Bitcoin's 10x Potential: A Realistic Wall Street Disruption?

Table of Contents

Bitcoin's Technological Advantages Over Traditional Finance

Bitcoin's core strength lies in its revolutionary technology, offering several advantages over traditional financial systems.

Decentralization and Transparency

Bitcoin operates on a decentralized blockchain technology, eliminating the need for intermediaries like banks or payment processors. This peer-to-peer system enhances transparency and significantly reduces the risk of fraud. The immutability of the blockchain ensures that transactions are secure and cannot be easily altered.

- Reduced Counterparty Risk: Unlike traditional systems, Bitcoin transactions aren't reliant on a single entity, minimizing the risk of default or manipulation.

- Faster Transaction Speeds (in certain instances): While Bitcoin transactions can sometimes be slower than traditional payment systems, the speed is often faster internationally and for certain types of transactions.

- Lower Fees (in some instances): Bitcoin transactions often involve lower fees compared to international wire transfers, particularly beneficial for cross-border payments.

Programmability and Smart Contracts

Beyond simple transactions, Bitcoin's underlying technology enables the creation of smart contracts and decentralized applications (dApps). This programmability opens doors to innovative financial tools within the burgeoning world of Decentralized Finance (DeFi).

- DeFi Applications: Examples include decentralized lending platforms, decentralized exchanges (DEXs), and decentralized insurance protocols, challenging traditional financial services.

- Impact on Traditional Finance: DeFi applications have the potential to disrupt traditional lending, insurance, and investment management sectors by offering greater transparency, efficiency, and accessibility.

Bitcoin's Growing Adoption and Institutional Interest

The increasing acceptance of Bitcoin by both individuals and institutions signals its growing legitimacy and potential for long-term growth.

Increasing Institutional Investment

Major corporations and hedge funds are steadily allocating portions of their portfolios to Bitcoin, signifying a shift in the perception of Bitcoin from a speculative asset to a potentially valuable investment.

- Examples of Major Institutional Investors: Companies like MicroStrategy and Tesla have made significant Bitcoin purchases, demonstrating confidence in its future value.

- Impact of Regulatory Clarity: Greater regulatory clarity in various jurisdictions is likely to further encourage institutional investment, reducing uncertainty and increasing confidence.

Global Adoption and Growing Usage

Bitcoin's global adoption is accelerating, particularly in emerging markets with unstable fiat currencies. Many view Bitcoin as a hedge against inflation and a store of value.

- Examples of Countries with High Bitcoin Adoption: El Salvador's adoption of Bitcoin as legal tender is a notable example, with other countries exploring similar paths.

- Impact of Inflation on Bitcoin Demand: High inflation rates in many parts of the world are driving demand for Bitcoin as a potential inflation hedge.

Challenges and Risks to Bitcoin's 10x Potential

While Bitcoin's potential is significant, several challenges and risks could hinder its path to a 10x price increase.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin and cryptocurrencies remains uncertain globally. This lack of clarity creates hurdles for wider adoption and can significantly impact price stability.

- Examples of Different Regulatory Approaches: Different countries are taking varying approaches to regulating cryptocurrencies, ranging from outright bans to regulatory frameworks promoting innovation.

- Potential Impacts of Stricter Regulations: Stricter regulations could stifle innovation and limit Bitcoin's growth potential.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile, experiencing significant swings in both directions. This volatility presents substantial risks for investors.

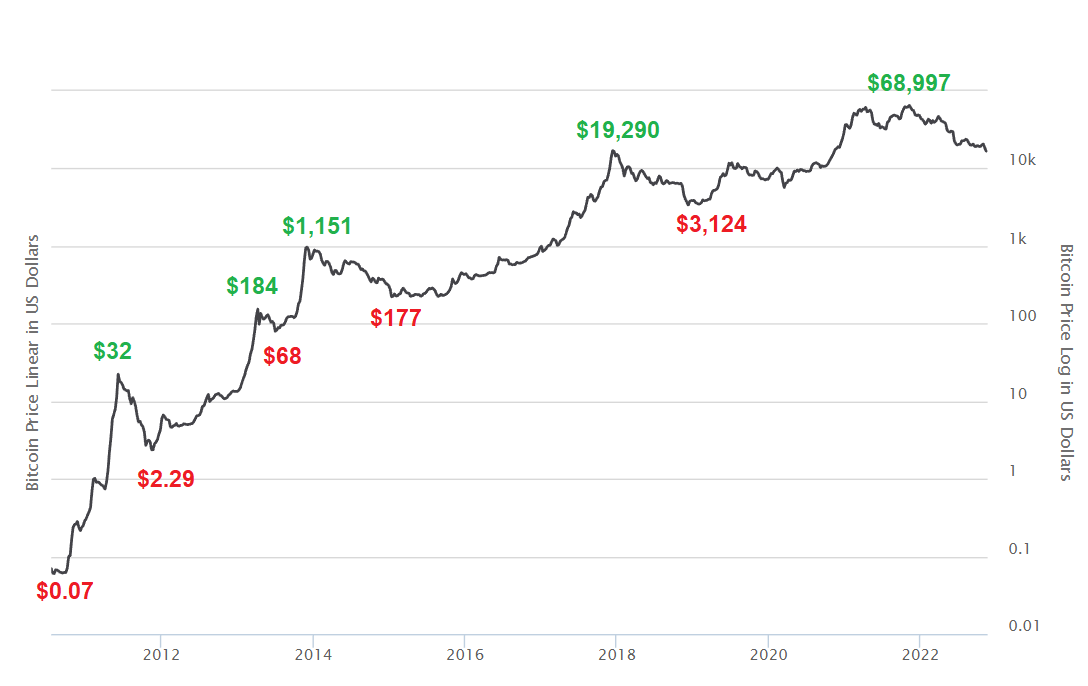

- Historical Examples of Bitcoin's Price Swings: Bitcoin's history is marked by dramatic price increases and equally dramatic drops, highlighting the inherent risk.

- Strategies for Managing Risk: Investors should employ risk management strategies such as diversification and dollar-cost averaging to mitigate potential losses.

Analyzing the 10x Potential: Realistic or Overly Optimistic?

Predicting Bitcoin's future price is inherently speculative, but analyzing potential catalysts and obstacles can shed light on the likelihood of a 10x increase.

Factors Supporting a 10x Increase

Several factors could potentially drive Bitcoin's price to 10x its current value:

- Widespread Institutional Adoption: Continued institutional investment could significantly increase demand and drive up the price.

- Regulatory Clarity: Clear and consistent regulatory frameworks globally could boost investor confidence and fuel growth.

- Increased Demand: Growing global adoption and increased use of Bitcoin as a store of value and medium of exchange could drive demand.

Factors Limiting a 10x Increase

Conversely, several factors could limit Bitcoin's price growth:

- Regulatory Crackdown: A significant regulatory crackdown could suppress demand and negatively impact the price.

- Competition from Other Cryptocurrencies: Competition from other cryptocurrencies could divert investment and limit Bitcoin's market share.

- Technological Challenges: Technological limitations or scalability issues could hinder Bitcoin's wider adoption and use.

Conclusion: Bitcoin's 10x Potential – A Verdict

Bitcoin's technological advantages and growing adoption provide a compelling case for its disruptive potential. However, regulatory uncertainty and inherent price volatility pose significant risks. A 10x increase is certainly possible, driven by factors like widespread institutional adoption and increased global demand. However, regulatory crackdowns or competition could act as significant roadblocks.

Before investing in Bitcoin, it's crucial to conduct thorough research, understand the associated risks, and assess your own risk tolerance. Bitcoin investment offers potentially significant rewards, but only with careful consideration of the potential downsides. Make informed decisions about Bitcoin investment, carefully weighing the potential for disruption and future price action against the inherent risks involved. The future of Bitcoin, and its potential for a 10x increase, remains a compelling narrative, but one that requires a balanced and informed perspective.

Featured Posts

-

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025 -

Arsenal Protiv Ps Zh Predviduvanja Za Prviot Mech

May 08, 2025

Arsenal Protiv Ps Zh Predviduvanja Za Prviot Mech

May 08, 2025 -

India Pakistan Conflict Unprecedented Strikes Across The Border

May 08, 2025

India Pakistan Conflict Unprecedented Strikes Across The Border

May 08, 2025 -

Top Cryptocurrency Pick Van Eck Forecasts 185 Price Increase

May 08, 2025

Top Cryptocurrency Pick Van Eck Forecasts 185 Price Increase

May 08, 2025 -

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025

The Long Walks First Trailer Simple Design Chilling Effect

May 08, 2025

Latest Posts

-

Ethereum Price Resilient Upside Break Imminent

May 08, 2025

Ethereum Price Resilient Upside Break Imminent

May 08, 2025 -

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025 -

Top 10 Characters In Saving Private Ryan A Definitive Ranking

May 08, 2025

Top 10 Characters In Saving Private Ryan A Definitive Ranking

May 08, 2025 -

The Unscripted Power Of Realism Saving Private Ryans Unforgettable Scene

May 08, 2025

The Unscripted Power Of Realism Saving Private Ryans Unforgettable Scene

May 08, 2025 -

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025

Ethereum Price Analysis Resistance Broken 2 000 In Sight

May 08, 2025