Stock Market Pain: Investors Push Prices Higher Despite Risks

Table of Contents

H2: Ignoring the Warning Signs: Why Investors are Pushing Prices Up Despite Risks

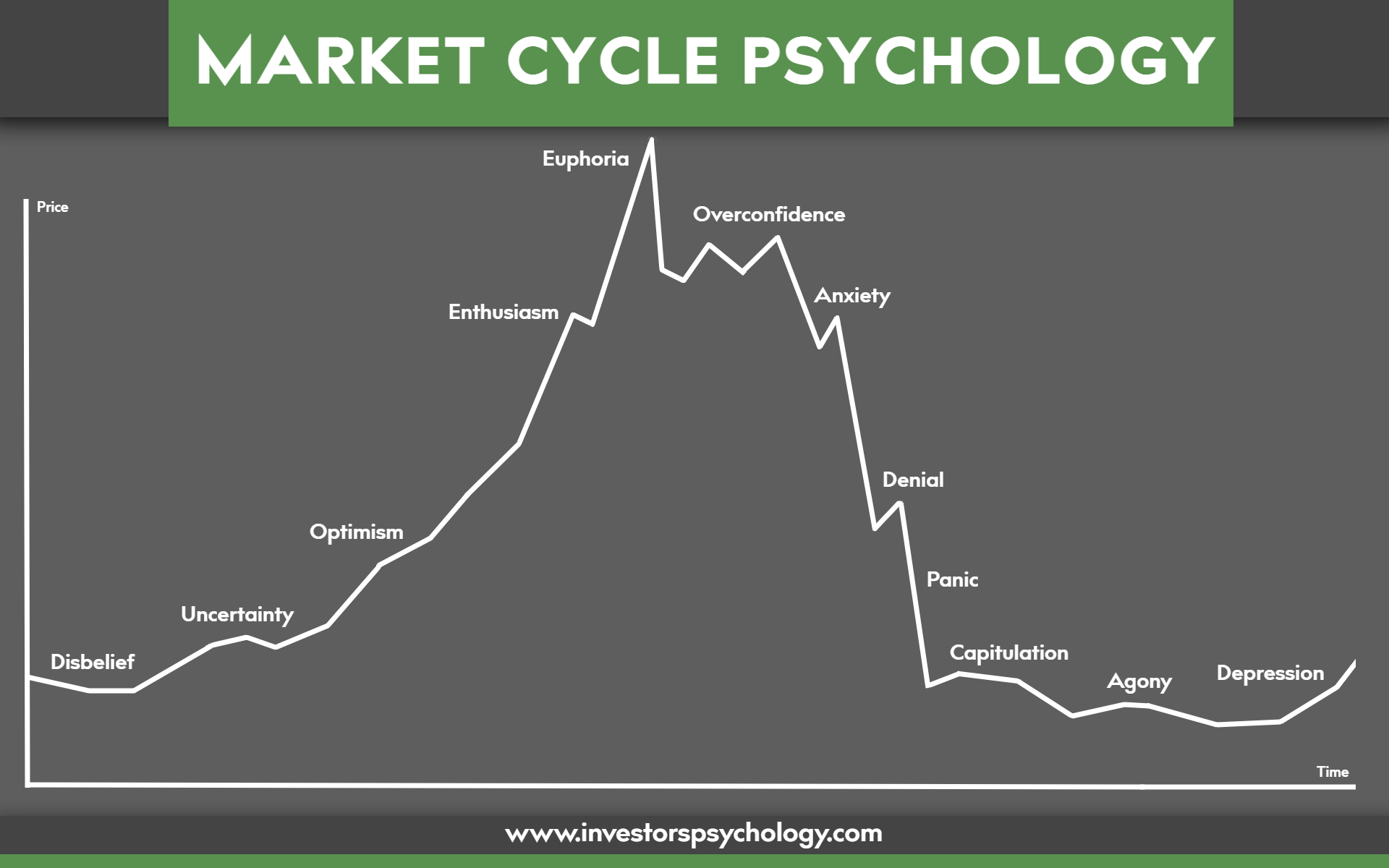

The current market surge is a perplexing phenomenon, driven by a potent cocktail of factors that seem to be overriding fundamental economic realities. The "Stock Market Pain" many investors feel stems from this disconnect between seemingly positive market performance and underlying economic weaknesses.

H3: The Role of Speculation and FOMO (Fear Of Missing Out):

Speculation and the fear of missing out (FOMO) are playing a significant role in driving irrational exuberance. The "get rich quick" mentality, fueled by social media and anecdotal success stories, is luring investors into speculative investing, often disregarding fundamental analysis.

- Meme stocks: The resurgence of meme stocks demonstrates the power of social media-driven speculation, where prices are driven by hype rather than fundamentals.

- Market rallies: Recent market rallies have often been short-lived and fueled by speculative trading, lacking the underlying support of strong economic indicators.

- Psychological factors: The psychology of fear and greed is influencing investor behavior, with FOMO overriding rational risk assessment. Investors are afraid to miss out on potential gains, even if it means ignoring significant risks.

H3: The Impact of Quantitative Easing and Government Intervention:

Years of quantitative easing (QE) and government stimulus packages have injected massive liquidity into the financial system, artificially inflating asset prices. While intended to stimulate economic growth, these policies have also created a market environment where valuations may be detached from reality.

- Quantitative easing: The expansion of the money supply through QE has increased liquidity, making it easier for investors to borrow money and invest in the stock market.

- Government stimulus: Government stimulus packages, while intended to support the economy, have also contributed to increased market liquidity and potential inflation.

- Market sentiment: This injection of liquidity has had a significant impact on market sentiment, creating a false sense of security and encouraging risk-taking.

H3: Short-Term Gains vs. Long-Term Risks:

The focus on short-term gains is masking significant long-term risks. While prices may be rising now, ignoring fundamental analysis and economic realities could lead to a painful market correction in the future.

- Market correction: The potential for a significant market correction remains high, given the current economic climate and inflated valuations.

- Inflation impact: High inflation erodes corporate earnings, potentially leading to lower stock prices in the long run.

- Fundamental analysis: Ignoring fundamental analysis and focusing solely on short-term gains increases the risk of significant financial losses.

H2: Analyzing the Current Market Conditions: A Look at Key Indicators

Understanding the current market conditions requires analyzing key economic indicators and their potential impact on stock prices. The current "Stock Market Pain" is exacerbated by these interconnected challenges.

H3: Inflation and Interest Rates:

Inflation remains stubbornly high, forcing central banks to continue raising interest rates. This increases borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profitability.

- Current inflation figures: High inflation figures continue to exert pressure on the market, dampening consumer spending and increasing uncertainty.

- Interest rate hikes: Further interest rate hikes are expected, further impacting borrowing costs and potentially slowing economic growth.

- Impact on borrowing costs: Increased borrowing costs for businesses and consumers can lead to reduced investment and spending, slowing economic activity.

H3: Corporate Earnings and Profitability:

While some companies are reporting strong earnings, others are struggling with rising costs and slowing demand. Analyzing corporate earnings and profitability is crucial for assessing the health of the market.

- Corporate earnings reports: A careful analysis of recent corporate earnings reports reveals a mixed picture, with some companies thriving and others facing headwinds.

- Earnings forecasts: Future earnings forecasts are uncertain, reflecting the ongoing economic challenges and market volatility.

- Earnings revisions: The potential for earnings revisions, both positive and negative, highlights the uncertainty surrounding corporate profitability.

H3: Geopolitical Factors and Uncertainty:

Geopolitical events and uncertainty contribute to market volatility and risk. Global events can significantly impact investor sentiment and market performance.

- Geopolitical events: Ongoing geopolitical tensions and conflicts create uncertainty and can trigger market swings.

- Market uncertainty: This uncertainty makes it difficult to predict market movements and increases the risk of investment losses.

- Risk factors: Geopolitical risks represent a significant challenge for investors trying to navigate the current market environment.

H2: Navigating the Stock Market Pain: Strategies for Investors

Despite the challenges, investors can mitigate the "Stock Market Pain" by adopting prudent strategies.

H3: Diversification and Risk Management:

Diversification and effective risk management are crucial for protecting your portfolio during volatile market conditions.

- Asset classes: Diversifying across different asset classes reduces the overall risk of your portfolio.

- Portfolio diversification: A well-diversified portfolio is less susceptible to significant losses in any one asset class.

- Risk tolerance assessment: Understanding your own risk tolerance is critical for making informed investment decisions.

- Hedging strategies: Employing hedging strategies can help to mitigate potential losses.

H3: Fundamental Analysis and Due Diligence:

Thorough research and fundamental analysis are more important than ever. Don't let speculation dictate your investment decisions.

- Financial statement analysis: Analyzing financial statements provides a deeper understanding of a company's financial health.

- Company management evaluation: Evaluating the competence and integrity of company management is crucial for long-term investment success.

- Industry trends: Understanding industry trends helps to identify companies with growth potential.

3. Conclusion:

The current market situation presents a significant challenge for investors. The "Stock Market Pain" experienced by many stems from the paradox of rising prices despite significant economic risks. Speculation, government intervention, and a focus on short-term gains are contributing factors. However, by focusing on diversification, risk management, and thorough fundamental analysis, investors can navigate these turbulent waters and make informed decisions. Remember to conduct your own research, understand the inherent risks, and never invest more than you can afford to lose. The "Stock Market Pain" can be lessened by making informed, well-researched decisions. Continue your education on investing strategies for volatile markets to mitigate future "Stock Market Pain."

Featured Posts

-

The Future Of Nordic Defense Collaboration Between Sweden And Finlands Armed Forces

Apr 22, 2025

The Future Of Nordic Defense Collaboration Between Sweden And Finlands Armed Forces

Apr 22, 2025 -

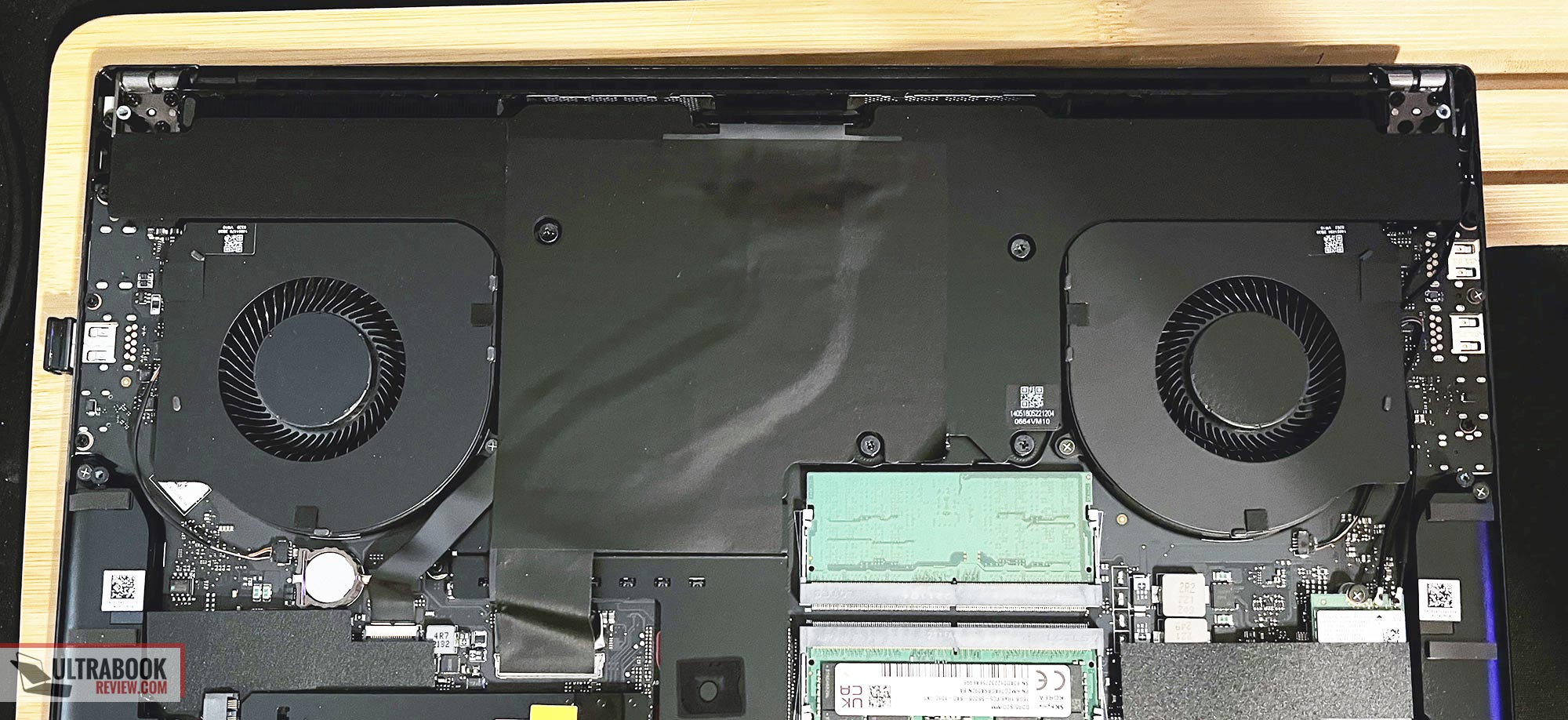

Review Razer Blade 16 2025 Ultra Portable Power At A Premium

Apr 22, 2025

Review Razer Blade 16 2025 Ultra Portable Power At A Premium

Apr 22, 2025 -

The Next Pope How Francis Legacy Will Shape The Conclave

Apr 22, 2025

The Next Pope How Francis Legacy Will Shape The Conclave

Apr 22, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Gambling Trends

Apr 22, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Gambling Trends

Apr 22, 2025 -

A Timeline Of Karen Reads Murder Cases

Apr 22, 2025

A Timeline Of Karen Reads Murder Cases

Apr 22, 2025