China's Economic Stimulus: Rate Cuts And Bank Lending In Response To Tariffs

Table of Contents

- Interest Rate Cuts as a Stimulus Tool

- The Mechanics of Rate Cuts

- Limitations of Rate Cuts

- Boosting Bank Lending: The Role of Financial Institutions

- Government Directives and Loan Targets

- Impact on Credit Growth and Economic Activity

- The Effectiveness of Stimulus Measures in the Face of Tariffs

- Short-Term vs. Long-Term Impacts

- Geopolitical Considerations

- Conclusion

Interest Rate Cuts as a Stimulus Tool

The Mechanics of Rate Cuts

Lowering interest rates is a cornerstone of monetary policy, designed to stimulate economic activity. By reducing borrowing costs, it encourages businesses to invest and consumers to spend. This injection of capital into the economy aims to increase aggregate demand and, consequently, economic growth.

- Impact on lending rates: Reduced interest rates translate to lower borrowing costs for businesses and individuals, making loans more accessible and affordable.

- Effect on corporate investment: Lower borrowing costs incentivize businesses to undertake expansion projects, purchase new equipment, and hire more workers.

- Influence on consumer spending: Lower interest rates can lead to increased consumer spending through cheaper mortgages, auto loans, and other forms of credit.

- Potential for inflation: While stimulating economic activity, rate cuts also carry the risk of increased inflation if demand outpaces supply. The People's Bank of China (PBOC) must carefully monitor this balance.

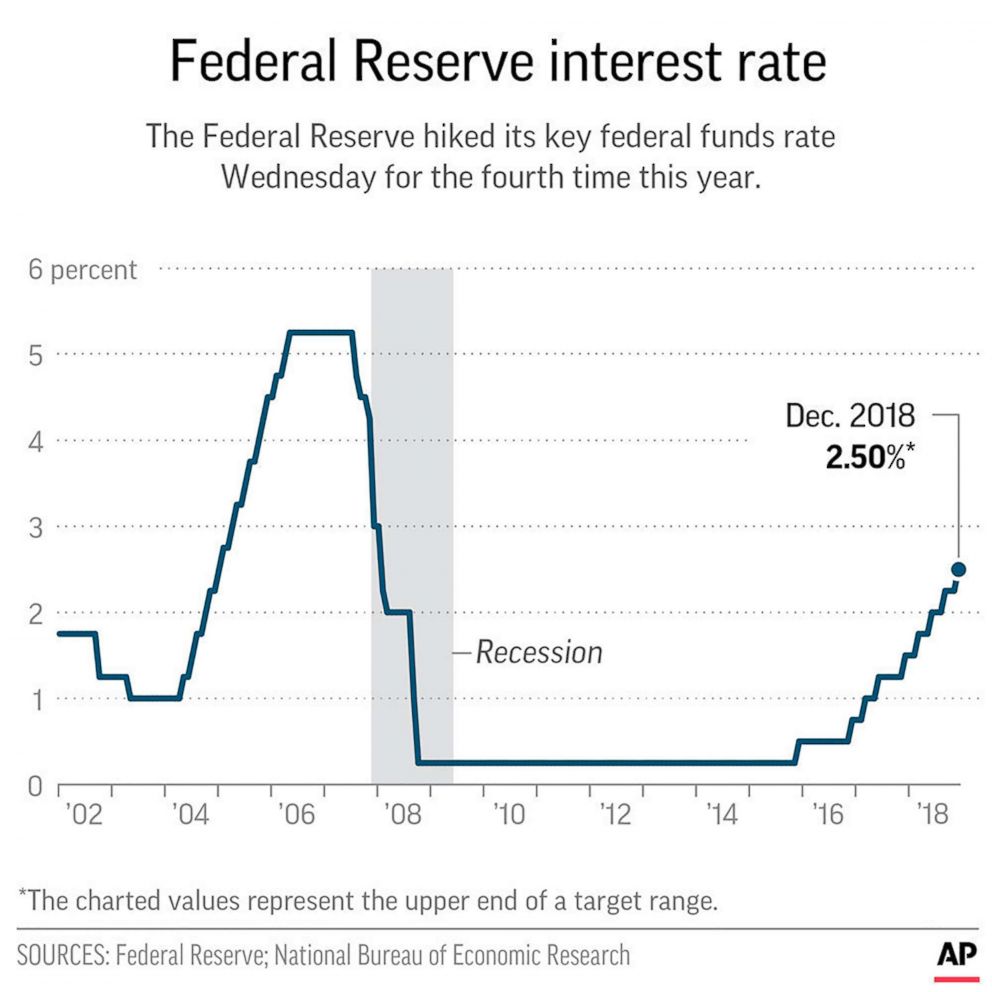

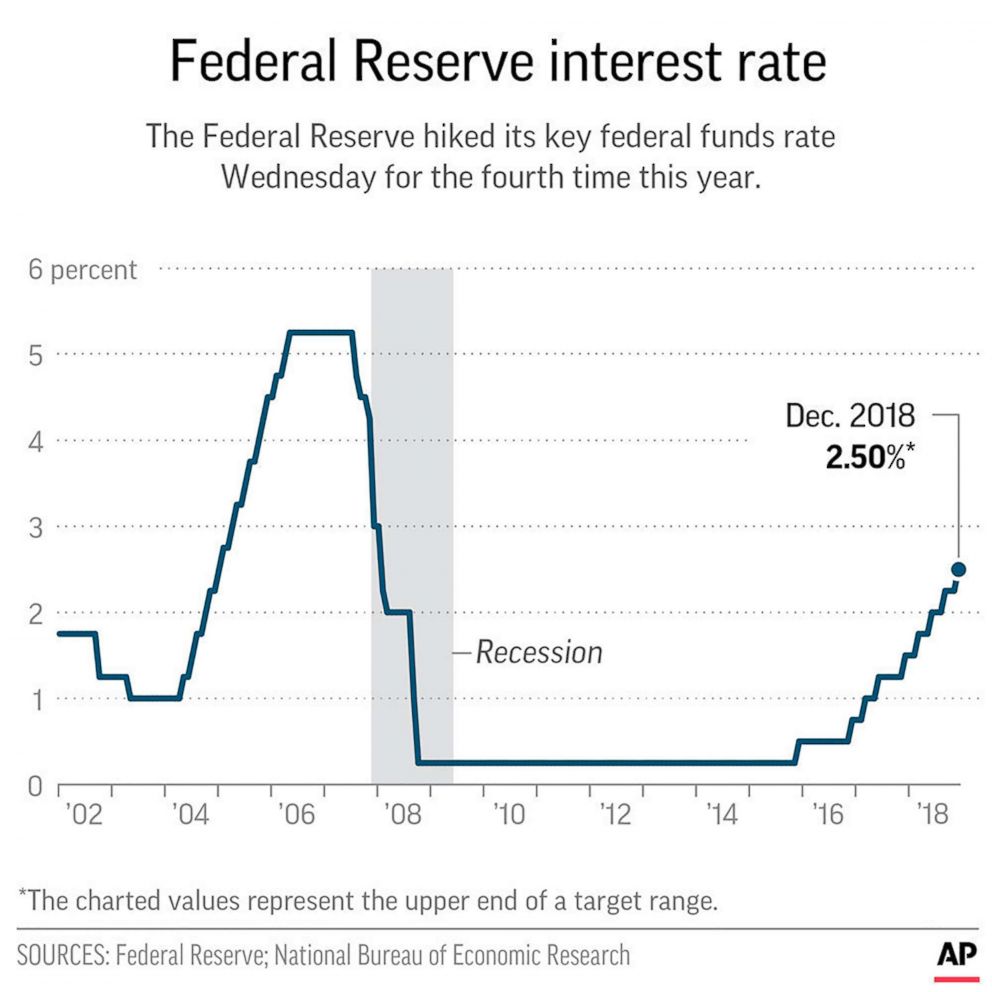

Historically, China's rate cuts have had a mixed impact. For instance, the rate cuts in 2018 and 2019 led to a short-term boost in investment but were less effective in stimulating consumption due to lingering economic uncertainty.

Limitations of Rate Cuts

While rate cuts can be effective stimulus tools, relying solely on them presents significant limitations. In an environment of low confidence, businesses may be hesitant to borrow even at lower rates.

- Effectiveness in stimulating private investment: The effectiveness of rate cuts depends on factors beyond interest rates, including business sentiment, risk appetite, and regulatory environments.

- Risks of capital flight: If rate cuts are perceived as a sign of economic weakness, they can trigger capital flight as investors seek higher returns elsewhere.

- Potential for inflationary pressures: Excessive rate cuts can fuel inflation, potentially undermining long-term economic stability.

Therefore, a balanced approach is necessary. China could consider alternative stimulus measures such as targeted fiscal spending on infrastructure projects or reforms to improve the business environment.

Boosting Bank Lending: The Role of Financial Institutions

Government Directives and Loan Targets

The Chinese government plays a significant role in directing bank lending through various directives and loan targets. This involves setting specific targets for lending to specific sectors deemed crucial for economic growth.

- Specific lending targets set by the government: The government often sets targets for lending to strategic sectors such as infrastructure development, small and medium-sized enterprises (SMEs), and high-tech industries.

- Mechanisms used to encourage lending: Banks may face pressure or incentives to meet these lending targets, potentially compromising prudent lending practices.

- Risks of non-performing loans: Government-directed lending can increase the risk of non-performing loans (NPLs) if projects are not financially viable or properly managed.

For example, the government's push for infrastructure projects via increased bank lending has contributed to significant infrastructure development, but it also carries the risk of overcapacity and potential NPLs if projects fail to generate sufficient returns.

Impact on Credit Growth and Economic Activity

Increased bank lending directly influences several key economic indicators. A surge in credit often correlates with increased economic activity.

- Correlation between lending and economic growth: Increased bank lending fuels investment and consumption, directly impacting GDP growth.

- Sectoral distribution of loans: The government's focus on specific sectors influences the distribution of loans, shaping the pattern of economic development.

- Impact on employment figures: Increased investment and economic activity generally lead to higher employment figures.

Statistical data from the PBOC reveals a strong correlation between credit growth and GDP growth in China. However, this correlation doesn't always translate to sustainable long-term economic growth, especially without structural reforms.

The Effectiveness of Stimulus Measures in the Face of Tariffs

Short-Term vs. Long-Term Impacts

China's stimulus measures, while providing a short-term boost, may not fully offset the long-term negative impacts of tariffs.

- GDP growth in the short term: Stimulus measures have helped to maintain relatively high GDP growth rates in the short term, but this growth may not be sustainable.

- Structural reforms needed for long-term growth: China needs to address underlying structural issues such as overreliance on investment, inefficient state-owned enterprises, and environmental challenges for long-term sustainable growth.

- Impact on foreign investment: Tariffs and trade disputes create uncertainty, potentially deterring foreign direct investment.

The short-term growth achieved through stimulus may mask underlying vulnerabilities, and the long-term effects of tariffs may ultimately outweigh the positive impact of the stimulus.

Geopolitical Considerations

China's stimulus response is inextricably linked to its geopolitical relationship with the US and other trading partners.

- Impact on trade relations with the US and other countries: The stimulus measures could be seen as a response to trade tensions and may influence future trade negotiations.

- Implications for global economic stability: China's economic performance has a significant impact on global economic stability. The success or failure of its stimulus efforts will have global repercussions.

- The role of international cooperation: International cooperation and trade agreements are essential for managing trade disputes and fostering global economic growth.

The ongoing trade war and global uncertainty complicate the evaluation of China's stimulus efforts. Different scenarios, such as a resolution of trade disputes or further escalation, significantly influence the outcomes.

Conclusion

China's economic stimulus plan, relying heavily on rate cuts and increased bank lending in response to tariffs, has yielded mixed results. While providing a short-term boost to GDP growth and investment, the sustainability of this approach is questionable without addressing underlying structural issues. The effectiveness of these measures is further complicated by the ongoing trade disputes and the inherent risks associated with government-directed lending. Understanding the complexities of China's economic stimulus requires careful consideration of both short-term gains and long-term sustainability. For a deeper understanding, further research into China's economic policies and the global implications of its response to trade tariffs is recommended. Continue to stay informed on developments in China's economic stimulus strategies and their global impact.

The Trump Effect How His Xrp Endorsement Impacts Institutional Investors

The Trump Effect How His Xrp Endorsement Impacts Institutional Investors

Ukraine Cemetery Corruption The Exploitation Of Fallen Soldiers

Ukraine Cemetery Corruption The Exploitation Of Fallen Soldiers

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

Neymar Te Psg Historia E Transferimit 222 Milione Eurosh Sipas Agjentit Dhe Dokumentacionit

Neymar Te Psg Historia E Transferimit 222 Milione Eurosh Sipas Agjentit Dhe Dokumentacionit

Check Daily Lotto Results For Friday 18th April 2025

Check Daily Lotto Results For Friday 18th April 2025