Bitcoin's Potential 1,500% Surge: A Growth Investor's Prediction

Table of Contents

Historical Bitcoin Price Performance and Volatility

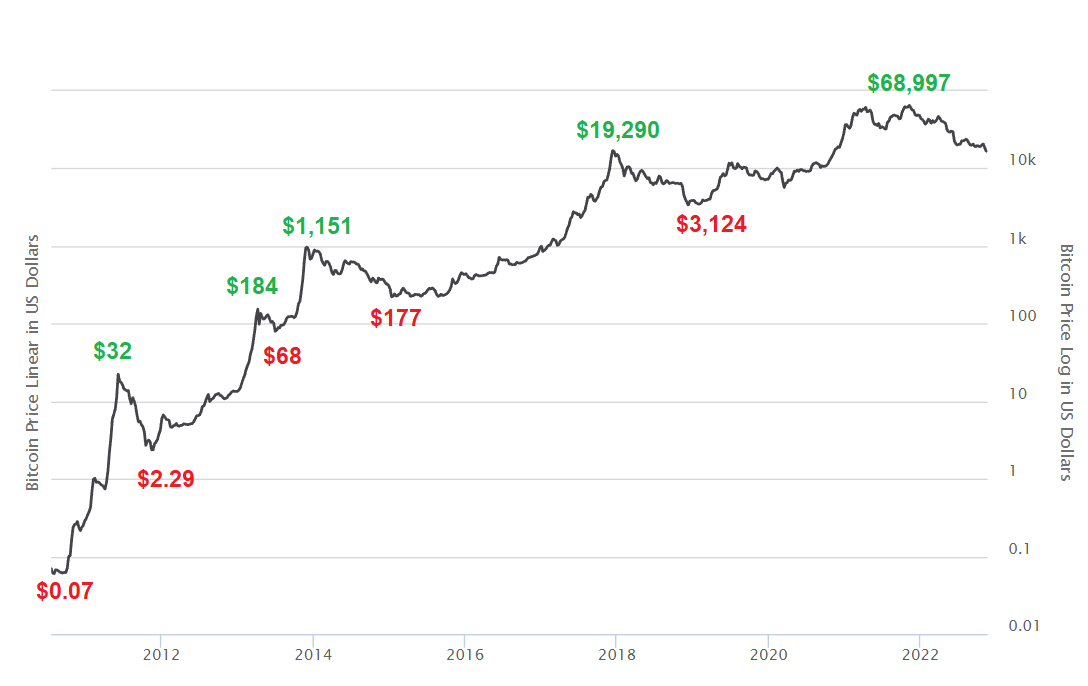

Understanding Bitcoin's past is crucial for predicting its future. Bitcoin's history is punctuated by periods of explosive growth, often followed by significant corrections. Analyzing Bitcoin price history reveals several key drivers:

- Bitcoin Halving Events: The halving, which cuts Bitcoin's block reward in half approximately every four years, has historically been followed by substantial price increases. This is due to the reduced supply of newly mined Bitcoin.

- Institutional Adoption: The increasing acceptance of Bitcoin by major financial institutions and corporations significantly impacts price. Companies like MicroStrategy and Tesla's Bitcoin investments boosted market confidence.

- Regulatory Changes: Government regulations, both positive and negative, can influence Bitcoin's price. Clearer regulatory frameworks can increase institutional confidence, while stringent regulations can dampen market enthusiasm.

(Insert a chart or graph visually representing Bitcoin's historical price data here.)

Keywords: Bitcoin price history, Bitcoin price chart, Bitcoin volatility, Bitcoin halving, Bitcoin institutional adoption, Bitcoin regulation

Factors Fueling the 1,500% Bitcoin Price Prediction

Several factors contribute to the ambitious 1,500% Bitcoin price prediction, although it's crucial to approach such projections with caution:

Adoption by Institutional Investors

Large financial institutions are increasingly allocating assets to Bitcoin, viewing it as a potential inflation hedge and a diversification tool. This growing institutional interest adds substantial buying pressure to the market.

Global Macroeconomic Factors

Global inflation, geopolitical instability, and concerns about the devaluation of fiat currencies are driving investors towards alternative assets like Bitcoin. Its decentralized nature and limited supply make it an attractive store of value.

Technological Advancements

The development of the Lightning Network and other Layer-2 scaling solutions addresses Bitcoin's scalability challenges, improving transaction speed and reducing fees. This enhances Bitcoin's usability and attracts wider adoption.

Scarcity of Bitcoin

Only 21 million Bitcoin will ever exist. This inherent scarcity is a significant driver of its potential value, similar to precious metals like gold. As demand increases and supply remains fixed, the price is expected to rise.

Keywords: Institutional Bitcoin adoption, Bitcoin inflation hedge, Bitcoin Lightning Network, Bitcoin scarcity, Bitcoin limited supply

Potential Risks and Challenges to Reaching a 1,500% Surge

While the potential rewards are significant, it's crucial to acknowledge the risks:

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is constantly evolving. Unfavorable regulations in key markets could negatively impact its price.

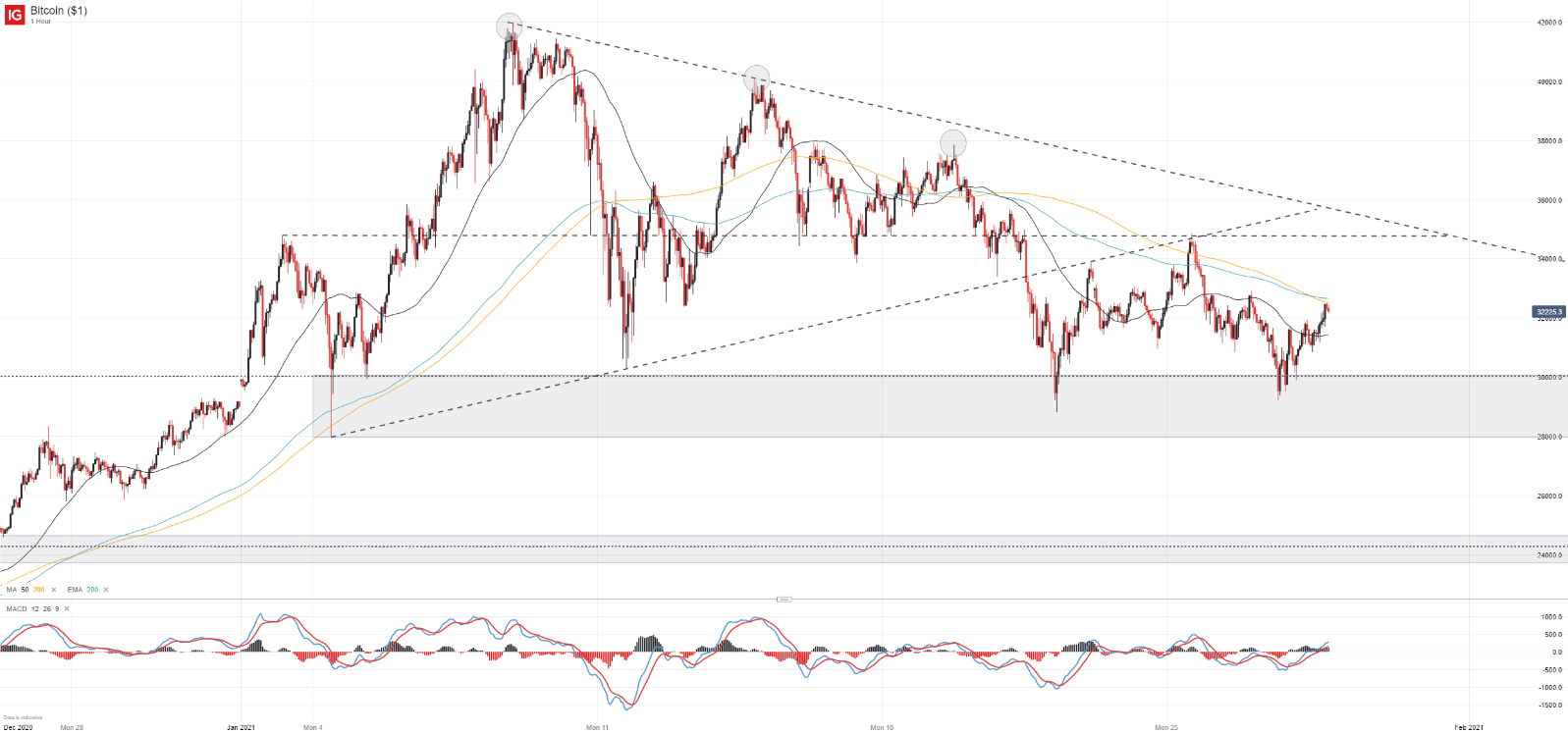

Market Volatility and Corrections

Bitcoin's price is notoriously volatile. Significant price drops ("market corrections") are a common occurrence and investors need to be prepared for such events.

Competition from Other Cryptocurrencies

The cryptocurrency market is highly competitive. The emergence of new cryptocurrencies with innovative features could divert investment away from Bitcoin.

Security Concerns

Security breaches and hacking remain a significant concern. Investors need to take appropriate security measures to protect their Bitcoin holdings.

Keywords: Bitcoin regulation, Bitcoin risk, cryptocurrency risks, Bitcoin security, Bitcoin price correction

Investing in Bitcoin: Strategies for Growth Investors

Investing in Bitcoin requires a careful and considered approach:

- Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across various asset classes.

- Risk Tolerance: Assess your risk tolerance before investing. Bitcoin is a high-risk, high-reward investment.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals helps to mitigate risk by averaging your purchase price over time.

- Long-Term Investment Horizon: A long-term investment horizon is generally recommended to ride out market volatility.

Keywords: Bitcoin investment strategy, Bitcoin diversification, Dollar-Cost Averaging, long term Bitcoin investment, Bitcoin risk management

Conclusion: Is Bitcoin's 1,500% Surge a Realistic Possibility? A Call to Action

A 1,500% surge in Bitcoin's price is certainly ambitious. While factors like institutional adoption, macroeconomic conditions, and technological advancements support the potential for significant growth, the inherent volatility and regulatory uncertainty present substantial risks. The possibility of substantial rewards exists, but equally, significant losses are also a possibility. Before investing in Bitcoin or any cryptocurrency, conduct thorough research, understand the risks, and carefully consider your personal financial situation. Only invest what you can afford to lose. Don't rely solely on predictions; make informed decisions based on your own due diligence. Learn more about responsible Bitcoin investment strategies and navigate the world of cryptocurrency with caution and awareness.

Featured Posts

-

The Hunger Games Directors Stephen King Adaptation A 2025 Horror Release

May 08, 2025

The Hunger Games Directors Stephen King Adaptation A 2025 Horror Release

May 08, 2025 -

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025 -

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025 -

Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

May 08, 2025

Bitcoin Price Jumps On Optimistic Trade Negotiation Outlook

May 08, 2025 -

Yann Sommers Thumb Injury How Will Inter Milan Cope

May 08, 2025

Yann Sommers Thumb Injury How Will Inter Milan Cope

May 08, 2025

Latest Posts

-

Debate Ignites Has A New War Film Surpassed Saving Private Ryan

May 08, 2025

Debate Ignites Has A New War Film Surpassed Saving Private Ryan

May 08, 2025 -

A New Challenger Appears Is Saving Private Ryan No Longer The Top War Film

May 08, 2025

A New Challenger Appears Is Saving Private Ryan No Longer The Top War Film

May 08, 2025 -

The Best War Movie Debate Has Saving Private Ryan Been Overtaken

May 08, 2025

The Best War Movie Debate Has Saving Private Ryan Been Overtaken

May 08, 2025 -

Dcs Batman A Fresh Start With A New 1 Issue And Costume

May 08, 2025

Dcs Batman A Fresh Start With A New 1 Issue And Costume

May 08, 2025 -

Saving Private Ryan Dethroned A New War Film Takes The Crown

May 08, 2025

Saving Private Ryan Dethroned A New War Film Takes The Crown

May 08, 2025