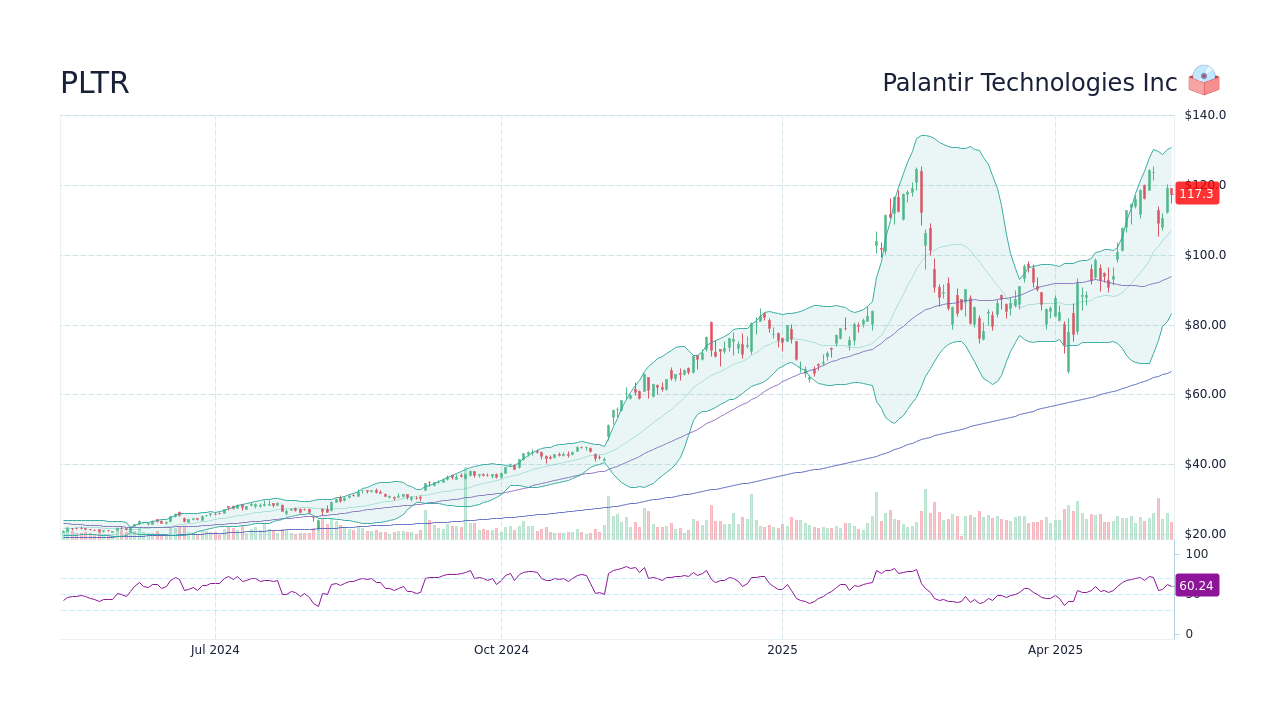

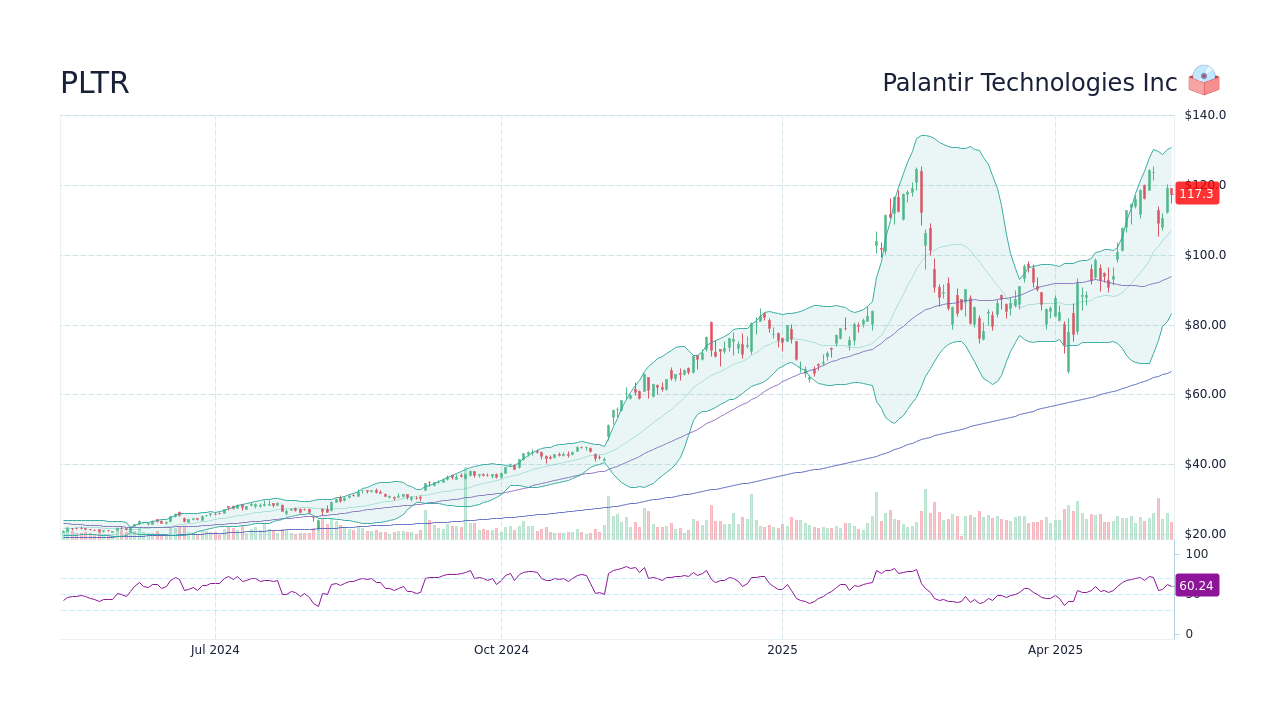

Palantir Stock Prediction: 2 Superior Investments For The Next 3 Years

Table of Contents

Understanding the Palantir Investment Landscape

Palantir's Strengths and Weaknesses

Palantir Technologies (PLTR) has carved a niche for itself in the big data analytics market with its innovative platforms, Palantir Gotham for government clients and Palantir Foundry for commercial enterprises. Its strengths include:

- Cutting-edge technology: Palantir utilizes advanced artificial intelligence and data analytics to provide powerful insights to its clients.

- Strong government contracts: A significant portion of Palantir's revenue comes from lucrative government contracts, providing a stable revenue stream.

- Growing commercial sector: Palantir is actively expanding its presence in the commercial sector, targeting large enterprises with its Foundry platform.

However, Palantir also faces challenges:

- High valuation: PLTR stock currently trades at a high valuation, making it susceptible to market corrections.

- Competition: The data analytics market is highly competitive, with established tech giants like Microsoft and Google posing significant challenges.

- Dependence on government contracts: While stable, reliance on government contracts can limit growth and expose the company to changes in government spending.

Risks Associated with Direct Palantir Investment

Direct investment in PLTR stock carries substantial risks:

- High PLTR stock price volatility: Growth stocks like Palantir are often subject to significant market swings, leading to substantial price fluctuations.

- Market volatility impact: Overall market conditions heavily influence the PLTR stock price, creating uncertainty for investors.

- Dependence on large contracts: The loss of key contracts could negatively impact Palantir's financial performance.

- Significant investment risk: The high valuation and competitive landscape present considerable investment risk. Predicting the future PLTR stock price with accuracy is extremely difficult, making it a high-risk proposition for many.

Superior Investment Alternative 1: Diversified Tech ETF

Benefits of a Tech ETF

Instead of betting on a single stock, consider diversifying your investment with a technology exchange-traded fund (ETF). This offers several key benefits:

- Diversification: A Tech ETF spreads your investment across multiple technology companies, reducing the risk associated with a single stock like Palantir.

- Reduced risk: Diversification significantly mitigates investment risk by lessening the impact of any single company's underperformance.

- Exposure to growth: A Tech ETF provides exposure to the overall growth potential of the technology sector.

- Passive investment: Index funds and ETFs generally require minimal active management, making them convenient for investors.

Choosing the Right Tech ETF

Selecting the right Tech ETF requires careful consideration:

- Expense ratio: Choose an ETF with a low ETF expense ratio to maximize your returns.

- Underlying holdings: Review the ETF's holdings to ensure they align with your investment goals and risk tolerance.

- Historical performance: Examine the ETF's past performance, but remember that past performance is not indicative of future results. Look for consistent, strong performance over the long term.

- Portfolio diversification: Ensure the ETF provides adequate portfolio diversification across various tech sub-sectors.

Superior Investment Alternative 2: Growth Stock Portfolio with Lower Volatility

Building a Balanced Growth Portfolio

A well-diversified portfolio of growth stocks offers another excellent alternative to direct PLTR investment:

- Large-cap stocks: Include established, financially strong tech giants for stability.

- Mid-cap stocks: Add mid-sized companies with high growth potential for more significant returns.

- Small-cap stocks (optional): Consider a small allocation to small-cap companies for higher risk/reward, but only if you have a higher risk tolerance.

This approach offers a blend of stability and growth potential, reducing overall portfolio volatility compared to a single-stock investment like Palantir. By spreading your investments across different market capitalization tiers, you'll achieve a level of diversification that mitigates investment risk.

Monitoring and Adjusting the Portfolio

Active portfolio management is crucial for long-term success:

- Regular review: Regularly review your portfolio's performance and asset allocation.

- Rebalancing: Rebalance your portfolio periodically to maintain your desired asset allocation.

- Market adaptation: Adjust your investment strategy as market conditions change.

Effective asset allocation and consistent portfolio rebalancing are essential to optimize returns and minimize risk over the next three years.

Conclusion

While Palantir's future holds potential, direct investment carries significant risk. This analysis highlights two superior investment strategies – investing in a diversified tech ETF and creating a balanced growth stock portfolio – for potentially better returns and reduced risk over the next 3 years. These alternatives offer a more robust approach to capitalizing on the growth of the tech sector without the inherent volatility of a single stock like Palantir. Consider your investment goals and risk tolerance before making any decisions. Start planning your superior investment strategy today by researching tech ETFs and building a diversified growth stock portfolio. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Transgender Experiences Under Trump Administration Executive Orders

May 10, 2025

Transgender Experiences Under Trump Administration Executive Orders

May 10, 2025 -

Pam Bondis Controversial Remarks On Killing American Citizens

May 10, 2025

Pam Bondis Controversial Remarks On Killing American Citizens

May 10, 2025 -

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 10, 2025

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 10, 2025 -

Broad Street Diners Fate Demolition For Hyatt Hotel Construction

May 10, 2025

Broad Street Diners Fate Demolition For Hyatt Hotel Construction

May 10, 2025 -

Binge This Stephen King Show In Under 5 Hours

May 10, 2025

Binge This Stephen King Show In Under 5 Hours

May 10, 2025