Understanding Petrol Prices In Nigeria: The Dangote-NNPC Dynamic

Table of Contents

- The Role of NNPC in Determining Petrol Prices

- NNPC's historical dominance:

- NNPC's current strategies:

- The Anticipated Impact of the Dangote Refinery

- Increased domestic refining capacity:

- Potential impact on petrol prices:

- Other Factors Influencing Petrol Prices

- Global crude oil prices:

- Exchange rate fluctuations:

- Government regulations and policies:

- Conclusion

The Role of NNPC in Determining Petrol Prices

The Nigerian National Petroleum Corporation (NNPC) has historically held a dominant role in determining petrol prices in Nigeria. This influence stems from its control over fuel importation and distribution.

NNPC's historical dominance:

For decades, NNPC was the primary importer of refined petroleum products, including petrol. This control, coupled with government fuel subsidies, created a system where prices were often artificially low, significantly impacting the national budget.

- Fuel subsidy removal: The debate surrounding fuel subsidy removal has been a recurring theme, highlighting the tension between affordable fuel and the substantial financial burden on the government.

- Import parity pricing: The NNPC's pricing structure was often linked to import parity pricing, meaning domestic prices reflected international crude oil prices and import costs, plus a markup.

- NNPC pricing structure: The lack of transparency in NNPC's pricing structure has often fueled accusations of inefficiency and lack of accountability. Past price fluctuations were frequently blamed on the fluctuating global crude oil market, but internal inefficiencies also played a significant role.

NNPC's current strategies:

The NNPC is currently undergoing significant reforms aimed at greater transparency and market liberalization. This includes a gradual shift towards deregulation of the downstream sector.

- Fuel deregulation: The push for fuel deregulation aims to allow market forces to dictate prices, potentially leading to more competitive pricing.

- Market liberalization: This process involves increasing private sector participation in the importation and distribution of refined petroleum products.

- NNPC reforms: Ongoing reforms within NNPC aim to improve efficiency, transparency, and accountability in its operations. The success of these reforms will significantly impact future petrol pricing in Nigeria.

The Anticipated Impact of the Dangote Refinery

The Dangote Refinery, upon full completion, is poised to drastically alter the landscape of Nigeria's petroleum sector. This massive refinery represents a significant investment in increasing Nigeria's local refining capacity.

Increased domestic refining capacity:

The Dangote Refinery, with a projected capacity to refine 650,000 barrels of crude oil per day, is expected to significantly reduce Nigeria’s dependence on imported refined petroleum products.

- Local refining: Increased local refining capacity will reduce reliance on imports, minimizing exposure to fluctuations in global crude oil prices and exchange rates.

- Petroleum independence: The refinery is a significant step towards petroleum independence for Nigeria, strengthening the nation's energy security.

- Dangote refinery capacity: The sheer scale of the Dangote refinery’s capacity promises to revolutionize the supply of refined petroleum products within Nigeria. The potential for job creation in related industries is also substantial.

Potential impact on petrol prices:

The refinery's impact on petrol prices is a subject of considerable speculation. Increased domestic supply could lead to increased competition and potentially lower prices.

- Price competition: The entry of the Dangote Refinery into the market is expected to foster price competition, potentially leading to lower petrol prices for consumers.

- Market dynamics: Actual price reductions will depend on a multitude of factors, including the refinery’s operational efficiency, the overall demand for refined petroleum products, and government policies.

- Refined petroleum products: The increased availability of refined petroleum products, including petrol, is expected to ease supply constraints and potentially stabilize prices.

Other Factors Influencing Petrol Prices

Beyond the NNPC and the Dangote Refinery, several other factors significantly influence petrol prices in Nigeria.

Global crude oil prices:

Global crude oil prices are a major determinant of petrol prices in Nigeria. Nigeria imports a significant amount of crude oil, making it susceptible to global market fluctuations.

- Crude oil price volatility: Volatility in the global crude oil market directly impacts the cost of importing and refining crude oil, translating to fluctuations in petrol prices.

- OPEC influence: The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in influencing global crude oil prices, indirectly impacting petrol prices in Nigeria.

- Global oil market: Geopolitical events and global economic conditions also contribute to fluctuations in the global oil market, further impacting petrol prices.

Exchange rate fluctuations:

Fluctuations in the Naira's exchange rate against major currencies, primarily the US dollar, significantly affect petrol prices.

- Naira devaluation: A weaker Naira makes importing refined petroleum products more expensive, increasing petrol prices.

- Forex market: The dynamics of the Nigerian forex market heavily influence the cost of imports and, consequently, petrol prices.

- Import costs: The cost of importing refined petroleum products is directly proportional to the Naira’s exchange rate against the dollar.

Government regulations and policies:

Government regulations and policies, such as taxation, also influence the final price of petrol.

- Fuel taxation: Excise duties, Value Added Tax (VAT), and other taxes levied on petroleum products contribute to the final price paid by consumers.

- Government policies: Government policies, such as subsidies or price controls, can also directly impact petrol prices.

- Fiscal policy: Government fiscal policy decisions concerning taxes and subsidies significantly affect the cost of petrol to consumers.

Conclusion

The interplay between the NNPC and the imminent impact of the Dangote Refinery significantly influence petrol prices in Nigeria. While the refinery promises increased domestic refining capacity, potentially leading to lower prices and reduced reliance on imports, several other factors – including global crude oil prices, exchange rate fluctuations, and government policies – will continue to shape the market. Understanding these dynamics is crucial for navigating the complexities of Nigeria's fuel sector. Stay informed about developments concerning Dangote Refinery and NNPC to better understand future petrol price movements in Nigeria.

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Staff

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Staff

Unlocking The Nyt Crossword Strands Puzzle April 12 2025

Unlocking The Nyt Crossword Strands Puzzle April 12 2025

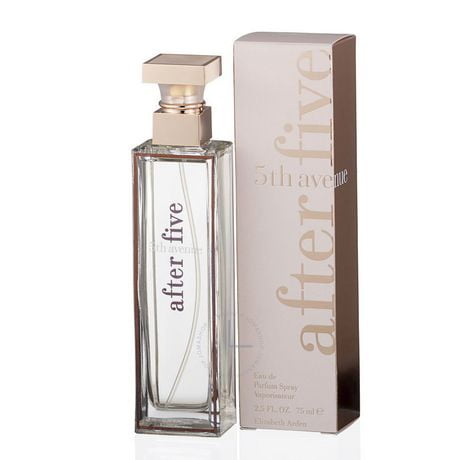

Save On Elizabeth Arden Skincare Walmart Alternatives

Save On Elizabeth Arden Skincare Walmart Alternatives

Transgenero Arrestada El Debate Sobre Banos Publicos Y Derechos Lgbtq

Transgenero Arrestada El Debate Sobre Banos Publicos Y Derechos Lgbtq

Aocs Fact Check Of Jeanine Pirro Key Moments And Takeaways

Aocs Fact Check Of Jeanine Pirro Key Moments And Takeaways