BofA On Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Key Arguments for a Calmer Market Outlook

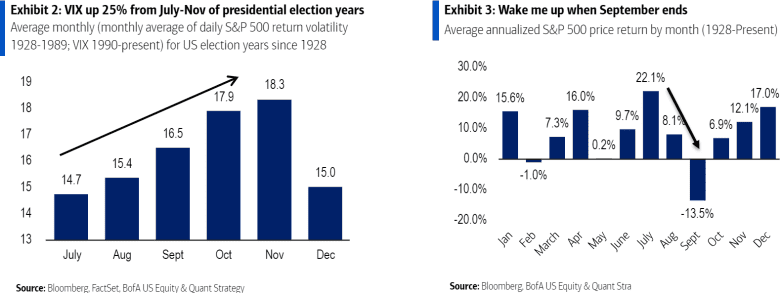

BofA's overall assessment of current market valuations leans towards a cautiously optimistic view. While acknowledging the challenges posed by inflation and interest rate hikes, they argue that the market is not significantly overvalued, offering potential opportunities for strategic investors.

- Data Points: BofA's report cites several key data points to support their argument. They point to a relatively healthy P/E ratio (Price-to-Earnings ratio) for the S&P 500, suggesting that current earnings justify existing stock prices, particularly when compared to historical averages. Furthermore, they highlight improving dividend yields in certain sectors, indicating a potentially stable income stream for investors.

- Attractive Sectors: BofA highlights the technology and healthcare sectors as particularly attractive, citing strong fundamentals and future growth potential. Conversely, they express some caution regarding the energy sector, given the volatility of commodity prices.

- Rationale: BofA's analysis considers several macroeconomic factors, including the Federal Reserve's (Fed) monetary policy, inflation projections, and global economic growth forecasts. They believe that while interest rate hikes will continue to impact valuations, the anticipated slowdown in inflation will ultimately support market stability.

Addressing Concerns about High Inflation and Interest Rates

High inflation and aggressive interest rate hikes are major concerns for investors. BofA's valuation analysis directly addresses these factors, incorporating their predicted impact into their models.

- Inflation and Interest Rate Predictions: BofA predicts a gradual decline in inflation throughout the coming year, anticipating that the Fed's actions will begin to take effect. They also forecast that interest rate hikes will eventually plateau, mitigating their negative impact on stock prices.

- Valuation Model Incorporation: BofA incorporates these predictions into their discounted cash flow models and other valuation techniques, adjusting for the anticipated changes in interest rates and inflation. This allows for a more realistic assessment of intrinsic value.

- Risk Mitigation: BofA suggests investors mitigate risks associated with inflation and interest rates through diversification. This includes a balanced portfolio allocation across different asset classes, such as equities, bonds, and potentially alternative investments like real estate.

BofA's Investment Strategies and Recommendations

Based on their valuation analysis, BofA recommends a strategic, diversified investment approach.

- Investment Recommendations: BofA advocates for a balanced approach, recommending overweight positions in technology and healthcare sectors, while maintaining a more cautious stance on energy. They also suggest exploring dividend-paying stocks to generate stable income streams.

- Specific Investment Vehicles: While not explicitly recommending specific stocks, BofA encourages investors to focus on companies with strong fundamentals, sustainable growth prospects, and robust balance sheets. They suggest exploring ETFs (Exchange-Traded Funds) for diversified exposure to specific sectors.

- Diversification and Risk Management: BofA strongly emphasizes the importance of diversification and risk management. They recommend investors carefully consider their risk tolerance and adjust their portfolio accordingly, seeking professional advice if needed.

Comparing BofA's View with Other Market Analyses

BofA's perspective isn't the only voice in the market. Comparing their analysis with other prominent financial institutions reveals both agreement and divergence.

- Other Analyst Perspectives: While some analysts share BofA's cautiously optimistic outlook, others express more pessimistic views, forecasting a more significant market correction. Goldman Sachs, for example, has recently expressed more concern about overvaluation in specific sectors.

- Market Performance Predictions: The divergence in opinions highlights the uncertainty inherent in market forecasting. While BofA anticipates moderate growth, other institutions predict slower growth or even a period of contraction.

- Reasons for Divergence: The differences in opinion largely stem from variations in assumptions regarding inflation, interest rate movements, and the overall pace of economic recovery.

Conclusion

BofA's report on stock market valuations provides a valuable perspective for investors navigating current market uncertainty. Their analysis, which considers factors such as inflation, interest rate hikes, and sector-specific performance, suggests that the market is not drastically overvalued, offering potential opportunities for strategic investment. By incorporating a diversified approach and carefully considering risk tolerance, investors can develop a sound investment strategy informed by BofA's findings. Understand BofA's perspective on stock market valuations and develop a sound investment strategy informed by BofA's analysis. Stay calm and informed about stock market valuations with BofA's insights. [Link to BofA's Report (if available)]

Featured Posts

-

Gaslighting Allegations Flood Social Media Following Newsoms Podcast Announcement

Apr 25, 2025

Gaslighting Allegations Flood Social Media Following Newsoms Podcast Announcement

Apr 25, 2025 -

Maquiagem Em Aquarela Guia Completo Para Iniciantes E Experts

Apr 25, 2025

Maquiagem Em Aquarela Guia Completo Para Iniciantes E Experts

Apr 25, 2025 -

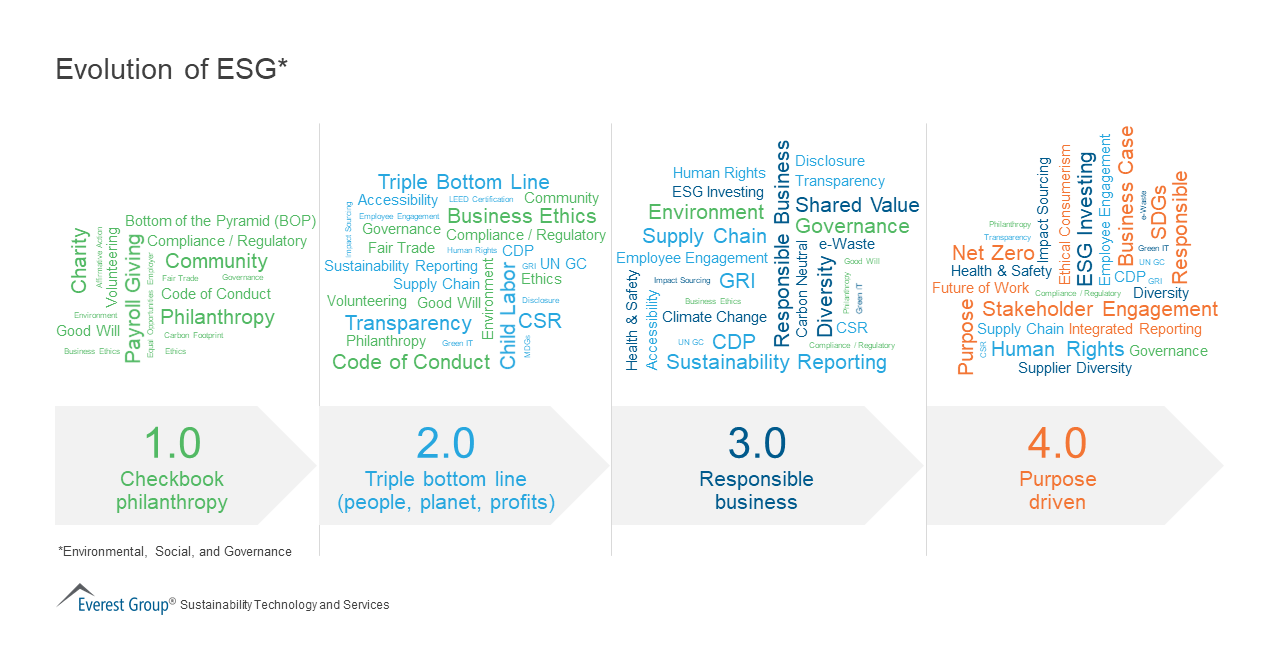

Canadian Regulatory Pause Examining The Controversy Surrounding Esg Reporting

Apr 25, 2025

Canadian Regulatory Pause Examining The Controversy Surrounding Esg Reporting

Apr 25, 2025 -

Us Congress Reintroduces Taiwan International Solidarity Act

Apr 25, 2025

Us Congress Reintroduces Taiwan International Solidarity Act

Apr 25, 2025 -

Are Stretched Stock Market Valuations Justified Bof As View

Apr 25, 2025

Are Stretched Stock Market Valuations Justified Bof As View

Apr 25, 2025

Latest Posts

-

La Cite De La Gastronomie De Dijon Et Les Difficultes D Epicure

May 10, 2025

La Cite De La Gastronomie De Dijon Et Les Difficultes D Epicure

May 10, 2025 -

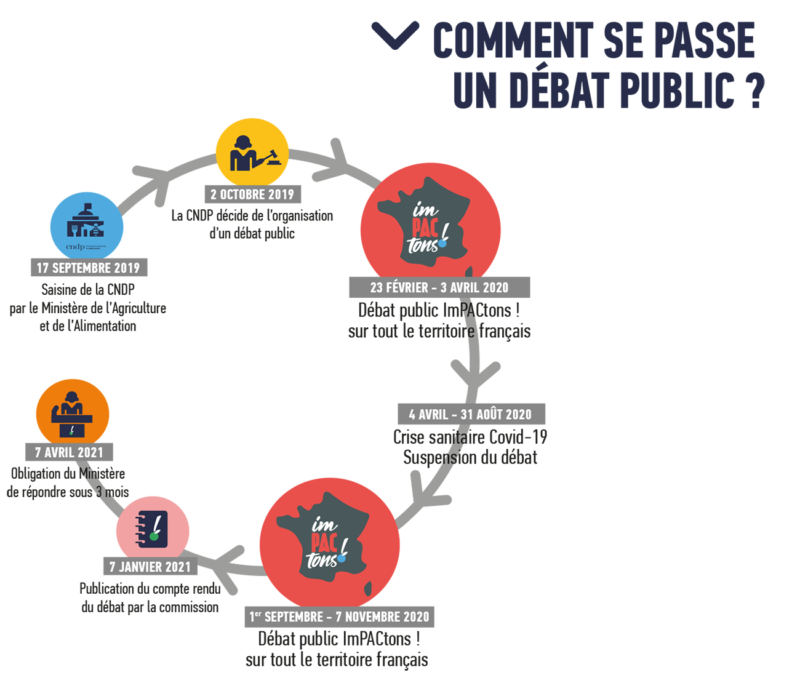

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Un Debat Public

May 10, 2025

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Un Debat Public

May 10, 2025 -

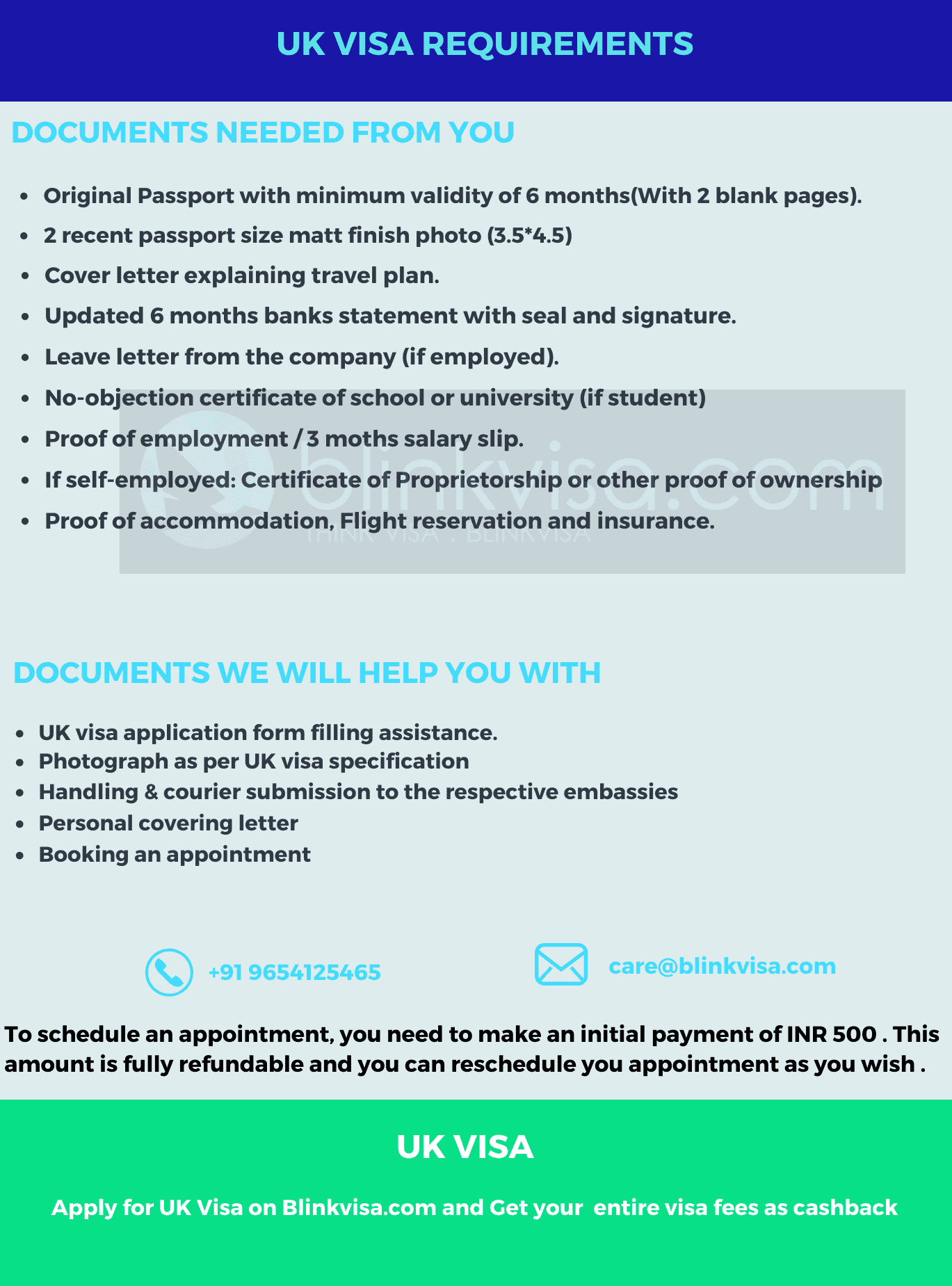

Updated Uk Visa Policies Impact And Implications

May 10, 2025

Updated Uk Visa Policies Impact And Implications

May 10, 2025 -

Visa Restrictions For Specific Nationalities Entering The Uk

May 10, 2025

Visa Restrictions For Specific Nationalities Entering The Uk

May 10, 2025 -

Dijon Concarneau 0 1 Resume Du Match De National 2 04 04 2025

May 10, 2025

Dijon Concarneau 0 1 Resume Du Match De National 2 04 04 2025

May 10, 2025