Telus Announces Q1 Earnings Growth And Dividend Boost

Table of Contents

Q1 Earnings Growth Surpasses Expectations

Telus's Q1 2024 financial performance significantly surpassed analyst predictions, demonstrating strong year-over-year growth across key metrics. This impressive performance underscores the company's continued success in the competitive telecom industry.

-

Revenue Growth: Telus reported a [Insert Percentage]% increase in revenue compared to Q1 2023, reaching [Insert Revenue Figure]. This substantial growth reflects the company's success in attracting and retaining subscribers.

-

Earnings Per Share (EPS) Increase: The company announced an increase in earnings per share (EPS) to [Insert EPS Figure], a [Insert Percentage]% jump from the same period last year. This signifies improved profitability and enhanced value for shareholders.

-

Key Growth Drivers: Several factors contributed to this outstanding performance:

- Increased Subscriber Base: A significant increase in both wireless and wireline subscribers fueled revenue growth.

- Successful Product Launches: The launch of new and innovative services and bundles resonated well with consumers.

- Effective Cost Management: Strategic cost-cutting measures further enhanced profitability.

-

Exceeding Analyst Expectations: Telus's Q1 results exceeded the consensus forecast of analysts, indicating a more positive outlook than previously anticipated. This outperformance underlines the strength of Telus's business model and operational efficiency.

Significant Dividend Increase Announced

Complementing the strong Q1 earnings, Telus announced a significant increase in its dividend. This demonstrates the company's confidence in its future prospects and its commitment to rewarding its shareholders.

-

Dividend Percentage Increase: The dividend has been increased by [Insert Percentage]%, reflecting a commitment to delivering value to shareholders.

-

New Dividend Payout Rate: The new annualized dividend payout rate is [Insert Payout Rate], representing a substantial increase in shareholder returns.

-

Enhanced Shareholder Returns: This dividend increase significantly boosts shareholder returns and reinforces investor confidence in the company's long-term growth trajectory.

-

Competitive Dividend Yield: The new dividend yield compares favorably to other major players in the Canadian telecom industry, making Telus an attractive investment option.

-

Dividend Payment Schedule: The new dividend payment schedule is as follows: [Insert Dates and Amounts].

Future Outlook and Guidance

Telus provided positive guidance for the remainder of 2024, expressing confidence in its ability to maintain its strong financial performance.

-

2024 Outlook: The company anticipates continued growth driven by [mention key factors like 5G expansion, new service offerings, etc.].

-

Updated Financial Guidance: Telus issued updated financial guidance, projecting [Insert Key Projections, e.g., revenue growth, EPS targets].

-

Challenges and Opportunities: While the outlook is positive, Telus acknowledged potential challenges such as increased competition and ongoing economic uncertainties. However, the company believes its strong market position and strategic initiatives will mitigate these risks.

-

Impact of Market Trends: The ongoing rollout of 5G technology and increasing competition are key market trends that will continue to shape Telus's performance. The company is actively adapting to these trends through innovation and strategic investments.

Analyst Reactions and Market Response

The market reacted positively to Telus's Q1 earnings announcement.

-

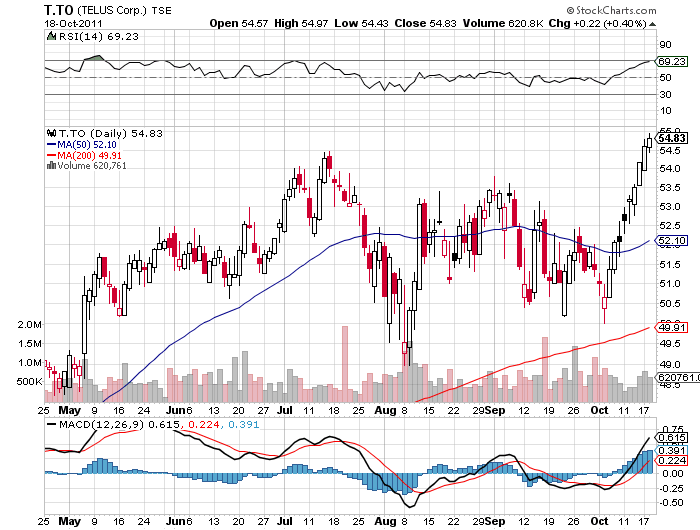

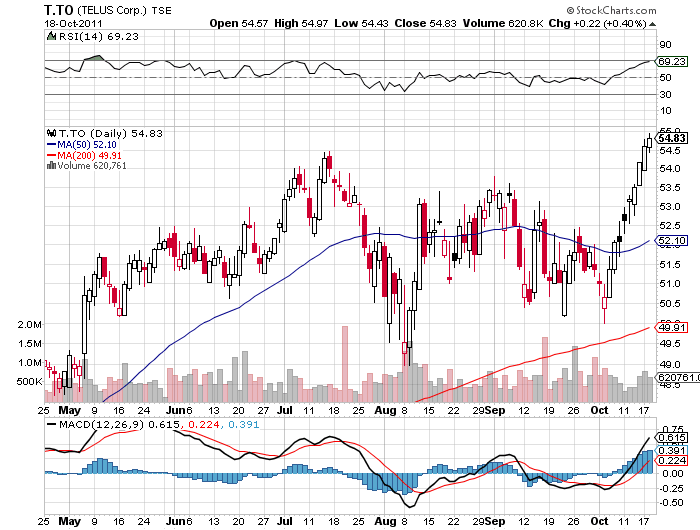

Stock Price Movement: Following the announcement, Telus's stock price experienced a [Insert Percentage]% increase, reflecting positive investor sentiment.

-

Analyst Quotes: [Insert quotes from analysts praising Telus’ performance and future prospects].

-

Investor Sentiment: Overall investor sentiment is overwhelmingly positive, with analysts upgrading their ratings and forecasts for the company.

Conclusion

Telus's Q1 2024 earnings announcement showcased strong financial performance, exceeding expectations with robust revenue growth and a significant increase in EPS. Coupled with a substantial dividend boost, the results highlight the company's commitment to shareholder returns and solidify its position as a leader in the Canadian telecom industry. The positive market reaction and analyst commentary further reinforce the strength of Telus's performance and future prospects. To learn more about Telus's Q1 earnings and dividend increase, visit their investor relations website. Stay informed on the latest developments in Telus's financial performance and its impact on the broader telecom industry. Consider Telus as a potential investment opportunity based on its strong Q1 performance and commitment to shareholder returns.

Featured Posts

-

I Tainia Jay Kelly Toy Netflix Ola Osa Prepei Na K Serete Gia Kloynei Santler And Ta Oskar

May 12, 2025

I Tainia Jay Kelly Toy Netflix Ola Osa Prepei Na K Serete Gia Kloynei Santler And Ta Oskar

May 12, 2025 -

2024 Houston Astros Foundation College Classic Schedule And Game Information

May 12, 2025

2024 Houston Astros Foundation College Classic Schedule And Game Information

May 12, 2025 -

Manfred Anticipates Massive Crowd At Bristol Motor Speedway

May 12, 2025

Manfred Anticipates Massive Crowd At Bristol Motor Speedway

May 12, 2025 -

L Autruche De Mask Singer 2025 Demasquage Et Speculations

May 12, 2025

L Autruche De Mask Singer 2025 Demasquage Et Speculations

May 12, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Problem Delays Mission

May 12, 2025

Blue Origin Rocket Launch Cancelled Subsystem Problem Delays Mission

May 12, 2025

Latest Posts

-

Persipura Butuh Kamu Dukungan Masyarakat Papua Sangat Penting

May 13, 2025

Persipura Butuh Kamu Dukungan Masyarakat Papua Sangat Penting

May 13, 2025 -

Leeds Vs Sheffield United Red Card Controversy Dominates Post Match Discussion

May 13, 2025

Leeds Vs Sheffield United Red Card Controversy Dominates Post Match Discussion

May 13, 2025 -

Prevazna Vaecsina Odmieta Prenajom Romovi Analyza Statistiky 74

May 13, 2025

Prevazna Vaecsina Odmieta Prenajom Romovi Analyza Statistiky 74

May 13, 2025 -

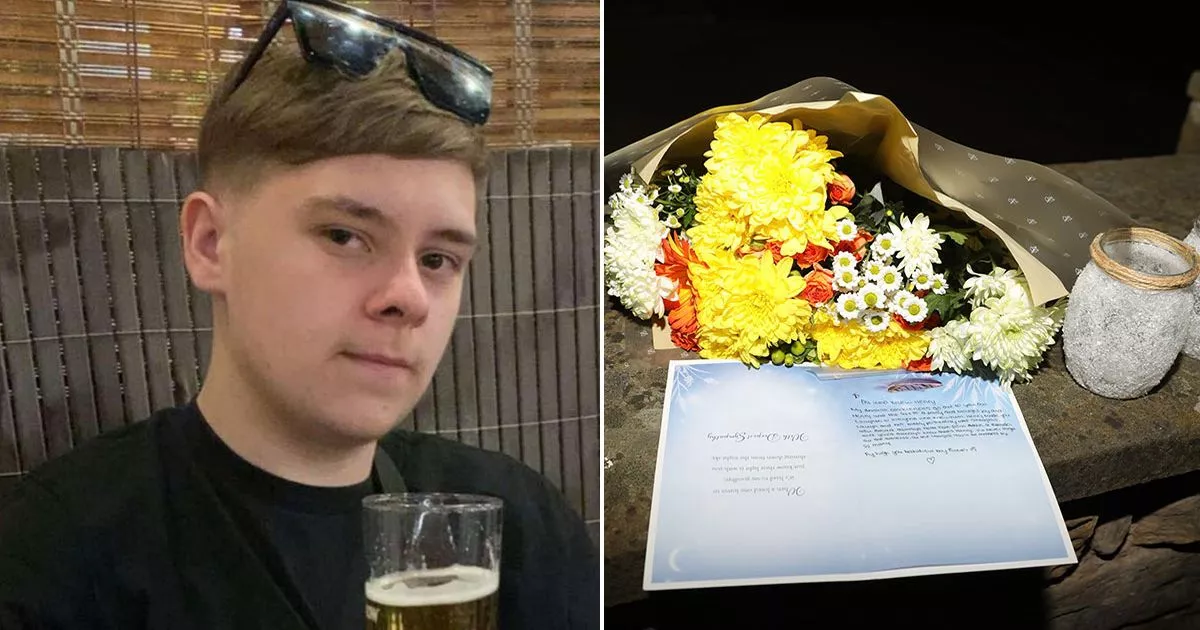

Remembering A Life Lost Funeral For 15 Year Old School Stabbing Victim

May 13, 2025

Remembering A Life Lost Funeral For 15 Year Old School Stabbing Victim

May 13, 2025 -

Did Sheffield United Dodge A Red Card Leeds Match Sparks Controversy

May 13, 2025

Did Sheffield United Dodge A Red Card Leeds Match Sparks Controversy

May 13, 2025