BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Problem

Table of Contents

BofA's Bullish Outlook: Understanding their Positive Market Assessment

Bank of America maintains a generally bullish outlook on the stock market, despite recent volatility. This positive assessment is rooted in their analysis of several key economic indicators and their predictions for future growth.

-

Specific Reports and Statements: BofA has released several research reports and public statements reiterating their positive market sentiment. These often include detailed economic forecasts and sector-specific analyses. Look for these reports on their official website and through reputable financial news sources.

-

Key Economic Indicators: BofA cites strong corporate earnings, resilient consumer spending, and a generally healthy global economic environment as key factors supporting their positive outlook. These indicators suggest continued growth and profitability for many companies, justifying – in their view – current valuations.

-

Promising Sectors: BofA often highlights specific sectors poised for growth, such as technology, healthcare, and certain consumer staples. Their analysis identifies opportunities within these sectors that could drive future market performance.

The methodology behind BofA's analysis involves sophisticated valuation models, considering factors beyond simple price-to-earnings ratios. They utilize a multifaceted approach, incorporating macroeconomic forecasts, industry-specific trends, and detailed company analysis.

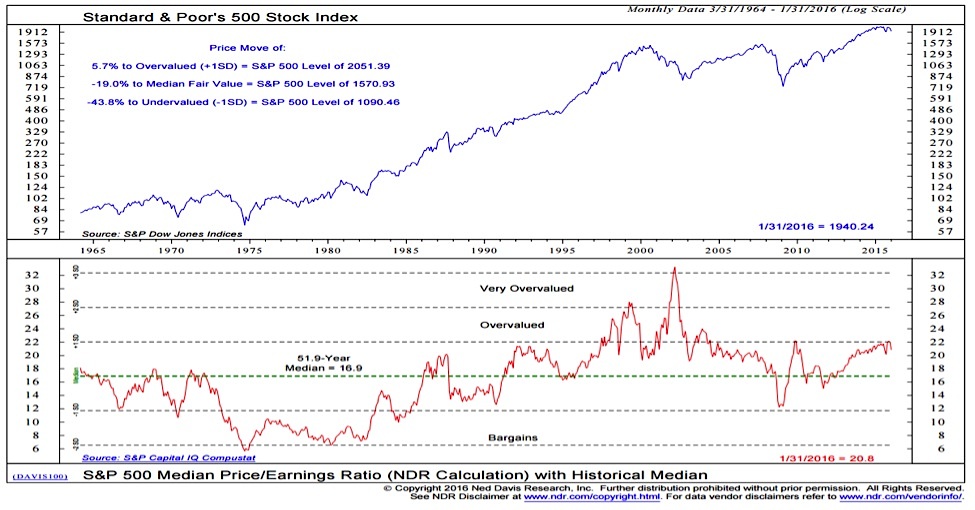

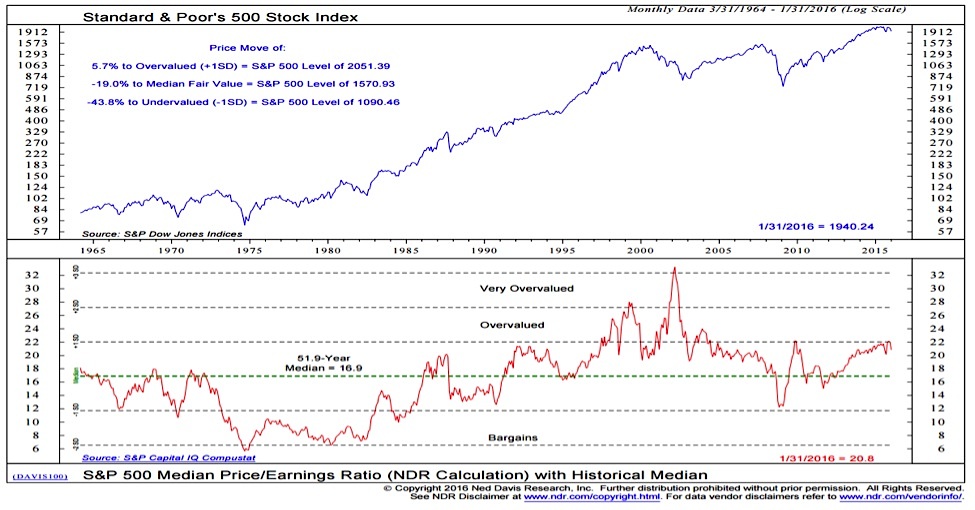

Addressing Concerns About High Price-to-Earnings Ratios (P/E): Why They Might Not Be Overvalued

Many investors are concerned about high price-to-earnings (P/E) ratios, a common metric used to assess whether a stock is overvalued. A high P/E ratio suggests investors are paying a premium for each dollar of a company's earnings.

-

BofA's Response to High P/E Concerns: BofA acknowledges the elevated P/E ratios but argues that several factors mitigate concerns. Low interest rates, for instance, can support higher valuations as investors seek higher returns in the equity market. Furthermore, BofA projects robust future earnings growth for many companies, suggesting that current P/E ratios may normalize over time.

-

Alternative Valuation Metrics: BofA doesn't rely solely on P/E ratios. They utilize a range of alternative valuation metrics, such as price-to-sales ratios, free cash flow multiples, and discounted cash flow models, to create a more comprehensive picture.

-

Justifying High Valuations: BofA points to specific companies and sectors that justify their high valuations based on strong growth prospects, disruptive technologies, or unique competitive advantages. They often provide detailed analysis to support these assessments.

It's crucial to remember that P/E ratios alone are insufficient to assess a stock's value. Context and a thorough understanding of the company's fundamentals are crucial.

The Role of Interest Rates and Monetary Policy in Shaping Market Valuations

Interest rates and monetary policy significantly impact stock market valuations. Lower interest rates generally stimulate investment by reducing borrowing costs and making equities more attractive relative to bonds.

-

BofA's Interest Rate Predictions: BofA’s predictions regarding future interest rate movements are a critical component of their market analysis. Their forecasts influence their assessment of how current valuations might evolve.

-

Influence on Valuations: BofA’s predictions for interest rates directly influence their view on stock valuations. For example, expectations of lower rates might support higher valuations, while predictions of rising rates could exert downward pressure.

-

Inflation and Monetary Policy: BofA’s analysis carefully considers inflation and the central bank's monetary policy response. These factors significantly impact interest rate expectations and overall market sentiment.

However, it's important to recognize that changes in interest rates can introduce market volatility and present risks for investors. Unforeseen shifts in monetary policy can impact valuations and overall market performance.

Navigating Market Volatility: BofA's Advice for Investors

BofA advises investors to maintain a long-term perspective and focus on diversification to manage risks associated with market volatility.

-

Recommended Strategies: BofA generally recommends strategies like diversification across asset classes (stocks, bonds, real estate), regular rebalancing, and long-term investing horizons.

-

Sector Recommendations: While specific recommendations may vary over time, BofA often suggests focusing on sectors with strong growth prospects based on their economic forecasts.

-

Importance of a Defined Strategy: A well-defined investment strategy, aligned with one's risk tolerance and financial goals, is essential to navigating market fluctuations effectively.

Conclusion

BofA's analysis suggests that current stock market valuations, while potentially high in certain areas, are not necessarily cause for alarm. Their positive outlook is supported by strong corporate earnings, resilient consumer spending, and predictions of manageable interest rate increases. The firm's assessment considers a broader range of valuation metrics beyond simple P/E ratios and incorporates their predictions for future economic growth. Remember, maintaining a long-term perspective, diversifying your portfolio, and considering your risk tolerance are key to navigating market uncertainty. Don't let concerns about stock market valuations prevent you from taking a considered approach to investing. Learn more about BofA's market analysis and investment strategies to make informed decisions about your portfolio.

Featured Posts

-

Red Wings Playoff Hopes Fade After Vegas Loss

May 10, 2025

Red Wings Playoff Hopes Fade After Vegas Loss

May 10, 2025 -

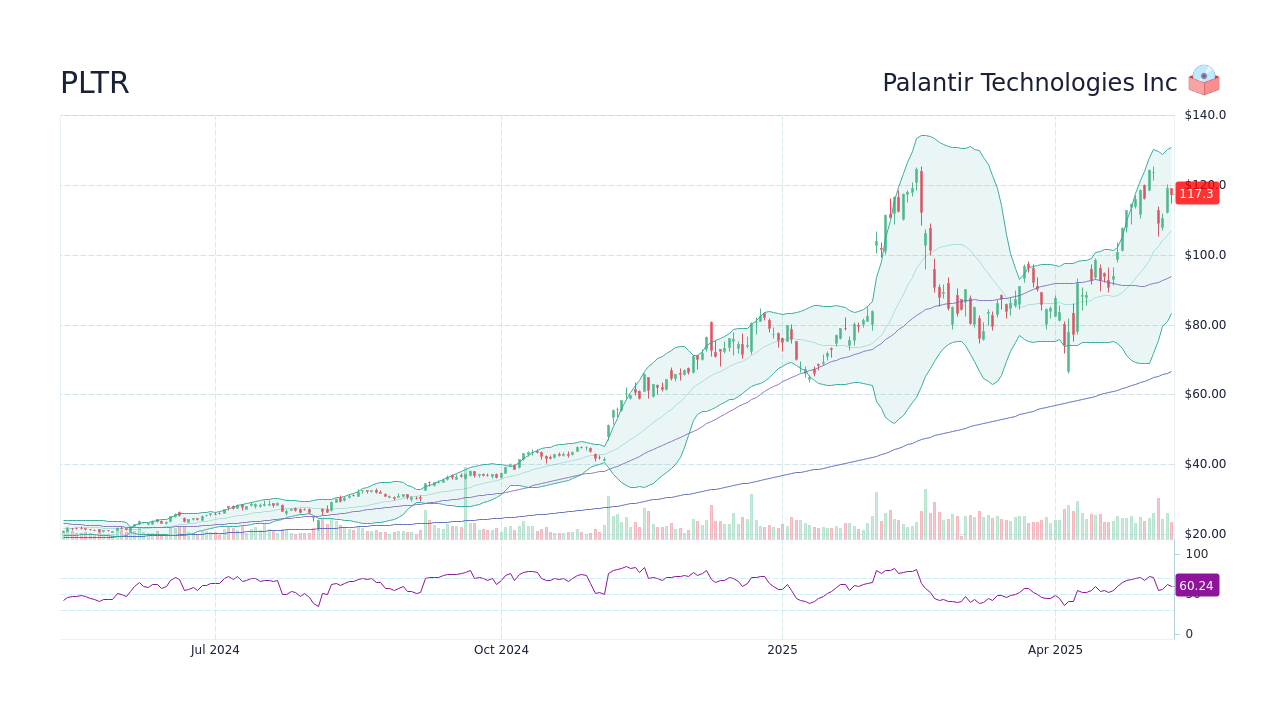

Palantir Stock Prediction 2 Superior Investments For The Next 3 Years

May 10, 2025

Palantir Stock Prediction 2 Superior Investments For The Next 3 Years

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Policies

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Policies

May 10, 2025 -

Understanding Petrol Prices In Nigeria The Dangote Nnpc Dynamic

May 10, 2025

Understanding Petrol Prices In Nigeria The Dangote Nnpc Dynamic

May 10, 2025 -

Makron I Tusk Novoe Soglashenie Mezhdu Frantsiey I Polshey

May 10, 2025

Makron I Tusk Novoe Soglashenie Mezhdu Frantsiey I Polshey

May 10, 2025