BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale: Why Stretched Valuations Aren't Necessarily a Cause for Alarm

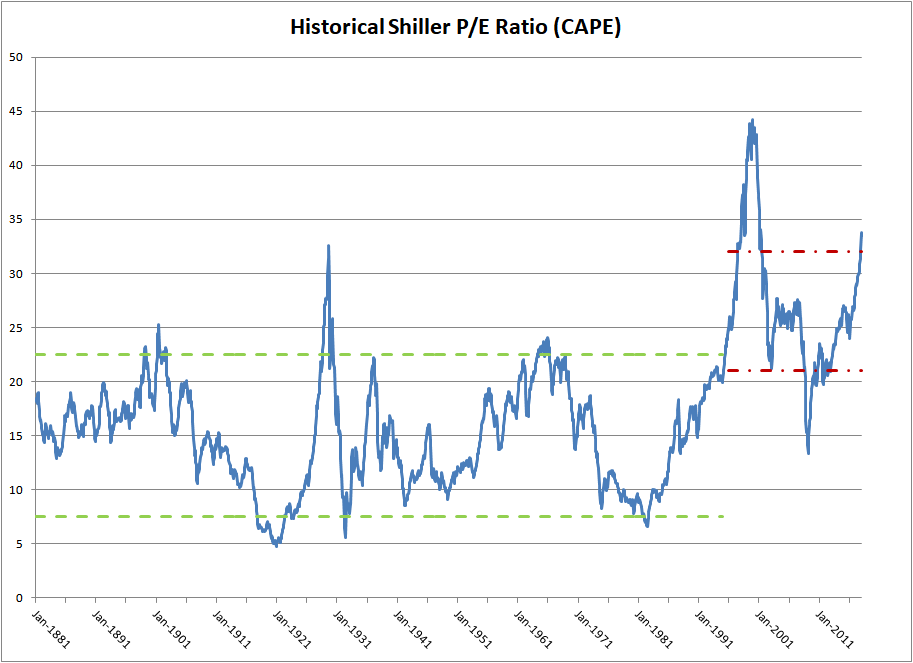

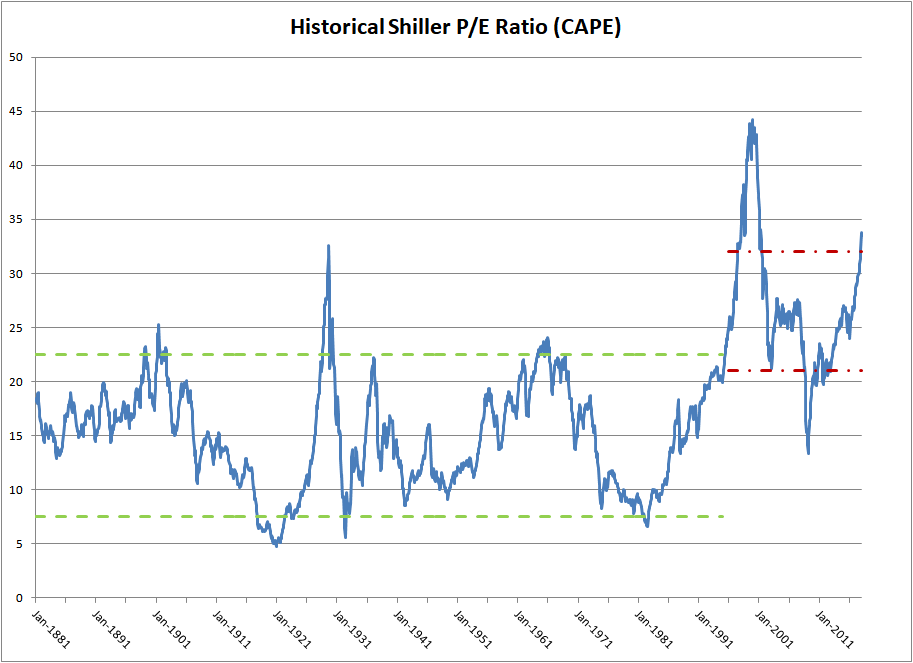

BofA's seemingly counterintuitive stance on stretched stock market valuations is rooted in a comprehensive analysis of various economic factors. Their assessment goes beyond simply looking at traditional valuation metrics like the Price-to-Earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE). Instead, they contextualize these metrics within the broader economic landscape, considering several key elements.

-

BofA's assessment of the current interest rate environment and its impact on valuations: BofA acknowledges that higher interest rates typically exert downward pressure on stock valuations. However, their analysis suggests that the current interest rate environment, while higher than in recent years, is still manageable and doesn't necessarily signal an impending market crash. They point to factors such as the resilience of the economy and the ability of companies to adapt to this higher-rate scenario.

-

Projected earnings growth and its role in justifying current valuations: BofA's optimistic outlook hinges significantly on their projections for future earnings growth. They believe that corporate earnings are likely to continue to grow, justifying, at least to some extent, the currently elevated valuations. This growth, they argue, will offset the impact of higher interest rates.

-

Analysis of inflation's influence on stock prices and future projections: Inflation is a double-edged sword. While it can erode purchasing power and increase input costs for companies, it can also stimulate economic activity and, potentially, higher earnings. BofA's analysis carefully weighs these competing factors to arrive at their outlook. Their projections suggest that inflation, while still present, is likely to moderate over time, mitigating its negative impact on stock valuations.

-

Discussion of other macroeconomic factors impacting BofA's view: Beyond interest rates, earnings growth, and inflation, BofA considers other macroeconomic factors in their assessment, such as consumer spending, employment data, and geopolitical events. A holistic view of these interwoven factors, they argue, provides a more nuanced and less alarmist perspective on current market valuations.

Counterarguments and Potential Risks: Addressing the Skeptics

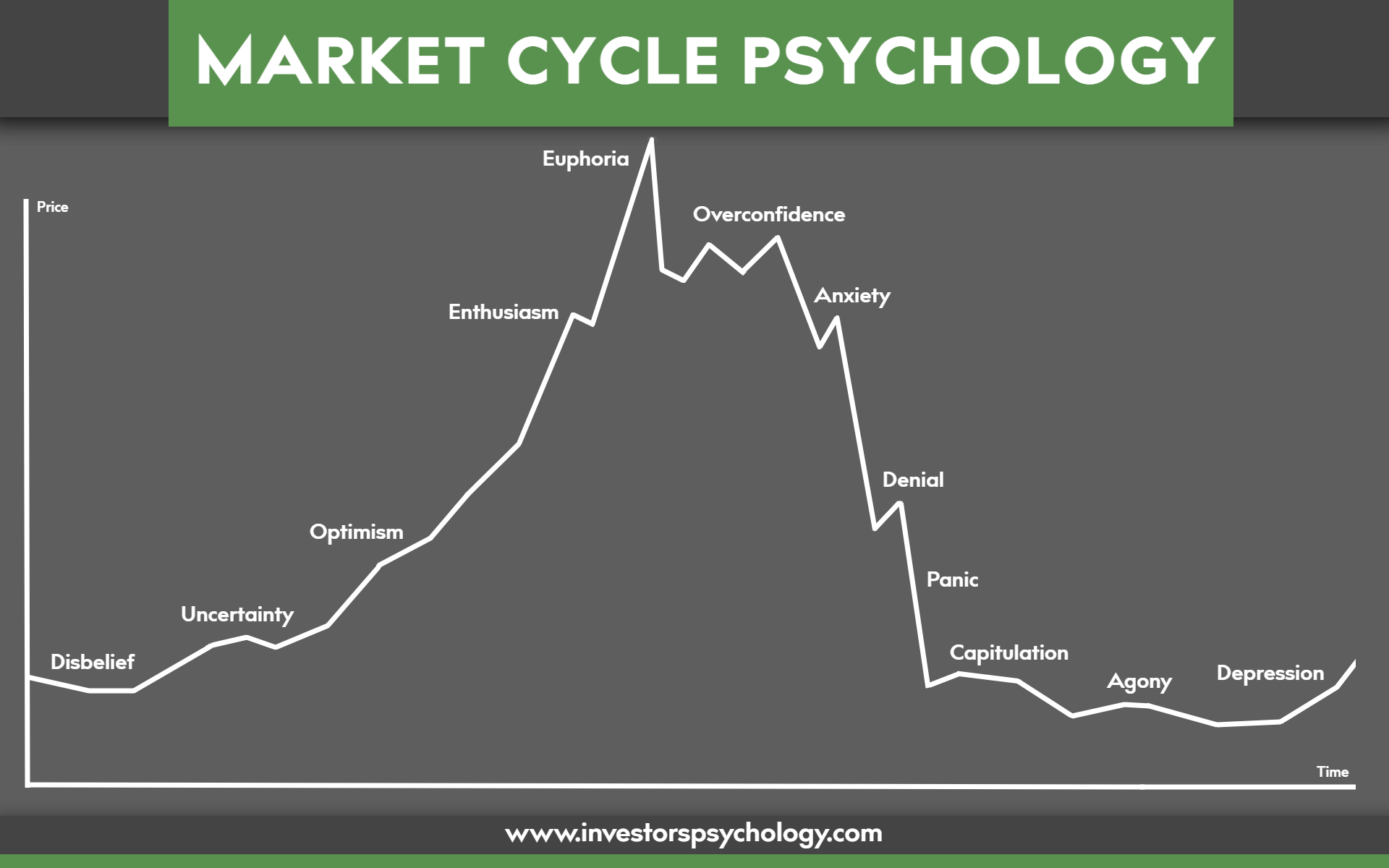

While BofA presents a compelling case, it's crucial to acknowledge potential counterarguments and risks. The market is complex, and even the most sophisticated analyses can't predict the future with certainty.

-

Analysis of potential downsides to current market valuations: Even with projected earnings growth, some argue that current valuations remain high relative to historical averages. This suggests that a correction, or even a more significant downturn, remains a possibility.

-

Discussion of historical precedents for market corrections following periods of high valuation: History offers numerous examples of market corrections following periods of extended high valuations. While past performance isn't necessarily indicative of future results, these historical precedents serve as a reminder that the risk of a downturn always exists.

-

Identification of key risk factors that could negatively impact the market: Several factors could negatively impact the market, including unexpected geopolitical events, a sharper-than-expected slowdown in economic growth, or a surge in inflation that proves difficult for central banks to control.

-

Exploration of potential diversification strategies to mitigate these risks: Diversification remains a cornerstone of sound investment strategy. Investors can mitigate the impact of potential market downturns by spreading their investments across different asset classes, sectors, and geographies.

Practical Investment Strategies Based on BofA's Outlook

BofA's assessment doesn't necessarily endorse a "buy-at-all-costs" approach. Instead, it suggests a more nuanced strategy tailored to individual risk tolerance and investment horizons.

-

Strategies for investors with a high-risk tolerance: Investors comfortable with higher risk might consider maintaining or even slightly increasing their equity exposure, focusing on companies with strong growth prospects.

-

Strategies for investors with a low-risk tolerance: More conservative investors may choose to maintain a more balanced portfolio, potentially shifting a greater portion of their assets into fixed-income securities.

-

Importance of diversification across different asset classes: Regardless of risk tolerance, diversification remains crucial. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk and reduce portfolio volatility.

-

Recommendations for long-term vs. short-term investment horizons: BofA's outlook seems more relevant to long-term investors. Short-term market fluctuations are less concerning for those with a longer time horizon to ride out potential market corrections.

Conclusion

While Bank of America's assessment suggests that stretched stock market valuations might not be an immediate cause for panic, it's crucial to remember that markets are inherently unpredictable. Their analysis highlights the importance of considering factors like interest rates, earnings growth, and inflation when evaluating market performance. Investors should carefully assess their own risk tolerance and develop a well-diversified investment strategy that aligns with their long-term financial goals. Remember to consult with a financial advisor before making any significant investment decisions.

Call to Action: Don't let concerns about stretched stock market valuations paralyze your investment decisions. Understand BofA's perspective and develop a well-informed investment strategy to navigate this evolving market. Learn more about managing your portfolio effectively in today's market environment. Consider seeking professional advice to create a personalized investment plan that aligns with your unique financial situation and risk tolerance.

Featured Posts

-

Analyzing Pope Francis Impact The Conclaves Verdict

Apr 22, 2025

Analyzing Pope Francis Impact The Conclaves Verdict

Apr 22, 2025 -

Stock Market Pain Investors Push Prices Higher Despite Risks

Apr 22, 2025

Stock Market Pain Investors Push Prices Higher Despite Risks

Apr 22, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 22, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 22, 2025 -

Trumps Economic Agenda Who Bears The Cost

Apr 22, 2025

Trumps Economic Agenda Who Bears The Cost

Apr 22, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 22, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 22, 2025