Trump's Economic Agenda: Who Bears The Cost?

Table of Contents

Tax Cuts and Their Impact

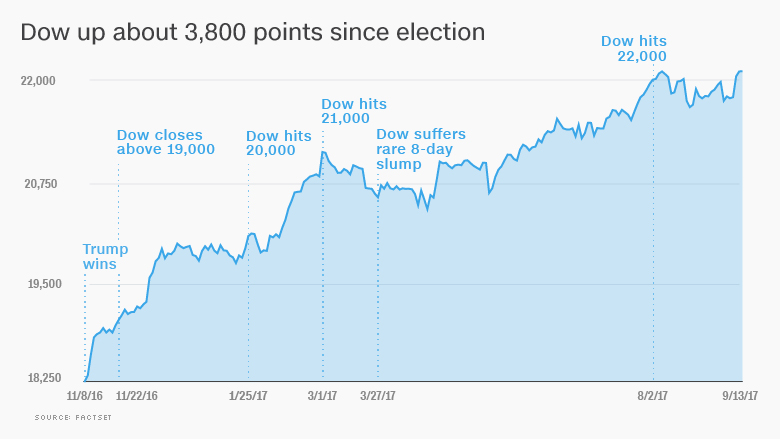

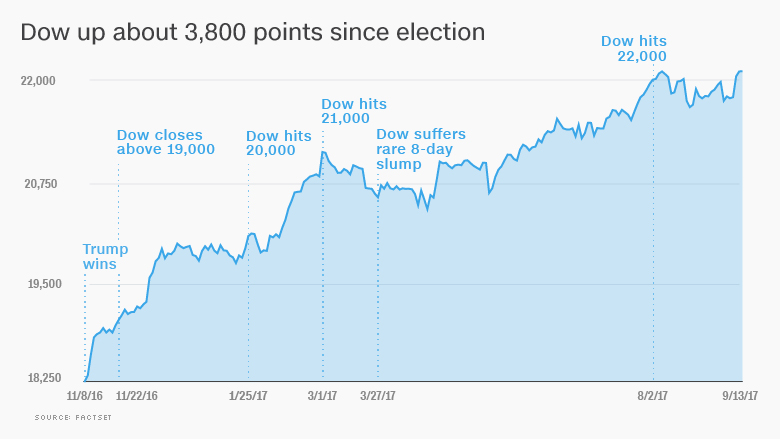

Trump's signature 2017 tax cuts, a cornerstone of his economic agenda, significantly lowered corporate and individual income tax rates.

Beneficiaries of the Tax Cuts:

- High-income earners and corporations: The tax cuts disproportionately benefited the wealthiest Americans and large corporations. Analysis from the Tax Policy Center showed that the top 1% of earners received the largest share of the tax cuts' benefits.

- Data illustrating the disproportionate benefit to the wealthy: Studies consistently demonstrated that the tax cuts led to a further concentration of wealth at the top, exacerbating existing income inequality. This widened the gap between the rich and the poor, a trend that continued throughout his presidency.

- Examples of specific tax cuts and their impact: The reduction in the corporate tax rate from 35% to 21% was a major component, leading to increased corporate profits but not necessarily translating into higher wages for workers.

Who Paid the Price?

- Potential increase in the national debt: The tax cuts contributed significantly to the increase in the national debt, raising concerns about long-term economic sustainability. The reduced tax revenue made it harder to fund government programs and invest in infrastructure.

- Impact on future government spending (e.g., social programs): Critics argued that the tax cuts forced cuts to crucial social programs, impacting essential services for vulnerable populations. Reduced government funding could also limit investment in education and infrastructure.

- Arguments for and against the tax cuts' long-term economic sustainability: Proponents argued the tax cuts stimulated economic growth, leading to higher tax revenue in the long run. However, critics countered that the benefits were short-lived and unsustainable, ultimately leading to a larger national debt.

- Mention any increased deficits resulting from the tax cuts: The national debt increased substantially during the Trump administration, partially due to the reduced tax revenue from the tax cuts.

Trade Policies and Their Consequences

Trump's "America First" approach involved implementing significant tariffs on imported goods, triggering a series of trade wars.

Tariffs and Their Effect on Consumers:

- Increased prices for imported goods: Tariffs led to higher prices for consumers on a range of goods, impacting household budgets and reducing purchasing power.

- Impact on specific industries and consumers: Certain industries, like agriculture, experienced significant negative impacts due to retaliatory tariffs from other countries. Consumers faced higher costs for everyday products.

- Examples of specific tariffs implemented and their economic consequences: The tariffs imposed on steel and aluminum, for example, led to higher costs for manufacturers and ultimately, consumers.

Winners and Losers in the Trade War:

- Farmers impacted by retaliatory tariffs: American farmers suffered significant losses due to retaliatory tariffs imposed by China and other countries.

- Businesses that benefited from protectionist measures: Some domestic industries benefited from increased protection against foreign competition, but this often came at the expense of consumers and other sectors of the economy.

- Discussion on the overall economic impact of trade wars initiated by the Trump administration: The overall economic impact of the trade wars remains a subject of debate, with studies offering conflicting conclusions about the net effect on economic growth.

Deregulation and its Economic Ramifications

The Trump administration pursued a significant deregulation agenda, impacting various sectors of the economy.

Environmental Deregulation and its Costs:

- Potential environmental damage and its economic consequences: Rolling back environmental regulations resulted in increased pollution and potential long-term environmental damage, with associated economic costs.

- Examples of specific deregulation measures and their environmental and economic impacts: Weakening fuel efficiency standards and environmental protection regulations led to increased emissions and potential health problems.

- Long-term costs associated with environmental damage: The long-term economic costs of environmental damage, such as increased healthcare expenses and damage to natural resources, could be substantial.

Financial Deregulation and its Risks:

- Increased financial instability and potential for economic crises: Easing financial regulations increased the risk of future financial crises and instability.

- Examples of financial deregulation policies: Certain measures aimed at loosening regulations on banks and financial institutions were criticized for increasing systemic risk.

- Discussion of the potential long-term consequences of deregulation: The long-term consequences of financial deregulation remain a significant area of concern, with the potential for unforeseen economic shocks.

Impact on Different Demographics

Trump's economic agenda had varied effects across different demographic groups.

The Working Class:

The impact on the working class was mixed. While job growth occurred in certain sectors, wage growth stagnated for many, and access to affordable healthcare remained a challenge. Statistics on employment rates and wage growth during this period provide a mixed picture.

Minorities:

The impact of Trump's policies on minority communities, concerning employment, housing, and access to resources, requires further nuanced analysis and research to draw definitive conclusions. Data on disparities in income and opportunity should be carefully examined.

Rural Communities:

Trump's trade policies and other economic measures significantly impacted rural communities and agriculture, leading to economic hardship in some areas. Support programs for farmers became essential during this period.

Conclusion

In conclusion, while Trump's economic agenda aimed to boost economic growth, the benefits were not evenly distributed. High-income earners and corporations reaped significant rewards from tax cuts, while the costs of trade wars and deregulation fell disproportionately on certain segments of the population, including the working class, minorities, and rural communities. Understanding the true costs of Trump's economic agenda is crucial for informed policy discussions. Continue your research on Trump's economic policies to form your own conclusions. Further research into the long-term impacts of these policies is necessary for a comprehensive understanding.

Featured Posts

-

Live Stock Market Updates Dollar Slides Amidst Trade Tensions

Apr 22, 2025

Live Stock Market Updates Dollar Slides Amidst Trade Tensions

Apr 22, 2025 -

Podcast Production Made Easy Ai Digest For Repetitive Documents

Apr 22, 2025

Podcast Production Made Easy Ai Digest For Repetitive Documents

Apr 22, 2025 -

Fractured Ties Analyzing The Breakdown In U S China Relations And The Risk Of Cold War

Apr 22, 2025

Fractured Ties Analyzing The Breakdown In U S China Relations And The Risk Of Cold War

Apr 22, 2025 -

Secret Service Closes White House Cocaine Investigation

Apr 22, 2025

Secret Service Closes White House Cocaine Investigation

Apr 22, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 22, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 22, 2025