Are Stretched Stock Market Valuations Justified? BofA's View

Table of Contents

The stock market has reached dizzying heights recently. A recent BofA Securities report highlights concerns about stretched valuations, prompting the crucial question: are these high valuations justified? This article delves into BofA's analysis, examining their valuation metrics, counterarguments, the role of inflation and interest rates, and their resulting investment recommendations. We will explore whether the current market exuberance is sustainable or if a correction is on the horizon.

H2: BofA's Valuation Metrics and Concerns

BofA Securities employs several key valuation metrics to assess market health. These include the widely used Price-to-Earnings (P/E) ratio, which compares a company's stock price to its earnings per share, and the Shiller PE ratio (also known as the cyclically adjusted price-to-earnings ratio or CAPE ratio), which considers inflation-adjusted earnings over a ten-year period. BofA also uses other proprietary models to assess overall market risk and potential for correction.

BofA's concerns regarding current valuation levels include:

- Elevated P/E Ratios: Current P/E ratios for many sectors are significantly higher than their historical averages, suggesting the market might be pricing in overly optimistic future growth.

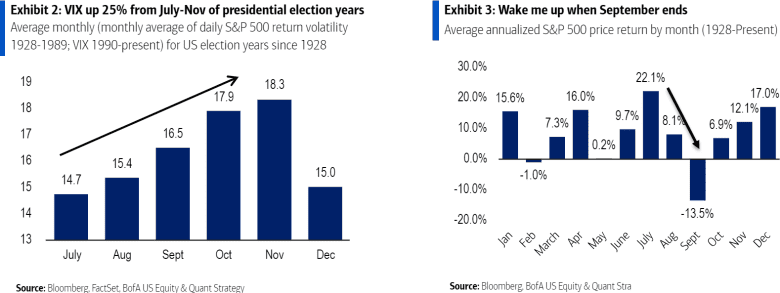

- Increased Market Volatility: High valuations often correlate with increased market sensitivity to negative news, leading to potential for sharp corrections. BofA's models suggest a higher probability of a market downturn based on these elevated valuations.

- Specific Sector Overvaluation: BofA often identifies specific sectors, such as technology or certain consumer discretionary areas, as particularly overvalued relative to their historical performance and future earnings potential. (Specific examples from recent BofA reports would be included here if available - citation needed).

H2: Counterarguments: Factors Supporting High Valuations

While BofA expresses concerns, several factors could justify the current high valuations:

- Strong Corporate Earnings Growth: Many companies have reported robust earnings growth, fueled by post-pandemic recovery and ongoing technological advancements. This positive performance could support higher stock prices.

- Low Interest Rates (Historically Low or Future Projections): Low interest rates make borrowing cheaper for businesses and increase the attractiveness of stocks relative to bonds, potentially driving up valuations. However, any future interest rate hikes would change this dynamic.

- Technological Innovation Driving Future Growth: Breakthroughs in technology, particularly in areas like artificial intelligence and renewable energy, offer the potential for significant future growth, justifying higher current valuations for companies leading in these sectors.

- Increased Investor Confidence: A positive economic outlook and investor confidence can drive demand for stocks, pushing up prices even beyond what traditional valuation metrics might suggest.

H2: The Role of Inflation and Interest Rates

Inflation and interest rates are critical factors influencing stock valuations. High inflation erodes corporate earnings and investor purchasing power. BofA's projections for inflation (cite source if available) will largely impact the earnings potential of companies and investor sentiment. Similarly, interest rate hikes increase the cost of borrowing for businesses and make bonds a more attractive investment, potentially reducing demand for stocks. BofA's interest rate forecasts (cite source if available) are critical to understanding their overall market outlook and valuation assessment.

- Inflation's Impact: High and persistent inflation significantly impacts corporate earnings, reducing profitability and investor confidence.

- Interest Rate Hikes: Increasing interest rates make borrowing more expensive for companies, reducing their ability to invest and potentially harming future earnings. This also increases the attractiveness of bonds, diverting investment away from the stock market.

- BofA's Forecast and Implications: BofA's forecasts for inflation and interest rates will directly inform their assessment of whether current stock market valuations are sustainable.

H2: BofA's Recommendations and Investment Strategies

Based on their valuation analysis, BofA typically provides recommendations for investors. These might include:

- Sector Rotation: Shifting investment from overvalued sectors to those deemed undervalued.

- Defensive Strategies: Adopting a more cautious investment approach, potentially focusing on lower-risk assets.

- Asset Allocation Advice: Adjusting the allocation of assets in a portfolio to better align with the market outlook.

Specific recommendations (e.g., overweighting value stocks, underweighting growth stocks) will vary depending on BofA's current assessment. (Specific recommendations from recent BofA reports would be included here – citation needed).

Conclusion: Are Stretched Stock Market Valuations Justified? BofA's Final Word and Your Next Steps

BofA's analysis reveals a complex picture. While strong earnings growth and low interest rates (currently) might support some of the higher valuations, the elevated P/E ratios and potential for inflation and interest rate hikes raise significant concerns. Whether current stretched stock market valuations are ultimately justified is a matter of ongoing debate and depends heavily on future economic indicators. BofA's view, based on their models and analysis, leans towards caution.

To make informed investment decisions, it's crucial to conduct thorough research and consider various perspectives, including BofA's in-depth analysis of stretched stock market valuations. Review recent BofA Securities reports and consider seeking advice from a qualified financial advisor to help navigate this complex market environment.

Featured Posts

-

The Impact Of The La Palisades Fires A List Of Celebrities Affected

Apr 25, 2025

The Impact Of The La Palisades Fires A List Of Celebrities Affected

Apr 25, 2025 -

Montana Senate Control Dems And Gop Coalition Dynamics

Apr 25, 2025

Montana Senate Control Dems And Gop Coalition Dynamics

Apr 25, 2025 -

Sherwood Ridge School Principal Faces Backlash Over Anzac Day Opt Out

Apr 25, 2025

Sherwood Ridge School Principal Faces Backlash Over Anzac Day Opt Out

Apr 25, 2025 -

Election Promises And The Looming Deficit An Economic Analysis

Apr 25, 2025

Election Promises And The Looming Deficit An Economic Analysis

Apr 25, 2025 -

The Company That Laid You Off Wants You Back What To Say

Apr 25, 2025

The Company That Laid You Off Wants You Back What To Say

Apr 25, 2025

Latest Posts

-

Changes To Uk Visa System Implications For International Students And Workers

May 09, 2025

Changes To Uk Visa System Implications For International Students And Workers

May 09, 2025 -

Uk Government Considers Visa Restrictions For Specific Countries

May 09, 2025

Uk Government Considers Visa Restrictions For Specific Countries

May 09, 2025 -

Stricter Uk Visa Rules Addressing Concerns Of Visa Fraud

May 09, 2025

Stricter Uk Visa Rules Addressing Concerns Of Visa Fraud

May 09, 2025 -

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025 -

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025