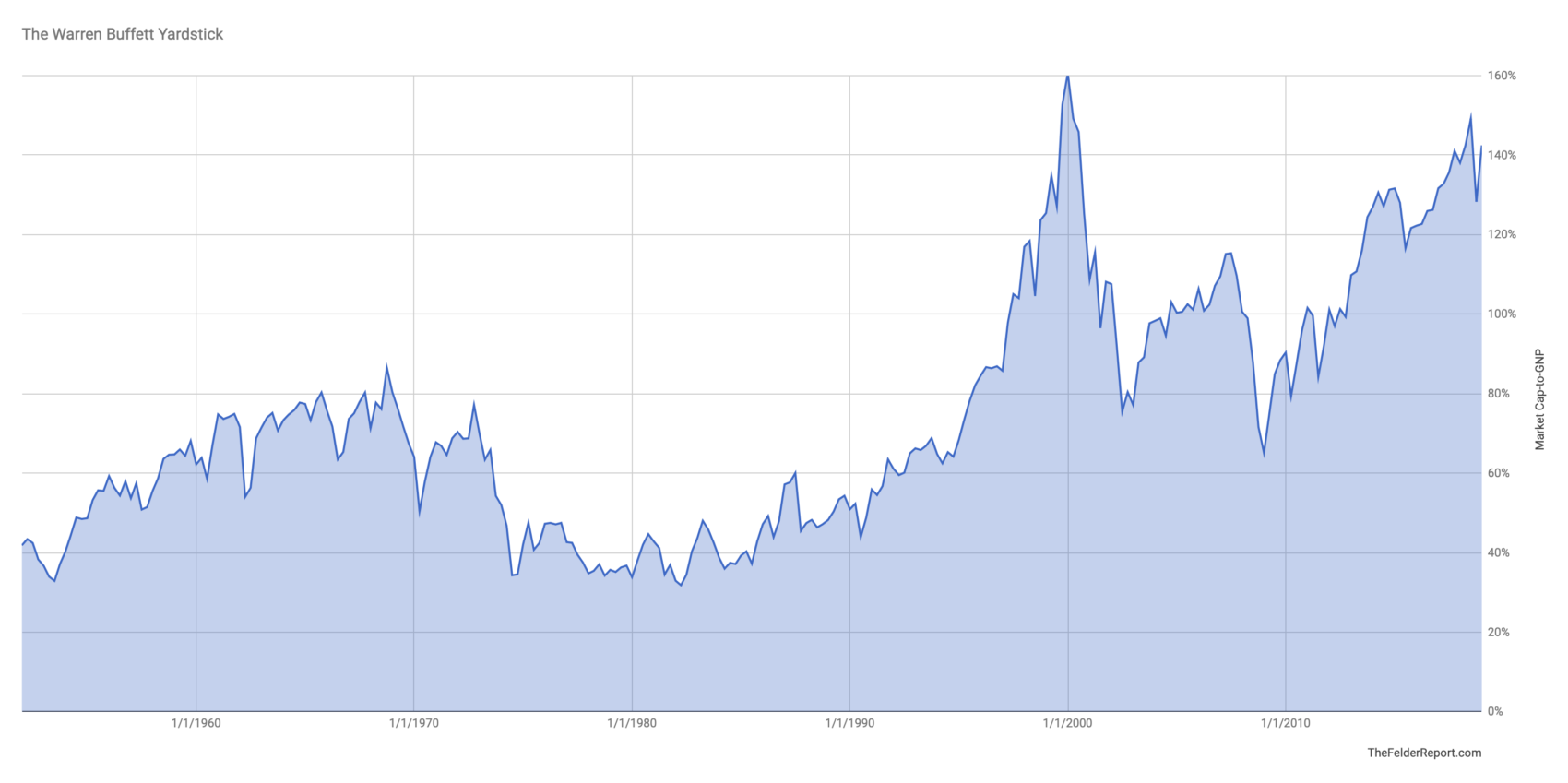

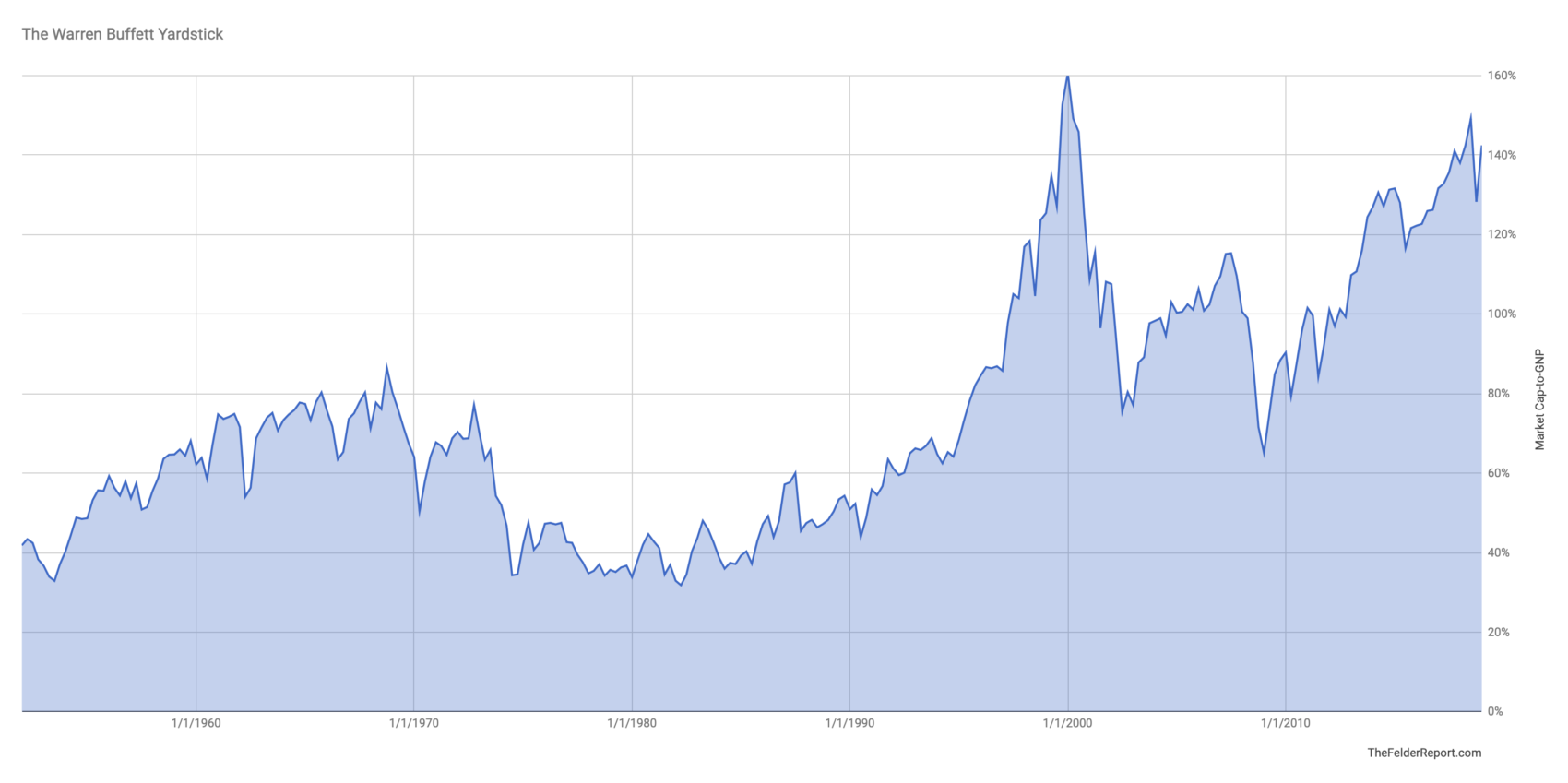

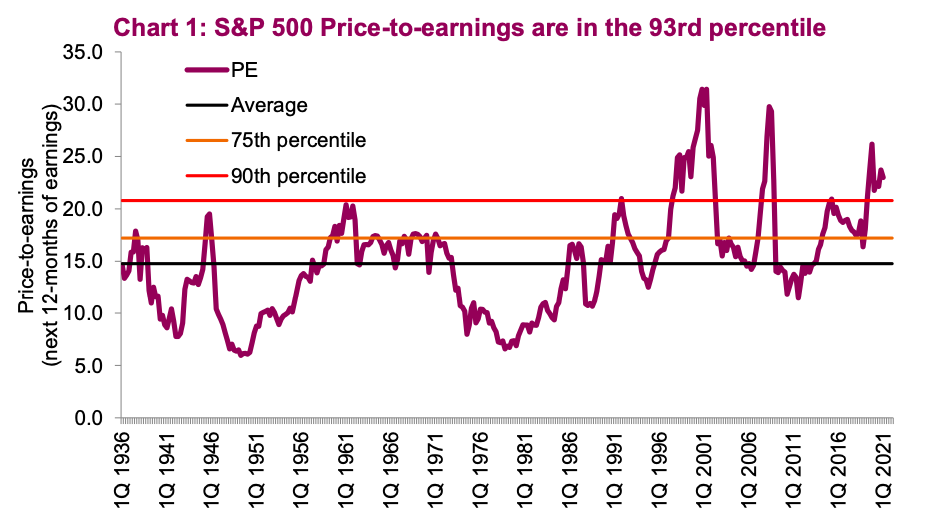

Valuation Metrics: BofA probably utilizes traditional valuation metrics like the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE), comparing current levels to historical averages and industry benchmarks. High ratios compared to historical norms would indicate overvaluation.

-

Supporting Data: The analysis may cite economic indicators such as inflation rates, interest rate forecasts, and corporate earnings growth to contextualize their valuation concerns. A mismatch between strong valuation metrics and slower-than-expected earnings growth could be a major concern.

-

Long-Term vs. Short-Term Perspective: BofA likely assesses whether these high valuations represent a temporary market anomaly or a longer-term trend. Their conclusions would significantly impact their recommendations for investors.

-

Overvalued Sectors: BofA might highlight specific sectors or industries that they believe are particularly overvalued, perhaps citing specific companies with inflated valuations relative to their earnings potential or future growth prospects. Technology stocks, frequently cited as overvalued in recent years, could be an example.

Counterarguments and Alternative Perspectives

While BofA's assessment carries weight, alternative perspectives exist on the subject of high stock market valuations.

-

Justified by Strong Earnings: Some argue that current high valuations are justified by strong corporate earnings growth, particularly in specific sectors. Robust profit margins and increasing revenue could support higher price-to-earnings ratios.

-

Low Interest Rate Environment: Historically low interest rates have made equities more attractive compared to fixed-income investments. This can inflate valuations as investors seek higher returns in a low-yield environment.

-

Alternative Investment Strategies: In a high-valuation environment, some investors may shift towards value investing, focusing on undervalued companies with strong fundamentals, or dividend investing, aiming for consistent income streams rather than capital appreciation.

-

Differing Analyst Opinions: It's important to note that not all financial institutions share BofA's concerns. Other analysts may interpret the data differently, potentially suggesting that current valuations are sustainable or even undervalued considering future growth prospects.

The Role of Interest Rates and Inflation

Interest rates and inflation significantly influence stock market valuations.

-

Rising Interest Rates and Stock Prices: Rising interest rates typically lead to decreased stock valuations. Higher borrowing costs reduce corporate profitability and make bonds a more attractive investment alternative, drawing funds away from the equity market.

-

Inflation's Impact: High inflation erodes purchasing power and can negatively impact corporate earnings. If inflation outpaces earnings growth, stock valuations can suffer.

-

BofA's Consideration of Macroeconomic Factors: BofA's analysis undoubtedly incorporates these macroeconomic factors, forecasting their potential impact on future earnings and, consequently, stock prices. Their outlook on inflation and interest rates is likely crucial to their overall valuation assessment.

Practical Implications for Investors

BofA's analysis and the broader discussion on high stock market valuations have several practical implications for investors.

-

Diversification Strategies: Investors concerned about high valuations should consider diversifying their portfolios across different asset classes, including bonds, real estate, and alternative investments, to reduce overall portfolio risk.

-

Risk Management Techniques: Implementing robust risk management techniques, such as stop-loss orders and position sizing, is crucial in mitigating potential losses in a potentially volatile market.

-

Asset Class Selection: Depending on their risk tolerance and investment horizon, investors may need to reassess their portfolio allocation and potentially shift towards more defensive asset classes if they believe a market correction is likely.

-

Long-Term Perspective: Maintaining a long-term investment perspective is vital, as short-term market fluctuations are normal. Investors with a longer time horizon can ride out market corrections and benefit from long-term growth.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's concerns regarding high stock market valuations highlight the need for cautious optimism in the current market environment. While counterarguments exist, understanding the potential risks associated with high valuations is crucial for informed investment decision-making. Remember, it's vital to consider your own individual risk tolerance and long-term financial goals when adjusting your investment strategy. Conduct thorough research, consult with a qualified financial advisor, and develop a well-informed investment strategy to effectively manage your portfolio in a high valuation environment. Understanding high stock market valuations is key to navigating the current market successfully.

Featured Posts

-

Investor Guide Understanding And Interpreting Stock Market Valuations Bof A

May 12, 2025

Investor Guide Understanding And Interpreting Stock Market Valuations Bof A

May 12, 2025 -

Shevchenko Open To Zhang Weili Fight Following Ufc 315

May 12, 2025

Shevchenko Open To Zhang Weili Fight Following Ufc 315

May 12, 2025 -

Shevchenkos New Dragon Inspired Ufc Gear A Closer Look

May 12, 2025

Shevchenkos New Dragon Inspired Ufc Gear A Closer Look

May 12, 2025 -

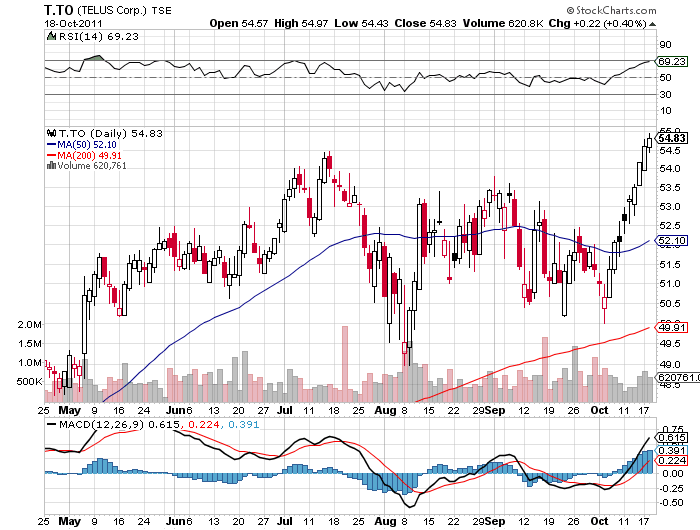

Telus Announces Q1 Earnings Growth And Dividend Boost

May 12, 2025

Telus Announces Q1 Earnings Growth And Dividend Boost

May 12, 2025 -

Chaplins Crucial Role In Securing Ipswich Town Victories

May 12, 2025

Chaplins Crucial Role In Securing Ipswich Town Victories

May 12, 2025

Latest Posts

-

School Holds Funeral For Slain 15 Year Old Student

May 13, 2025

School Holds Funeral For Slain 15 Year Old Student

May 13, 2025 -

Funeral Services For Teen Killed In School Stabbing

May 13, 2025

Funeral Services For Teen Killed In School Stabbing

May 13, 2025 -

Pl Retro On Sky Sports How To Find And Watch Premier League Classics In Hd

May 13, 2025

Pl Retro On Sky Sports How To Find And Watch Premier League Classics In Hd

May 13, 2025 -

15 Year Old School Stabbing Victim Laid To Rest

May 13, 2025

15 Year Old School Stabbing Victim Laid To Rest

May 13, 2025 -

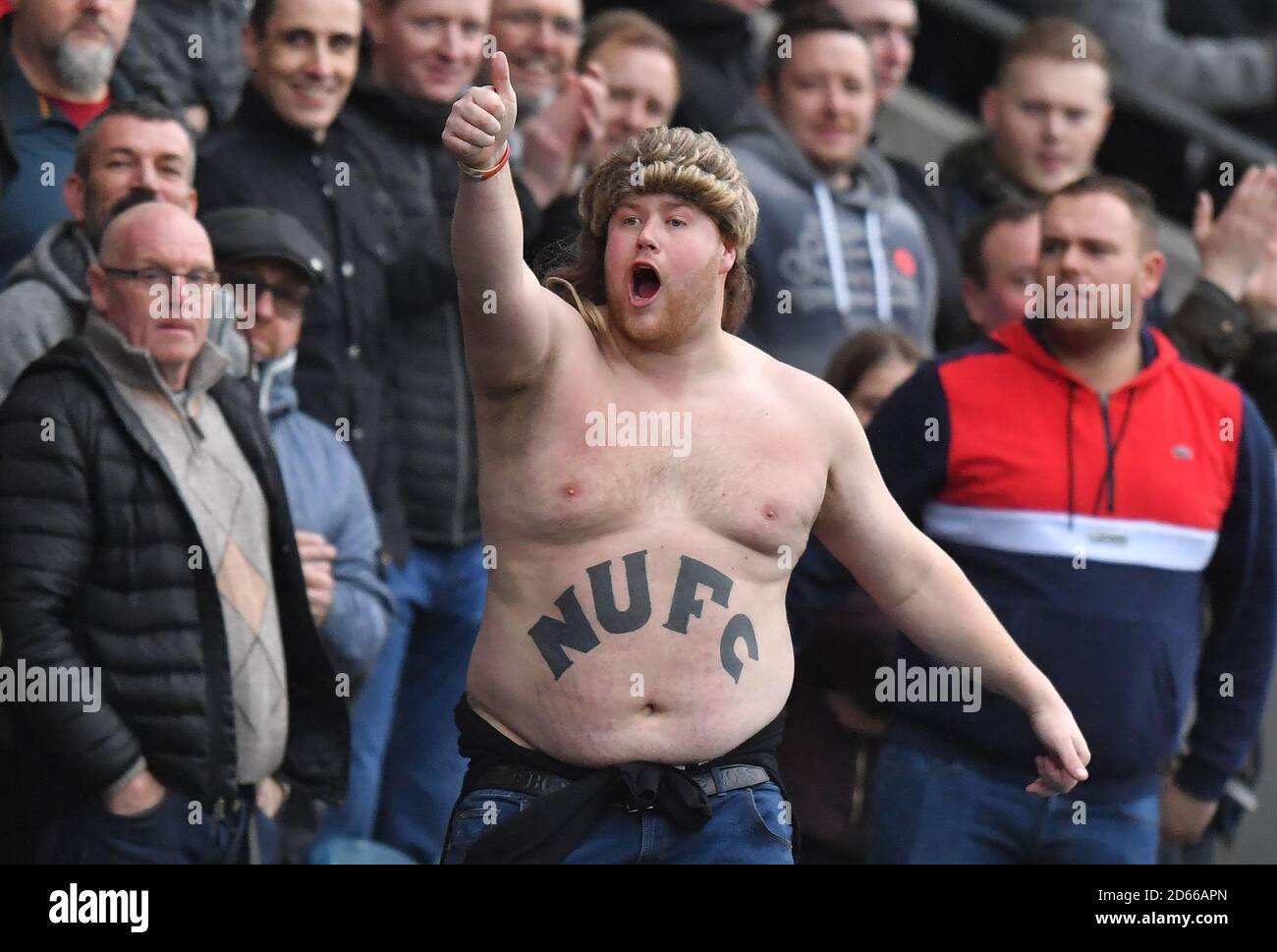

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025