Top Cryptocurrency Pick: VanEck Forecasts 185% Price Increase

Table of Contents

Understanding VanEck's Forecast Methodology

VanEck, known for its rigorous analytical approach, likely employed a combination of methodologies to arrive at its 185% Bitcoin price prediction. This probably includes fundamental analysis, examining Bitcoin's underlying value proposition and adoption rate; technical analysis, studying price charts and trading patterns to identify potential trends; and market sentiment analysis, gauging investor confidence and market dynamics.

However, it's crucial to understand the limitations of any predictive model. VanEck's methodology, while likely robust, cannot account for all unpredictable events. External factors, unforeseen technological advancements, or sudden shifts in regulatory environments could significantly impact the accuracy of their forecast.

- Specific factors considered in their model: Likely included Bitcoin's scarcity, growing institutional adoption, and increasing network security.

- Data sources used: VanEck likely leveraged on-chain metrics (transaction volume, network hash rate), trading volume data from major exchanges, and surveys on cryptocurrency ownership to inform their model.

- Potential biases or assumptions made: The model might assume continued technological improvements, sustained institutional investment, and a stable regulatory landscape, all of which are subject to change.

Factors Contributing to the Predicted Bitcoin Price Surge

Several factors contribute to VanEck's optimistic Bitcoin price prediction. Macroeconomic factors play a significant role. High inflation and concerns about fiat currency devaluation could drive investors towards Bitcoin as a store of value. Furthermore, increasing interest rates can make Bitcoin a more attractive alternative investment. Geopolitical instability also contributes to the appeal of Bitcoin's decentralized and borderless nature.

The adoption of Bitcoin by institutional investors is a key driver of price appreciation. Large corporations are increasingly adding Bitcoin to their balance sheets, viewing it as a hedge against inflation and a potential long-term investment. Retail investor interest is also growing, with a significant increase in the number of individuals holding Bitcoin.

Technological advancements within the Bitcoin ecosystem further enhance its appeal. The Lightning Network, for example, significantly improves transaction speeds and reduces fees, increasing Bitcoin's usability. The Taproot upgrade enhanced Bitcoin's scalability and privacy, addressing long-standing criticisms.

- Institutional adoption: Examples include MicroStrategy, Tesla, and several other publicly traded companies holding significant amounts of Bitcoin.

- Growing retail investor interest: Statistics show a substantial increase in cryptocurrency ownership globally, particularly among younger demographics.

- Technological improvements: Upgrades like Taproot and the development of the Lightning Network are enhancing Bitcoin's scalability and user experience.

Risks and Challenges Associated with the Prediction

While VanEck's prediction is encouraging, investors must acknowledge the inherent risks in the cryptocurrency market. Regulatory uncertainty remains a significant challenge. Changes in cryptocurrency regulations could negatively impact Bitcoin's price and accessibility. Market volatility is another major risk; Bitcoin’s price is notoriously susceptible to significant fluctuations. Security breaches, while rare, represent a potential threat to investor confidence and the overall stability of the Bitcoin network.

The emergence of competing cryptocurrencies and disruptive technological advancements also poses a threat to Bitcoin's dominance. New cryptocurrencies with enhanced features could attract investors away from Bitcoin.

- Regulatory risks: Governments worldwide are still developing comprehensive regulatory frameworks for cryptocurrencies. Changes in these regulations could lead to price volatility.

- Market volatility: Bitcoin's history is characterized by periods of extreme price volatility, creating both opportunities and risks for investors.

- Security risks: While the Bitcoin network is generally secure, the risk of hacks and scams remains, impacting investor trust and potentially leading to price drops.

Investing in Bitcoin Based on VanEck's Forecast: A Strategic Approach

VanEck's forecast provides a valuable perspective, but it shouldn't be the sole basis for investment decisions. A strategic approach requires thorough due diligence and a careful assessment of personal risk tolerance. Diversification is crucial; don't put all your eggs in one basket. Consider diversifying your investment portfolio across different asset classes, including traditional investments and other cryptocurrencies.

Dollar-cost averaging (DCA) is a risk-mitigation strategy where you invest a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the impact of market volatility. Setting realistic investment goals and time horizons is essential. Investing in Bitcoin should align with your long-term financial objectives.

- Risk tolerance assessment: Understanding your risk tolerance helps determine the appropriate level of Bitcoin exposure in your portfolio.

- Diversification strategies: Spread your investment across various asset classes to mitigate the risk associated with Bitcoin's volatility.

- Setting realistic investment goals: Define your investment goals (e.g., long-term growth, short-term gains) and choose a time horizon accordingly.

Conclusion: Should You Invest Based on the VanEck Bitcoin Prediction?

VanEck's 185% Bitcoin price prediction is a bold statement, supported by factors like growing institutional adoption, technological advancements, and macroeconomic conditions. However, the cryptocurrency market remains volatile and subject to significant risks, including regulatory uncertainty and market fluctuations. Therefore, any investment decision should be based on thorough research and a careful assessment of your risk tolerance.

Before investing in Bitcoin or any cryptocurrency, conduct extensive independent research. Understand the underlying technology, market dynamics, and potential risks involved. Consider consulting with a qualified financial advisor to create a well-diversified investment strategy. While VanEck's Bitcoin forecast presents a compelling opportunity, remember that cautious optimism and informed decision-making are paramount for successful cryptocurrency investment. Develop a robust "Bitcoin investment strategy" informed by thorough "cryptocurrency market analysis" and consider the implications of VanEck's Bitcoin forecast carefully. The potential for significant returns exists, but so does the potential for losses.

Featured Posts

-

Champions League Inter Milans Shock Win Against Bayern Munich In First Leg

May 08, 2025

Champions League Inter Milans Shock Win Against Bayern Munich In First Leg

May 08, 2025 -

Dissecting The Thunder Bulls Offseason Trade A Critical Analysis

May 08, 2025

Dissecting The Thunder Bulls Offseason Trade A Critical Analysis

May 08, 2025 -

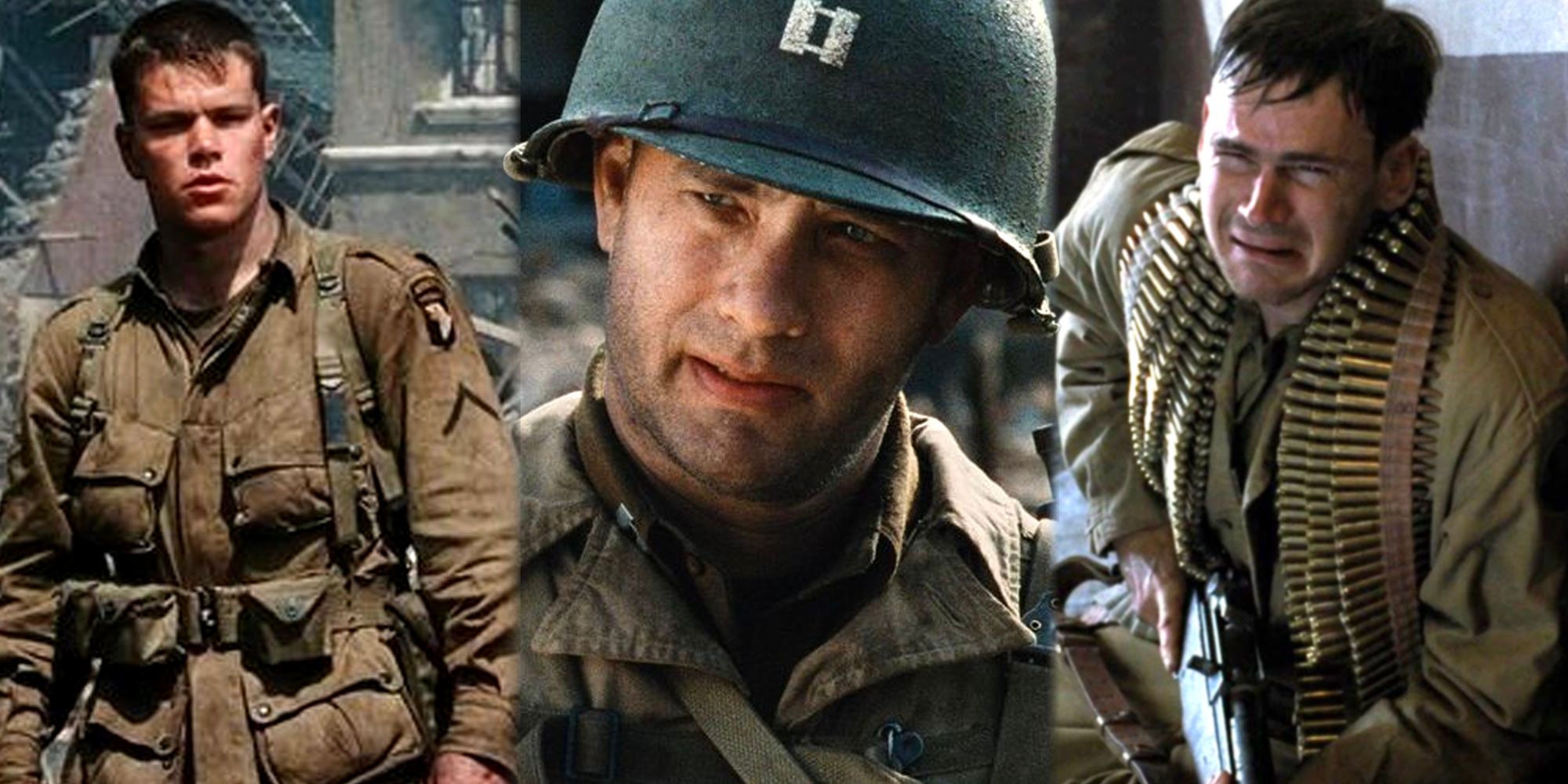

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025 -

Rogue Channels Cyclops A Look At The New X Men

May 08, 2025

Rogue Channels Cyclops A Look At The New X Men

May 08, 2025 -

Xrp 2000 Assuming The Keyword Language Is Chinese

May 08, 2025

Xrp 2000 Assuming The Keyword Language Is Chinese

May 08, 2025

Latest Posts

-

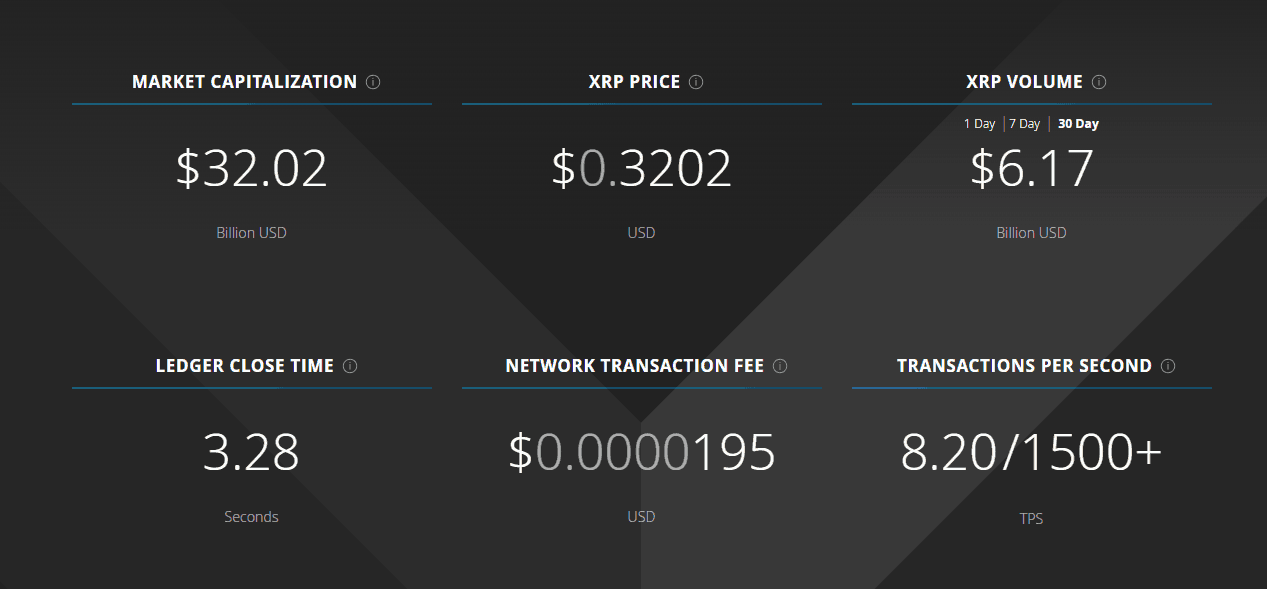

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025 -

Understanding Xrp Ripple Before You Invest

May 08, 2025

Understanding Xrp Ripple Before You Invest

May 08, 2025 -

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025 -

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025 -

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025