XRP's Surge: Outpacing Bitcoin After SEC's Grayscale ETF Filing Nod

Table of Contents

Ripple's Legal Victory and its Impact on XRP's Price

The recent positive developments in Ripple's legal battle against the SEC have significantly influenced XRP's price trajectory. Understanding this connection is crucial to grasping the current XRP surge.

The SEC Lawsuit and its Resolution

The SEC's lawsuit against Ripple, alleging that XRP is an unregistered security, cast a long shadow over the cryptocurrency. However, recent court rulings have painted a more favorable picture for Ripple.

- Partial Summary Judgement: The court's partial summary judgment ruled that XRP sales on public exchanges did not constitute the sale of unregistered securities. This significantly reduced the legal uncertainty surrounding XRP.

- Positive Impact on Legal Standing: This ruling bolstered XRP's legal standing, reassuring investors and potentially paving the way for greater regulatory clarity.

- Reduced Legal Uncertainty: The reduced legal uncertainty has boosted investor confidence, leading to increased trading volume and price appreciation.

Increased Institutional Interest in XRP

The positive legal news has sparked renewed interest from institutional investors who were previously hesitant due to the ongoing lawsuit.

- Potential Institutional Investors: Hedge funds, investment firms, and other large financial institutions are now more likely to consider adding XRP to their portfolios.

- Motivations for Institutional Investment: The reduced legal risk, combined with XRP's potential for future growth and adoption, makes it an attractive investment opportunity for institutions.

- Increased Trading Volume and Market Capitalization: Data shows a significant increase in XRP trading volume and market capitalization following the positive court rulings, further supporting the claim of increased institutional interest.

The Ripple Effect of Grayscale's ETF Approval on the Crypto Market

The Grayscale victory, while primarily focused on Bitcoin, created a positive ripple effect across the entire cryptocurrency market, indirectly benefiting XRP.

Positive Sentiment Across the Crypto Market

The SEC's approval of Grayscale's Bitcoin ETF signaled a potential shift in regulatory stance towards cryptocurrencies.

- Increased Investor Confidence: This decision boosted overall investor confidence and risk appetite, leading to a general increase in cryptocurrency prices.

- Positive Sentiment Spreads to Altcoins: The positive sentiment extended to altcoins like XRP, benefiting from the improved market mood and increased trading activity.

- Increased Market Liquidity: The inflow of institutional capital into Bitcoin, fueled by the ETF approval, also contributed to increased liquidity across the crypto market, benefiting XRP.

Increased Regulatory Clarity (Potential)

The Grayscale decision could pave the way for greater regulatory clarity for other cryptocurrencies, including XRP.

- Potential for Future ETF Filings: The success of Grayscale's Bitcoin ETF application could encourage other companies to file for ETFs covering other cryptocurrencies, potentially including XRP.

- Positive Implications for XRP Adoption: Increased regulatory clarity could lead to greater mainstream adoption of XRP, further boosting its price.

- Reduced Regulatory Risk: This clarity reduces regulatory risk for investors, making XRP a more attractive investment.

Technical Analysis of XRP's Price Movement

While fundamental analysis is crucial, a look at the technical aspects of XRP's price movement provides further insights into its recent surge.

Chart Patterns and Indicators

XRP's price chart has shown several positive indicators suggesting continued upward momentum. (Note: Specific chart patterns and indicators should be inserted here with appropriate visuals/charts).

- Key Support and Resistance Levels: Identifying key support and resistance levels helps predict future price movements.

- Breakout from Resistance: A successful breakout above a significant resistance level is a bullish signal.

Volume and Market Cap Analysis

The relationship between XRP's price increase, trading volume, and market capitalization provides further evidence of the surge's strength.

- Increased Trading Volume: A surge in trading volume alongside price increases confirms the strength of the upward trend.

- Market Capitalization Growth: A significant increase in market capitalization indicates growing investor confidence and adoption.

- Changes in Market Dominance: Analyzing changes in XRP's market dominance relative to other cryptocurrencies provides a broader perspective on its performance.

Conclusion: Is XRP's Surge Sustainable? Invest Wisely in XRP's Future

XRP's recent surge is a complex phenomenon driven by a confluence of factors: Ripple's legal progress, the positive market sentiment triggered by Grayscale's ETF approval, and encouraging technical indicators. However, it's crucial to acknowledge potential risks and uncertainties. Remaining legal challenges, inherent market volatility, and overall crypto market conditions could significantly impact XRP's future price.

Understanding XRP's surge requires careful analysis. While the positive developments are encouraging, it's vital to conduct thorough research before investing in XRP or any cryptocurrency. Remember that cryptocurrencies are highly volatile assets, and investment decisions should be based on individual risk tolerance and a comprehensive understanding of the market. Continue your research into XRP and explore its potential in the evolving cryptocurrency landscape.

Featured Posts

-

Top Cryptocurrency Pick Van Eck Forecasts 185 Price Increase

May 08, 2025

Top Cryptocurrency Pick Van Eck Forecasts 185 Price Increase

May 08, 2025 -

Vse O Matchakh Arsenal Ps Zh V Evrokubkakh Statistika I Analiz

May 08, 2025

Vse O Matchakh Arsenal Ps Zh V Evrokubkakh Statistika I Analiz

May 08, 2025 -

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025 -

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Capitol Attack Claims

May 08, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Capitol Attack Claims

May 08, 2025

Latest Posts

-

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism Of Tatum From Colin Cowherd

May 08, 2025 -

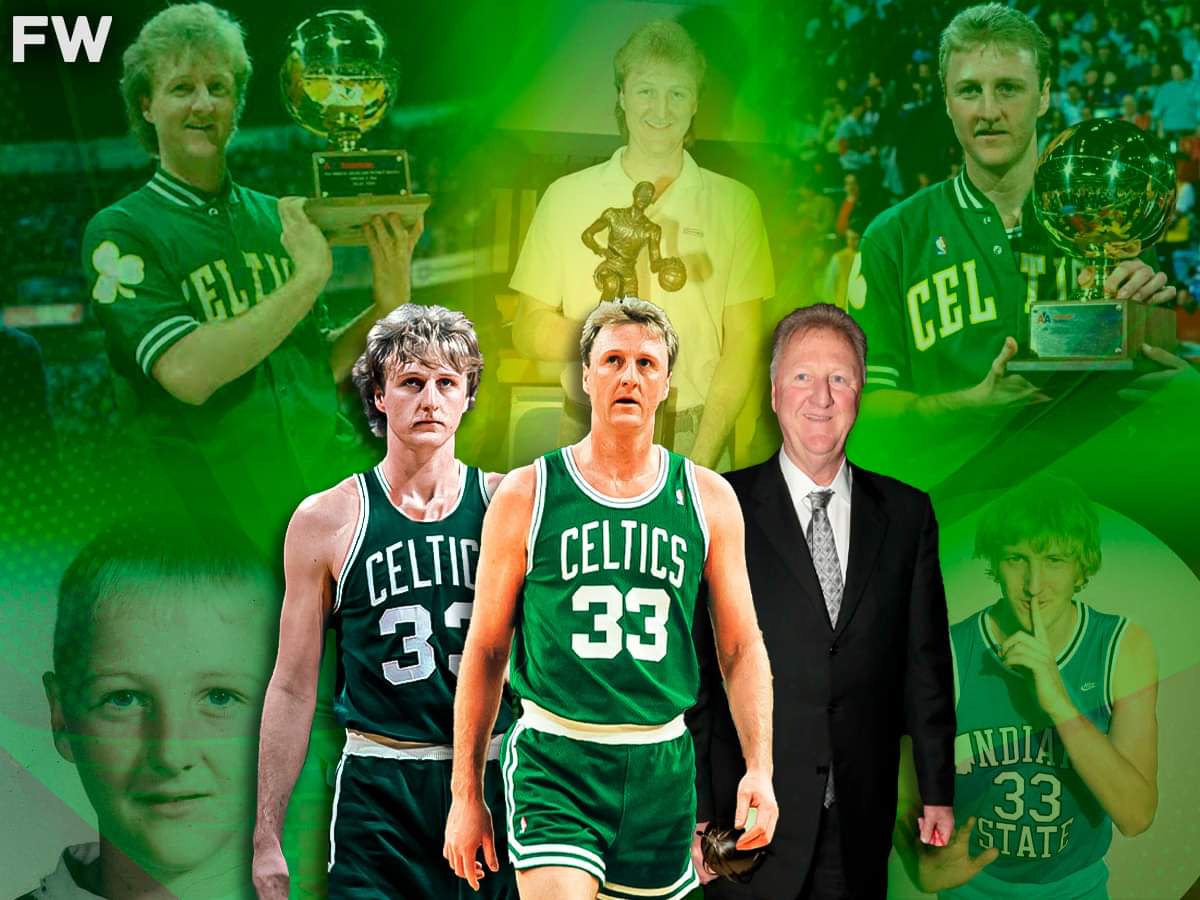

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1 Loss

May 08, 2025 -

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025 -

Cowherds Harsh Words Tatum Under Fire After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words Tatum Under Fire After Celtics Game 1 Loss

May 08, 2025